Editor: Zen, PANews

TON was one of the most important players in the cryptocurrency industry last year.

At the beginning of this year, TON's legitimate identity was reestablished, becoming the only designated blockchain infrastructure for Telegram mini-programs. The two parties also jointly proposed a grand vision to bring 30% of Telegram's over one billion users to the TON blockchain by 2028.

Although the TON ecosystem is not as hot as it was last year due to this deep "binding," several hotspots have still emerged. The most notable is the digital collectibles-related "Telegram Gifts" (similar to QQ Show) — in July this year, hip-hop artist Snoop Dogg created a limited edition Gift of his personal image, which sold out nearly one million copies in just 30 minutes, generating approximately $12 million in sales.

Telegram founder Pavel Durov also publicly described these Gifts as "social network native NFTs," rather than traditional profile pictures that circulate only within the crypto circle.

In addition, TON is continuously advancing in areas such as payments, retail DeFi, wealth management, RWA, and AI, upgrading Mini App capabilities around social products and IP. The path of Telegram and TON is often compared to a "global version of WeChat," and in this narrative, the Asia-Pacific region is crucial: it understands the "WeChat growth model" best and knows how to combine mini-programs, payments, and social interactions to create a commercial closed loop.

Recently, PANews interviewed John, the head of the TON Foundation for the Asia-Pacific region, about how he brought the first batch of Chinese-speaking teams into the TON ecosystem, as well as the specific progress in payments, DeFi, digital identity collectibles, RWA, and AI. Regarding support for startup teams, John also mentioned that from early projects to scalable teams, TON actually has a complete phased support system internally referred to as the "service triangle."

John: Starting from Zero with the TON Foundation

John joined the TON Foundation about three years ago, responsible for the Asia-Pacific region. All work related to the Chinese-speaking community has been built from scratch by him and his team.

In his early years, John worked in investment and innovation at major internet companies, with a diverse background. During that time, he researched sectors including e-commerce, short videos, social media, and even online education, and due to work requirements, he also experienced and studied the WeChat ecosystem quite comprehensively. "In fact, the WeChat ecosystem has spawned many unicorn companies, some of which have become very large globally, with the most typical examples being Pinduoduo, and later listed companies like Yunji, Waterdrop, Youzan, and Weimeng," John added.

"This experience was actually one of the important reasons I later joined the TON ecosystem." John revealed that he felt the future of the TON ecosystem might have some similarities with the WeChat ecosystem. On the other hand, he gradually became skeptical about the value and growth potential of Web2 business models, so he transitioned to Web3, initially working at an exchange on listing and investment.

In 2022, when the TON Foundation was just established, it sought someone who understood both Web2 and Web3 and had experience in investment and business, and John happened to be a good match, thus joining the team. "At that time, TON was almost starting from scratch; even the familiar Telegram built-in wallet had not yet launched, but I actually thought it was the best time to join early on."

In addition to the reasons mentioned above, John expressed a "sense of mission" at TON — in 2021, there were about 7 million mini-programs and 3 million mini-program developers in China, and converting even 10% of them to the Web3 world would be a huge increment. He hopes to bring excellent mini-programs and WeChat ecosystem entrepreneurs to TON to serve global users. In fact, by 2024, the Telegram mini-program ecosystem has already brought over $1 billion in revenue to third-party developers.

Chinese-speaking Region Producing TON Ecosystem Star Products

As the head of the Asia-Pacific region, John's main work focuses on major project BD, ecosystem team support and incubation, and team building. Additionally, John and his team are responsible for event sponsorship, regional operations, and keeping the headquarters updated on the demands and progress of Chinese-speaking developers.

"So we have another task, which is to continuously inform the Dubai headquarters: what do Chinese-speaking entrepreneurial teams really care about? What should we do to survive and develop in this complex and large market?" After three years, on one hand, the Chinese-speaking teams have built trust internally, and on the other hand, a number of projects have successfully stood out in the TON ecosystem.

The most representative of these is the cat-themed Telegram game Catizen. "I personally brought this project in through BD," John said. The team originated from the WeChat mini-game ecosystem and is very familiar with the distribution logic of mini-programs and the communication mechanisms of social networks. They initially started on Solana, but due to occasional on-chain delays, they quickly grew after moving to TON, and their token has already been listed on mainstream exchanges like Binance.

