Author: FinTax

1 Introduction

As crypto assets move from the fringes to the mainstream, the global tax regulatory "sky net" is accelerating its weave. Following the official release of the 2025 version of the digital asset broker information return form (Form 1099-DA) and its accompanying operational guidelines, the Internal Revenue Service (IRS) has recently updated two detailed rules. This move not only clarifies the mandatory reporting obligations of digital asset brokers but also refines the exemption threshold for de minimis transactions through supplemental rules, and innovatively provides optional reporting methods for stablecoins and specified NFTs. This is not just a change of form, but showcases that regulatory granularity has been refined to a per-token penetration level, as regulators lower compliance costs for market participants while ensuring tax transparency through differentiated rules. This article will analyze recent document updates of Form 1099-DA to explore current regulatory trends and core implications from the IRS to provide compliance references.

2 Root Cause: Content and Background of Form 1099-DA

2.1 Overview

Form 1099-DA is the information return form used by digital asset brokers to report digital asset transaction gains and losses to the IRS and clients. The 1099-DA is not a patch to the existing system but rather a specialized reporting form designed specifically for the inherent characteristics of digital assets.

According to the latest guidelines for 1099-DA (Instructions for Form 1099-DA (2025)), starting January 1, 2025, brokers must record and report the gross proceeds from each transaction. Notably, the IRS does not require reporting of cost basis and gain or loss nature for 2025, granting brokers a voluntary reporting grace period during which no penalties will apply for reporting errors. The mandatory reporting obligation for cost basis and gain or loss nature has been postponed until 2026 (for "covered digital assets" acquired after January 1, 2026) to provide brokers with a one-year system adjustment period to address historical legacy issues regarding on-chain asset ownership and cost tracing.

Furthermore, the latest guidelines for 1099-DA also propose more detailed requirements for the granularity of data reporting, mainly reflected in two dimensions: first, the "uniqueness" of asset identification, by introducing standardized DTIF (Digital Token Identifier Foundation) codes to eliminate ambiguities in token naming; second, the "structuring" of transaction nature to achieve isolation reporting of original minting gains (Primary Sale) from investor trading gains and losses. Specifically, the IRS, through the newly added Box 11c, has for the first time isolated the original minting gains of specified NFTs creators from the secondary market transfer gains and losses of investors, resulting in more refined reporting data received by the IRS.

Digital Assets: According to 1099-DA, digital assets refer to any value represented in digital form, recorded on a cryptographically secured distributed ledger (such as blockchain or any similar technology) without considering whether each specific transaction involving that digital asset is actually recorded on that distributed ledger; concurrently, such assets do not fall under cash (i.e., not issued by government or central bank dollar or any convertible foreign currency). Therefore, the IRS has a broad definition of digital assets, encompassing any digitally represented value recorded on a cryptographically protected distributed ledger, including cryptocurrencies, tokenized securities, and specified NFTs.

Qualifying Stablecoins: A digital asset qualifies as a stablecoin if it meets the following three conditions:

(1) The digital asset is intended to track a single convertible currency issued by a government or central bank (including the dollar) on a 1:1 basis;

(2) The digital asset employs an effective stabilization mechanism;

(3) The digital asset is widely accepted by parties other than its issuer as a means of payment.

Regarding the reporting entities, 1099-DA is primarily aimed at brokers and digital asset intermediaries.

- Brokers: According to the revised provisions under Section 6045 of the Internal Revenue Code, brokers refer to any person who is ready to execute digital asset sales on behalf of others in the ordinary course of business. In terms of digital asset sales, individuals are considered brokers if they meet the following conditions:

(1) Regularly propose redemption of digital assets created or issued by themselves to customers; or

(2) As agents, dealers, or digital asset intermediaries, execute customers' transactions involving digital assets.

- Digital Asset Middleman: Individuals providing facilitation services for the sale of digital assets and who can ascertain the seller's identity and the nature of the transaction.

If they meet the following conditions, they are considered digital asset intermediaries:

(1) Accept or process digital assets as a means of payment for stocks, commodities, regulated futures contracts, securities futures contracts, forward contracts, currency contracts, debt instruments, options, or securities futures contracts;

(2) Real estate reporting personnel who actually know or should typically know that the real estate buyer is using digital assets for payment;

(3) Accept digital assets as compensation for brokerage services;

(4) Own or operate one or more digital asset vending machines; or

(5) Digital asset payment processors (PDAP).

If they meet the following conditions, they are not considered digital asset intermediaries:

(1) Only engage in providing proof-of-work (PoW) or proof-of-stake (PoS) distributed ledger verification services (staking/mining) without offering any other functions or services; or

(2) Only provide hardware or software (via sales, licensing, or other means) that allows users to control the private keys to access digital assets on a distributed ledger (such as non-custodial wallets) without providing any other functions or services.

