撰文:肖飒法律团队

近年来,随着区块链技术的发展以及监管框架的不断完善,RWA(Real World Assets,现实世界资产)的代币化逐渐成为金融市场关注的焦点,香港、美国、新加坡等地都做出了不同程度的回应与尝试。与此同时,传统的IPO(首次公开募股)依然是企业融资的重要方式。那么,RWA和IPO之间究竟有何异同?各自的优势是什么?企业又改如何选择?飒姐团队今天就带大家唠唠二者之间的关系,以期为不同需求的企业在选择融资路径时提供参考。

01 简要谈谈什么是RWA和IPO

RWA,即现实世界资产的代币化,是指将如债权、房产、应收账款、基金份额、票据等传统金融资产,以区块链技术转化为可在链上流通的数字资产。这一过程不仅能够提升资产的流动性,还能降低交易成本、提高透明度。例如,一家基金公司可以将其持有的房地产项目收益权打包并发行为链上的虚拟货币,让全球范围内的投资者都能以更低门槛参与交易。

IPO,即首次公开募股,是企业首次向公众投资者发行股票并在证券交易所上市的行为。它是资本市场中最正式,最悠久也是合规监管最成熟的一种融资方式,需要会计师事务所、律师事务所以及券商三方中介参与,要经过严格的财务审计、法律合规性审查,并制作招股说明书等文件,标志着企业迈入公开市场。

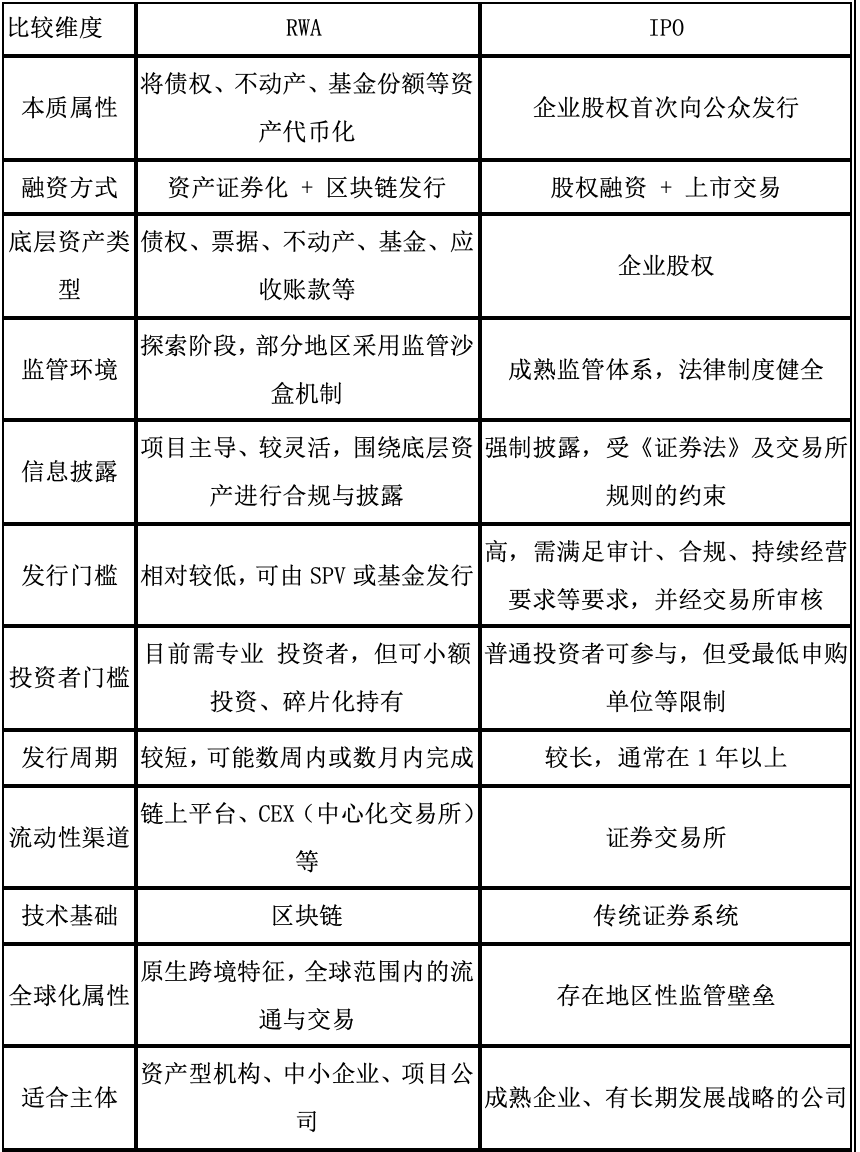

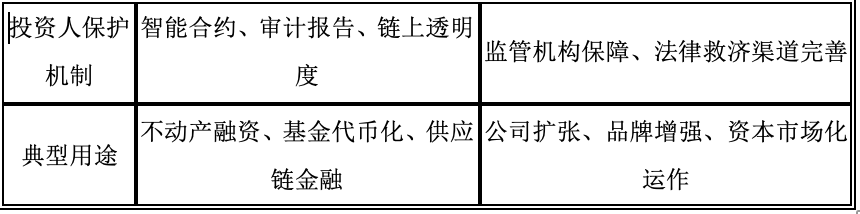

02一表说清:RWA与IPO的主要差异

03IPO和RWA的各自优势特点

RWA和IPO在一定程度上具有相似性,但因二者融资逻辑不同,实际上各具优势特点。

RWA作为一种借助区块链技术的新兴融资方式,具有如下优势:(1)低门槛高效率:RWA可以按需拆分投资额度,几百元甚至几十元就能参与,适合更广泛的投资人群。(2)流动性提升:原本不易流通的资产如应收账款或不动产收益权,在链上实现全球交易。(3)发行效率高:不依赖传统券商流程,无需长周期等待,技术搭建成熟后可快速发行。(4)链上透明性:所有交易记录在链上可追溯,增强信任机制。