John pointed out that from the end of 2022 to 2023, he personally spoke with at least around 200 Chinese-speaking teams. However, the number that was truly willing to build on the TON ecosystem was probably less than 10. During that period in 2023, it was still very early for TON, a very "rough" stage, with little fame, few teams, and few developers.

He stated, "By 2024, we will see a wave of explosive growth. To be honest, the vast majority of Chinese-speaking users only truly recognized TON from 2024." After the Tap2Earn model became popular, many other L1 and L2 projects connected with mini-games, bringing tens of millions to even billions of new users to major exchanges through listing. Due to the differences in overseas internet platforms compared to the closed nature of WeChat, there was no timely response. When exchanges noticed a decline in new user numbers and stopped listing, this caused the momentum of TON to not continue, instead helping other L1 and L2 projects gain a large number of users and assets.

Payments Connecting the TON Ecosystem

In the second quarter of this year, the TON Foundation established key support for five critical verticals, including payments, DeFi, GameFi, in-app economy, and AI Agent.

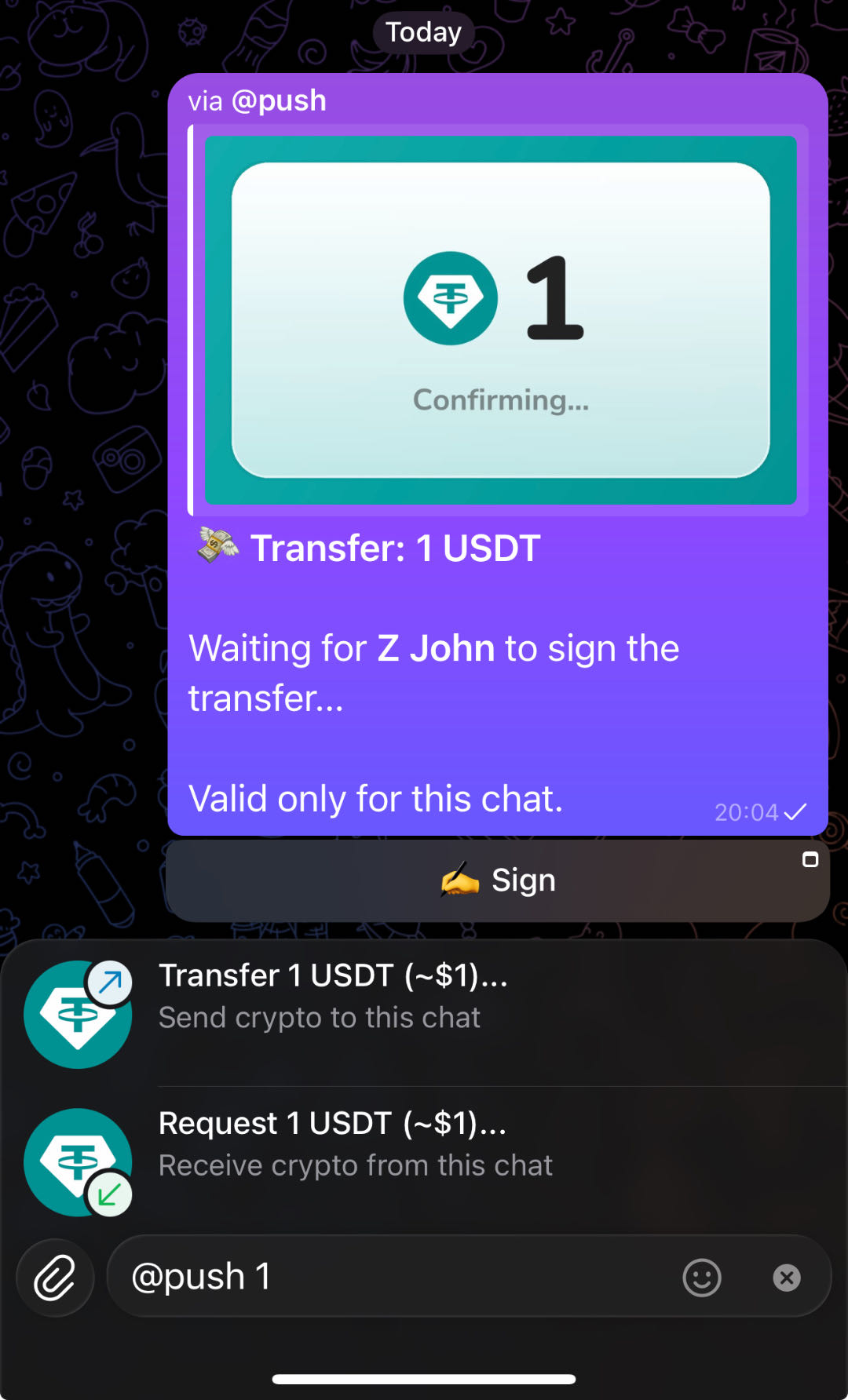

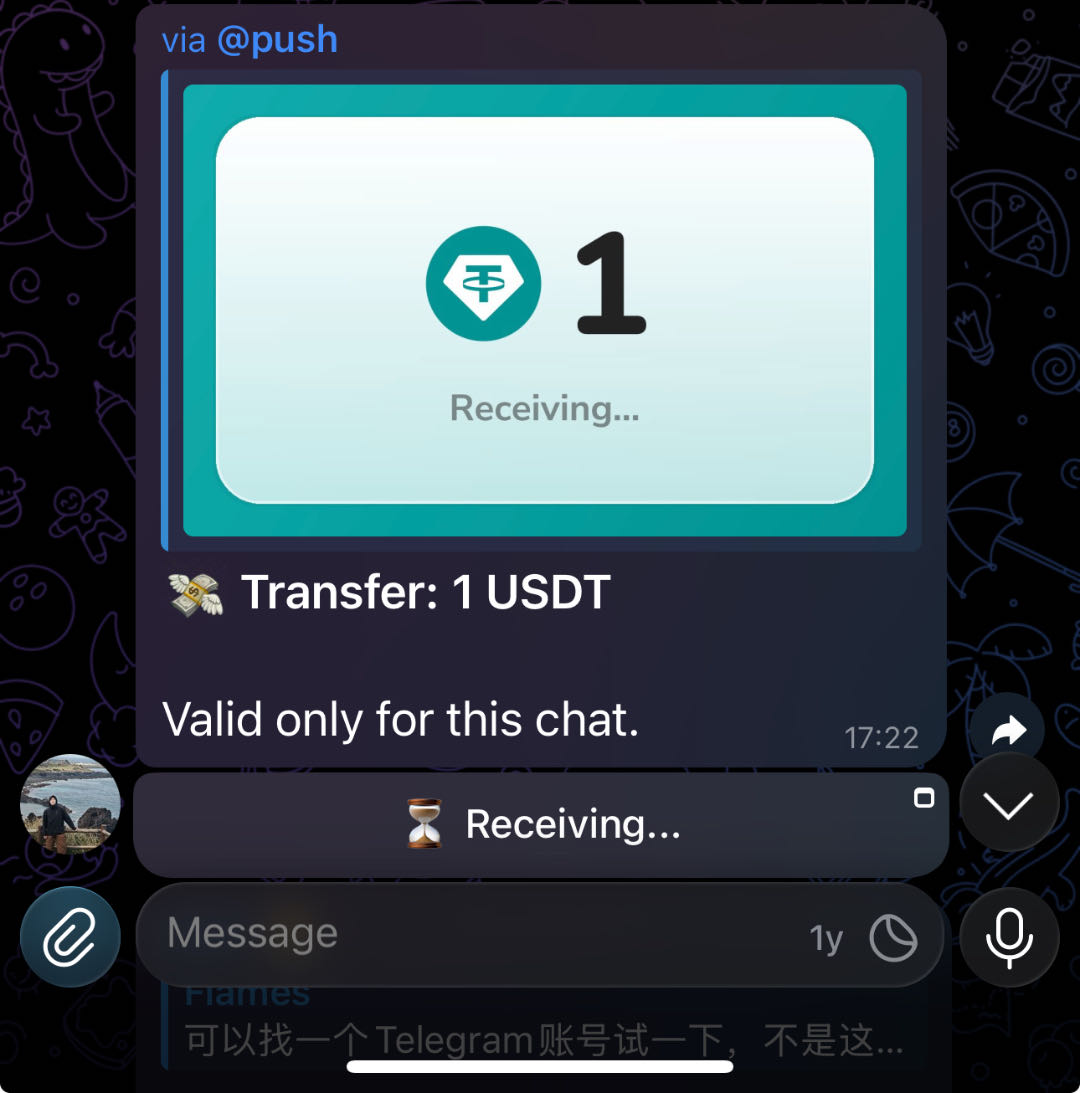

John believes that in the WeChat system, payments are "the foundation of foundations," and the same logic applies to the TON ecosystem. He pointed out that TON is currently focusing on three directions to find entrepreneurial teams: convenient peer-to-peer transfers and "on-chain red envelope" mechanisms, allowing users to complete signatures and transfer assets within Telegram groups; onboarding service providers and USDT bank card access in various regions to lower the entry barrier for newcomers; and promoting B-end settlement for cross-border trade, embedding stablecoins into foreign trade payment processes to serve overseas merchants.

"Chinese people can understand this best because WeChat Pay is the foundation of the WeChat ecosystem." John stated that payments are the layer of foundation that must be established in the TON ecosystem. Only with this layer in place can subsequent commercialization truly take off. "The foundation is currently designing gas-free stablecoin on-chain transfers, so users no longer have to worry about where the gas fees come from when transferring; additionally, they are actively bringing in fiat partners from various regions around the world."

In terms of supporting smoother peer-to-peer transfers of assets on TON, some teams have already created "on-chain signature red envelopes" based on the TON wallet, allowing users to set up a red envelope pool, drop a mini-program bot into a group, and group members can click to grab cryptocurrency.

He pointed out that many people misunderstand that the main application scenario of WeChat Pay is offline consumption, while in fact, about 80% of the transaction volume comes from peer-to-peer transfers between friends, group red envelopes, and other "social payments," with only about 20% being offline payments or online shopping payments.

Therefore, he believes that TON is naturally embedded in Telegram, this super social network, and this "social flow of funds" is an advantage that other blockchains do not have. Thus, TON will continue to delve into this field, not only promoting products through the TON wallet itself but also encouraging more teams to create red envelope and transfer mini-programs or bots to expand social C2C payments, while USDC is also on the verge of launch.

