GENIUS Act Signed: Stablecoin Rules Are Here

U.S. House Passes Three Major Crypto Bills in Landmark Vote

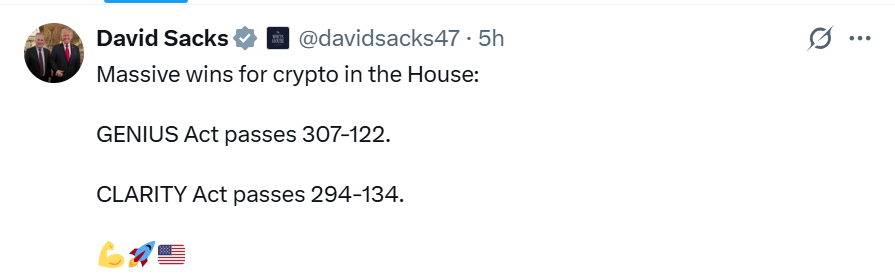

On July 17, 2025, the United States House of Representatives passed the Guiding and Establishing National Innovation for U.S. Stablecoins Act (GENIUS Act), which had previously been approved by the Senate in June . The CLARITY Act passed in a vote of 294-134 with 78 Democrats voting in favor — more than double the ~35 expected, and more than the 71 who voted to pass FIT21 last year. The Anti-CBDC Act passed in a vote of 219-210 with 2 Democrats voting in favor.

GENIUS Act Signing Set for July 18 at the White House

The signing ceremony for the GENIUS Act is set for tomorrow afternoon at the White House. Once signed by President Trump and fully implemented by regulators, it will bring much-needed clarity to the market and drastically reshape the regulatory landscape for payment stable coins in the United States.

Source: X

The vote for the bill was 68-30. It's a historic day for President Donald Trump's vast digital asset empire and the cryptocurrency sector, which invested over $250 million in the 2024 election cycle to win what is widely regarded as the most pro-crypto Congress in American history.

Key Provisions of the GENIUS Act: Backing, Audits, and Access

The passaed law aims to mandate 1:1 backing for stablecoins , require monthly audits, allow issuance by banks and state-licensed firms, and establish a federal framework for trusted digital dollars. The proposed comprehensive U.S. crypto legislation aims to provide legal clarity, safer stablecoins, institutional capital inflows, and a clear U.S. policy stance vs. CBDCs.

GENIUS Act's Impact on Stablecoin Products

• Smaller spaces for crypto-collateralized and algorithmic stable coins.

• Focus on domestic and international payments as the central thesis for stablecoins.

• Ban on yield on payment stablecoins, but regulators preserve room for future yielding stablecoins.

GENIUS Act Benefits for Companies

• Strict requirements benefit large stablecoin issuers.

• No restrictions on foreign issuers entering the U.S. dollar payment stablecoin market.

• Small stable coin issuers have a slight competitive advantage.

• Annual audited financial statements required from issuers with over $50 billion market capitalization.

By giving banks and fintechs regulatory certainty, the proposed rule may drive out smaller or worldwide issuers, boost institutional use of compliant stablecoins, and improve monitoring and compliance capabilities.

Wall Street and Big Tech React to Bill Approval

The big companies are excited to welcome the legislation. Whether it's chainlink, Anchorage Digital or Ondo each and every one posted on X showing their expression of their thoughts. JPMorgan Chase is launching JPMD , a deposit token that will function similarly to a stablecoin while remaining securely connected with the regular banking system. JPMD, which is built on Coinbase's Base blockchain, is only available to institutional clients and includes features like as 24/7 settlement and interest payments. This is part of a larger effort by traditional finance to adapt to the stablecoin era while not losing ground to crypto-native enterprises. Shopify has already launched USDC-powered payments via Coinbase and Stripe, while Bank of America is considering a stablecoin issue. According to Deutsche Bank, stablecoin transactions totaled $28 trillion last year, more than Mastercard and Visa combined. However, the legislation prohibits non-financial major IT businesses from issuing stablecoins directly unless they establish or collaborate with authorized financial institutions.

Stablecoin Market massive surge

The Stablecoins market cap is $243.33B. Trending coins include USDD (+7.14%) and DOLA (+5.73%). Tether is up by 0.05% and USDC by 0.01% in the last 24 hours.

Source : Coinmarketcap

As of July 18, 2025, Tether USDt (USDT) has a market capitalization of 160.37 billion dollars and has remained steady at $1.00, according to CoinMarketCap. The circulating supply reached 160.26 billion dollars, while the 24-hour trading volume reached 145.26 billion dollars, representing a 7.74% change.

Also read: 24-Hour Crypto Market News: Top Movers & Gainers免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。