Author: zhou, ChainCatcher

On November 5, digital asset and infrastructure company Ripple announced the completion of a $500 million strategic financing round, with a post-investment valuation reaching $40 billion—this is the largest external financing round for the project since its Series C funding in 2019 ($200 million, $10 billion valuation), marking a fourfold increase in valuation over six years.

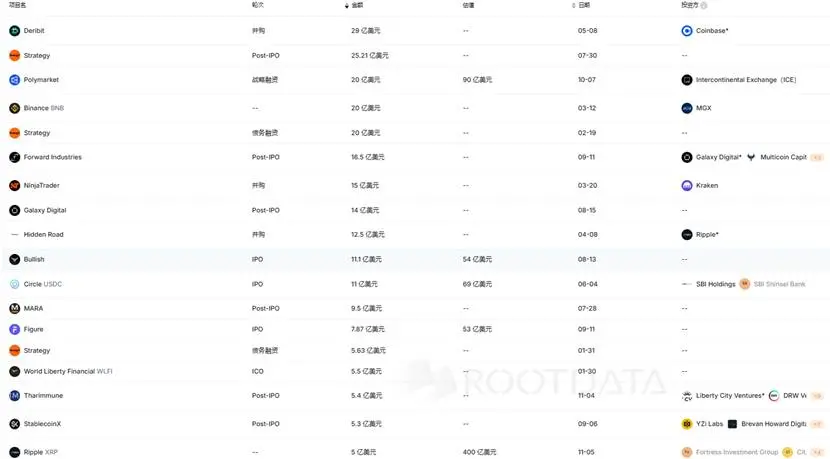

This round of financing was co-led by Fortress Investment Group and Citadel Securities, with follow-on investments from institutions such as Pantera Capital, Galaxy Digital, Brevan Howard, and Marshall Wace, setting a record as the third-largest single financing transaction in the crypto primary market for 2025, following Polymarket's $2 billion strategic financing in October and Binance's $2 billion minority stake transaction in March.

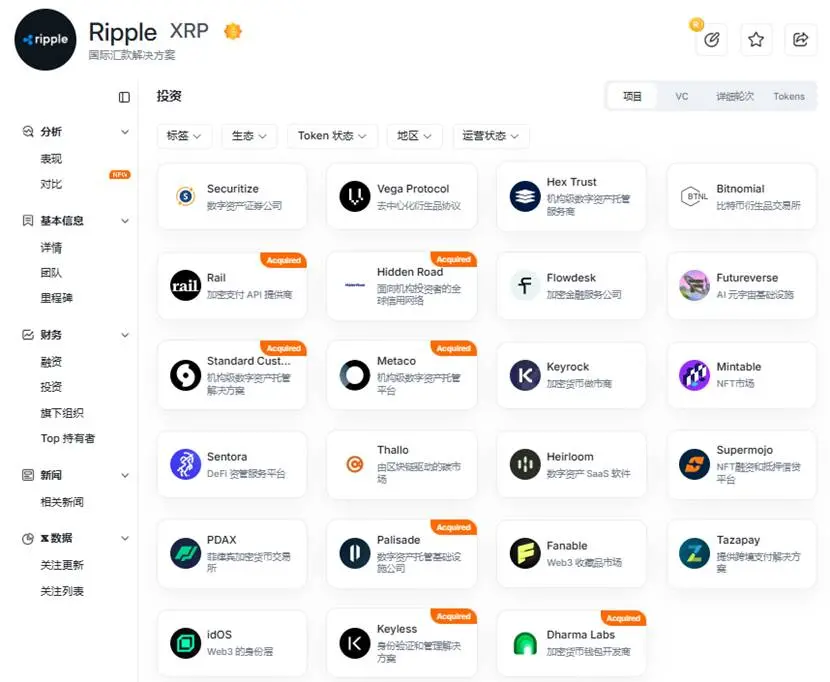

In terms of fund usage, Ripple stated that it will focus on ongoing mergers and acquisitions, global expansion of RLUSD, and building compliance infrastructure. This year, Ripple has launched a strategic investment plan exceeding $4 billion, acquiring institutional broker Hidden Road ($1.25 billion), corporate cash management platform GTreasury ($1 billion), payment infrastructure Rail ($200 million), and digital asset custodian Palisade (financials undisclosed).

It is reported that Ripple (also known as 瑞波) is a global cross-border payment network created by Ripple Labs, claiming to enable secure, instant, and nearly free global financial transactions of any scale using a distributed ledger. Ripple's business consists of a cross-border payment network (RippleNet), a compliant stablecoin (RLUSD), an enterprise-grade public blockchain (XRPL), and an institutional-level merger and acquisition ecosystem. According to RootData, XRP is currently priced at $2.33, up 7.2% in 24 hours, down 20% in the past month, ranking 4th in global market capitalization with a total market cap of $139.8 billion and a circulating supply of 6.01 billion coins.

From a valuation perspective, the $40 billion valuation is significantly higher than most similar projects. Public information shows that in the stablecoin sector, Circle's NYSE-listed market cap is about $25 billion, and Paxos is valued at about $2.4 billion; in the public blockchain infrastructure space, Polygon is valued at about $7 billion, while Sui and Aptos are valued at approximately $6 billion and $4.5 billion, respectively; in the payment network sector, Stellar's market cap is about $9 billion. Ripple's high valuation partly stems from the growth potential of its XRPL public blockchain and RLUSD, but is also influenced by the liquidity premium of its unlisted status. Ripple President Monica Long stated that the company currently has no IPO plans or timeline, which may extend the uncertainty of the investor exit path.

