Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETF Net Outflow of $798 Million

Last week, the US Bitcoin spot ETFs experienced a net outflow over three days, totaling $798 million.

Nine ETFs were in a net inflow state last week, with outflows primarily from IBIT, FBTC, and BITB, which saw outflows of $403 million, $155 million, and $79 million, respectively.

Data Source: Farside Investors

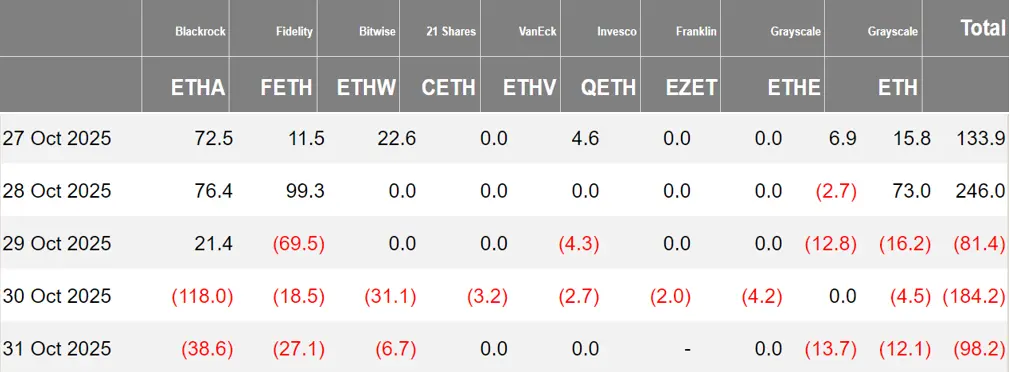

US Ethereum Spot ETF Net Inflow of $16.1 Million

Last week, the US Ethereum spot ETFs had a net inflow over two days, totaling $16.1 million.

The inflow last week was mainly from Grayscale ETH, with a net inflow of $56 million. Two Ethereum spot ETFs were in a net inflow state.

Data Source: Farside Investors

Overview of Crypto ETF Dynamics Last Week

Bitwise Updates XRP ETF Application Document, Management Fee Rate at 0.34%

Bitwise has updated its fourth revision of the XRP ETF application document, adding exchange information (New York Stock Exchange) and a management fee rate (0.34%). Eric Balchunas stated that these are typically the last few key steps needed in the ETF application process.

According to crypto journalist Eleanor Terrett, Canary Capital has submitted an updated S-1 form for its XRP spot ETF, removing the "delay amendment" that prevents registration from becoming effective automatically, and has handed over control of the timeline to the SEC.

Assuming Nasdaq approves the 8-A form application, Canary's XRP ETF will officially launch on November 13. Note: The government resuming operations may affect the timeline; if the application materials are complete and the SEC is satisfied, the timeline may be expedited; if staff raise more concerns, the timeline may be delayed. However, it is worth noting that the SEC Chairman himself seems to support companies utilizing the automatic effectiveness mechanism. Although he did not directly comment on the launch of the ETF, Paul Atkins stated yesterday that he was pleased to see companies like MapLight utilize the 20-day statutory waiting period to launch during the government shutdown and praised Bitwise and Canary for using the same legal mechanism when launching SOL, HBAR, and LTC ETFs this week.

Fidelity Submits S-1 Update for Its SOL ETF

According to crypto journalist Eleanor Terrett, Fidelity has just submitted an updated S-1 for its SOL ETF, removing the "delay amendment" that prevents registration from becoming effective automatically, and granting the SEC control over the timeline, a modification that mirrors the already listed Bitwise SOL ETF.

Grayscale Launches Solana ETF with Staking Feature and Lists on NYSE Arca

According to The Block, Grayscale has converted its GSOL into an ETF and listed it on NYSE Arca, including a SOL staking feature, claiming to have become the largest Solana ETP manager in the US.

The day before, Bitwise launched its Solana ETF on the NYSE; Canary launched Litecoin and HBAR ETFs on Nasdaq. During the US government shutdown, the SEC issued guidance: S-1s without delay amendments can automatically become effective after 20 days; and has approved listing standards for commodity trust shares on three exchanges, potentially accelerating the launch of multiple crypto ETFs.

21Shares Submits HYPE Spot ETF Registration Application to SEC

Documents from the US SEC show that 21Shares US LLC has submitted an S-1 registration statement for the "21Shares Hyperliquid ETF."

This ETF aims to track the dollar price performance and staking yield of the Hyperliquid network's native token HYPE, reflecting overall returns after deducting related fees. The fund structure is in the form of a Delaware statutory trust, with custodians including Coinbase Custody and BitGo Trust.

Canary Has Submitted an Updated S-1 Document for Its Spot Solana ETF, Fee Set at 0.5%

According to the SEC's official website, Canary has submitted an updated version of its S-1 application document for its spot Solana ETF, with a fee set at 0.5%.

Spot SOL, LTC, and HBAR ETFs Have Started Trading on Wall Street

Crypto journalist Eleanor Terrett posted on X platform that the first batch of spot SOL, LTC, and HBAR ETFs has started trading on Wall Street.

Bitwise to Launch Solana Staking ETF (BSOL)

Cointelegraph posted on X platform that Bitwise will launch its Solana staking ETF (BSOL), which is the first 100% spot SOL exposure ETP in the US.

VanEck Submits Sixth S-1/a Amendment for Spot Solana ETF

According to analyst MartyParty, VanEck has submitted its sixth S-1/a amendment for its spot Solana ETF, with changes including: the submission status changed to "effective," and the fee set at 0.3% (which was also 0.3% in previous documents).

Views and Analysis on Crypto ETFs

Crypto analyst Miles Deutscher pointed out that the current weakness in the crypto market is mainly influenced by three factors: DAT liquidation operations putting pressure on Bitcoin and Ethereum, the depletion of ETF demand leading to consecutive net outflows, and the severe psychological and substantive impact of the October 10 incident on the market.

Despite this, he believes that a strong rebound in Bitcoin prices could completely change market dynamics and is expected to reach new highs. Deutscher advises investors to focus on researching potential areas such as smart agents, robotics, RWA, and prediction markets during the market downturn, while closely monitoring changes in on-chain liquidity to prepare for a market recovery.

According to DL News, Grayscale's research director Zach Pandl predicts that the US Solana spot exchange-traded fund (ETF) could replicate the successful performance of Bitcoin and Ethereum products, absorbing at least 5% of the total supply of Solana tokens within the next one to two years.

At current prices, this means that over $5 billion worth of Solana tokens could be absorbed by companies like Grayscale and Bitwise. This week, two Solana ETFs officially began trading. Bitwise's BSOL launched on Tuesday, and Grayscale's GSOL listed on Wednesday. Unlike Bitcoin ETFs, Solana ETFs support staking features, with an annualized yield of approximately 5.7%.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。