DeFi: Wealth Management for Ordinary Users

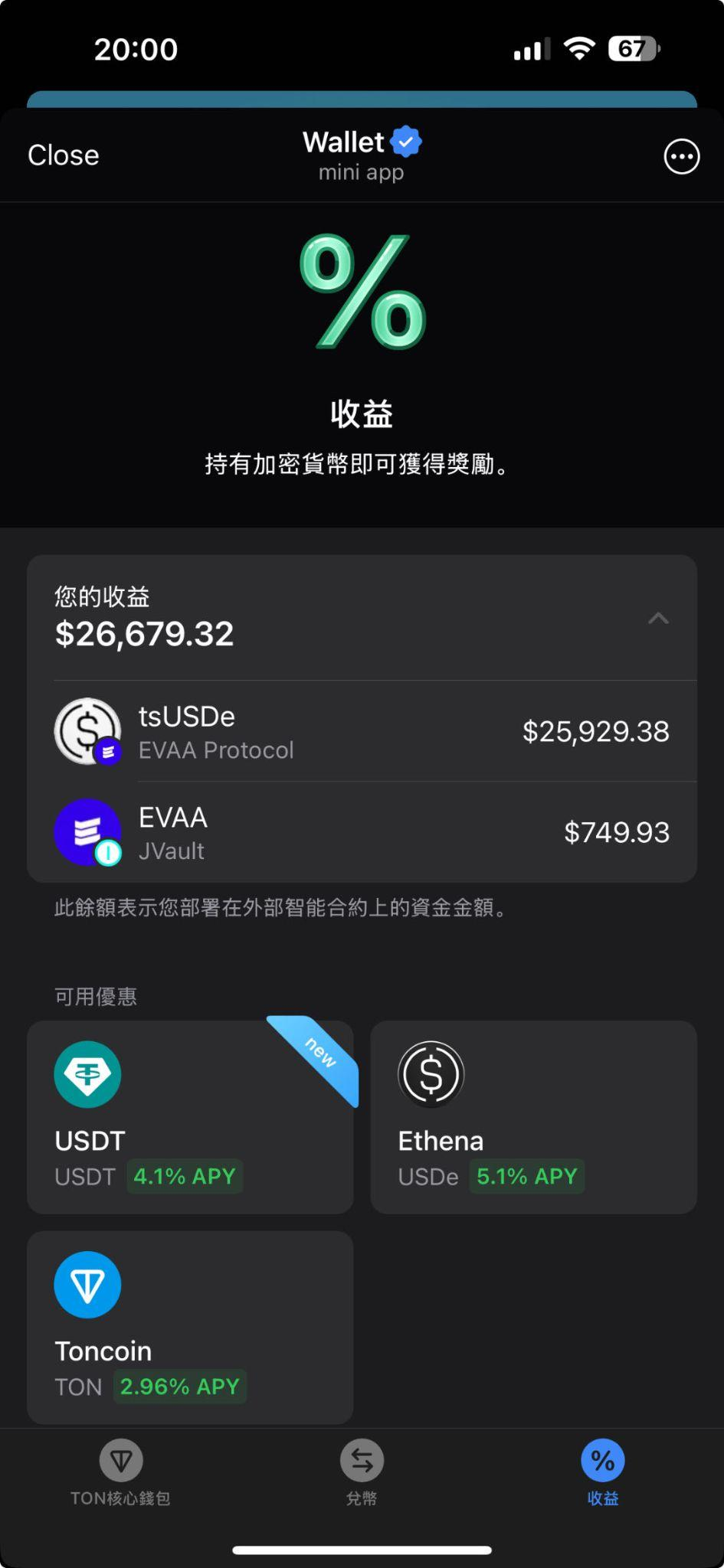

In the DeFi field, John pointed out that this year, TON has a clear positioning for DeFi: it is "on-chain wealth management for ordinary people" (Retail DeFi), similar to stable yield products like Yu'ebao, rather than high-risk plays.

Now, when you open the TON wallet in Telegram, you can see the "Earning" entry, which already has some products. For example, USDe: USEe has been issued on TON, with a current TVL exceeding $200 million. The normal annualized return is about 6% to 9%, but during the early promotion phase, we have subsidies, which can bring the annualized return to 16% to 19% when combined. John stated that the first round of subsidies has ended, and the next round will be linked to "social recommendations." "Using multi-level social viral marketing to attract new users is a path that aligns very well with TON's social distribution advantages."

In addition to stablecoin yield products, TON has also introduced tokenized assets related to gold this year, packaging them as a selectable yield asset in the wallet. Next, TON will also tokenize Telegram's corporate bonds into RWA assets. John revealed that TON has been running on the institutional side for several months in this regard, aiming to include it in "Earning" so that ordinary users can directly allocate it. Additionally, yield-generating assets on the TON chain can now also be used as collateral for DeFi lending protocols on TON.

In terms of DEX, TON has also completed both CFMM and CLMM models. John stated that the TON ecosystem now has a CLMM-based DEX called TONCO. This project launched quite late, but its trading volume now accounts for 32% of the TON ecosystem DEX market share, with cumulative fee income exceeding $1 million and trading volume surpassing $430 million, making it one of the core liquidity entry points.

"So this year, the DeFi sector has completely filled in the foundational aspects, including Lending, CDP, LSD, stableswap, Bridge, Prep DEX, Vaults, and even the Chainlink oracle that will officially launch early next year," John stated. The next step is to repackage these complex "DeFi Legos" into a more accessible presentation, combined with social recommendations, transforming them into wealth management products that ordinary users can easily understand and use with a single click.

Telegram Gift: IP Assets and Digital Identity Economy

In the interview, John emphasized the Telegram Gift, which is also one of the hottest directions for TON this year.

Gifts are not just static profile pictures; they are a complete set of wearable and displayable "digital identity collectibles": they can be worn on users' Telegram profile pages and provide exclusive themed backgrounds for chat windows.

