Written by: Sanqing, Foresight News

On November 3, Hong Kong Web3 gaming and digital asset investment giant Animoca Brands announced plans to relist on the Nasdaq in the third quarter of 2026 through a reverse merger with Nasdaq-listed Currenc Group (stock code: CURR). According to documents submitted to the U.S. Securities and Exchange Commission (SEC), Animoca Brands shareholders will hold approximately 95% of the shares post-merger, while Currenc's existing shareholders will retain about 5%. The target valuation for the transaction is approximately $1 billion, but based on Currenc's current market value, the post-merger company valuation could reach $2.4 billion.

Unlike a traditional IPO, this is a form of "backdoor listing," which still requires approval from both parties' shareholders and review by relevant regulatory agencies. Currenc will acquire all of Animoca's equity in exchange for shares and will divest Currenc's AI finance and digital remittance business before the transaction. The merged company will continue to operate under the name "Animoca Brands," focusing on blockchain games, NFTs, digital assets, and blockchain infrastructure.

This transaction signifies that after being forced to delist from the Australian Securities Exchange (ASX) in 2020, Animoca Brands has finally found a new path to the capital market by 2026. Transitioning from a company marginalized by traditional regulatory frameworks, it will return to the mainstream financial stage with a holding model centered on an ecological matrix and asset network.

Web3 Complex

Animoca Brands owns star blockchain games like The Sandbox, a long list of game IP licenses, and hundreds of Web3 project investments. However, during this listing preparation process, the company is clearly pushing for a narrative iteration, packaging itself from a simple "blockchain games + investment holding" into a more complete ecological structure.

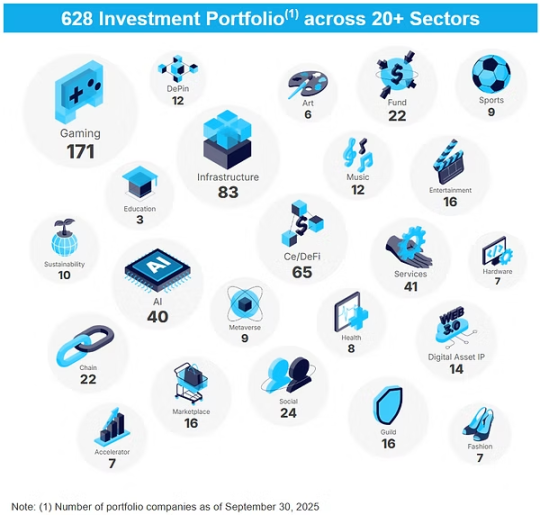

At the top level, there are familiar content and traffic elements: blockchain games, NFTs, IP collaborations, etc., forming the user-facing front end. The Sandbox remains a symbolic entry point. The middle layer consists of investment and asset networks. The equity and token positions accumulated by Animoca Brands over the years cover more than 600 projects across various tracks, including exchanges, infrastructure, public chains, DeFi protocols, and content platforms. Its balance sheet resembles an industry map of Web3.

Animoca Brands Portfolio

Animoca Brands is transitioning from virtual assets to real-world applications. The native flagship project Mocaverse is no longer just an avatar NFT but has been developed into a membership hub for the Animoca Brands ecosystem, carrying identity, rights, and task systems. The MOCA token launched around Mocaverse is beginning to take on functions of points, community incentives, and governance, abstracting decentralized user contributions and rights into a "common language" that can flow across projects. On the infrastructure side, Animoca Brands has launched the EVM-compatible public chain Mocachain, attempting to consolidate decentralized assets and interactions onto its technology stack with a public chain focused on identity and data protocols.

Mocaverse, MOCA, and Mocachain weave a network within the Web3 world and extend into the real world through Airshop. Airshop collaborates with partners in aviation, hotels, and more, transforming game assets and membership points from on-chain symbols into real expenditures. Coupled with a Hong Kong stablecoin joint venture and RWA-related layouts, Animoca Brands is attempting to piece together a mainline: from content traffic to asset networks, and then to identity and payments, weaving the scattered projects and users of the on-chain world into a virtual economic community that can reach the real world.

