Author: Pix

Translation: Tim, PANews

Every cycle has its moments of flaunting wealth.

It's not just about on-chain data or wallet screenshots; more importantly, it's about the display of wealth in the real world.

Some people were still unknown a year ago, but now they walk into luxury watch stores, splurging cash on high-end timepieces and posting wrist photos online.

What seems trivial at this moment marks a significant shift in market psychology.

Let’s analyze this phenomenon from the most basic level.

Why Watches?

The reasoning is simple: Rolex belongs to Veblen goods. (Note: Veblen goods are luxury items for which demand increases as the price rises, seemingly contradicting the law of demand.)

The more expensive the item, the more people want to buy it.

They do not showcase value through functionality but through price.

People purchase items not for their practicality but for the status they represent.

Once the nouveau riche become wealthy, their greatest desire is for the world to know about their wealth.

They do not buy land or government bonds.

They purchase symbols of wealth: watches, luxury cars, and sometimes NFTs.

But it’s not as straightforward as it initially appears.

Lagging Indicator

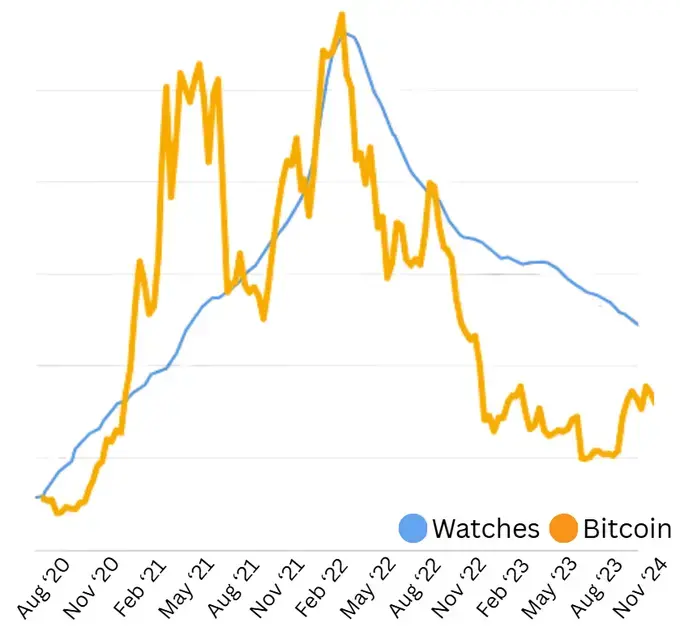

Watch Index vs. Bitcoin Price from 2020 to 2024

In 2021, most people believed that watch prices rose in sync with cryptocurrencies.

However, from a timing perspective, the watch market did not experience a boom when Bitcoin first hit its all-time high.

When NFT prices became as expensive as houses, the watch market surged again.

That round of Rolex price increases was not the beginning of the crypto bull market but a signal of the market's peak.

The usefulness of this phenomenon lies in the lagging nature of the luxury goods market.

In the data charts, we can see that the trends of both are not far apart but are perfectly timed.

The watch index lags behind cryptocurrencies when rising, then peaks slightly later, and ultimately crashes almost in sync.

Rolex prices plummeted nearly 30% within a year after the crypto market crash.

This was not due to a disappearance of demand but because the core demand driving prices (symbol of identity) had diminished.

This makes watches an atypical signal.

They cannot reflect fundamentals but only market sentiment.

Moreover, their effects are clearer and more concise than most existing indicators.

An Alternative Indicator

In traditional finance, there are volatility indices (like the VIX index).

In the futures market, there are funding rates.

But both are indirect indicators.

Luxury goods are different; they reflect not only investor behavior but also their emotions.

They believe they are very wealthy and are eager for the world's attention.

This is not a good phenomenon; when you see watch prices premium to retail prices by double, or someone flaunting their custom Rolex NFT, it often signals the peak of the crypto bull market.

Since wealth has been created, the next step is naturally to squander it.

So, what stage are we currently in?

What Stage Are We in the Cycle?

We are currently approaching historical highs again, with Bitcoin rising and Ethereum also on the rise.

Even older mainstream coins like ADA and XRP have risen by 50% in the past month.

However, Rolex prices remain calm. Prices are stable, and some models are even unsold. Dealers are not reporting shortages, and premiums are not significant.

At first glance, this seems bearish, but in reality, it may be quite the opposite.

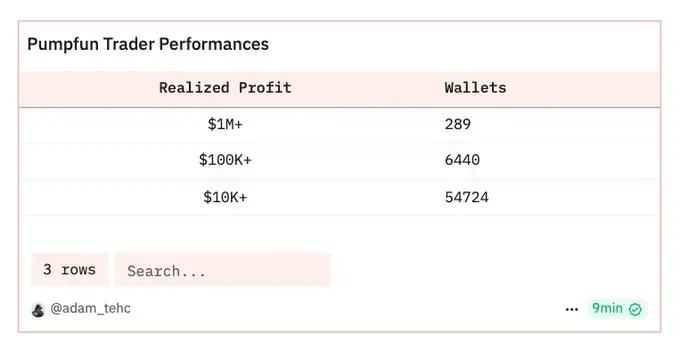

The truth is that the profits accumulated in this cycle have not yet been widely realized.

