Author: Luke, Mars Finance

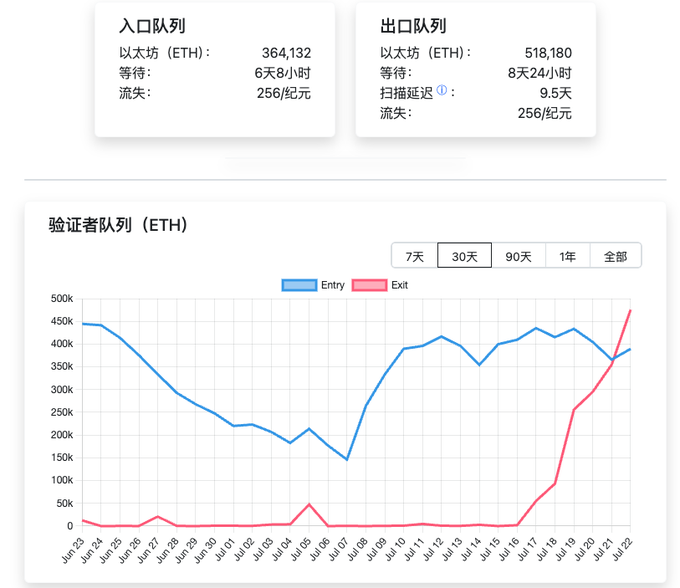

Recently, the Ethereum beacon chain has staged a peculiar "siege" scenario. Outside the walls, over $1.3 billion worth of ETH has been queuing for 6 days, anxiously waiting to enter and become network validators; inside, a "large army" worth nearly $1.9 billion, approximately 519,000 ETH, is stuck on a one-way street congested for over 9 days, waiting to exit. This massive wave of exits, in its scale, almost perfectly replicates the exodus of validators triggered by Celsius's bankruptcy liquidation in January 2024.

The historical similarities always provoke thoughts. As you may have observed, such a concentrated large-scale exit is hard not to associate with a unified action by a single giant whale or institution. The market can't help but feel a tinge of unease: is another giant about to fall? Or is an early investor making an epic profit-taking at a high price?

However, unlike the panic scene during the Celsius incident, where the exit queue surged ahead while the entrance was deserted, this "Exodus" is accompanied by an equally strong influx into the "Promised Land." This large-scale two-way flow, like a prism, reflects a much more complex structural change within the Ethereum ecosystem than mere "dumping" or "fleeing." It is not a signal of crisis but rather a carefully planned capital repositioning, a profound game revolving around profit, ambition, and technological paradigms.

The "Cost" of Security: Interpreting the Congested Queue

To understand this capital drama, one must first grasp the rules of its stage. Validators cannot "leave at will," which stems from a core security mechanism in Ethereum known as the "Churn Limit." This is not a network flaw but a carefully designed firewall aimed at preventing drastic fluctuations in the validator population over a short period, thereby ensuring the network's stability and security. The protocol limits the number of validators that can enter and exit the network within each epoch (approximately 6.4 minutes) to prevent, for example, a large number of malicious validators from quickly absconding after a successful attack.

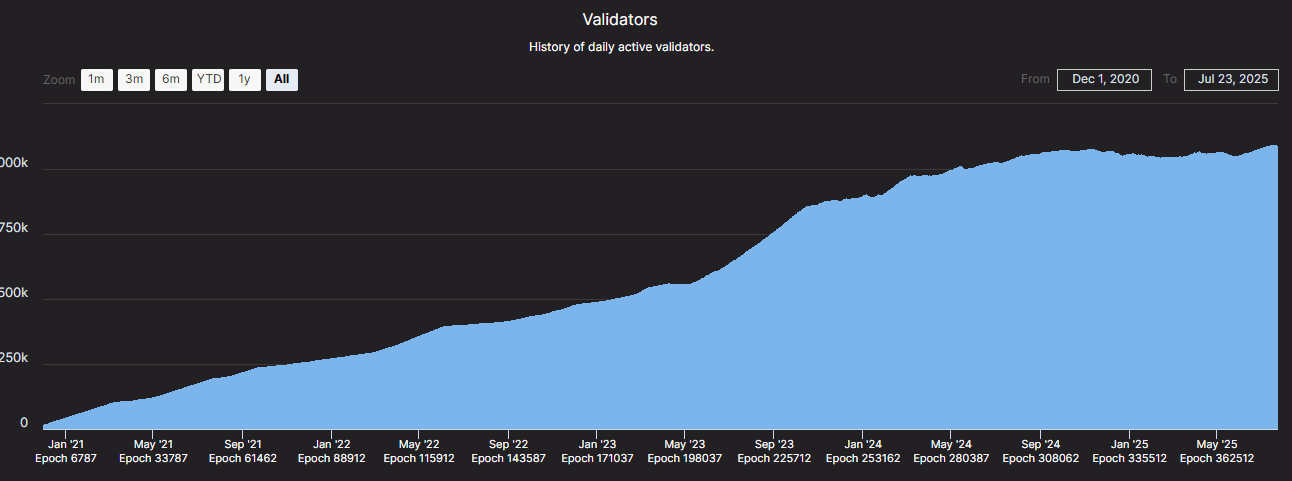

Currently, with the total number of active Ethereum validators surpassing one million, this limit stabilizes at about 16 slots per epoch, translating to a maximum of approximately 3,600 validator entry and exit requests per day. When demand exceeds this threshold, queuing becomes inevitable. Therefore, the current wait time of over 9 days is the "time cost" that all stakers collectively pay to exchange for the robust economic security and finality guarantees of the entire network.

