Rationally and with evidence, let me tell you why AAVE could rise to $1000.

Written by: Kolten, Aave, Avara

Translated by: Alex Liu, Foresight News

In the decentralized finance (DeFi) space, distribution capability determines everything, and no one does it better than Aave. With five years of market experience, millions of users, and the deepest liquidity in DeFi, projects built on Aave can achieve scale effects and network effects that are unmatched elsewhere.

Project teams can simply connect to Aave and immediately gain access to the infrastructure, user base, and liquidity support that would normally take years to build — this is what is known as the "Aave Effect."

Some Key Data

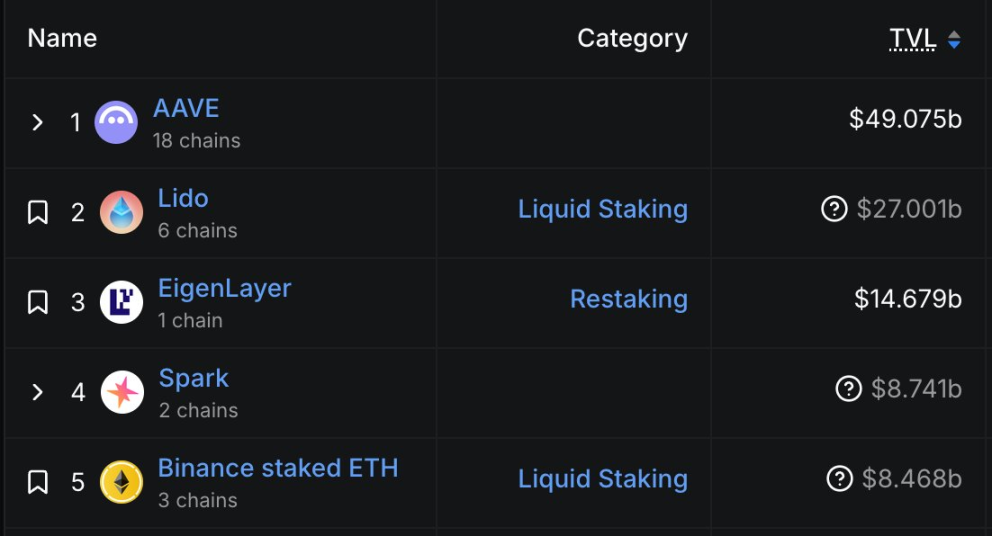

Data Source: DefiLlama

Aave is currently the largest protocol in DeFi, and even the largest protocol in history, accounting for 21% of the total locked value (TVL) in DeFi; 51% of the TVL of all lending protocols; and total net deposits exceeding $49 billion. (Translator's note: It has now exceeded $50 billion)

While these numbers are impressive on their own, what’s more important is Aave's distribution influence. For example:

Ethena's stablecoin sUSDe saw its deposits on Aave surge from $2 million to $1.1 billion within two months after focusing on integrating Aave;

Pendle achieved $1 billion in deposits just weeks after its PT token was added to Aave, and this figure has now reached $2 billion, making Aave the largest supply market for Pendle tokens;

KelpDAO's rsETH saw its TVL grow from 65,000 ETH to 255,000 ETH after connecting to Aave, achieving a fourfold increase in just four months.

Additionally, Aave hosts over 50% of active stablecoin assets, is the largest destination for BTC in DeFi, and is the only protocol with a TVL exceeding $1 billion across four different networks. This distribution capability is unparalleled.

Why Is This Happening?

Any protocol can attract deposits through incentives (such as token rewards or liquidity mining), thus driving asset supply growth, so looking solely at TVL is not enough to judge a protocol's true activity level. At this point, attracting deposits is a widely understood challenge, while stimulating asset usage demand is very difficult — unless you are Aave.

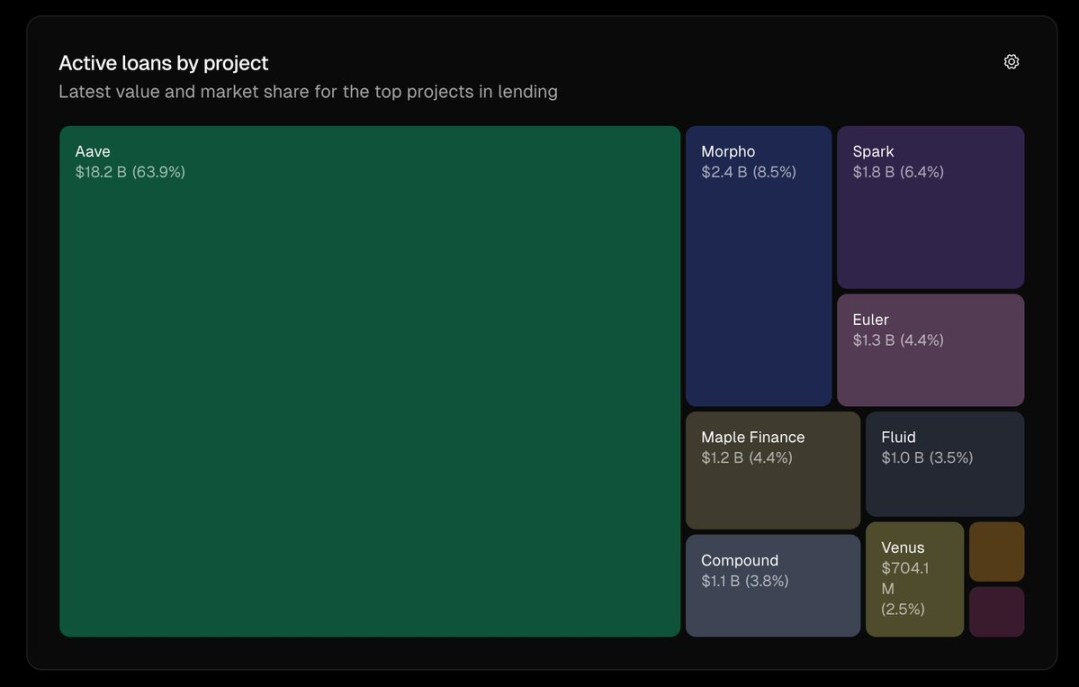

Active borrowing volume, data source: Token Terminal

Aave's current total active borrowing exceeds $18 billion, surpassing the total of all competitors combined. Aave is not just a simple staking platform; the assets deposited by users on Aave are lent out or used as collateral to borrow other assets, rather than just "sitting in the pool."

This creates a continuous demand mechanism in a positive feedback loop. When an asset is added to Aave, or a project is built on it, it can immediately benefit from this real market demand. All ecosystem participants benefit from the actual economic activity brought by the active user base.

This is particularly crucial for development teams looking to build products based on Aave. Aave has withstood multiple market cycles, continuously gaining the trust of developers and users over five years, and has long managed billions of dollars in assets, far earlier than many currently popular protocols.

More importantly, developers building on Aave are not limited by "capacity." In contrast, Aave can support a much higher supply and borrowing scale than its competitors, making it highly feasible for any scale of fintech application (whether targeting retail, institutions, or both).

Future Outlook

With the upcoming launch of Aave V4, this "effect engine" will continue to expand. The new architecture will bring richer asset support and new lending strategies for developers and users.

All the elements that constitute Aave's core value — including its distribution capability, trust foundation, active usage rate, etc. — will be further strengthened in V4. If interested, it is recommended to read the article "Understanding Aave V4’s Architecture" for an in-depth understanding of the upcoming updates.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。