Traditional banks and crypto companies compete in on-chain finance; how to balance technology and regulation?

Author: Shania, Jay Jo

Source: Tiger Research

Translation: Baihua Blockchain

JP Morgan issues deposit tokens on public blockchains and integrates technology into the existing order. In contrast, Circle builds a completely technology-based new order by establishing a trust bank.

Interestingly, these two participants, with vastly different backgrounds and approaches, are now embracing new technologies and building new institutions. This strategy ultimately blurs the lines between them.

However, this identity ambiguity may also weaken their inherent competitive advantages, as seen in the previous experiences of the fintech industry. Therefore, each participant needs to understand their "unfair advantage" and find a balance between technology and institutions.

1. The Battle for On-Chain Financial Infrastructure

Blockchain technology is becoming a new cornerstone of global financial infrastructure. Traditional financial institutions and native crypto companies are fiercely competing for leadership in the next generation of financial systems. JP Morgan enhances efficiency by integrating blockchain technology into the traditional financial system, while Circle focuses on building a new financial infrastructure entirely based on blockchain as an alternative to traditional structures.

This model is similar to the past competition between fintech and techfin driven by large technology companies. However, the current competitive landscape is vastly different. Past competition primarily focused on improving user experience and providing limited financial services, while the current competition has delved into the core infrastructure level, covering asset issuance, capital flow, transaction settlement, and asset custody.

This competition is not only about technological advantages; at its core, it is about who will design and operate the future financial ecosystem. Traditional financial institutions attempt to undergo gradual transformation within the existing regulatory and system framework, while native crypto companies focus on technological efficiency and scalability to build a new order. This report will explore the on-chain financial strategies of JP Morgan and Circle, analyze the development direction of on-chain financial infrastructure, and how each participant shapes the new global financial order.

2. JP Morgan: Building Blockchain on Traditional Finance

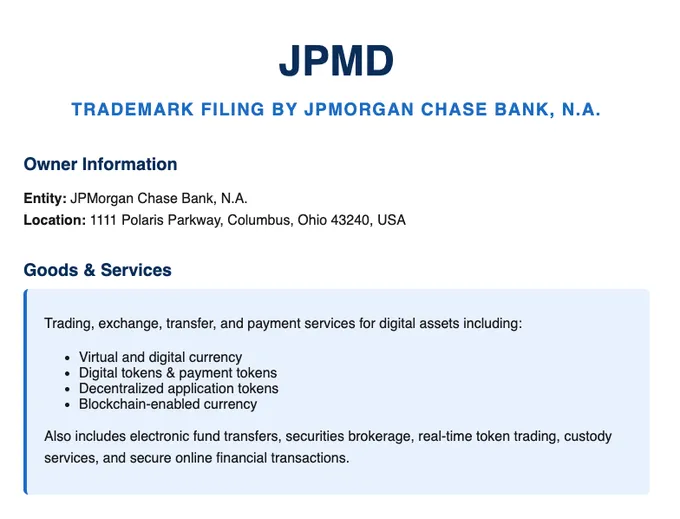

Source: JPMD Filing

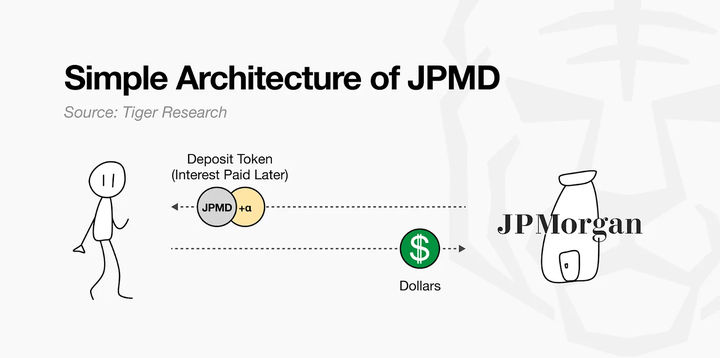

In June 2025, JP Morgan's blockchain division Kinexys began trial operations of deposit tokens (JPMD) on the public blockchain Base. Previously, JP Morgan had only applied blockchain technology on a small scale within private blockchain infrastructure. This time, JP Morgan adopted a different strategy by issuing assets directly on an open network and supporting on-chain transactions. This marks a significant turning point for traditional financial institutions to directly operate financial services on public blockchains.

JPMD combines the characteristics of digital assets and traditional deposits. When customers deposit US dollars with JP Morgan, the bank records it as a deposit on its balance sheet and subsequently issues an equivalent amount of JPMD tokens on the public blockchain. These tokens can circulate freely on the blockchain while retaining the legal claim to bank deposits. Token holders can redeem them for US dollar cash at a 1:1 ratio and may enjoy deposit protection and interest income. Unlike traditional stablecoins that concentrate profits with the issuer, JPMD offers users more substantial financial rights.

These features provide asset managers and investors with practical conveniences that go beyond conventional legal stability. For example, if assets operating on the public blockchain use JPMD as a payment tool, they can achieve 24-hour redemption. In contrast to the need for a separate "withdrawal" path to convert stablecoins into fiat currency, JPMD supports instant conversion to cash. Additionally, JPMD offers deposit protection and potential interest income, thereby enhancing the on-chain asset management ecosystem.

