Written by: Charlie Little Sun

The current payment industry is undergoing profound structural changes. Since the end of 2024, enterprise-level services in the stablecoin sector have become a battleground, with major payment giants accelerating their layouts through acquisitions.

Stripe acquired Bridge for $1.1 billion last year, gaining a complete platform capable of stablecoin transfer and custody through enterprise-level APIs. Recently, Coinbase reportedly offered $2 billion to acquire BVNK, aiming to transform its USDC distribution advantage into a stablecoin orchestration business. After failing to acquire BVNK, Mastercard is rumored to be bidding $1.5 to $2 billion for Zero Hash, with the goal of moving 24/7 on-chain settlement from the experimental stage to large-scale application.

In this context, the market is closely watching Visa's next moves.

These transactions reflect a key trend: stablecoins are evolving from trading assets to payment infrastructure.

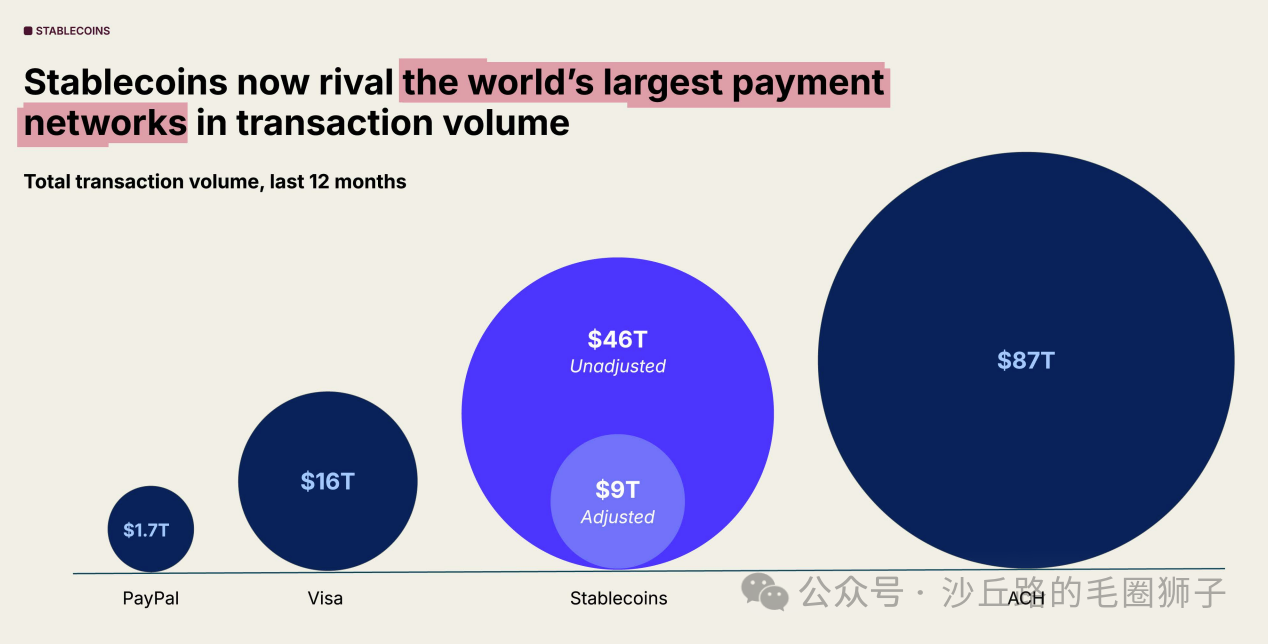

A report from a16z shows that in the past 12 months, stablecoins completed $46 trillion in on-chain transfers, and even after adjustments, the actual scale of $9 trillion is close to Visa's annual transaction volume. This data indicates that stablecoins have become an undeniable payment settlement channel.

Visa's Strategic Heritage and Investment Logic

Examining Visa's acquisition history, it is clear that it has a "infrastructure-first" strategic preference. The acquisitions of Earthport and Currencycloud a few years ago focused on their underlying clearing network capabilities; even the failed attempt to acquire Plaid reflected an emphasis on key data flow nodes and the layout of other payment networks.

In the cryptocurrency sector, Visa has continued this cautious strategy. From the stablecoin settlement pilot with Circle in 2021, to the investment in Anchorage in 2019, and the bet on BVNK in early 2025, it reflects a "validate first, expand later" incremental approach. This strategy controls early risks while ensuring a quick response when the regulatory environment matures.

Capability Gap: From Technical Validation to Product Implementation

Current competitors' acquisitions show that the focus of industry competition has shifted from validating technical feasibility to full-stack productization capabilities. Having a stablecoin orchestration platform means that enterprises can quickly launch commercial products aimed at merchants, cross-border payments, and treasury management.