IPO作为一种传统的,企业迈向资本市场的融资方式,具有如下优势:(1)融资额度高:一旦成功上市,企业通常可实现数亿甚至数十亿的融资额。(2)品牌信誉提升:上市即意味着通过了监管层的严格审核,对企业品牌形象有极大正面作用。(3)资本运作空间大:通过后续的增发、并购重组、股权激励等工具,利用资本市场多维赋能企业效益增长。(4)投资人保护机制完善:较为规范的监管环境、成熟制度和法治保障投资者权益。(5)广泛的投资群体基础:覆盖机构、散户等各类投资人,市场流动性充沛。

04IPO与RWA的监管偏向差异——以香港为例

香港作为中西交汇的国际金融中心,始终在传统金融与新兴金融之间寻找平衡。在RWA与IPO两种融资方式的监管上,香港展现出明显的“差异化监管导向”:对IPO强调严谨合规、信息披露和投资者保护;对RWA则采取相对开放、鼓励创新但逐步纳管的态度。

香港IPO制度长期以来遵循严格的《证券及期货条例》框架,上市流程由香港交易所和证券及期货事务监察委员会(SFC)共同监管,涵盖保荐、尽职调查、审计审查、信息披露、公众持股比例等多个环节,确保上市企业具备稳定财务表现、持续经营能力及良好治理结构。这种强监管既保障了投资者权益,也提升了香港市场的公信力。

相比之下,香港对RWA的监管则展现出“包容审慎”的试验性思维。SFC近年来频繁发布有关代币化资产的监管通函,逐步建立监管沙盒、虚拟资产服务提供者发牌制度,并将RWA类代币纳入合资格投资产品范畴进行监管尝试。例如,2023年发布的《有关代币化证监会认可投资产品的通函》就首次明确了产品提供者须对代币化安排的管理和运营可靠性负责,需确保与服务提供商兼容等,还应按证监会要求说明相关安排的可靠性,必要时获得第三方审查验证及法律意见,表明香港力图在金融进步与投资者保护间实现平衡。

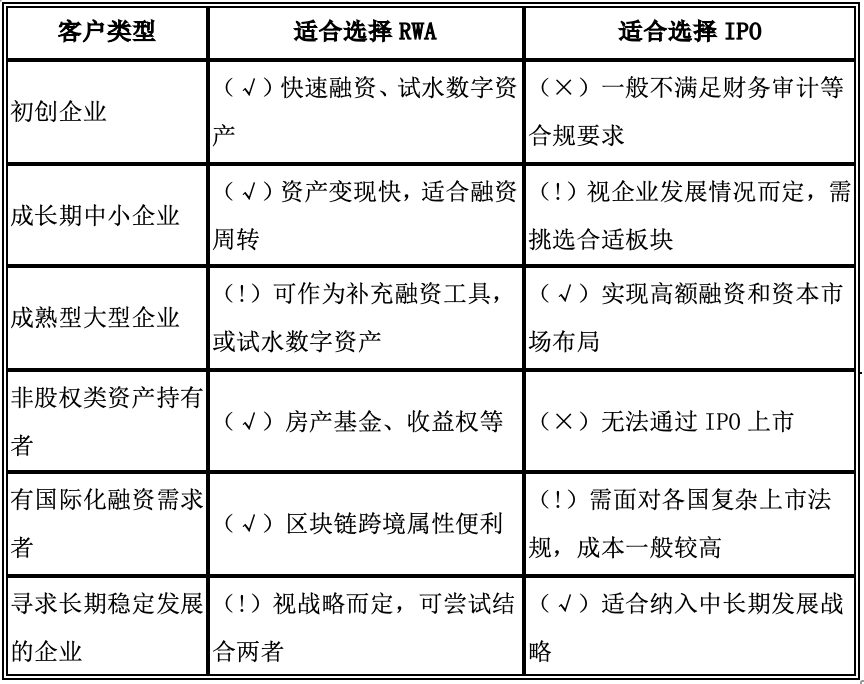

05一表说清:IPO和RWA适合的客户群体

06写在最后:IPO和RWA——互补而非替代

我们应当认识到,RWA不是IPO的替代者,而是对传统融资体系的补充与重塑。它为中小企业和资产持有方提供了前所未有的融资渠道,提升了金融包容性;而IPO仍旧是企业走向成熟、拥抱公众市场和全球资本的关键路径。对企业而言,应根据自身的发展阶段、融资需求、资产结构和战略布局,合理选择或组合RWA与IPO。未来,随着监管机制的成熟、技术门槛的降低和市场接受度的提升,RWA和IPO有望共同构建更加多元、透明、高效的融资生态体系。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。