That string of astonishing profit figures once placed them on a pedestal, but ultimately it was just a brief revelry before the night of liquidation.

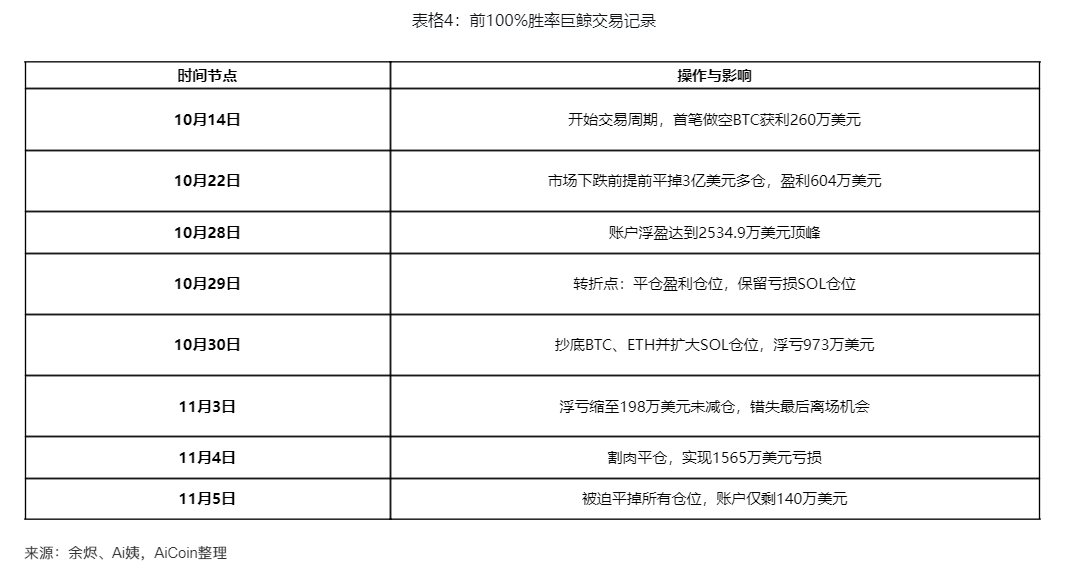

An anonymous whale who once maintained a 100% win rate reached his profit peak on October 28: $25.349 million. Just a week later, in the early hours of November 5, he was forced to close all positions, leaving only $1.4 million in margin in his account. Over $44 million evaporated in the market.