The recent meme coin craze has only created a small number of millionaires.

In this hype-filled crypto market, this data is not significant.

However, you will now notice that the phenomenon of Rolex prices rising is happening again.

Posts about Rolex are more frequent on crypto Twitter, and discussions have increased, but it is far from the heat of 2021.

Also, remember that the last time luxury watch shipments only began to improve in the later stages of the bull market: not when Bitcoin first peaked, but after the second peak, when everyone felt like a millionaire.

When everyone wants to feel significant, Rolex will become a choice.

History Does Not Repeat Itself, But It Rhymes

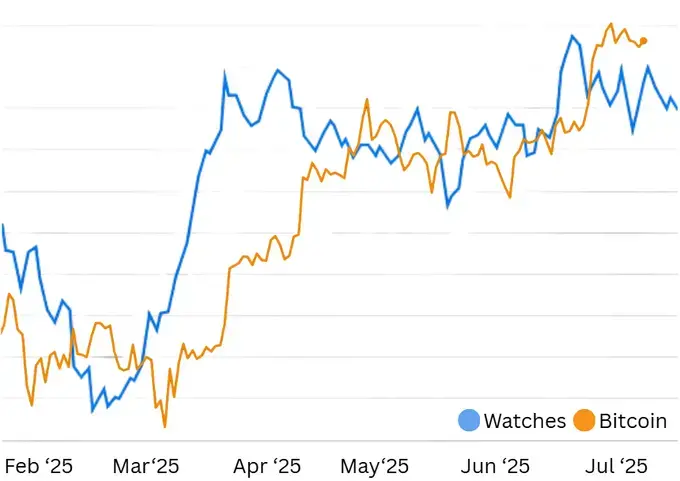

In the past few months, some changes have occurred; the prices of Bitcoin and watches have begun to correlate.

The trends are not completely aligned, but they are sufficiently evident.

In 2021, cryptocurrencies rose first, followed by the NFT craze, and then the price surge of Rolex. The watch market has a certain lag, and the two do not move in sync.

Is the Rolex market now starting?

Well, not exactly; this time the trend looks a bit different.

Luxury watches and Bitcoin have almost started rising simultaneously, and since March, they have been nearly in sync.

But if you zoom in on the charts, you will notice differences.

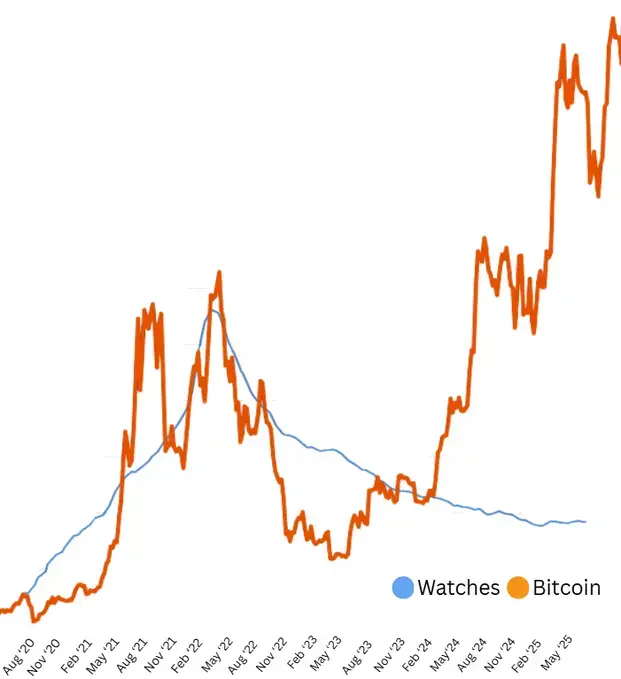

Zoomed-In Trend Chart

Bitcoin is close to its historical high, but watches are not.

Most indicators are still far below their 2022 peaks, except for Rolex and Patek Philippe; the overall watch market is down.

Cartier, Omega, and even Audemars Piguet have seen prices drop by 30-40% compared to retail prices.

This data is important because it indicates two things.

First, we have not yet entered the market excitement phase.

Second, most watches are still a poor investment.

Their original design intent is not to retain value but to convey emotional value.

Note: The rise in watch prices does not mean we are at the market peak, but it does indicate that we have entered the mid-stage of the bull market.

People tend to wait until the tough times are over before they are willing to spend on symbolic consumption. This statement usually indicates a position in the middle of the bull market cycle, roughly two-thirds in.

Wealth is accumulating, and confidence is returning. But real consumption has not yet begun.

When the moment of "wealthy consumption" arrives, even without looking at chart indicators, you will know.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。