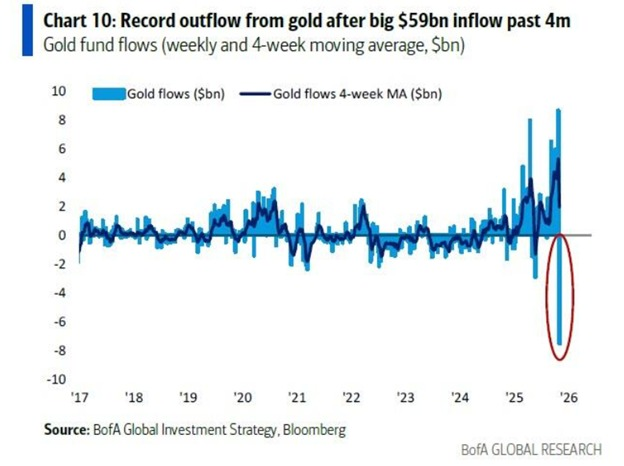

After getting up, I saw a piece of data: in the past week, gold funds experienced a net outflow of over $7.5 billion, marking the largest net outflow in the history of gold funds. Of course, this outflow is still minor compared to the cumulative net inflow of $59 billion over the past four months, but interestingly, it is very likely that this $59 billion is the "exit liquidity."

More importantly, as funds flow out of gold funds, it indicates that some investors' risk aversion is beginning to weaken, their risk appetite is starting to rise, and they believe that the macroeconomic risks in the U.S. are easing. In simpler terms, it is very likely that the funds flowing out of gold will enter risk markets.

This article is sponsored by @Bitget | Save the most on fees, receive the most gifts, and become a VIP at Bitget

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。