Cryptocurrency News

November 4 Highlights:

1. Perp Dex aggregation platform Liquid completes $7.6 million seed round financing, led by Paradigm.

2. Owen Gunden deposits 1,288.76 bitcoins into Kraken again, worth $138.23 million.

3. Balancer: Some V2 composable stable pools were attacked and have been paused, while V3 and other pools remain unaffected.

4. FTSE Russell first puts index data on-chain via Chainlink DataLink.

5. Yi Lihua: Current market sentiment is overly fearful, and it has investment value in the short term.

Trading Insights

Whale liquidation warns of risks, long and short positions focus on key support.

- Market news: Risk events and policy expectations intertwine.

- Whale liquidation warns: A whale with a 100% win rate suffers its first loss, not only losing all previous profits but also currently facing a floating loss of over $10 million; "Brother Maji" also liquidated $15 million, highlighting the core role of strict stop-loss settings in risk control.

- Main operator movements: "Insider 1011" chose to increase long positions in BTC (Bitcoin) and ETH (Ethereum) after last night's market crash, with long and short positions continuing to diverge.

- Macro policy expectations: The U.S. government may resume operations soon, and attention should be paid to the impact of macro indicators such as non-farm payroll data and unemployment claims on the market.

- Technical analysis: Key support under pressure, clear differentiation among mainstream coins.

- Overall market trend:

- Last night, BTC directly broke through the key support level of 106,000, ETH fell below 3,600, and SOL fell below 170; if bullish momentum remains weak today, BTC may test the 100,000 level or come close.

- Although BTC breaking 106,000 is considered a "false breakout," there was a short-term long opportunity at the lower boundary of the range, but after last night's crash, caution is required for short-term longs.

- Core view: As long as BTC does not effectively break below 106,000, the judgment of "large cycle range movement" remains.

- Differentiation among mainstream coins:

- Coins like ETH and SOL have fallen below their most important support levels, showing signs of weakness technically.

- Mainstream altcoins are performing even weaker, with almost no safe space for long positions; choosing a "high short strategy" has a higher probability of profit and clearer space.

LIFE IS LIKE

A JOURNEY ▲

Below are the real trading signals from the Big White community this week. Congratulations to the friends who followed along. If your operations are not going well, you can come and try it out.

Data is real, and each order has a screenshot from the time it was sent.

**Search for the public account: *Big White Talks About Coins*

BTC

Analysis

Last Friday, the data for Bitcoin spot ETFs was still not good enough, with U.S. investors net withdrawing over 2,000 bitcoins, of which BlackRock's investors accounted for over 1,300, ranking first, while the data from other investors was negligible. More importantly, no U.S. institution had a net inflow on Friday; almost all had net outflows.

In week 94, U.S. investors withdrew over 7,600 bitcoins in total. Although this is not a large number, it indicates that traditional investors' buying sentiment is declining. In week 93, there was still a net inflow of over 3,600 bitcoins, showing that investors' purchasing power is quite weak.

