Week 6 of 2026 Bitcoin On-chain Data Changes — — Bear and Bull Transition, perhaps a chance to start building positions.

This week, the biggest shock to the cryptocurrency market was that the price of $BTC touched $60,000 without any obvious negative news. This price is below the peak of the previous cycle, which means one thing for many people: the bear market has arrived.

In 2025, we discussed many times whether the market was experiencing a rebound or a reversal. The view was that even though Bitcoin's price was reaching new highs, the market's risks had not been alleviated, and the market had not met the conditions for a reversal. For BTC at that time, it could not be considered a bear market, as BTC was like AI in traditional markets—people thought it was in a bubble, but it had not yet popped.

Bitcoin's Net Unrealized Profit and Loss (NUPL)

From the historical Bitcoin panic data (NUPL), the trend had always been in the yellow zone, which often represents strong market confidence. At this time, the market is usually optimistic. However, from the data of the past week, it can be seen that it has moved from yellow into the orange phase, which represents panic.

This means that from the perspective of market sentiment, if the decline continues, it is very likely to enter the red zone, which often represents capitulation—a substantial panic sell-off resulting from real emotional collapse. Thus, the current stage can be said to be a transition phase between bull and bear. If market confidence continues to lack, the bear market could open directly.

However, this period is often a good time to start building positions. It doesn't mean going all in right now, but rather taking advantage of the downturn to invest in a planned manner—buying 5% of positions every time the price drops by $5,000, etc. The goal is not to buy at the lowest price, but to have chips in hand when rebounds or reversals occur.

S&P 500 Volatility Index (Fear Index)

I have experienced this phase many times, the latest being in April 2025 when Bitcoin's price dropped due to tariff issues. Many people said the bull market was over and a deep bear market was approaching, with Bitcoin's price about to test $40,000. But less than a month and a half later, it reached a historical high, and at that time it was still in the yellow zone. I was bottom fishing because VIX had dropped significantly.

From historical data, when $BTC's NUPL (LTH) enters the red zone and VIX breaks above 30, these are usually very good bottom fishing points. This also made me realize that bottom fishing is often not about looking at the price, but rather considering more historical indicators that rarely go wrong. Of course, I am still an ordinary person, sometimes I feel the price is low and buy in. However, I have been buying recently to prepare for 2028, which can also be considered part of building positions.

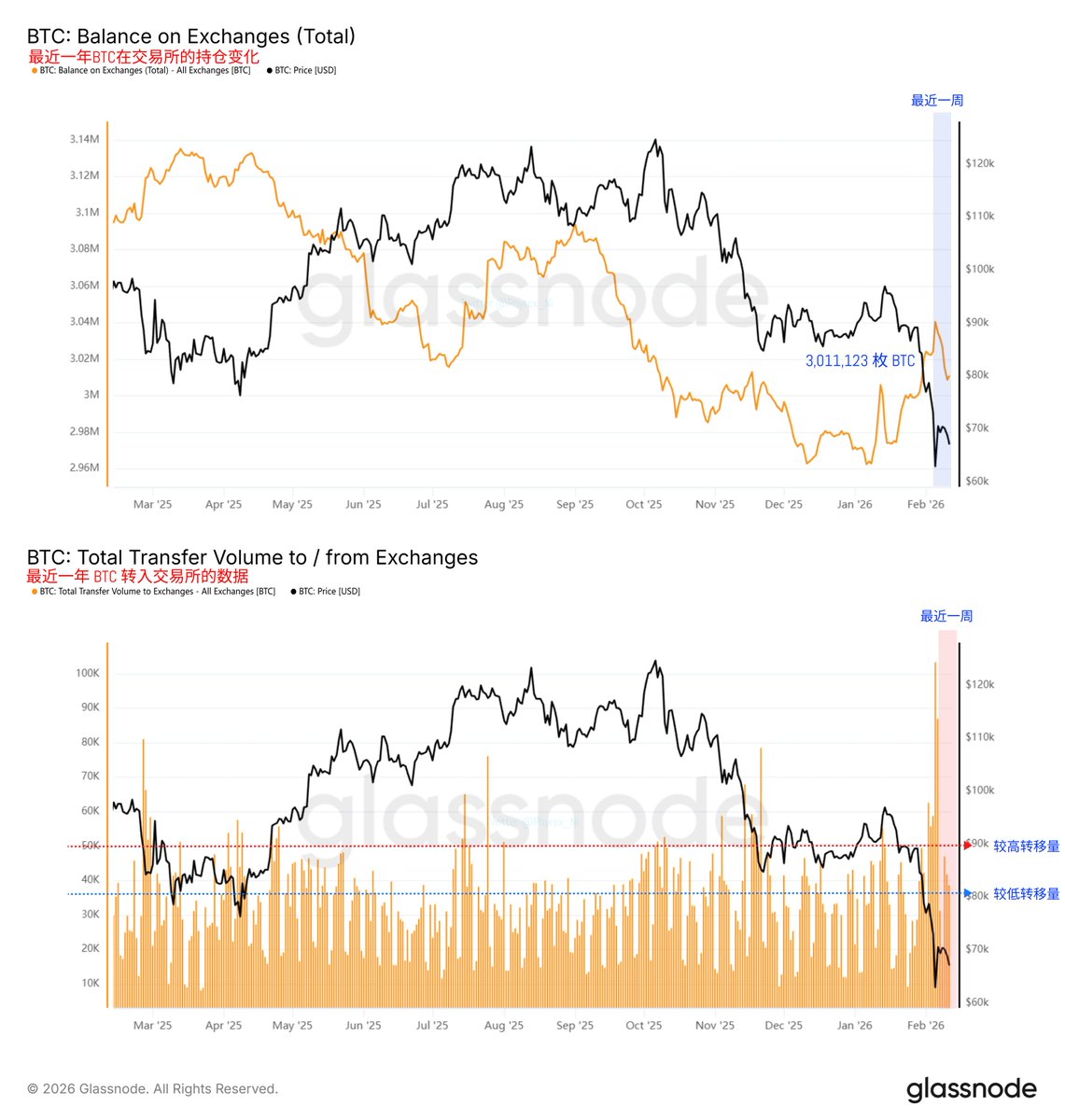

Recent Year’s Stock of Bitcoin in All Exchanges and Amount Transferred to Exchanges

