作者:Michael Nadeau

来源:The DeFi Report

原文标题:《Has the Bear Market Arrived?》

编译及整理:BitpushNews

今年以来,黄金和标普500指数的表现均已超越BTC。然而,所有看似"看涨的催化剂"在年底前依然存在。

降息、监管、稳定币、代币化、流动性、贸易协定、GDP、科技七巨头财报、大规模财政法案、特朗普。

从表面上看,市场环境似乎不错。

尽管如此,随着市场情绪和基本面开始恶化,加密市场参与者似乎陷入了希望与怀疑之间的僵局。

在本报告中,我们旨在通过硬数据和市场情绪观察来穿透迷雾。

免责声明:所表达观点为作者个人观点,不应作为投资建议。

让我们开始吧。

动量数据

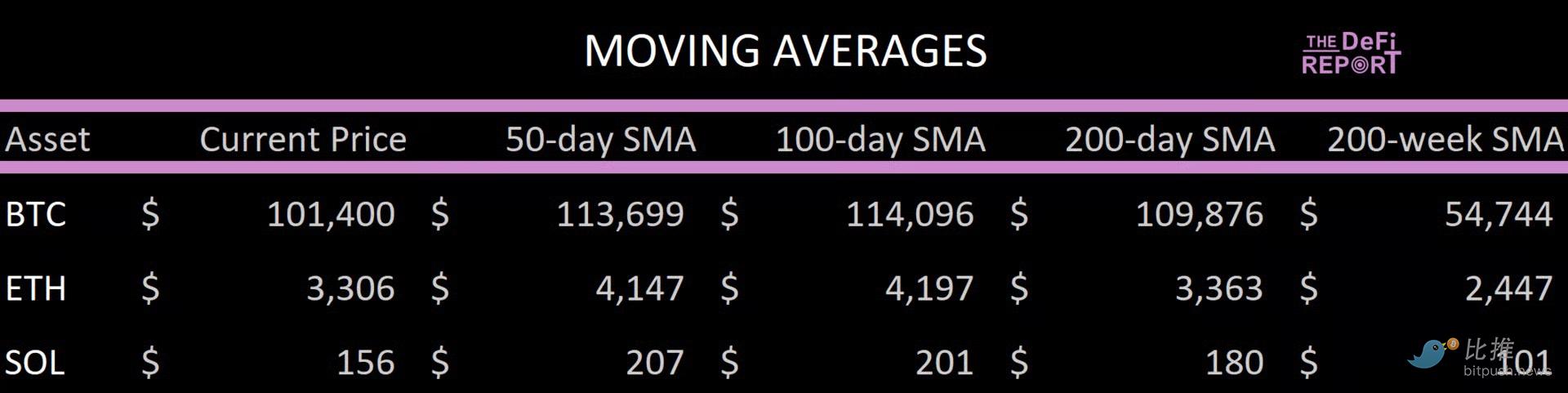

移动平均线

数据来源:The DeFi Report,截至2025年11月4日

BTC、ETH和SOL均已失守其50日、100日和200日简单移动平均线(SMA)。我们关注的关键数字是BTC的10.28万美元(其50周移动平均线)。为什么?因为在过去的周期中,当BTC周线多次收于50周移动平均线下方时,周期顶部便已确认。