In summary, digital asset intermediaries include not only traditional CEX (centralized exchanges) but also extend to custodial wallet providers, payment processors (PDAP), and digital asset vending machine (Kiosk) operators.

To intuitively understand the uniqueness of 1099-DA, the following table compares it to traditional financial and payment reporting forms.

2.2 Core Content

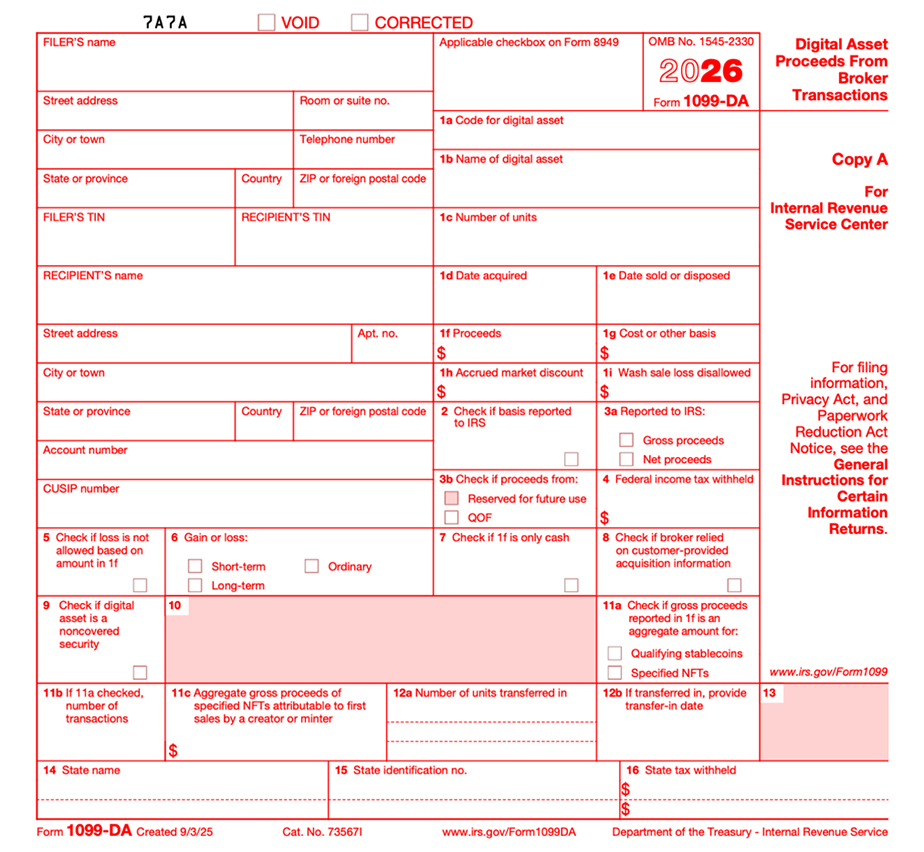

The structure of the 1099-DA form corresponds to traditional securities form 1099-B but adds several detailed boxes reflecting crypto characteristics:

Box 1a & 1b (Digital Asset Code and Name): Mandatory introduction of DTIF coding; if a particular token does not have a DTIF code, it must be labeled "999999999" (alphanumeric identifier). If the optional aggregate reporting method for specified NFTs is used, Box 1a also requires "999999999" to be filled in, and Box 1b should state "Specified NFTs"; if the optional aggregate reporting method for qualifying stablecoins is used, Box 1a should include the DTIF identifier for that stablecoin, and Box 1b should include the name of the stablecoin.

Box 1f (Total Amount Received): May include cash and fair values of services, digital assets, or other property received.

Box 1g (Cost Basis): Although voluntary in 2025, this will become central to calculating gains and losses in the future.

Box 11a & 11b (Aggregate Reporting Mark): A special path designed for stablecoins and specified NFTs, indicating whether the optional reporting method was used and the number of transactions covered.

Box 11c (Primary Market Sales): Specifically used to capture original gains from the minting phase of creators for specified NFTs, distinguishing them from secondary market transfers.

2.3 Background of the Introduction of Form 1099-DA

2.3.1 Within the United States

In August 2021, the Infrastructure Investment and Jobs Act (IIJA) was passed by the Senate and signed into effect in November of the same year. This act amended Section 6045 of the Internal Revenue Code, explicitly including "digital assets" within the legal definition of "brokers" for reporting purposes, aimed at enhancing tax transparency through a third-party automatic reporting system.