Geographical Migration and Valuation Rollercoaster

Animoca's capital migration from ASX to Nasdaq is a microcosm of regulatory geography. Hong Kong is its birthplace, Australia was its initial stage, and the U.S. is about to become its reconstruction platform. Each stage reflects the survival logic of Web3 companies in the gaps of institutional frameworks.

The delisting from Australia stemmed from regulatory shocks in the crypto era. ASX had concerns about crypto, NFTs, and blockchain gaming, while Animoca Brands' business model straddled the gray area. That forced delisting caused the company to lose liquidity but provided an opportunity to break free from traditional frameworks.

Hong Kong was once seen as its natural home, with increasingly friendly policies, more inclusive regulations, and closer capital relations making it a candidate for Animoca Brands. However, Hong Kong's capital market resembles a gentle harbor, lacking liquidity, having a conservative valuation system, and a traditional investor structure. For a Web3 group with complex assets and cross-border narratives, this stage is too small.

The U.S., on the other hand, is quite the opposite. The market here is bustling, and regulations are strict, but it provides companies with a clearer pricing mechanism. Moreover, U.S. crypto policy has shifted from strict regulation during the Biden era to a pro-crypto stance under the Trump administration, including the SEC pausing multiple crypto cases, the Justice Department disbanding its crypto enforcement division, and a more lenient framework for stablecoins and digital assets.

Thus, the spotlight on Nasdaq belongs not only to tech companies but also to those brave enough to reach out between the old and new orders. Animoca Brands' choice to restart here is not just for fundraising but also to be seen again. It needs a stage that can amplify its influence, a gateway to push Web3 back into mainstream discourse.

Financial Times interviews Yat Siu

According to key data disclosed by Animoca Brands over the past three years (as shown in the table below), overall revenue slightly declined during 2022–2024, but the scale of digital assets and equity investments continued to grow, and operating expenses remained stable, indicating a transition from speculative cycles to stable asset allocation.

Animoca Brands 2022-2024 Financial Report Data

However, over the past five years, Animoca Brands' valuation has fluctuated dramatically, much like the crypto market.

- When it was delisted in 2020, its market value was only about 120 million AUD, almost forgotten by traditional capital.

- During the blockchain gaming boom in 2021, its valuation rose to $1 billion after two rounds of financing. In October of the same year, it raised another $65 million, bringing its valuation to $2.2 billion.

- A new round of $75 million financing in 2022 pushed its private equity valuation to $5.9 billion, followed by Temasek and other institutions subscribing to $110 million in convertible bonds, maintaining this range.

- In the 2023 bear market, off-market trading showed significant discounts, and the market adjusted its valuation to $3–4 billion.

- This reverse merger has been reported by multiple media outlets to have a target valuation of $1 billion, but based on shareholding ratios, the post-merger entity valuation is approximately $2.4 billion.

The drop from the private equity peak of $5.9 billion in 2022 to the target valuation of $1 billion in 2025 reflects the rational repricing of the market after the NFT and blockchain gaming bubble burst. However, based on the post-merger valuation of $2.4 billion, Animoca Brands remains one of the highest-valued Web3 groups globally.

Expansion of Crypto Equity Narrative

The significance of this transaction may extend far beyond the corporate level. In the past, crypto stocks have mainly revolved around mining companies, exchanges, and recently DAT companies, with very few publicly listed companies representing content and application layers. The entry of Animoca Brands will mark the birth of a new category, a "crypto holding company" centered on ecological matrices and supported by asset networks. It possesses real business and cash flow while holding token and equity positions; it operates content and controls capital. This structure blurs the boundaries between crypto and traditional sectors and provides the industry with a new valuation coordinate.

For traditional investors, Animoca Brands will be another window into the crypto world; for those within the industry, it serves as a mirror, reflecting the transition from conceptual bubbles to institutional integration. Regardless of how the market ultimately prices it, it is exploring a template for the next round of integration between Web3 companies and traditional capital markets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。