Source: Fortune

Original Title: Crypto founders are getting very rich, very fast—again

Translation and Compilation: BitpushNews

In the startup world, we are accustomed to stories where founders toil for years and eventually become millionaires when their companies go public or are acquired.

This wealth legend is also playing out in the cryptocurrency field, but the path to riches is often much shorter.

A typical case is Bam Azizi. He founded the crypto payment company Mesh in 2020 and completed a $82 million Series B funding round this year.

Normally, this type of funding should be fully invested in company development, but this time at least $20 million went directly into Azizi's personal pocket.

This money comes from "secondary sales"—investors purchasing shares from founders or other early participants. This means that while the funding amount looks impressive, the actual money entering the company's account may be significantly less. However, for founders, they do not have to wait many years; they can achieve financial freedom in the blink of an eye.

This is not necessarily a bad thing. A spokesperson for Mesh pointed out that the company has partnered with PayPal to launch an AI wallet and is developing well. But the problem is that in the current bull market, founders are cashing out through secondary sales before the company has truly proven its value.

Million-Dollar Mansions

Azizi is not alone. Since the bull market that began last year, Bitcoin has soared from $45,000 to $125,000, creating countless wealth myths.

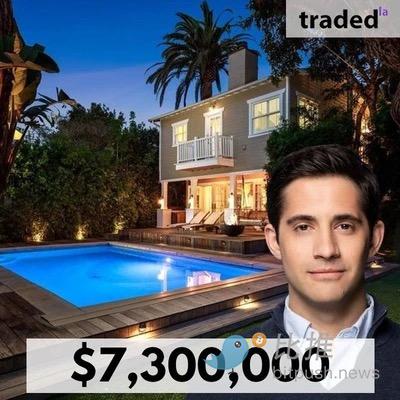

In mid-2024, the crypto social platform Farcaster completed a $150 million Series A funding round, of which at least $15 million was used to buy shares held by founder Dan Romero.

This former Coinbase employee does not hide his wealth; in an interview with Architectural Digest, he showcased his $7.3 million mansion located in Venice Beach, a estate consisting of four buildings that the magazine called an "Italian-style garden."

While the decoration is successful, Farcaster's development has been less than smooth.

Reports indicate that the platform has fewer than 5,000 daily active users, far behind competitors like Zora. Romero did not respond to this.

Omer Goldberg also benefited. His security company Chaos Labs saw $15 million of the $55 million Series A funding go into his personal pocket. This company, backed by PayPal Ventures, has become an important voice in the blockchain security field, but it also remains silent about this deal.

Why Venture Capitalists Are Willing to Pay

According to industry insiders, secondary sales are becoming increasingly popular in the current hot cryptocurrency market and in trending sectors like AI.

Top venture capital firms like Paradigm and Andreessen Horowitz often agree to purchase founder shares to secure lead investor positions for high-quality projects.

For investors, this is essentially a gamble. The common stock rights they acquire are limited and far less favorable than preferred shares in traditional financing. However, in an industry accustomed to "painting a big picture," whether it is appropriate to generously reward founders who have not yet succeeded is indeed debatable.

Veteran cryptocurrency observers should be familiar with this scenario. During the ICO boom in 2016, countless projects easily raised hundreds of millions by issuing tokens. They promised to revolutionize blockchain technology and surpass Ethereum, but most have now disappeared.

At that time, investors tried to use "governance tokens" to constrain founders, but one venture capitalist admitted, "They call them governance tokens, but they really govern nothing."

By the time of the new bull market in 2021, the financing model began to align more with traditional Silicon Valley models, but the phenomenon of founders cashing out early still existed.

The payment company MoonPay saw executives cash out $150 million during a $555 million funding round.

When the media reported that the CEO spent $40 million on a Miami mansion, the market was beginning to cool.

The once-star project OpenSea is similar; the founding team cashed out significantly during financing. But as the NFT craze faded, the company now has to seek transformation.

"You Are Building a Faith Community"

Why don't venture capitalists stick to a more traditional incentive model—allowing founders to meet basic financial needs in Series B or C but requiring them to wait until the company is truly successful to reap huge rewards?

Senior transaction lawyer Derek Colla pointed out the key: most cryptocurrency companies are "light asset," not requiring the massive capital investments seen in the chip industry, so this portion of funds naturally flows to the founders.

He further explained, "This industry is extremely reliant on influencer marketing, and there are too many people willing to throw money at founders. Essentially, you are building a faith community."

Secondary trading expert Glen Anderson put it more bluntly: "In hype cycles like AI and cryptocurrency, as long as you tell a good story, you can easily cash out." However, he emphasized that founders cashing out does not mean they have lost confidence in the project.

Lawyer Colla believes that significant cashing out does not diminish founders' enthusiasm. He cited MoonPay as an example; although the founders faced criticism due to the mansion incident, the company's business continues to develop healthily. The failure of Farcaster is not necessarily due to the founders not working hard, "he is working harder than most."

But he also acknowledged that truly outstanding entrepreneurs choose to hold their shares long-term because they believe these equities will multiply in value when the company goes public. "Great founders never want to sell in the secondary market," Colla summarized.

In this industry full of opportunities and bubbles, wealth comes quickly and leaves just as fast. As a new wave of wealth creation sweeps in, perhaps we should consider: what kind of incentives can truly nurture great companies?

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。