For Visa, the ideal acquisition target must fill key capability gaps: enterprise-level key security management, cross-chain circulation solutions compliant with multiple national regulations, treasury reconciliation systems comparable to VisaNet experiences, and a robust developer ecosystem.

This requires "custody + orchestration" vertical integration capabilities, rather than simple technical overlays.

In-Depth Analysis of Core Acquisition Targets

Based on years of understanding and observing the industry, I believe the following five companies are most likely to enter Visa's acquisition radar:

Fireblocks: Ready-made Solution for Enterprise Custody and Orchestration

Fireblocks' core value lies in its already validated institutional service capabilities. The platform uses multi-party computation (MPC) custody technology, combined with a sophisticated policy engine and mature developer APIs, to build infrastructure serving thousands of financial institutions. Notably, Fireblocks is actively building a payment network specifically for global multi-asset liquidity, and its network effects are beginning to show.

From an integration perspective, Fireblocks can provide Visa with "out-of-the-box" stablecoin service capabilities. After the acquisition, Visa can immediately gain access to a rigorously audited key management system, treasury tools supporting cross-chain and cross-bank operations, and a mature institutional client network. The specific integration path is clear: deploy Fireblocks' policy layer and orchestration capabilities into VisaNet's adjacent "tokenized currency services" area, and then open up settlement, payment, and cross-border net settlement functions through Visa's native APIs.

Potential risks mainly lie in two areas: valuation pressure and business focus. As an industry leader, the acquisition cost of Fireblocks will undoubtedly be high; at the same time, its business covers the entire crypto asset stack, requiring the establishment of commercial barriers to ensure that the stablecoin business receives priority resources without affecting existing client relationships.

Anchorage Digital: Compliance-First Strategic Choice

Anchorage's core advantage lies in its U.S. OCC bank charter, which has built a strong regulatory moat. As a licensed digital asset bank, its infrastructure in custody and settlement fully meets bank-level standards. In the current increasingly stringent regulatory environment, this bank-level architecture provides the safest path for scaling expansion.

For Visa, Anchorage's appeal lies in its ability to provide "peace of mind" to partners. Issuing banks, acquiring institutions, and banking partners can directly adopt its stablecoin treasury services without rewriting risk management protocols. Visa's previous strategic partnership with Anchorage has also reduced integration risks at the personnel and process levels.

However, this compliance advantage comes with corresponding costs. A bank-first culture may lead to a relatively slow pace of innovation, and Visa may need to undertake complementary construction or additional acquisitions to accelerate developer distribution and consumer-facing SDK development.

Paxos: Strategic Layout with Control Over Issuance Rights

As a stablecoin issuer holding a trust license, Paxos has accumulated complete legal and operational capabilities in the operation of PYUSD and USDP. Acquiring Paxos means that Visa can not only settle stablecoins but also provide "minting as a service" to banks and fintech companies, fundamentally changing Visa's positioning in the stablecoin ecosystem.

The leverage effect brought by this control over issuance rights is significant. Through minting services, Visa can influence compliance standards, reserve asset management strategies, and project design standards, shaping industry norms throughout the ecosystem without having to build a closed garden.

However, this strategic value also comes with corresponding challenges. With the GENIUS Act officially becoming law, issuers will face stricter regulatory scrutiny, and the integration process will place higher demands on Visa's policy, treasury, and risk teams. Additionally, Paxos is fiercely competing with Circle and Tether for stablecoin market share, and choosing to support a non-leading player in the current multipolar competitive landscape may not be the wisest strategic choice.

MoonPay: Strategic Bet on Distribution Priority

MoonPay has established strong brand recognition and high-quality user traffic in the consumer entry field. Its outstanding advantage lies in directly reaching high-intent users in the creator and gaming ecosystems, and it has validated the linkage model between stablecoin balances and card payments through collaboration with a competing network starting with "M."

From an integration perspective, this is more about commercial integration rather than technical integration. Visa needs to unify business rules, handle or isolate business associations with competitors, and promote a Visa-prioritized roadmap in areas such as card payments, refunds, and dispute resolution.

The main risks lie in partner perception and valuation pressure. MoonPay's brand image has dual characteristics: on one hand, it can accelerate consumer acceptance; on the other hand, it may raise concerns among bank projects that prefer infrastructure services.

Rain: Precise Matching of Card Issuance and Settlement

Rain's unique positioning is its complete focus on the area where Visa already has a global scale advantage—card issuance—while its innovation lies in designing stablecoin settlements from the outset. As a principal member of Visa, Rain has driven multiple brand projects and successfully delivered practical use cases like the Avalanche card, demonstrating that stablecoin wallets can clearly map to everyday card consumption scenarios.

