Author: Mask

On Monday, Bitcoin just set a new historical high of $120,000, with a cumulative increase of 30% since last December. However, behind this surge, a key shift is occurring: Bitcoin's market dominance may have peaked in the short term, while Ethereum is quietly leading the altcoin market in a capital rotation.

Cryptocurrency analyst Benjamin Cohen recently emphasized that Bitcoin's breakthrough of the $121,000 mark validates the rationale for maintaining BTC as a primary investment in the portfolio, yet the market has subtly changed.

From July 15 to 16, Bitcoin's price plummeted from a historical high of $123,100 to $116,300, with a single-day drop of over 5%. As Bitcoin entered a correction, the ETH/BTC ratio steadily rose, reflecting Ethereum's relative strength and capital rotation.

Ethereum not only outperformed Bitcoin but also began to drive the altcoin market. Recent data shows that liquidity is continuously flowing into this sector rather than out.

1. Historical Cycles: A New Turning Point for Bitcoin's Dominance

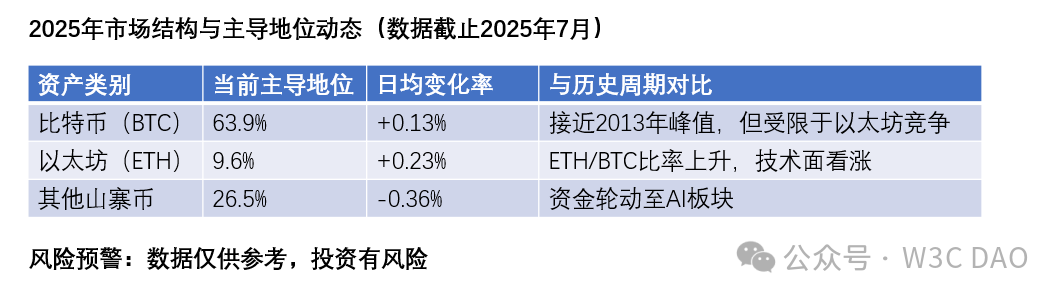

In June of this year, Bitcoin's dominance (BTC.D) soared to over 65%, reaching its highest level since 2021. Analysts at the time generally predicted that this indicator would continue to rise to around 71%, suggesting that altcoins might face significant adjustments. However, recent data indicates that Bitcoin's dominance has begun to wane.

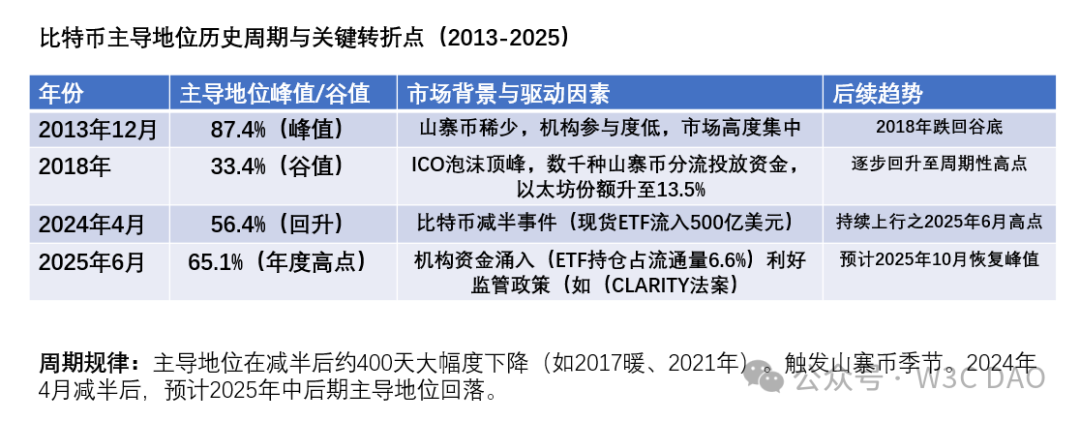

Research by cryptocurrency market analysts reveals predictable cyclical fluctuations in Bitcoin's dominance. By analyzing historical data from 2017, 2019, 2023, and 2024, it was found that Bitcoin's market dominance is expected to recover in late October 2025, with these cyclical changes vividly reflected in specific data.

In December 2013, Bitcoin accounted for 87.4% of the total market capitalization of the entire cryptocurrency market, nearly monopolizing it. At that time, the number of altcoins was scarce, and institutional participation was limited, leading to a highly concentrated market.

However, by 2018, the situation changed dramatically, with Bitcoin's dominance dropping to a historical low of 33.4%. Meanwhile, Ethereum and other cryptocurrencies reached market shares of 13.5% and 53.1%, respectively, ushering in a brief period of prosperity for altcoins.

The key driver behind this phenomenon was the peak of the ICO bubble, where a large number of altcoin projects emerged, diverting speculative funds that were originally concentrated in Bitcoin.

Entering 2025, the market landscape is reshaping again. Data from June 27 shows that Bitcoin's dominance rebounded to an annual high of 65.1%, far exceeding Ethereum's 8.9% and other cryptocurrencies' 26.0%.

These numbers indicate that, against the backdrop of the overall cryptocurrency market's continued expansion, funds are flowing back into Bitcoin.

