A seemingly impressive employment report and a dovish statement from a Federal Reserve official have triggered a significant pullback in the cryptocurrency market. This reflects deep concerns in the market regarding the Federal Reserve's policy path. In the context of the government shutdown leading to the absence of official non-farm payroll data, this data has become a rare barometer for the market's assessment of the labor market.

1. Detailed Interpretation of ADP Data

The U.S. October ADP employment data released last night showed an increase of 42,000 jobs, far exceeding the market expectation of 25,000 to 28,000 jobs, marking the highest level in three months. This data has garnered significantly more market attention than usual due to the ongoing government shutdown and the absence of official economic data.

However, a deeper analysis of the data reveals that this report is not as strong as it appears on the surface.

From the perspective of business size, job growth is entirely driven by large enterprises.

● Large enterprises with more than 250 employees added 76,000 jobs in October, while small and medium-sized enterprises continued to lay off workers.

● This phenomenon raises concerns among economists, as small and medium-sized enterprises are the main drivers of job growth in the U.S. economy, typically creating about three-quarters of new jobs.

Industry differentiation is also evident.

● Growth mainly came from the trade, transportation, and utilities sectors, with 47,000 jobs added in a single month.

● The financial services sector also performed well, with 11,000 new jobs.

● However, the information services sector saw a reduction of 17,000 jobs, and manufacturing has contracted for the third consecutive month, while employment in professional and business services continues to decline.

Wage data also conveys complex signals.

● Wages for those remaining in their jobs grew steadily at 4.5% year-on-year, the lowest level since 2021;

● Wages for job changers increased slightly to 6.7%, but still remain well below last year's levels.

This "Goldilocks" data—neither too hot nor too cold—should theoretically be interpreted as positive by the market.

2. The Federal Reserve's Dilemma and Divergence

Following the release of the ADP data, the comments from Federal Reserve Governor Milan are noteworthy. While he referred to the data as a "pleasant surprise," he immediately emphasized that the current monetary policy is "too restrictive," suggesting that further rate cuts are reasonable. This seemingly contradictory statement actually reflects the immense pressure currently faced within the Federal Reserve.

● Divergence within the Federal Reserve has reached a rare level in recent years. Dovish representative Milan advocates for more aggressive rate cuts, even suggesting that if economic data meets expectations, the Federal Reserve should cut rates by another 50 basis points. In contrast, hawkish representative and Kansas City Fed President Schmidt voted against rate cuts in October, citing persistently high inflation.

● Such divergence is quite rare in the history of the Federal Reserve—over the past 40 years, there have only been five instances where opposing views on tightening and loosening monetary policy appeared simultaneously.

Complicating matters further, the Federal Reserve is facing the challenge of an "information vacuum."

● Due to the ongoing government shutdown, key economic indicators, including the non-farm payroll report and CPI inflation data, have been delayed. Federal Reserve Chairman Powell recently admitted in a press conference that this is akin to "driving in the fog," increasing the difficulty of decision-making.

● According to the CME "FedWatch" tool, the market's expectation of a 25 basis point rate cut in December has dropped from over 90% a week ago to the current 62.5%. This sharp change indicates a significant increase in uncertainty regarding the Federal Reserve's policy path.

3. Multiple Impacts on the Cryptocurrency Market

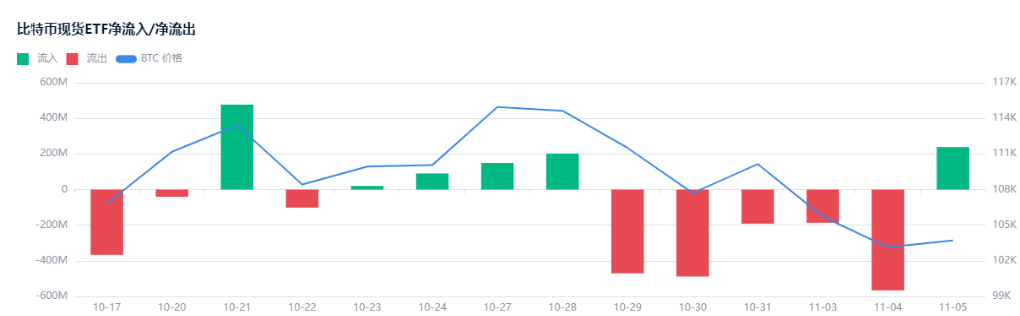

The unexpected response in the cryptocurrency market followed the better-than-expected ADP data. Prior to the data release, the market had already shown signs of weakness and began a pullback process. Bitcoin fell below the psychological threshold of $100,000, with a daily decline of over 5%; Ethereum lost the support level of $3,100; and the top ten cryptocurrencies by market capitalization generally declined. More alarmingly, the total liquidation amount across the network reached $2.1 billion in the past 24 hours, with over 480,000 traders being forcibly liquidated.

This reaction may seem unusual, but it actually reveals the underlying logic of the current market.