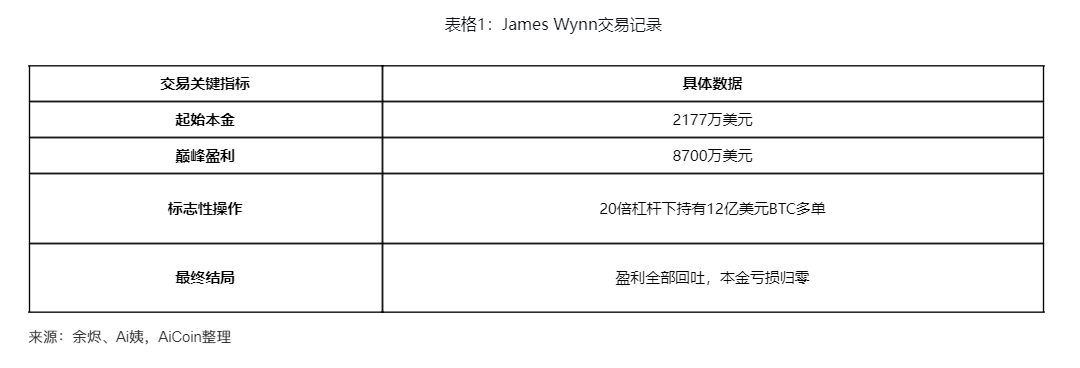

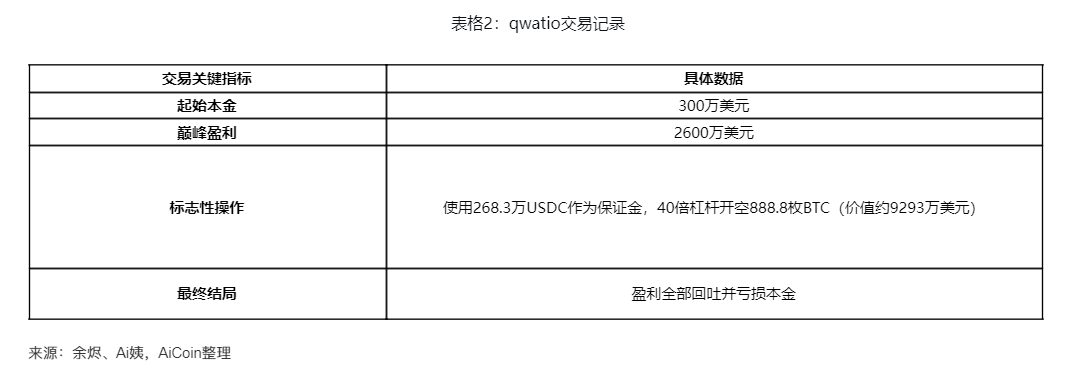

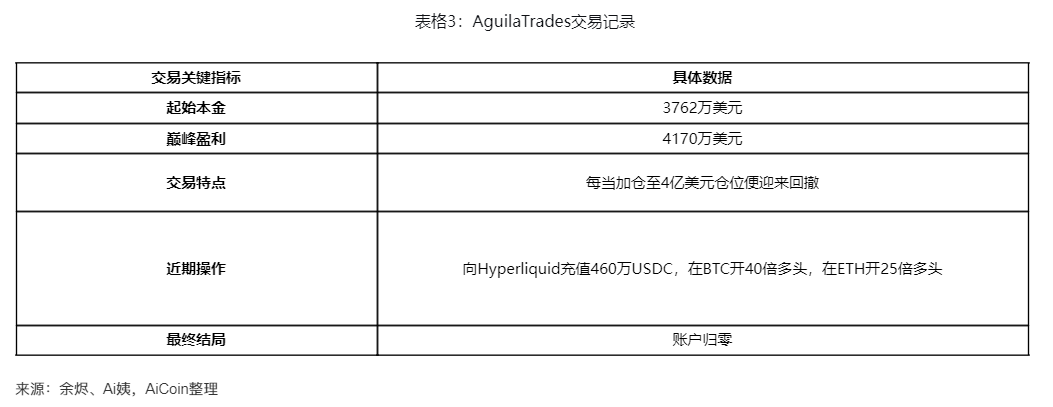

He was not the only victim. On the Hyperliquid platform, several whales, including James Wynn, qwatio, and AguilaTrades, experienced similar trajectories: massive profits, leveraged positions, market reversals, and then liquidation to zero.

These stories collectively reveal a harsh truth: in the world of high-leverage trading, no matter how glorious the past, the ultimate outcome of lacking risk management is often just one—failure to exit.

1. Four Major Whales' Trading Records

In the fervent land of high-leverage trading on Hyperliquid, four traders from different backgrounds rose to prominence with astonishing performances, mockingly referred to by the community as "insider traders." They seemed to possess the ability to turn stone into gold, unaware that fate had already marked the price in the shadows.

2. The Fall of the [100% Win Rate] Whale

Among all these whales, the most eye-catching is the "former 100% win rate whale." His story fully illustrates how a trader can transition from glory to destruction, serving as a living textbook on the risks of high-leverage trading.

● On October 14, he began his 14 consecutive wins myth with a precise short-selling operation. He bought 5,255 ETH, sold all the next day for $22 million USDC, and shorted BTC with about 5x leverage, earning $2.6 million overnight.

● On October 22, he closed about $300 million in long positions early before the market fell, making a profit of $6.04 million, praised by the community as "the brother reacted quickly."

● At 6:12 AM on October 28, his account's floating profit peaked at $25.349 million, marking the last unilateral rise in his profit and loss curve. However, after the peak, the crisis quietly approached.

● October 29 became a turning point; he chose to close profitable positions first while holding onto losing ones. This "cutting profits and letting losses run" reverse operation laid the groundwork for his later disastrous defeat.

● On October 30, a speech by Federal Reserve Chairman Powell triggered a brief market drop, and he chose to bottom-fish BTC and ETH while simultaneously increasing his SOL position. By that evening, all three positions were underwater, with a floating loss of $9.73 million.

● At 8 AM on November 3, the floating loss shrank to $1.98 million, just one step away from breaking even, yet he did not reduce his positions. Just three hours later, the market turned down, and his four long positions all returned to floating losses.