From the weekly data of stock in exchanges, the recent week saw a decrease in $BTC in stock, but the total decrease is very slow, around 12,000 Bitcoin over the week. However, I observed from the data that more selling activity is occurring on exchanges, meaning that a large amount of selling is happening there, so BTC's stock does not display changes; only when it is withdrawn to the chain does it show fluctuations. Thus, while it appears there has been continuous withdrawal (buying), the price continues to fall.

Moreover, concerning the amount of Bitcoin transferred to exchanges, although the sentiment has not been good in the past week, the amount of selling being transferred is indeed decreasing. This indicates that investors, when faced with high prices, are no longer engaging in panic selling, showing a reluctance to suffer deep cuts. This is also one of the reasons why I say it may be a time to try building positions.

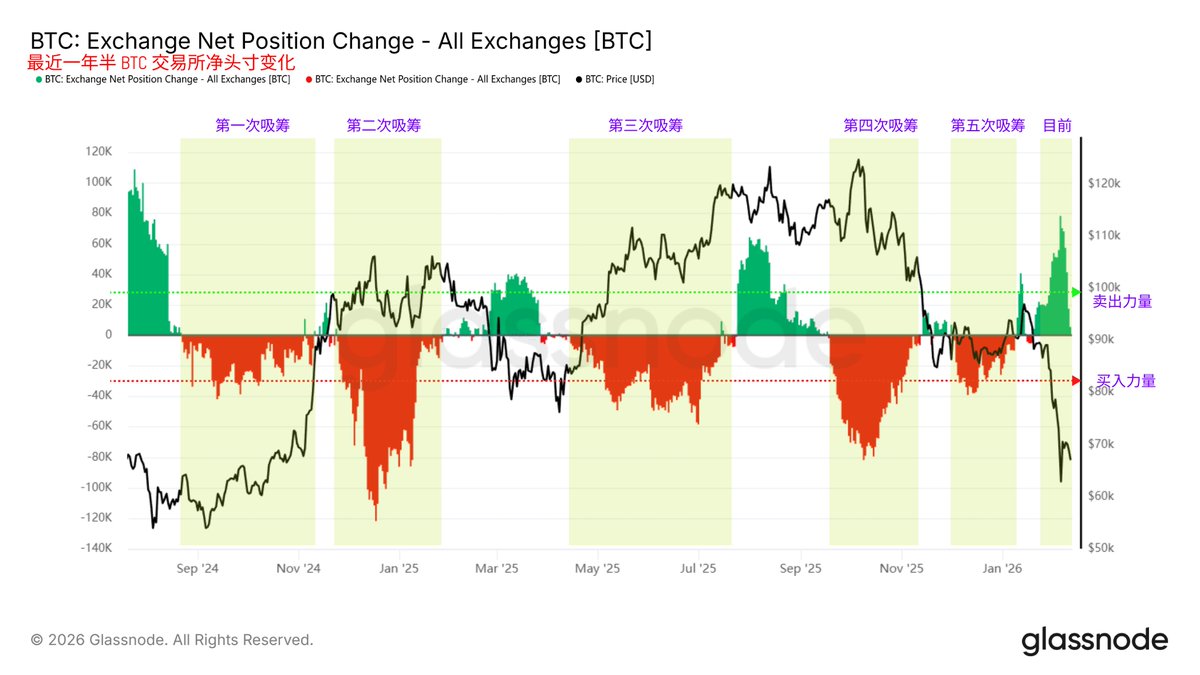

Recent Year’s Bitcoin Positions in Exchanges

Although selling has decreased, the trend of buying has not manifested. This is why I said only to build positions, rather than going all in. It’s apparent that there have been five instances of large-scale accumulation in the last year and a half, with three of them being very large. The first and second instances were very close together, while the fourth and fifth instances, although also closely timed, clearly show a gradual weakening of the buying trend. This reflects the decreasing liquidity of BTC.

At this stage, from the selling strength, it can be seen that it is not only on a downward trend, but almost at the foot of the mountain. The next thing to watch is whether market sentiment and liquidity can support the rise in $BTC’s purchasing power. If there can be large-scale buying like the three instances in the middle, then it would indicate a bull market transition.

The reasons for these three instances are:

1+2. The elections and Trump coming to power, which do not need much explanation.

3. The end of the Sino-American trade war

4+5. The Federal Reserve’s expectations for easing and the SEC’s exemptions for innovation

From a trend perspective, October should be a very stable month. If not for the joint liquidation caused by October 11th, it is very likely that the fifth instance would not have separated from the fourth, and the fourth accumulation could have raised a new high with the rate cuts in October. Unfortunately, after October, it became evident that November and December did not experience any major mishaps, as the market worked hard to boost purchasing power. However, the gap in liquidity was too large; the scale of the fifth phase of accumulation was the weakest among the five, thus the buying power steadily waned.

So looking back at the present, whether a sixth instance can occur requires either an epic positive stimulus or significant easing from the Federal Reserve. If neither can be achieved, I still believe Bitcoin can slowly rebound, but how far it can rebound is hard to say. Especially before June, the biggest contention still revolves around Trump’s tariff policies and the monetary war between Trump and the Federal Reserve.

@bitget VIP, lower rates, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。