BTC的长期200周移动平均线目前为5.47万美元。如果我们正走向熊市,我们预计BTC价格最终将在熊市底部向200周移动平均线(该线将持续上升)收敛。

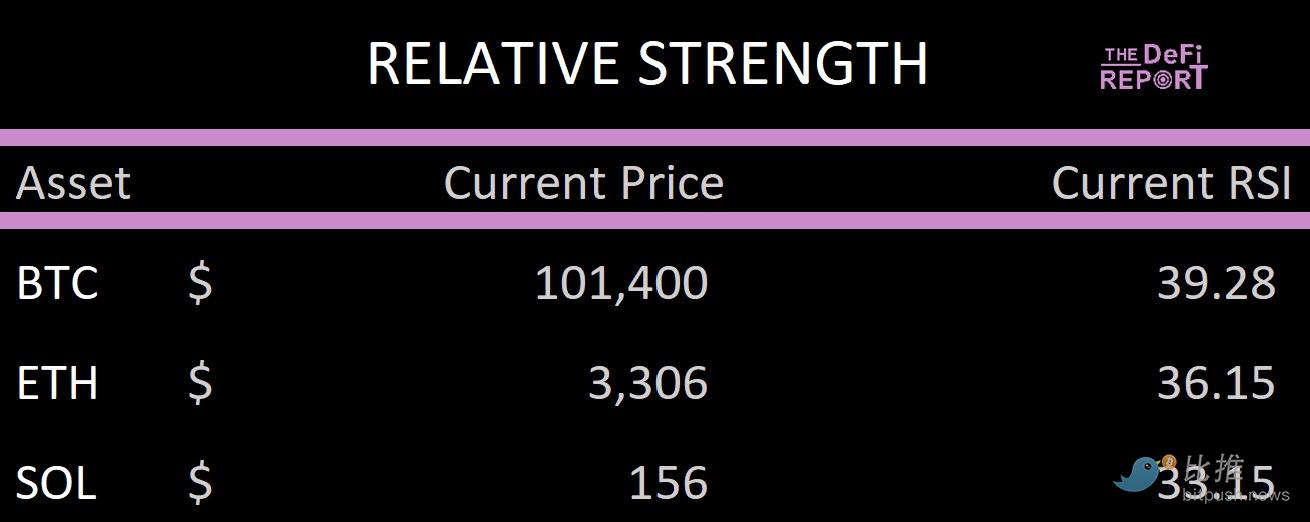

相对强弱指数

数据来源:The DeFi Report,截至2025.11.4。RSI = 14周期。

BTC、ETH和SOL均正在接近"超卖"水平(低于30)。更长尾部的山寨币已经处于超卖状态。

在牛市中,这通常是"逢低买入"的绿灯。

流量数据

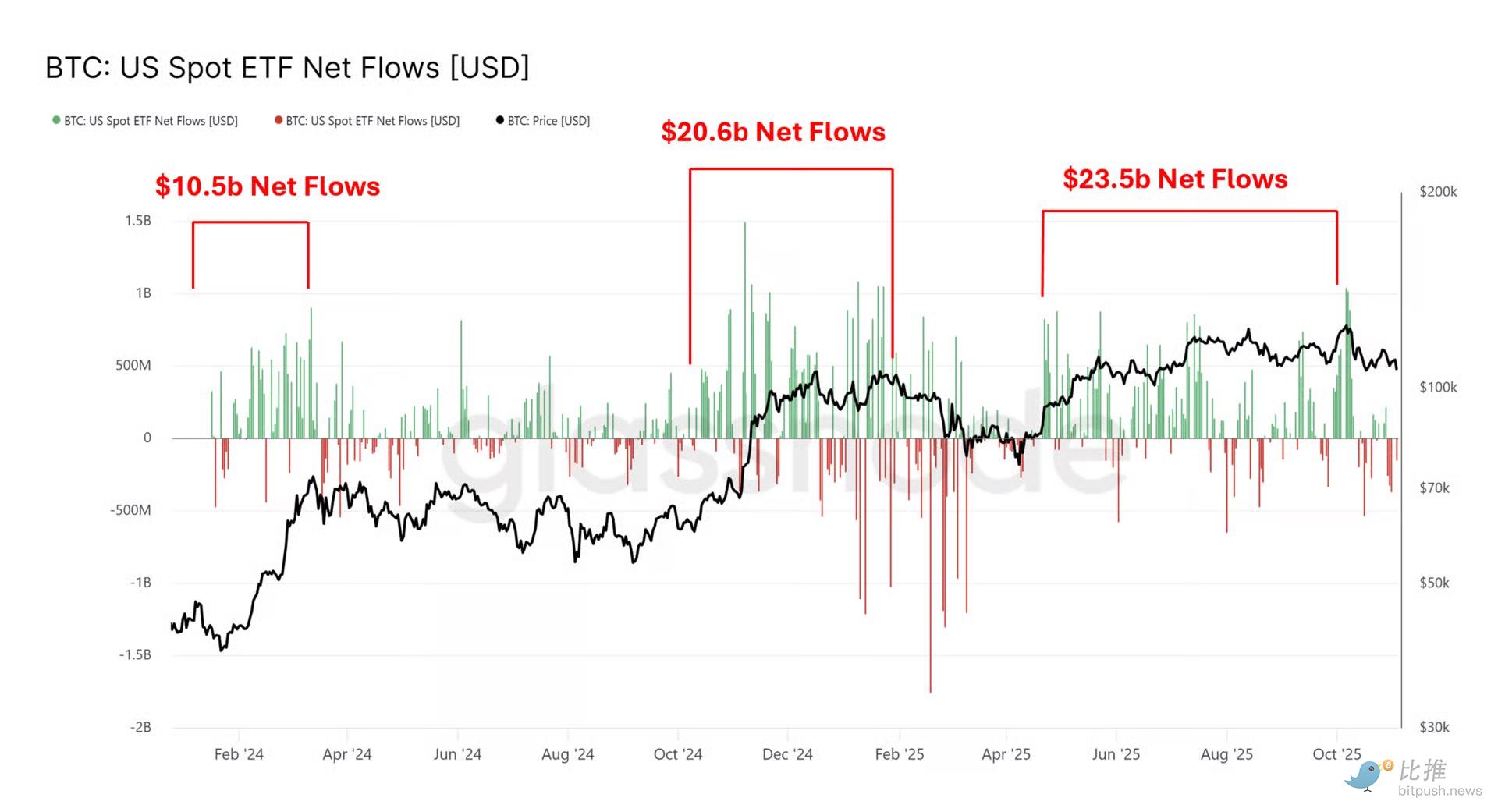

ETF

数据来源:Glassnode,截至2025年11月4日

就资金净流入量和资产管理规模而言,比特币ETF已成为历史上最成功的金融产品之一。

然而,自10月10日以来,ETF出现了14亿美元的净流出。但让我们担忧的并非流出的规模,而是流入的缺乏。

随着需求减弱,比特币最大的积累者似乎即将耗尽"弹药"……

MicroStrategy购买情况

数据来源:High Charts,截至2025年11月4日

MicroStrategy目前持有超过64.1万枚BTC。他们在2023年10月至2025年7月期间购买了47.6万枚BTC。

这相当于同期BTC总发行量的1.19倍。

那么在过去的三个月里呢?他们仅购买了1.22万枚BTC。

作为参考,MicroStrategy的BTC持有量是第二大BTC国债公司的12倍。他们约占"国债"市场总量的65%。

随着ETF需求减弱,且最大的BTC持有者似乎在短期内"弹药耗尽",我们从链上的长期持有者群体中看到了什么?