● On November 4, he cut losses by closing long positions in BTC, ETH, and SOL worth $258 million, realizing a loss of $15.65 million. This figure was comparable to the $15.83 million profit he had earned from 14 consecutive wins over the previous 20 days.

● Around 5 AM on November 5, it all ended. He was forced to close all positions, leaving only $1.4 million in margin in his account. The total of $15.83 million profit from 14 consecutive wins and $28.76 million principal amounted to $44.67 million, all wiped out in one loss.

3. The Deadly Temptation of High Leverage

Although the trading stories of these whales differ, they all share a common deadly factor—high leverage. Leverage is like a sharp double-edged sword, capable of instantly magnifying profits while swiftly destroying wealth.

● The essence of leverage is borrowed trading, allowing traders to control positions far exceeding their own capital with a small amount of principal. On derivative trading platforms like Hyperliquid, leverage multiples often reach 20x, 50x, or even more.

● High leverage greatly reduces survival probability. Even that whale with 14 consecutive wins ultimately lost everything due to being "4% away" from liquidation. Market volatility itself does not kill traders, but the amplified volatility from leverage can.

● AguilaTrades chose to use 40x leverage on BTC, putting him at risk of liquidation when the price dropped more than 2.5%. The 25x long position on ETH also carries similar risks, as he was betting or gambling on a short-term rebound. In the highly volatile cryptocurrency market, a 2.5% intraday fluctuation is almost the norm, making high-leverage positions akin to walking on the edge of a cliff.

4. Common Fatal Flaws of the Whales

Analyzing the trading behaviors of these whales reveals several key fatal weaknesses they share, which are magnified in a high-leverage environment.

● Overconfidence and arrogance. Continuous profits can create an illusion of invincibility, leading traders to believe their judgments are always correct. The whale with 14 consecutive wins, after reaching the peak, did not choose to take profits but instead continued to increase positions, ultimately leading to a collapse.

● Refusal to admit mistakes and stop losses. Several whales, when facing losses, chose to add positions against the trend, trying to "hold on until they break even" rather than cutting losses in a timely manner. The whale with 14 consecutive wins did not reduce positions when the floating loss had shrunk to $1.98 million, missing the last exit opportunity.

● Concentrated risk rather than diversification. These whales often hold high-leverage positions across multiple positions simultaneously, and once the market turns overall, they face a chain reaction. The 14 consecutive wins whale held long positions in BTC, ETH, and SOL simultaneously, with no hedging protection during a market-wide decline.

● Emotion-driven decisions. At critical moments, these traders were driven by greed or fear rather than rational analysis. When the liquidation price of the whale with 14 consecutive wins was approached, "any rational trader should have stopped, but he added positions at ETH $3,497 and SOL $159," further pushing up the liquidation line.

5. Survival Rules for High-Leverage Trading

These bloody cases provide us with valuable lessons. To survive in high-leverage trading, several iron rules must be followed.

● Strictly control leverage multiples. Leverage is a double-edged sword; exceeding one's risk tolerance with leverage is destined to lead to destruction. Even that whale with 14 consecutive wins kept his leverage within 8x during the successful early phase, while it significantly increased during the later uncontrollable phase.

● Firmly execute stop-loss strategies. "Stop-loss is the cost of trading, not a loss." Setting clear stop-loss points and strictly executing them is key to long-term survival. If these whales had decisively cut losses in the early stages of losses rather than adding positions against the trend, their outcomes might have been completely different.

● Timely take profits. Floating profits are just numbers on paper; only profits after closing positions are true wealth. James Wynn's peak profit of $87 million and the whale's floating profit of $25.349 million ultimately turned out to be fleeting.

● Maintain humility and respect. The market is always right; past success does not guarantee future performance. The failure of the whale with 14 consecutive wins largely stemmed from overconfidence in his own judgment while ignoring market uncertainties.

The market is never short of stars, only short of longevity. When the whale with 14 consecutive wins closed his last position in the early hours of November 5, looking at the remaining $1.4 million in margin, he may have finally understood this truth.

Leverage can amplify profits but cannot amplify wisdom; it can accelerate wealth accumulation but can also accelerate demise. After the tragedies of these whales, a new legend on Hyperliquid is about to be written, whether it will repeat the past cycle or break the chapter of fate remains to be seen.

Join our community to discuss and become stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。