● Expectations for U.S. dollar liquidity are being restructured. The better-than-expected ADP data has reduced market expectations for a rapid rate cut by the Federal Reserve, leading the dollar index to break through the 100 mark and rise for five consecutive days. A stronger dollar typically puts pressure on dollar-denominated crypto assets, as investors can obtain relatively substantial risk-free returns without taking on the high risks associated with cryptocurrencies.

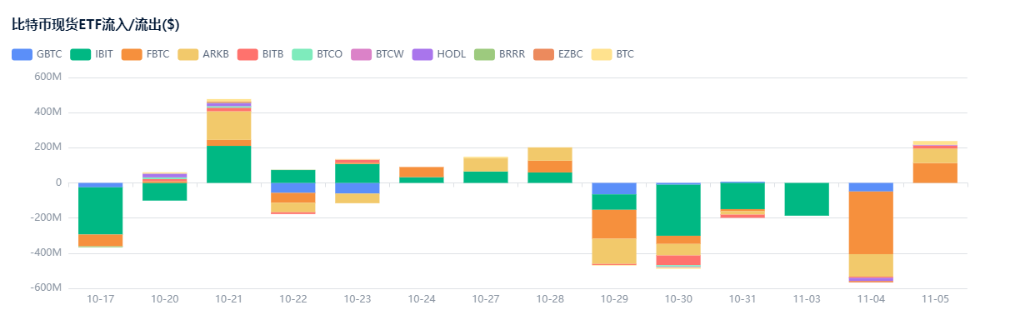

● Market risk appetite is changing. In the context of increasing uncertainty, investors tend to take profits and reduce exposure to high-risk assets. On-chain data shows a significant decrease in the amount of stablecoins flowing out of exchanges in the past three days, and institutional investors have net redeemed about $350 million through spot Bitcoin ETFs, indicating a cautious short-term attitude of institutional funds.

● The internal structure of the cryptocurrency market is changing. The put/call ratio in the options market has risen to a three-month high, indicating that investors are actively seeking downside protection. The miner holding index shows increased selling pressure, particularly as North American listed mining companies have sold about 4,000 Bitcoins in the past week, far exceeding normal levels. These micro changes exacerbate the downward pressure on the market.

4. The Far-reaching Impact of the Absence of Non-farm Data

In traditional finance, non-farm payroll data is often referred to as the "king of data." Its continued absence has profound implications for the market's pricing mechanism, and this Friday's non-farm data may be delayed due to the government shutdown.

● The market information ecosystem has been disrupted. In the absence of authoritative and comprehensive employment market data, investors are forced to rely on the ADP report, weekly unemployment claims data, and other "suboptimal indicators" to piece together the employment market picture. These alternative data sources have limitations in sample coverage and statistical methods, and their conclusions should be viewed with caution.

● Analyst expectations have diverged significantly. For October's non-farm data, even if it is released on time, Wall Street's expectations range from a decrease of 60,000 to an increase of 100,000 jobs, and this rare level of divergence itself reflects the market's high uncertainty. In normal times, analysts' expectations for non-farm data typically cluster within a relatively narrow range.

● Algorithmic trading exacerbates market volatility. Many quantitative trading models rely on official economic data as key input variables, and in the absence of this data, models may overreact to alternative data. The sharp market fluctuations following the release of the ADP data partially reflect this mechanism.

5. Outlook and Strategy: Finding Certainty Amid Uncertainty

In the face of a complex situation, how should investors respond?

● Closely monitor alternative indicators. Before official data resumes, focus on high-frequency data such as the employment component of the ISM services PMI, the Indeed hiring index, and initial unemployment claims by state to piece together the real state of the employment market from multiple dimensions. Additionally, the inflation expectations component of the University of Michigan consumer confidence survey is particularly noteworthy, as it is a forward-looking indicator highly valued by the Federal Reserve.

● Pay attention to changes in capital flows. For the cryptocurrency market, the growth of stablecoin supply is an important indicator for assessing incremental capital. If the total supply of major stablecoins resumes growth, it may indicate that the market is about to gain new momentum. Meanwhile, net inflow/outflow data from exchanges can reflect short-term changes in investor sentiment.

● Adopt a defensive allocation strategy. In a rising volatility environment, reducing leverage is key. Investors may consider increasing their allocation to assets with strong hedging properties, such as decentralized stablecoins, while also watching for early signs of decoupling between Bitcoin and U.S. stocks. Historically, cryptocurrencies have shown independent trends during periods of rising uncertainty in the traditional financial system.

● Seize the opportunity for policy shifts. Regardless of how individual data fluctuates, the monetary policy cycle of the Federal Reserve remains the most critical variable. The current gap between market expectations and Federal Reserve statements creates potential investment opportunities. Once the Federal Reserve clearly shifts towards easing, cryptocurrencies, as an asset class highly sensitive to liquidity, are likely to rebound first.

The market is always seeking a balance between data and reality. For the cryptocurrency market, the true test lies not in the positive or negative implications of a single data point, but in whether it can prove its unique value proposition amid the fluctuations of the traditional financial system. History tells us that the most uncertain moments often harbor the greatest opportunities.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。