John mentioned that popular items like "Plush Pepe" now have a floor price close to $10,000, with the highest increase of about 400 times, and there are only a little over 2,000 of them. Its value comes from two points: scarcity + social bragging. As the popularity of Gifts continues to rise, the entire TON ecosystem has also seen many mini-programs for the secondary market of Gifts. "Later, the official team created a secondary market, but interestingly, third-party mini-programs in the ecosystem ended up generating higher trading volumes." Currently, the market size for Gifts has reached several hundred million dollars.

"Now we are also promoting the gradual on-chain confirmation of all these Gift transactions," John stated. Some mini-programs in the TON ecosystem can already trade these Gift NFTs directly on-chain. The core of this change is: when a Gift rises from "a few bucks" to "a scarce asset worth tens of thousands of dollars," users will naturally care about whether it has on-chain confirmation and whether they truly own the asset.

"We have a well-performing secondary market mini-program called Tonnel, which supports listing, bidding, and instant transactions for each Gift," John added. Around these rare Gifts, financial play has even emerged: some people use high-priced Gifts as collateral, similar to a pawn shop, to exchange for USDT; or they rent out Gifts to earn rental income. This type of business was initially called GIFI Auction, as most ordinary Telegram users do not understand what DeFi is, and it was later renamed Rent to help users better understand the mechanism of earning rental income through leasing.

In addition to Gifts, TON has also turned Stickers, a lighter asset, into NFTs that can be used directly in Telegram. Well-known IPs like Azuki and Fat Penguin have also launched their Sticker NFTs on TON. Furthermore, the recently launched TON NFT 2.0 new protocol allows NFT issuers to set royalties for future secondary market transactions, enabling IP owners to continuously earn NFT transaction royalty commissions in the future, thereby better incentivizing IP creators. To support this, the foundation has also established an official Sticker store that supports the NFT 2.0 protocol: Fuse.

John pointed out that after the Fat Penguin Stickers were released, they continued to extend their reach by launching co-branded mini-games. "This echoes a trend we have observed: within the WeChat mini-game ecosystem, WeChat is also promoting IP co-branded mini-games. The reason is simple: on one hand, IPs come with built-in traffic, making customer acquisition cheaper; on the other hand, IPs can extend the lifecycle of mini-games and improve user retention rates."

Companionship, Leasing, and Trading Services in the AI Agent Economy

The combination of AI with blockchain and cryptocurrency has always been a key direction for industry exploration. Telegram is, in fact, the most natural large internet platform for combining chatbots — it has arguably the best bot API in the world. John stated that the ecosystem has already developed some "AI species" — bots that interact with one billion users based on chat interfaces and are empowered by large models, and their development speed has exceeded official expectations.

For example, there is an application in the TON ecosystem called StarAI [https://t.me/TheStarAIBot], which offers AI companion characters. Users can shape the characters according to their personal preferences, training their personalities and speaking styles, and then chat with them; they can also directly choose from AI characters that others have already trained to interact with. When the chat reaches a certain stage, it triggers a payment, which is completed through payments on the TON wallet chain.

When users feel that the character they have created is valuable, they can mint it as an NFT on-chain. "This means you are not just a player but also an agent. You can discover and refine a marketable AI personality like a scout, and earn money by going out and chatting with others through this character, with creators able to participate in revenue sharing. If someone sees long-term value in this character, they can even buy the entire character as an IP NFT and collect it in their TON wallet within Telegram."

This is essentially the "agent economy," where the AI character itself is a commodified IP that can be operated, shared in profits, and transferred. John stated that the StarAI team has been operating for over a year, generating real income (without issuing tokens) and maintaining a stable active user base of several hundred thousand. He believes this is very important — it shows that on TON, there are already people making money purely from product services, rather than relying on issuing tokens to profit at the expense of others.

In addition, Telegram's founder announced at the Blockchain Life conference in Dubai last Wednesday the launch of the Cocoon (Confidential Compute Open Network) protocol, a decentralized network for securely executing AI inference computations while protecting user privacy. Through this network, AI application developers can use TON tokens to pay GPU owners for processing inference requests. Telegram itself will be the first major client to use Cocoon for confidential AI requests.

