$MSTR has created a template for cryptocurrency treasury strategies.

Author: Thomas (Tom) Lee (not drummer) FSInsight.com

Compiled by: Deep Tide TechFlow

Interpretation DAT* (Digital Asset Treasury) and BTC/ETH treasury strategies

*Post has been approved by @saylor (MicroStrategy CEO)

Case Study: $MSTR has created a template for cryptocurrency treasury strategies.

- Since implementing the $BTC strategy in 2020, the stock price of the strategy has soared from $13 to $455.

Question:

How much of the stock price increase is attributed to the rise in Bitcoin prices, and how much is attributed to thecryptocurrency reserve strategy?

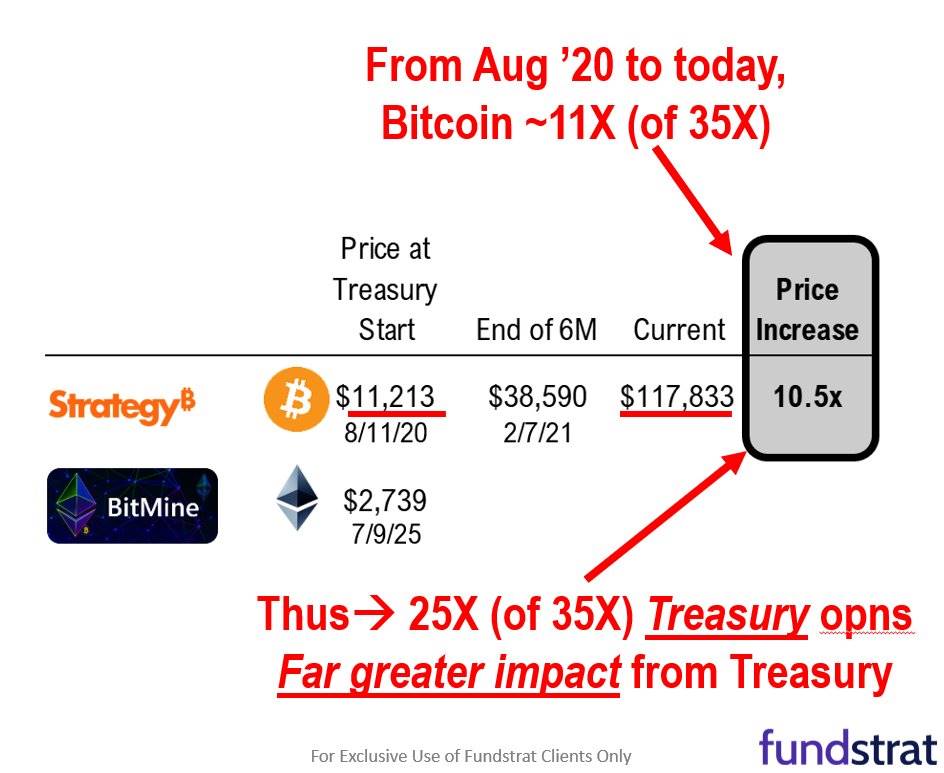

Behind the 35-fold increase in $MSTR stock price:

11 times is due to Bitcoin ($BTC) price rising from $11,000 to $118,000

25 times is due to the treasury strategy

This means an increase in the number of Bitcoins held per share

The impact of the treasury strategy far exceeds the increase in token prices.