持有者群体数据

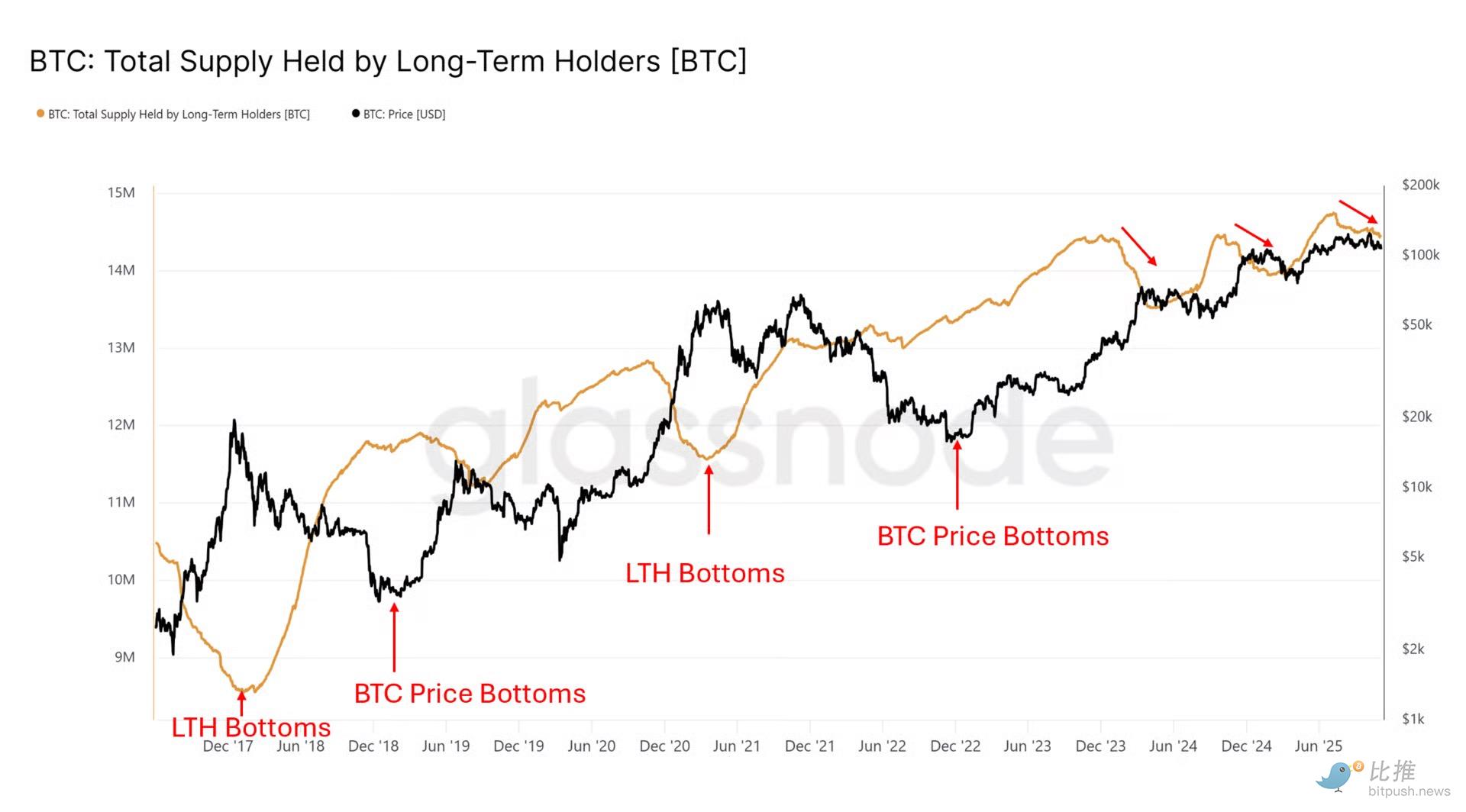

长期持有者

数据来源:Glassnode,截至2025年11月4日

更多的抛售。这是本轮周期中的第三次派发潮。

历史上,市场扩张只有在长期持有者从派发转向持续积累后才会开始。在本周期中,我们已经两次看到这种情况上演。

然而,如果我们正在进入熊市,我们可以看到,在2017年周期峰值后,长期持有者转为净积累者之后,又过了10个月BTC价格才正式触底。

类似地,在2021年第一个周期峰值后,长期持有者重返市场之后,又过了9.5个月BTC价格才正式触底。

在未来几个季度当我们看到这一转变发生时(以及当我们的"公允价值"目标位被触及时),我们将提醒大家。

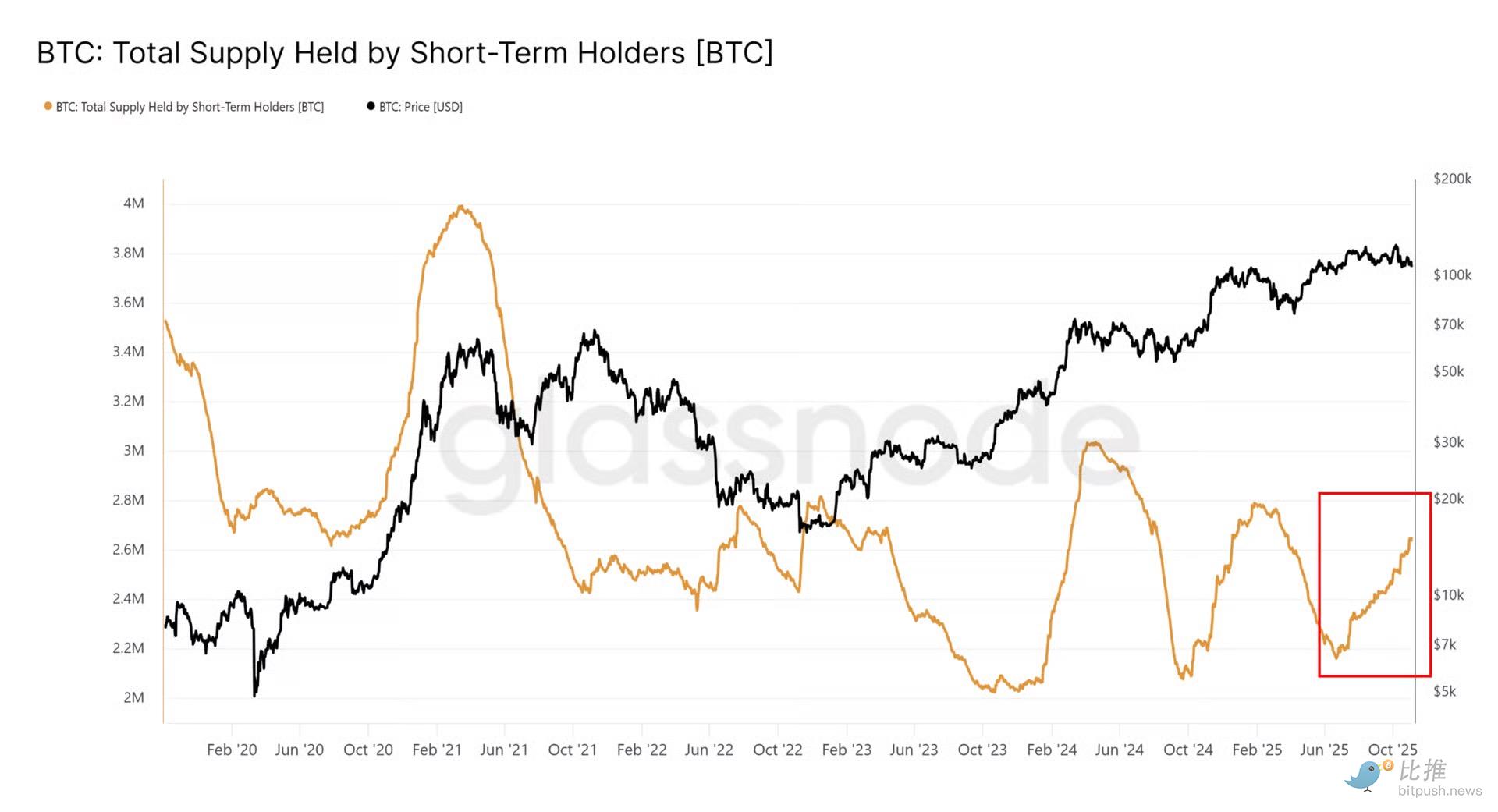

短期持有者

数据来源:Glassnode,截至2025年11月4日

随着长期持有者退出市场,他们已将代币转手给新一波的短期持有者。

我们认为,当这群短期持有者最终投降并将他们的代币出售时(其中部分代币会由新的长期持有者接手),长期持有者将重新步入市场。

市场情绪

正如引言中所述,我们的感觉是市场中仍有相当一部分人在坚持希望。

降息、监管、稳定币、代币化、流动性、贸易协定、GDP、科技七巨头财报、大规模财政法案、特朗普。