Based on Cocoon, AI developers gain access to low-cost computing power while using user data without infringing on privacy, and GPU suppliers receive TON tokens as compensation, allowing users to enjoy AI applications without sacrificing their privacy data.

AI application developers now only need to privately message their planned models (such as DeepSeek, Qwen, etc.) and the desired daily request volume and average token input/output scale through this link; GPU owners who want to earn TON tokens by contributing computing power can also privately message through this link: specifying the number and model of GPUs they wish to provide (e.g., H200), VRAM, and machine working hours.

John stated, "The network will go live this month. From now on, users will no longer need to rely entirely on training models that can steal data privacy and centralized large model companies that manipulate user behavior."

At the conference, Pavel Durov also announced that next year there will be more involvement in the core technology of the TON blockchain, along with other exciting news.

Creating "Low-Risk, Stable Yield" RWA

"In terms of RWA, one of the directions we are currently pursuing is Telegram corporate bonds," John said. The general idea is to tokenize high-quality corporate bonds issued by Telegram, which are owned by many top global investment institutions and yield an annualized return of 8-10%, mapping them onto the TON chain to become on-chain assets that can be held and traded, and then placing them in the TON wallet for users to choose like wealth management products. This product is expected to be launched to users by the end of this year or early next year, and users can also use it in TON ecosystem's DeFi protocols to obtain higher yields.

"This is just the first step; we will also introduce more traditional financial assets. For example, we are collaborating with Backed Finance and Kraken to gradually launch tokenized US stocks and ETFs in different regions within the TON wallet. This is a type of 'high-recognition' asset that is easiest for ordinary users to understand. However, we will not only focus on traditional Wall Street assets. We are also exploring some non-standard RWAs that are more closely integrated with our ecosystem."

John revealed that there are teams in Hong Kong working on ride-hailing mini-programs, with the idea of breaking down "future autonomous vehicle fleets" into a revenue-generating asset that can be pre-purchased. Today's taxi drivers can buy these "fleet shares" in advance, and once the fleet is operational and starts generating revenue, the drivers can earn income based on revenue sharing, avoiding the future unemployment impact of autonomous driving.

Theoretically, this allows drivers to gradually shift from "exchanging time for driving" to "holding production materials and enjoying revenue sharing." We break down the revenue rights of a real-world vehicle/fleet into tradable revenue certificates, allowing drivers, as laborers, to become "shareholders" in advance.

"So for us, RWA is not simply about putting Wall Street assets on-chain. It can also be about tokenizing AI machine assets that greatly enrich real-world productivity, allowing ordinary participants to hold revenue rights."

John also stated that the standards for TON when dealing with RWA are completely different from the traditional DeFi notion of "the higher the yield, the better." The mainstream users of TON are Telegram users, which does not equate to seasoned players in the crypto space. They are more concerned about safety and stability, avoiding price decoupling like that of USDe on October 11, so what we need to do is to create assets that they can understand and trust.

Developer Support and the "Service Triangle"

The Asia-Pacific region has a large number of excellent developers, and this year TON has also launched a Telegram 2C application accelerator training camp to cultivate high-quality mini-game projects in the Asia-Pacific region. John stated that the mini-game accelerator/training camp is just one part of the support for developers and entrepreneurs.