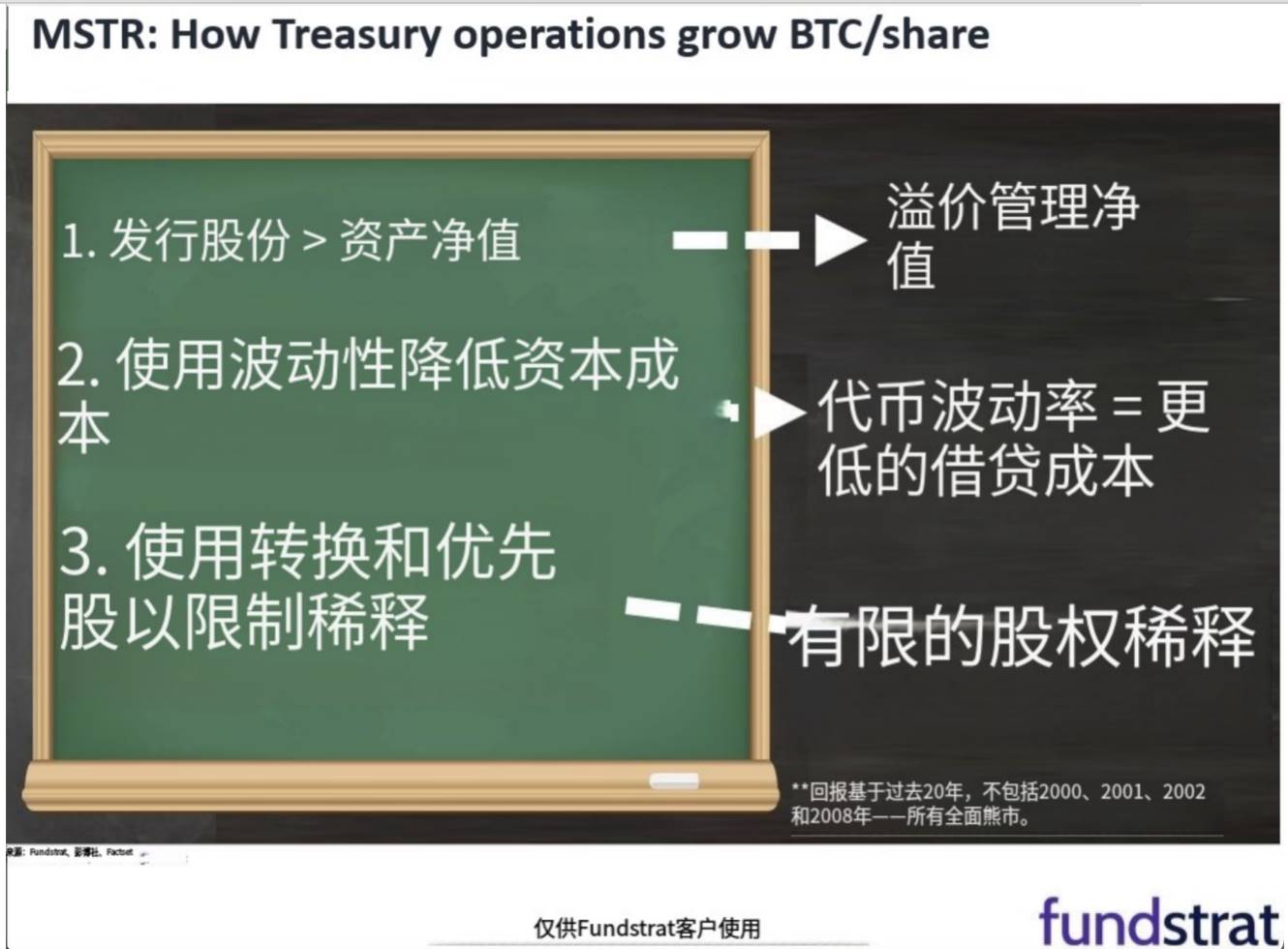

$MSTR's treasury DAT (Digital Asset Treasury) strategy increases the number of tokens held per share in the following ways:

Issuing stock > P/NAV (Price to Net Asset Value) = increase in the number of tokens per share

Reduced price volatility of tokens lowers borrowing costs = higher return on investment (ROI)

Using convertible bonds/preferred stock = limits equity dilution

By the way:

$ETH is more volatile than $BTC

Therefore, this volatility has a greater impact on ETH DAT than on BTC DAT.

@grok created the following table (excerpt)

Deep Tide Note: This table shows some of MicroStrategy (MSTR)'s financing activities since it began incorporating Bitcoin into its treasury in 2020. This includes internal cash, convertible senior notes, senior secured notes, secured loans, and ATM equity program, with almost all funds used to purchase Bitcoin.

Bitmine announced its ETH treasury strategy on June 30, 2025, and completed the transaction on July 9, 2025.

The example of $MSTR shows that purchasing tokens can:

- Increase the number of tokens held per share

$BMNR on the 7th day after the initial transaction:

Acquired $1 billion worth of ETH

$MSTR acquired $250 million worth of tokens in the same timeframe

That concludes the content.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。