In the early hours of today Beijing time, the U.S. House of Representatives passed three pieces of cryptocurrency-related legislation: the CLARITY Act, the GENIUS Act, and the Anti-CBDC Surveillance National Act. The GENIUS Act is expected to be signed into law by Trump on Friday local time.

This not only marks the first time the U.S. has established a national regulatory framework for stablecoins but also sends a clear signal that stablecoins are moving out of the gray area and into the fringes of the mainstream financial system. Meanwhile, major financial centers such as Hong Kong and the European Union are also accelerating their efforts, indicating that the global landscape for stablecoins is undergoing a significant reshaping.

Looking back over the past few months, we can see that stablecoins have almost overnight transformed from a financial variable under regulatory scrutiny into a new infrastructure recognized by officials. What has happened behind the scenes, and who is driving stablecoins to become the new protagonists on the global financial stage? How should we rationally understand this wave of enthusiasm?

From Web3 Narrative to National Strategy, Who is Driving?

Since the beginning of the year, stablecoins have undoubtedly risen to become the focal point of global financial policy and narrative.

However, this wave is not coincidental, nor is it merely a product of natural technological evolution; it is a structural shift driven by policy forces, particularly the policy shift during the Trump era, which has played a disruptive "catfish role."

On one hand, Trump has consistently opposed central bank digital currencies (CBDCs) and has clearly expressed support for a market-driven digital dollar route. On the other hand, from endorsing family business USD1 to promoting and soon signing the GENIUS Act, Trump is actively fulfilling his campaign promise to loosen regulations on the crypto market.

This series of signals has directly compelled global regulatory bodies to reassess stablecoins. Thus, within just a few months, stablecoins have transitioned from a marginal topic in the crypto sphere to a key discussion point at the national strategy level. Apart from Hong Kong finalizing a timeline for the "Stablecoin Regulation," major economies worldwide are beginning to seriously consider and accelerate the establishment of clear compliance frameworks for stablecoins:

The EU's MiCA Regulation (Markets in Crypto-Assets), effective in 2024, comprehensively covers the compliance regulation of crypto assets and provides detailed classifications for stablecoins;

The ruling party of South Korea, led by newly elected President Lee Jae-myung, has proposed the "Basic Law on Digital Assets," which clearly states that as long as a South Korean company has a capital of at least 500 million won (approximately $370,000) and ensures refunds through reserves, it can issue stablecoins;

Objectively speaking, the passage of the GENIUS Act is not just a loosening of regulations on stablecoins in the U.S., but also a clear choice for the digital dollar route—abandoning CBDCs while supporting compliant, privately issued dollar stablecoins.

It is foreseeable that this statement from the U.S. will serve as a reference paradigm for regulatory designs in other countries, pushing stablecoins into the common discussion framework of global financial policy.

The Path of Stablecoins is Changing

In recent years, the stablecoin market has long been dominated by Tether (USDT) and Circle (USDC), representing two paths: "circulation efficiency" and "compliance transparency."

USDT focuses on cross-platform circulation and matching efficiency, dominating exchanges and gray settlement networks;

USDC emphasizes asset compliance and transparency, deeply engaging in regulatory-friendly scenarios and institutional client systems;

