Original|Odaily Planet Daily (@OdailyChina)

After half a year, the price of ETH has returned to $3,600 today. It must be said that the "Ethereum version of Strategy," Sharplink (NASDAQ: SBET), led by Consensys CEO and Ethereum co-founder Joseph Lubin as chairman of the board, has played a significant role. Today, Sharplink released major news: plans to issue an additional $5 billion in common stock on top of the originally planned $1 billion to further purchase ETH for the company's treasury. Odaily Planet Daily will summarize Sharplink's related actions and explore the potential for ETH's price increase in this article.

Sharplink's crypto rebirth journey: from an obscure betting company to "ETH version of Strategy"

Before May 27 of this year, many people might have felt unfamiliar with Sharplink. Although this company, primarily engaged in U.S. lottery and lottery marketing, began exploring the application of blockchain technology in gambling as early as 2024 and acquired a 10% stake in the UK company Armchair Enterprises Limited for $500,000 in cash this February, the latter being the operator of CryptoCasino.com.

Aside from exploring blockchain business, Sharplink's previous partners included well-known sports brands and leagues such as the NBA, NHL, and Turner Sports. The reason it had not attracted attention from traditional financial markets and the cryptocurrency market before was because—its business performance was too poor.

Despite being a publicly traded company in the U.S., its market value was only around $2 million, with a stock price of about $2.90. According to its financial report, Sharplink's revenue in 2024 was only $3.6623 million, a year-on-year decrease of 26.1% (down from $4.9527 million in 2023); operating expenses were significantly reduced by 45.6%, from $10.4259 million in 2023 to $5.6692 million, but the net income was only $1.01 million (earnings per share of $2.29), compared to a net loss of $14.2432 million in 2023 (loss per share of $5.19). This was mainly due to the gains from divesting non-core businesses (Sports Gaming Client Services and SHGN, sold for $22.5 million in cash in January 2024) amounting to $14.5733 million. As of December 31, 2024, the company's cash balance was only $1.4367 million, a year-on-year decrease of 42.2%.

The somewhat poor operating conditions forced Sharplink to seek alternative paths to maintain its stock price above the Nasdaq's minimum requirement of $1; moreover, it also failed to meet Nasdaq's basic requirement of at least $2.5 million in shareholder equity.

In the face of internal and external difficulties, Sharplink CEO Rob Phythian and Consensys CEO and Ethereum co-founder Joseph Lubin hit it off. Thus, Sharplink transformed from a struggling betting marketing company into the current "ETH version of Strategy."

The miracle of the surge in crypto concept stocks: from less than $3 to over $100

On May 27, SharpLink Gaming, Inc. (NASDAQ: SBET) announced the signing of a securities purchase agreement for a $425 million private placement, planning to issue approximately 69.1 million shares of common stock (or equivalent securities) at a price of $6.15 per share (with company management team members at $6.72 per share). Consensys Software Inc. led the investment as the main investor, with participants including well-known crypto venture capital firms such as ParaFi Capital, Electric Capital, Pantera Capital, and Galaxy Digital.

Once the news broke, Sharplink's stock price skyrocketed from less than $3 to over $100, eventually retreating to $35.83 after hours, and closing at $79.21 on May 29.

In early June, SharpLink Gaming officially announced the completion of the $425 million private financing, led by Consensys. The subsequent plan was to use the proceeds to purchase ETH and make it the main reserve asset for its treasury. Consensys CEO and Ethereum co-founder Joseph Lubin would join its board and serve as chairman. Additionally, it is worth noting that at that time, aside from the 69.1 million common shares issued by Sharplink, only 2 million shares were available for trading in the market, while the remaining shares were restricted by registration rights agreements, expected to be tradable only months later, providing a buffer period for maintaining Sharplink's listing qualifications and market value management.

Since then, Sharplink has entered a seemingly crazy "ETH buy-buy-buy phase," and the price of ETH has begun to rise.

Sharplink stock price trend

ETH price candlestick chart

In less than two months, Sharplink has purchased ETH in large quantities through various channels such as OTC and crypto exchanges. As of July 16, the company had accumulated over 300,000 ETH, with an average purchase price of about $2,701, resulting in an unrealized profit of $130.9 million.

In the last two days, Sharplink has continued to make moves, with the most recent increase occurring this morning, when it first added 18,712 ETH (worth about $65.45 million) to its Ethereum strategy reserve; then further increased by 14,180 ETH (worth about $50.1 million), bringing the total purchased today to 32,892 ETH (worth about $115 million).