From a business perspective, as the news of the large financing was announced, on November 6, the total circulation of Ripple's compliant stablecoin RLUSD surpassed $1 billion for the first time. Launched just 330 days ago, this stablecoin has entered the top 11 global USD stablecoins according to DefiLlama, with a current circulation of $1.022 billion, of which $819 million is on the Ethereum chain and $203 million is natively circulating on the XRP Ledger.

Ripple President Monica Long stated that Ripple has processed nearly $100 billion in payment volume to date, and RLUSD is the "primary stablecoin" used for payment flows. However, in the stablecoin market dominated by USDT ($183 billion) and USDC ($76 billion), RLUSD's market share is relatively small, still facing liquidity competition risks.

Regarding the XRPL public blockchain, as Ripple's technological core, it has served over 500 financial institutions globally, with an annualized transaction volume approaching $95 billion. The recent upgrade of XRPL introduced EVM-compatible sidechains and collaborated with Polygon CDK to enhance smart contract functionality. The DeFi ecosystem of XRPL is relatively lagging, with DefiLlama data showing that XRPL DeFi TVL is only $7.959 million (ranked 49th), far behind mainstream public chains like Solana ($10.1 billion) and Ethereum ($74.7 billion).

Additionally, it was reported today that Mastercard will collaborate with Gemini and Ripple to explore the use of RLUSD stablecoin on XRPL for settling fiat card transactions. The backend settlement of the Gemini XRP credit card has fully migrated to the XRP Ledger, using RLUSD to achieve final settlement in 3 seconds. Mastercard stated that this collaboration will become one of the first cases of regulated U.S. banks using public blockchain and regulated stablecoins to settle traditional card transactions, potentially reducing merchant costs.

In this context, the financing provides backing for RLUSD's growth, the scale of the stablecoin injects liquidity for real-time credit card settlements, and the Mastercard collaboration validates the feasibility of compliant public blockchain as an alternative to traditional rails. These three developments form a positive feedback loop, potentially marking Ripple's transition from the concept of "blockchain version of SWIFT" to a revenue-driven global settlement infrastructure.

However, Ripple is currently facing two key regulatory events. First is the progress of the XRP spot ETF approval. The applications for XRP spot ETFs submitted by seven institutions, including Grayscale, Bitwise, Franklin Templeton, WisdomTree, Canary Capital, 21Shares, and CoinShares, collectively updated their S-1 filings on November 4, removing the originally planned indefinite delay clause and replacing it with an automatic effectiveness mechanism similar to that of Bitcoin and Ethereum ETFs. The earliest batch is expected to take effect between November 13 and 15, with Polymarket predicting a 99% probability of approval within 2025.

Notably, the REX-Osprey XRP ETF (ticker XRPR) was listed on September 18, with a first-day trading volume of $37.7 million, setting a record for the highest single-day debut trading volume this year. If the subsequent seven ETFs are launched, it may attract more compliant funds, providing XRP with a deeper liquidity pool, which will help stabilize extreme volatility in the long term.

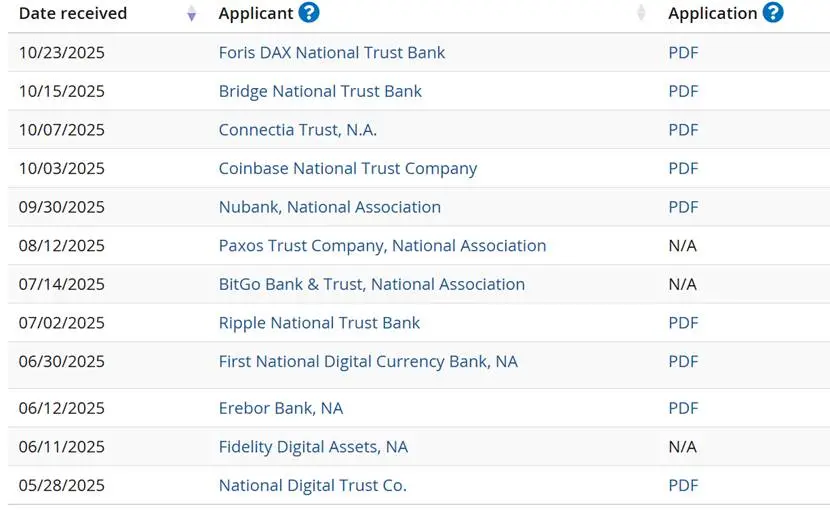

Second is the application for a U.S. banking license. Ripple submitted an application to establish Ripple National Trust Bank to the Office of the Comptroller of the Currency (OCC) on July 2, 2025, which is currently in a 120-day statutory review period, with preliminary results expected by November 2, 2026, at the latest. According to the latest status on the OCC's official website, Circle (First National Digital Currency Bank) applied on June 30 and has exceeded the 120-day review period without approval; Paxos applied on August 12 and is under review; Coinbase applied on October 3 and is also under review.

Ripple is one of the earlier applicants, and if the license is approved, RLUSD reserves could be directly deposited into the Federal Reserve's master account, enabling 24/7 real-time minting and redemption. Ripple would become the second crypto-native enterprise to hold a federal trust license after Anchorage Digital. This would create a dual regulatory benefit with the XRP ETF, enhancing institutional adoption confidence and the scale of capital inflow.

Overall, Ripple has recently seen a flurry of positive developments; however, when breaking down its business, the stablecoin sector has become a red ocean, XRPL lacks competitiveness among public chains, and cross-border payment business still relies primarily on traditional payments. Under the pressure of multiple competitive forces and regulatory uncertainties, whether it can maintain a $40 billion valuation, whether through compliance breakthroughs or partnerships with Mastercard, ultimately depends on the realization of data, as the market has already cast its vote with its feet.

Click to learn about job openings at ChainCatcher

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。