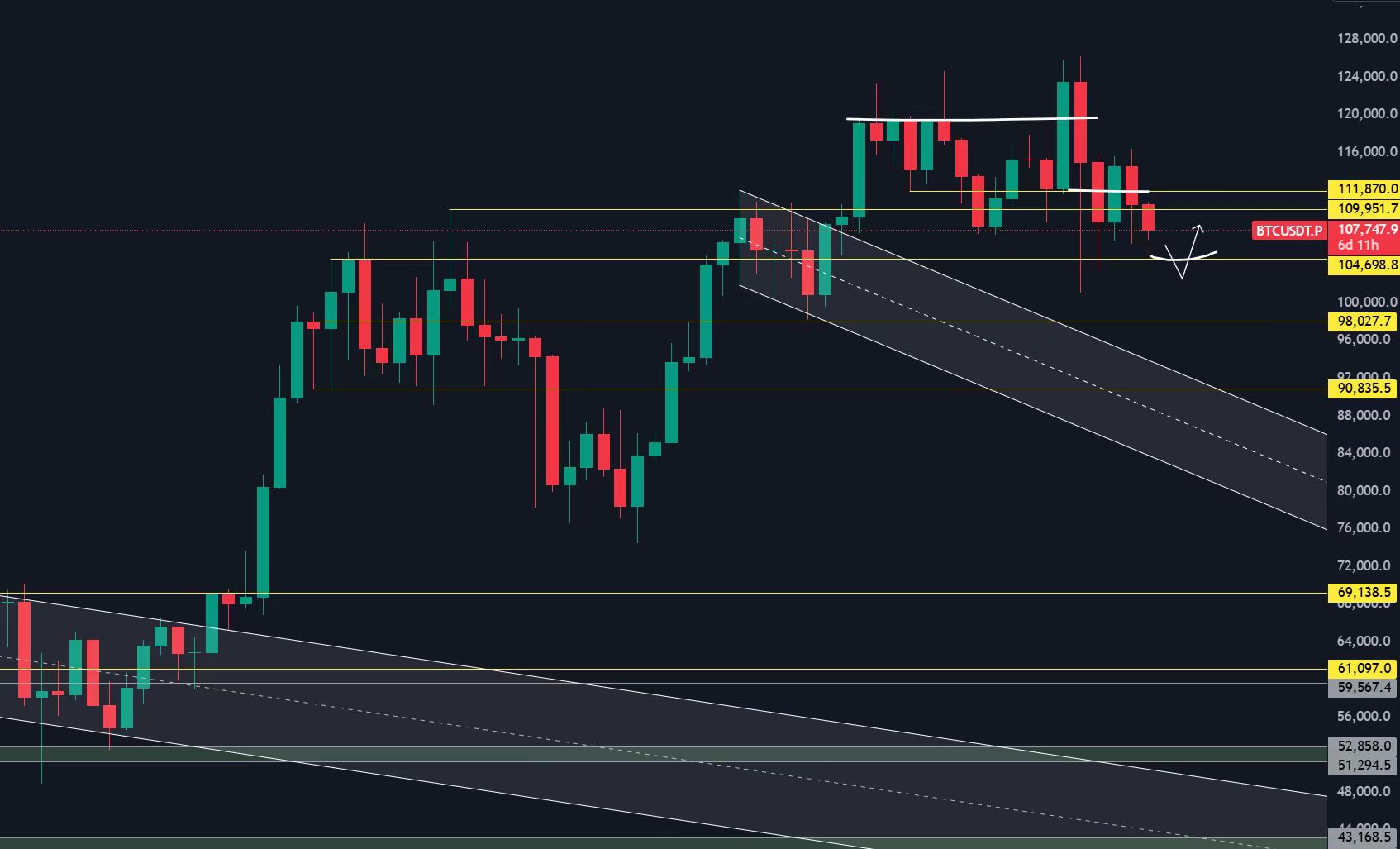

The weekly K-line failed to close above the key level of 112,000, increasing the possibility of a retest of the key level of 105,000. If there is a test of 105,000 this week, pay attention to whether there is a false breakdown and a reclaim; if so, there may be a bounce here. Today, on-chain whales are buying, and all positions are firmly held.

ETH

Analysis

Compared to Bitcoin, Ethereum's data shows less selling pressure. Although selling still predominated in the past week, at least during the week, U.S. investors bought very little but sold a significant amount. Similar to Bitcoin, BlackRock investors show signs of significant selling. I will keep an eye on this data to see when customized contacts might appear.

In week 66, the data shows that total investors bought less than $7,000 worth of ETFs, which has a limited impact on the market. Last month, there was a net sale of over 73,000 ETFs, indicating that selling pressure from investors may be slightly higher, but the key is still to look at the details.

Ethereum has once again broken the 4,000 mark. Currently, we need to see how Bitcoin will move. Altcoins generally follow Bitcoin. If Bitcoin tests the key level of 105,000 again, Ethereum may test the lower edge of the 3,500 channel. In recent days, on-chain whales have not shown further actions.

Disclaimer: The above content is personal opinion and for reference only! It does not constitute specific operational advice and does not bear legal responsibility. Market conditions change rapidly, and the article has a certain lag. If you have any questions, feel free to consult.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。