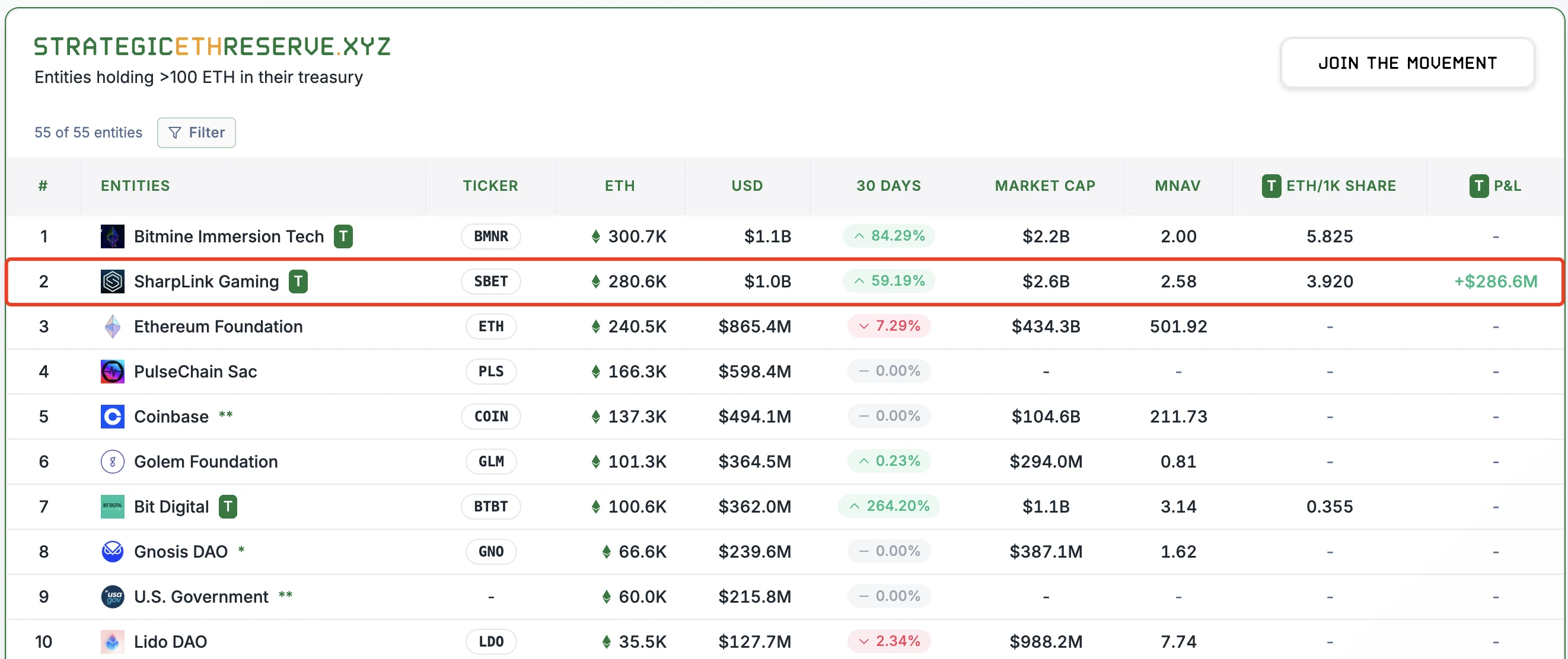

Additionally, according to information from the ETH reserve website, when Sharplink's ETH holdings reached 280,000, its unrealized profit had already grown to about $286 million; currently, its ETH holdings have reached a staggering nearly 340,000, worth nearly $1.2 billion. And this is just the beginning.

ETH reserve website TOP 10 information

Sharplink's additional move: plans to raise another $5 billion to increase ETH holdings

Latest news shows that Sharplink has submitted an updated prospectus to the U.S. Securities and Exchange Commission (SEC), planning to issue an additional $5 billion in common stock on top of the originally planned $1 billion to further purchase Ethereum (ETH) for the company's treasury. Market analysis suggests that Sharplink's potential $5 billion buying power could help push the price of ETH to at least over $5,000.

On the other hand, Sharplink's market value has surged from around $2 million to approximately $3.6 billion now. Despite experiencing nearly a 35-fold increase in stock issuance, its market value has increased by about 1,800 times, making it a "fighter in the U.S. stock market." The latest data shows its after-hours stock price is reported at $37.41, with a 24-hour increase of about 2.77%.

In comparison, the stock price of Strategy which initiated the "public company BTC strategic reserve plan" has risen from $300 at the beginning of the year to the current after-hours price of $458, with an annual increase of 55.84%, and a market value currently reported at $126.8 billion; while Sharplink (SBET) stock price has risen from about $8 at the beginning of the year to around $36 now, with an annual increase of about 374%.

Compared to the large-scale Strategy, Sharplink, occupying the ecological niche of "ETH version of Strategy," is expected to replicate its stock price miracle and stage a doubling act once again.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。