这些因素使许多人得出结论,认为四年周期已成为"过去式"。

现在,BTC自2023年1月以来一直处于只涨不跌的趋势中。每次逢低买入都是正确的操作。

因此,许多市场参与者可能很难从更看涨的立场转变过来也就不足为奇了。毕竟,所有的叙事都依然成立。

市场对Jordi Visser近期一篇题为《比特币的无声IPO:为何当前盘整并非你所想的那样》的精彩文章的反应,强化了我们对市场结构/情绪的看法。

X平台

我带着一丝嘲讽转发了那篇包含文章链接的推文,没想到竟获得了260万次展示。

这篇文章讲了什么?它把比特币近期的横盘整理比作一场"无声IPO"——不过是早期玩家在离场,为新底部筑底。全文都带着那种"我见多了,别慌,只管囤币"的论调。

虽然这更像是一碗"心灵鸡汤"而非数据驱动的分析,市场却照单全收。就好像投资者急需心理按摩似的。

这个现象暴露了当前市场结构的本质。

关键启示是什么?市场上仍然弥漫着浓厚的"乐观剂"。投资者需要"情绪慰藉"。那篇文章正好满足了这种需求,这恐怕就是它能病毒式传播的原因。谁知道呢,也许最终市场真会如文章所言,但这个现象确实值得仔细琢磨。

或许,在市场最需要信念支撑的时刻,投资者需要的不仅是冷冰冰的数据,更是一个能让他们安心的故事。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。