On the technical level, Rain currently supports issuance and settlement capabilities based on Solana, Tron, and Stellar, expanding the coverage of tokens and channels without adding extra middleware. For Visa, this creates an immediately usable product line: native stablecoin settlement cards, refund processes supporting dispute resolution, and issuer control coordinated with VisaNet rather than simply added on.

Limitations lie in its focus and scope. Rain prioritizes cards and is not a complete custody or orchestration platform. If Visa already has custody/orchestration capabilities elsewhere, or pairs Rain with strategy/treasury tools to complete the tech stack, this limitation can be acceptable.

Emerging Forces Worth Noting

While deeply analyzing the main acquisition targets, there are also some companies that, although outstanding in specific areas, fall slightly short in overall strategic alignment:

Ramp Network is known for its excellent SDK quality and developer experience, establishing a good reputation in the enterprise market. Transak focuses on channel coverage and mobile-optimized experiences, with significant advantages in emerging markets like Latin America, where its stablecoin business has a high proportion and is growing rapidly. These two companies are relatively small in scale, making them easier to integrate, and they can quickly amplify value through Visa's global network.

Notably, in cross-border payment scenarios, the ability to connect local payment systems like PIX and SPEI with stablecoin settlements is becoming increasingly important. These niche companies can help Visa quickly expand into specific markets and scenarios.

Sardine, as a typical related field company, has fraud detection and instant settlement capabilities that can indeed enhance Visa's conversion rates in card and channel businesses. However, acquiring more "risk brains" does not address Visa's core capability gap in stablecoin custody and orchestration.

Similarly, Crossmint's technological accumulation in digital asset issuance is also worth noting. The company's experience in simplifying blockchain interactions, particularly its wallet infrastructure and developer tools, provides a reference for building user-friendly stablecoin applications. However, its business focus (still transitioning from the NFT sector) remains distant from Visa's need for comprehensive stablecoin orchestration capabilities.

Bitso, as a trading giant in Latin America, holds significant value in channel cooperation, but its positioning as an exchange (despite rapid growth in payments as a second curve) makes it difficult to become a core middleware for a payment network like Visa, presenting clear channel conflicts.

TripleA holds a license from the Monetary Authority of Singapore, and its compliance framework is well recognized by banking clients; RedotPay is growing rapidly in the Asia-Pacific market; Thunes is expanding into the U.S. market. These companies are distinctive in their respective fields, but they have not yet reached the scale requirements that Visa prioritizes in channel coverage.

Additionally, while Mural and Borderless have made beneficial explorations in cross-border payment processes for small and medium enterprises, they remain relatively early-stage in terms of licensing coverage, distribution networks, and enterprise-level validation.

Strategic Implementation Path and Key Considerations

Visa's advantage lies in its ubiquitous network effects (network of networks). Once the core capabilities of "custody + orchestration" are established, the company can launch a series of innovative products: real-time cross-border payments settled in stablecoins, configurable threshold merchant treasury auto-exchanges, and off-chain acceptance solutions that retain traditional dispute resolution experiences.

In formulating specific acquisition strategies, Visa needs to weigh several key factors: the direction of regulatory policy development will directly impact the valuation of different business models; the degree of control over issuance rights and the coverage of distribution channels need to be balanced; the complexity of technological integration and the speed of commercialization are also important decision-making criteria.

From a historical decision-making perspective, solutions that can smoothly integrate with existing systems of its banking partners without significantly increasing compliance complexity are more likely to be favored (after all, the bulk of transaction fees goes to banks, not to Visa). This means that Visa may prioritize platforms with mature institutional service experience and strict compliance standards.

Conclusion

Stablecoin orchestration platforms have become a new battleground for infrastructure in the payment industry. Visa's traditional advantages lie in network effects and bank trust, and its acquisition strategy should focus on transforming multi-currency settlement capabilities into a productized "custody to consumption" complete solution.

In the current market environment, Fireblocks leads in capability matching, Anchorage has a clear advantage in compliance, Paxos represents the strategic value of issuance rights, MoonPay provides important distribution channels, and Rain can directly enhance Visa's core card issuance business.

The final decision will depend on the pace of changes in the external environment: whether the clarification of regulatory policies, the solidification of the issuer landscape, or the formation of consumer usage habits becomes the decisive factor first.

Regardless, for Visa, completing key layouts before the competitive landscape is fully defined while maintaining sufficient flexibility to respond to a rapidly changing environment will be crucial for maintaining its leading position in the stablecoin era.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。