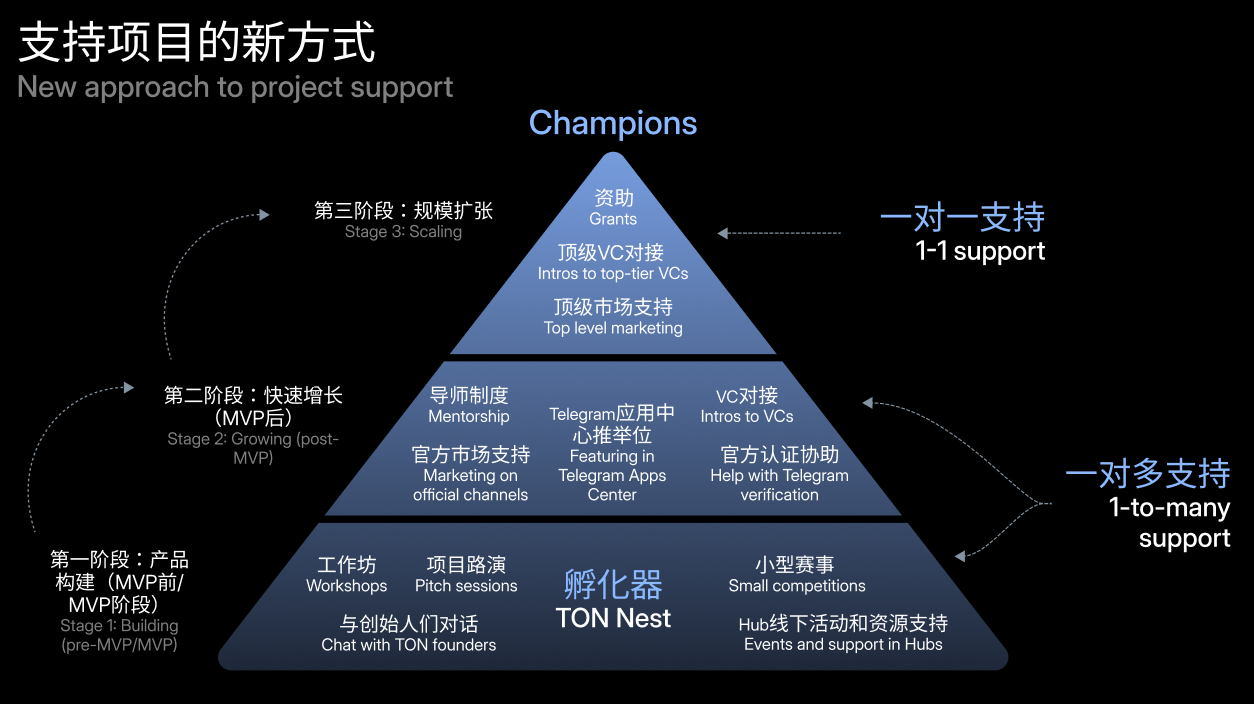

"We actually have a complete support system for projects at different stages globally, which we internally refer to as a service triangle. From early projects to scalable teams, there will be corresponding support at different levels."

John stated that at the very bottom are the teams that have just entered the ecosystem, meaning those still in the product formation stage or even at the idea or pre-MVP stage. Workshops, small competitions, pitch events, and offline hub activities are the most suitable platforms for them as they start out. Teams with more time can also join the incubator TON Nest.

Moving up to the second level, we find the "growth stage" teams, which already have an MVP and a product that can actually run. At this stage, support will transition from basic onboarding to mentorship. In simple terms, it’s a combination of mentorship + official endorsement + resource matchmaking. For example: how to get certified for the Telegram official public account/bot/mini-program, exposure resources in the Telegram mini-program store. The positioning at this level is to "bring the product to the surface," transforming it from a good idea/good demo into a project with identity and credit endorsement.

Further up is the third level, which corresponds to the scale expansion phase. This stage is essentially for teams that have already launched and are starting to scale up. Support at this level will be more about "1-on-1 resource opening": including securing funding from the foundation, directly connecting you with top VCs, and arranging higher-level marketing to become a "representative project of the TON ecosystem." This level is more about Champions, which are the projects that TON is focusing on.

John revealed that TON plans to restart the global hackathon next year, and they are already designing it internally, aiming to make it better than previous editions. "This year, we basically did not hold large-scale hackathons, just to free up resources to make next year's edition a more complete and systematic version."

"But the most important thing next year will definitely be the various AI agent bots within the Telegram ecosystem. Because any ecosystem is fundamentally determined by the founder's most important direction. And Telegram has the best bot development ecosystem in the world and hundreds of millions of users who want to protect their privacy data." John expressed confidence that with Pavel's latest proposal for protecting user privacy data through AI inference mining, AI projects will become the latest trend in the TON ecosystem.

"So, we hope to find more AI-related projects to thrive within Telegram, especially in the social private domain AIGC prediction markets, which can meet the regional long-tail markets that have not been satisfied by centralized Polymarket/Kashi."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。