After two years of professional consultation and public discussion of policy details, on July 9, 2024, the U.S. Treasury and IRS officially released Treasury Decision 10000 (Gross Proceeds and Basis Reporting by Brokers and Determination of Amount Realized and Basis for Digital Asset Transactions), which precisely defines the components for brokers, clarifies the types of transactions that need to be reported, and provides detailed methods for cost basis accounting. This regulation took effect on September 9, 2024.

TD 10000 stipulates that 1099-DA will officially be implemented in 2026, with each box configuration supported by the legal foundation provided by TD 10000, requiring brokers to report digital asset gains and cost basis information from January 1, 2025.

2.3.2 Outside the United States

It is noteworthy that the introduction of 1099-DA is not only a unilateral upgrade of tax regulation for digital assets in the United States but also responds to the global trend of tax transparency. At the end of 2022, the Organization for Economic Cooperation and Development (OECD) officially released the Crypto-Asset Reporting Framework (CARF), aimed at establishing a global standard for automatic exchange of tax information on crypto assets. On November 10, 2023, the United States and over 40 other countries issued a joint statement committing to accelerate the implementation of the CARF framework. On July 30, 2025, the United States proposed to implement CARF in its digital asset information disclosure document. On November 14, 2025, the IRS submitted the "Broker Digital Transaction Reporting" proposal (CARF: US Broker Digital Transaction Reporting) to the White House, aiming to implement CARF, which is currently under review. If the U.S. implements CARF, it will allow the IRS to obtain key information about U.S. tax residents' overseas cryptocurrency accounts and utilize this information for tax enforcement.

Although the U.S. has not yet signed the CARF multilateral agreement or initiated automatic exchanges of crypto asset tax data with other jurisdictions based on CARF, the official implementation of 1099-DA marks the establishment of a mature foundational data collection system in the U.S., laying a technical foundation for future automatic exchanges of tax data with other countries.

3 Seizing the Opportunity: Recent Policy Interpretation of 1099-DA in the U.S.

Recently, the IRS has significantly accelerated the pace of regulation on crypto assets; the new detailed rules show that its policy output has evolved past macro compliance requirements into specific standards that incorporate enforceability and efficiency.

3.1 De Minimis Exemption and Aggregate Reporting Rules

While maintaining strict regulation, the IRS demonstrates some flexibility in its new rules, forming a system of burden reduction through the nesting and layering of de minimis rules and optional reporting methods, aimed at avoiding regulatory redundancy.

The specific operation is: Brokers must first determine, based on the asset nature, whether the transaction is applicable to the "optional reporting method"; once the optional reporting method is chosen, the IRS provides a corresponding "de minimis exemption threshold," and reporting on Form 1099-DA is only required when the transaction amount exceeds this specific threshold; otherwise, reporting is exempt.

The optional reporting method determines "how to report": For qualifying stablecoins with very minimal value fluctuations and specified NFTs that have consumable attributes, under the conditions of the optional reporting method, the new rules allow brokers to simplify or be exempted from transactional reporting, switching to aggregate reporting.

The de minimis exemption rules determine "whether to report": To avoid excessive impact from massive retail consumption data (such as using cryptocurrency to purchase coffee, and daily small payments) on the tax review system, the IRS has established differentiated de minimis exemption thresholds for different transaction types and reporting methods:

Digital Asset Payment Processor (PDAP) Sales Threshold: $600

If the total payments or related transactions handled by a digital asset payment processor (PDAP) for the same customer within a year do not exceed $600, there is no need to file Form 1099-DA.

Qualifying Stablecoin Optional Reporting Threshold: $10,000

For qualifying stablecoins filed under the optional reporting method for aggregate reporting, if the designated total sales proceeds (after deducting relevant transaction costs) for a customer at the broker do not exceed $10,000 for the year, the broker is exempt from reporting.

Specified NFTs Optional Reporting Threshold: $600

For specified NFTs transactions filed under the optional reporting method for aggregate reporting, if the total sales proceeds (after deducting transaction costs) from all specified NFTs for a customer at the broker do not exceed $600 for the year, the broker is exempt from reporting.

3.2 Exclusion from Federal/State Joint Reporting Scheme

Additionally, another recent technical trend is that the IRS has clarified that the 1099-DA for the 2025 tax year will not participate in the "Federal/State Joint Reporting Plan (CF/SF)," meaning brokers can no longer submit state tax data in a single click through the federal system or may need to submit data separately to local tax authorities according to state laws.

4 Conclusion

In light of the multiple challenges posed by 1099-DA, high-net-worth investors, project parties, and Web3 institutions must urgently adapt to the new reporting rules. For Web3 practitioners, transaction data governance is not only to meet IRS reporting requirements and reviews, but also to enhance their own clear financial maps. In the tide of increasing transparency in regulation, those who can first complete the upgrade from "chaotic accounts" to "tax compliance" will be the ones who gain lasting certainty in the increasingly competitive global Web3 landscape.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。