JP Morgan launched the deposit token to address the capital flows and new income structures surrounding stablecoins. For instance, Tether generates approximately $13 billion in revenue annually, while Circle earns billions by managing safe assets like U.S. government bonds. The revenue models of these stablecoins differ from traditional loan-deposit interest spreads but generate similar income structures through customer funds.

Of course, JPMD also has limitations. Its design fully complies with existing financial regulatory frameworks, making it difficult to achieve complete decentralization and openness of blockchain. Currently, this service is only available to institutional clients. Nevertheless, JPMD provides a practical strategy for traditional financial institutions to enter financial services based on public blockchains while maintaining stability and compliance. Many industry observers believe that JPMD represents the ongoing evolution of structural connections between traditional finance and the on-chain ecosystem.

3. Circle: Building Native Finance on Blockchain

Circle has become a key player in the on-chain finance space through its stablecoin USDC. USDC is pegged to the U.S. dollar at a 1:1 ratio, with reserves consisting of cash and short-term U.S. Treasury bills. The technological advantages of USDC include low costs and instant settlement, making it a practical alternative for many companies for corporate payments and cross-border remittances. USDC supports real-time fund transfers 24/7 without the complex procedures of the traditional SWIFT network, helping businesses overcome the limitations of traditional financial infrastructure.

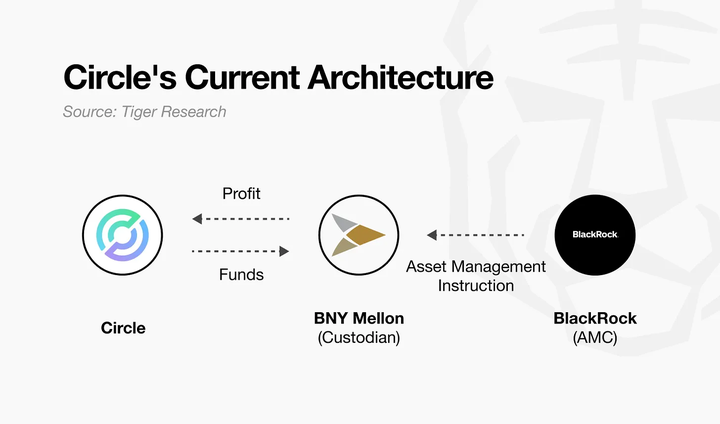

However, Circle's current business structure has some limitations. BNY Mellon serves as the reserve custodian for USDC, while BlackRock is responsible for asset management. This structure outsources core functions to external institutions. While Circle can earn interest income, it has limited direct control over the assets. Additionally, its current revenue model is highly dependent on a high-interest-rate environment. To achieve long-term sustainability and revenue diversification, Circle needs a more independent financial infrastructure and stronger operational authority.

Source: Circle

To address these limitations, Circle applied to the Office of the Comptroller of the Currency (OCC) in June 2025 to establish a national trust bank. This move is not only a compliance effort but also a transformation strategy. Many industry observers believe this marks Circle's transition from a mere stablecoin issuer to a comprehensive financial institution. The trust bank status will enable Circle to directly manage reserve custody and asset operations, thereby strengthening internal control over its financial infrastructure and expanding digital asset custody services for institutional investors.

Circle originated as a native crypto company but is now adjusting its strategy to build sustainable operations within the existing institutional framework. This involves trade-offs, such as reduced flexibility and increased regulatory burdens. The scope of permissions obtained in the future will depend on policy developments and regulatory interpretations. Nevertheless, this move marks a key milestone in how on-chain financial structures grow and adapt within existing institutional frameworks.

4. Who Will Lead On-Chain Finance?

Participants from different backgrounds are actively entering the on-chain financial ecosystem, from traditional financial institutions like JP Morgan to native crypto companies like Circle. This phenomenon is reminiscent of the competitive landscape in the past fintech industry. At that time, technology companies entered the financial sector by internalizing core functions like payments and remittances, while traditional financial institutions expanded user touchpoints and improved operational efficiency through digital transformation.

The key is that this competition is not merely parallel; it breaks down the boundaries between the two. A similar phenomenon is now reappearing in the on-chain finance space. For example, Circle directly handles core functions like reserve management and asset custody by applying to establish a trust bank, while JP Morgan issues deposit tokens on public blockchains, expanding into the on-chain asset management field. Both started from different directions but gradually absorbed each other's strategies and business areas, trying to find a new balance.

This trend brings new opportunities but also comes with risks. If traditional financial institutions rush to mimic the agility and speed of technology companies, they may conflict with existing risk control systems. For instance, Deutsche Bank promoted a "digital-first" strategy and made large-scale IT investments, but conflicts with old infrastructure led to system errors, resulting in billions of dollars in losses.

Conversely, native crypto companies face different risks. They may sacrifice flexibility and execution capabilities in pursuit of institutional acceptance—qualities that have always been their main competitive advantages.

The success of competition in on-chain finance ultimately depends on a profound understanding of one's own foundation and unique advantages. Companies must formulate strategies based on their "unfair advantages" and coordinate the integration of technology and institutional frameworks on this basis. Whether they can balance these two elements will determine who can become the ultimate winner.

Article link: https://www.hellobtc.com/kp/du/07/5986.html

Source: https://reports.tiger-research.com/p/battle-of-onchain-finance-idn

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。