This extreme pursuit of security forms a distinct backdrop that sets Ethereum apart from other public chains. In contrast, some public chains that seek higher transaction speeds and capital efficiency may have much shorter staking unlock periods. This is not a judgment of superiority or inferiority but rather a difference in strategic trade-offs. For Ethereum, which aims to become the global decentralized settlement layer, security is always the top priority. This long queue is a physical manifestation of its core values.

Capital's "Repositioning": From Basic Returns to the Gravity of Restaking

Since the congestion of the queue is an inherent design of the protocol, the core question shifts to: why at this moment would one or more whales endure a long wait to execute an exit? The answer is not simply profit-taking but a deeper capital strategic reallocation, with its gravitational center pointing to the current hottest narrative in the crypto world — Restaking.

Restaking, pioneered by the EigenLayer protocol, has completely reshaped the yield landscape for ETH. It allows users to restake already staked ETH or its liquidity tokens (LSTs, such as stETH) to other emerging protocols that require security guarantees (such as oracles, cross-chain bridges, etc.), thereby earning additional "multiple yields" on top of the basic staking returns. This transforms ETH from a purely yield-generating asset into a "crypto economic bandwidth" that can provide trust and security for countless new services.

With significant backing from top venture capital firms like a16z, EigenLayer's total value locked (TVL) has surpassed $18 billion, attracting over 14 million ETH. Glassnode's analysis sharply points out that the additional yield potential provided by restaking has fundamentally "distorted" the original staking incentives, making the native annualized staking yield of about 3% less attractive.

This is the core driving force behind the large number of validators "switching vehicles." Many early capital participants, who engaged in native staking or simple liquid staking, are choosing to exit, likely to redeploy funds into liquidity restaking protocols (LRTs) that can offer higher compound returns. They are not bearish on Ethereum; on the contrary, they want to "go long" on the future of the Ethereum ecosystem in a more efficient and aggressive manner. This seemingly "exodus" action is, in fact, an internal migration towards higher yield frontiers.

The Other Side of the Wave: Institutional Influx and Regulatory Green Lights

While existing capital is making savvy repositioning, a continuous influx of new capital is also pouring in, creating a prosperous scene at the entrance queue. This powerful influx is primarily driven by two catalysts: regulatory clarity and the immense imagination surrounding ETFs.

In May of this year, a statement from the U.S. Securities and Exchange Commission (SEC) cleared key compliance hurdles for institutional staking. The statement clarified that as long as the service provider plays a technical and managerial role, certain types of staking services do not constitute securities issuance. This undoubtedly opened the floodgates for institutional staking service providers like Coinbase and Figment. Figment's report also confirmed this, showing that its delegated staking business grew by over 100% following the SEC statement.

A grander narrative revolves around Ethereum spot ETFs. Although the first batch of approved ETFs temporarily stripped away staking functions to expedite approval, major issuers, including BlackRock and Fidelity, are actively submitting applications to reintegrate staking rewards into their product designs. Bloomberg ETF analyst James Seyffart predicts that the SEC may approve such "yield-bearing" ETH ETFs as early as the fourth quarter of this year. Once implemented, it is expected to guide a tsunami of passive institutional capital into the Ethereum staking ecosystem through compliant channels. This new influx of funds is a significant force in forming the entrance queue, creating an interesting hedge against the "repositioning" capital seeking higher yields.

The Evolution of the Protocol: Paving the Way for an Expanding Economy

The market's clamor and the flow of capital will ultimately transmit pressure to the evolution of the Ethereum protocol. Core developers have not overlooked these signals; they are actively building underlying infrastructure capable of supporting larger-scale and more complex economic activities in the future.

In the upcoming Pectra upgrade, the highly anticipated EIP-7251 proposal is a direct response to the surge in the number of validators. It plans to significantly increase the maximum effective staking balance for a single validator from 32 ETH to 2048 ETH. This means that large institutions will no longer need to manage thousands of independent validator accounts, greatly reducing operational complexity and enabling automatic compounding of rewards, which is crucial for products like ETFs.

At the same time, discussions about raising the mainnet gas limit to accommodate more transactions are becoming increasingly heated, receiving public support from Ethereum co-founder Vitalik Buterin. In response to the congestion issue exposed by the current exit queue, the community has also proposed solutions like EIP-7922, suggesting the introduction of a "dynamic churn limit" to handle peak entry and exit requests more flexibly while ensuring network security and improving user experience.

Conclusion

Looking back at the bustling scene on the beacon chain, what we see is no longer a simple fluctuation of capital but a symphony of an increasingly mature ecosystem evolving in multiple dimensions. Profit-taking is a normal rhythm of the market, institutional influx brings new scale and compliance, and the innovation of restaking builds new risks and opportunities on top of value, while the core protocol steadily improves itself under the combined effects of all these factors.

This long queue, rather than being a warning of risk, is a testament to Ethereum's vitality and attractiveness. The challenges it brings — whether the centralization concerns that ETFs and LRTs may trigger or the layered risks of restaking — are "luxurious troubles" that a successful, widely adopted platform will inevitably face. As optimists like BitMEX founder Arthur Hayes foresee, Ethereum's journey is towards the stars and the sea. Its ultimate test lies in how to uphold its foundational principles of decentralization and security while managing this growing prosperity and complexity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。