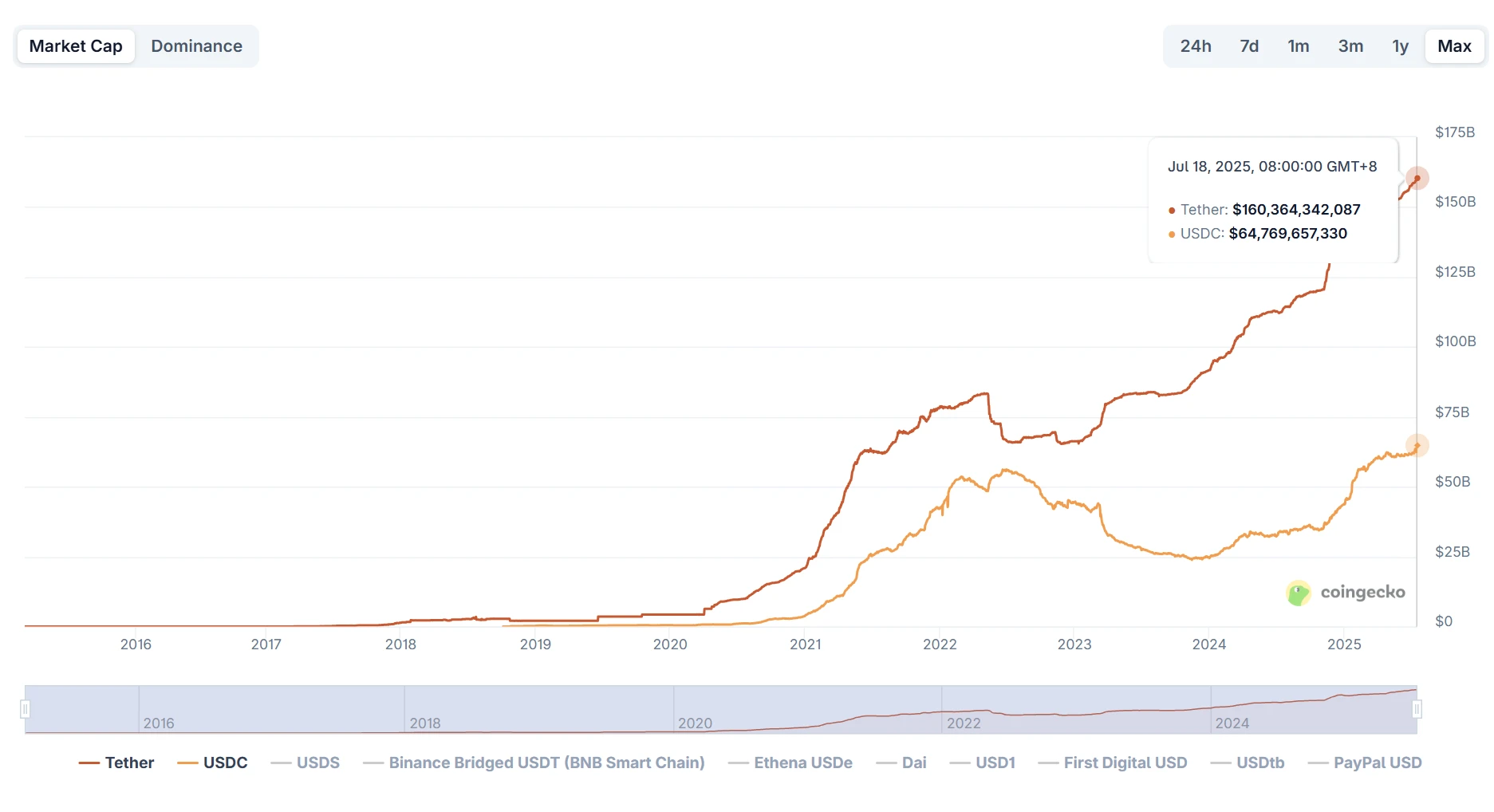

From an overall scale perspective, since 2025, stablecoins have continued to grow—according to CoinGecko data, as of July 18, the total market capitalization of stablecoins across the network is approximately $262 billion, an increase of over 20% compared to the beginning of the year.

This also means that during the recovery of the crypto market, stablecoins remain the most core "liquidity entry point," with the duopoly of USDT and USDC still solid—USDT's total market capitalization exceeds $160 billion, accounting for over 60%; USDC remains around $65 billion, accounting for about 25%, with the two combined accounting for nearly 90%.

Starting in 2024, more and more Web2 financial enterprises and traditional capital forces are entering the market, using stablecoins to build on-chain settlement tools. For example, PayPal's PYUSD and the newly politically backed USD1 are two representative signals:

PYUSD (PayPal USD) is launched by payment giant PayPal, naturally equipped with cross-border settlement scenarios and a global merchant network; USD1 aims for on-chain compliant deposits and withdrawals as well as cross-border business, supported by political and business resources backed by Trump, targeting enterprise settlement scenarios.

It can be said that, with the support of institutional and national forces, these emerging stablecoin projects are driving the function of stablecoins from "Web3 liquidity tools" to a value bridge connecting Web3 and the real economic system. Their use cases are gradually penetrating into diverse applications such as supply chain finance, cross-border trade, freelancer settlements, and OTC scenarios.

Behind the Frenzy, What are the Real Challenges for Stablecoins?

However, objectively speaking, while the GENIUS Act has granted stablecoins institutional recognition, it has also brought more compliance requirements, setting clearer regulatory boundaries for their development.

For instance, issuing entities must comply with KYC/AML management, funds must have custodial segregation and third-party audits, and in extreme circumstances, issuance limits or usage restrictions may be set. This means that stablecoins have gained legal status but have also officially entered the role of "regulated currency."

From this perspective, whether stablecoins can break through the application limitations of the Web3 label will be key to achieving incremental implementation. After all, looking further, the greatest growth potential for stablecoins does not lie within the Crypto internal circle but in the broader Web2 and the global real economy.

Just like the main increments for USDT and USDC, which no longer come from on-chain interactive users but from small and medium-sized enterprises and individual merchants with a strong demand for cross-border settlements, emerging markets and financially disadvantaged regions unable to access the SWIFT network, residents of inflationary countries eager to escape currency fluctuations, and content creators and freelancers unable to use PayPal or Stripe.

In other words, their future largest increment lies not in Web3 but in Web2—the true killer application of stablecoins is not "the next DeFi protocol," but "replacing traditional dollar accounts."

This also means that once stablecoins become the foundational vehicle for digital dollars globally, they will inevitably touch sensitive nerves related to monetary sovereignty, financial sanctions, and geopolitical order.

Therefore, the next phase of growth for stablecoins will inevitably be closely related to the new map of dollar globalization and will become a new battleground among governments, international institutions, and financial giants.

In Conclusion

The essence of currency issuance has always been an extension of power, relying not only on asset reserves and settlement efficiency but also on national credit, regulatory permissions, and international status endorsements.

Stablecoins are no exception. If they want to truly penetrate the real economic system from the Crypto world, relying solely on market mechanisms or business logic is ultimately insufficient. Therefore, the compliance support brought by the global policy shift in 2025 is undoubtedly an important driving force for stablecoins to move toward the mainstream, but it also means they must survive in a more complex game.

This is a long-cycle game, and we are currently at the stage where it truly begins.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。