2. Ethereum's Strong Rise: ETH/BTC Ratio Releases Key Signals

As Bitcoin entered a correction, Ethereum displayed remarkable strength. Top analyst Ted Pillows observed that the key driving force behind Ethereum's recent rise was the massive liquidity pool gathered above $3,000. After successfully breaking through the $2,850 resistance level, Ethereum's upward momentum rapidly increased, pushing the price past the $3,100 mark and entering a new opportunity zone.

The Relative Strength Index (RSI) reached 68.50, supporting this bullish outlook. The RSI stabilized above the overbought zone, indicating that Ethereum may be accumulating energy for a new round of increases.

On-chain data shows that on July 10, Ethereum futures open interest reached a record $36.1 billion, increasing by $3.5 billion within 24 hours. Over the past month, Ethereum's open interest surged by 72%, reflecting a significant increase in market activity.

Fundamentally, positive news also emerged. After Trump announced progress in U.S.-China trade talks, ETH briefly broke through $2,600, with a single-day increase significantly surpassing Bitcoin; SharpLink Gaming announced its listing on Nasdaq, along with a $425 million investment plan to acquire approximately 69.1 million shares at $6.15 per share, establishing the first Ethereum fund company listed on Nasdaq.

This initiative, led by Ethereum co-founder Joe Lubin, mimics MicroStrategy's Bitcoin fund strategy, with plans to purchase 120,000 Ethereum and participate in staking, potentially leading to a "supply compression" effect—where a large number of tokens exit circulation. As expectations for Ethereum staking ETFs heat up, its "monetary attributes" are expected to strengthen, with capital flows adjusted for market capitalization likely to surpass Bitcoin.

This strength is not an isolated phenomenon; Ethereum's rise is pulling mainstream altcoins like Solana and XRP upward, forming a rising tier centered around ETH. The market is beginning to realize that Ethereum is not only a technological platform but also a value anchor in the crypto ecosystem.

3. Liquidity Migration: The Eve of Market Structural Change

In mid-July, the cryptocurrency market experienced a violent shake-up. In just 24 hours, the total liquidation amount across the network reached $559 million, involving over 190,000 traders.

The liquidation structure showed significant differentiation: the double kill phenomenon of Bitcoin was particularly prominent, with short liquidations of $103 million being more than four times the $24.07 million in long liquidations, while the Ethereum market exhibited an unusual pattern where long liquidations of $63.51 million exceeded short liquidations of $41.64 million.

This extreme market condition exposed the fatal flaws of traditional centralized exchanges. When Bitcoin's price plummeted from $62,800 to $58,200 in just three hours, many leveraged traders faced forced liquidations due to liquidity exhaustion.

As mainstream exchanges fell into chaos, decentralized platforms demonstrated strong resilience. Data shows that when mainstream exchanges experienced a 12% spike, XBIT's BTC price fluctuations remained controlled within 3%.

After the liquidation events, XBIT's trading volume surged by 37%, with 68% of new users migrating from original centralized exchanges, indicating that traders are turning to safer and more transparent trading environments during extreme market conditions.

Institutional fund flows are also noteworthy, with the Bitcoin inventory on exchanges dropping to a historical low, accounting for only 14.5% of the total. Meanwhile, the number of "whale" addresses holding over 1,000 Bitcoins increased to 2,135.

This indicates that although short-term speculative funds are withdrawing, long-term holders' confidence in Bitcoin remains solid, providing a strong foundation for the market.

CryptoQuant CEO Ki Young Ju pointed out, "This bull market may become the longest bull market cycle in history," as new funds continue to flow in through channels like ETFs. Institutional investors like BlackRock are not only increasing their Bitcoin holdings but are also laying out plans for the Ethereum ecosystem.

4. Altcoin Season: Signs of Historical Pattern Repeating

Market analyst Moustache noted that Ethereum's rise may continue to impact the overall altcoin market, driving their prices further up, a view supported by historical data.

In July 2020, when Ethereum's price closed above the Gaussian channel's midpoint, the total market capitalization of altcoins, excluding Ethereum, grew by over 1,400%. Similarly, in November 2023, after Ethereum broke through the midpoint, the market capitalization of altcoins increased by over 200% within a year.

The outlook for the 2025 altcoin season is further enhanced by the repeating patterns following Bitcoin's halving. Historical data shows that in 2017 and 2021, Bitcoin's dominance significantly declined about 400 days after halving, triggering a rally in altcoins.

Considering that the most recent Bitcoin halving occurred in April 2024, a similar decline in dominance may happen within the next 100 days. Analyzing historical trends predicts that if this pattern repeats, the market capitalization of altcoins could soar to $15 trillion.

Market breadth indicators are also releasing positive signals. The G Index (an indicator developed by Coin Dao Academy) reached 1,916 points on July 10, nearing the critical point of 2,000 that triggers a major altcoin bull market.

This indicator reflects the weighted performance of the top 100 cryptocurrencies, providing a better reflection of the overall altcoin trend than merely observing Bitcoin or Ethereum. The AI sector is becoming a focal point for capital, with related cryptocurrency projects like Heco (Horseshoe) achieving hundreds of times in gains as tech giants increasingly invest in the AI field.

5. Risks Remain: Strategies for Ordinary Investors

Dynamic Position Balancing: Gradually increase exposure to ETH and quality altcoins while holding a base position in Bitcoin. Historical data shows that when BTC's dominance peaks, the ETH/BTC exchange rate averages over 40% gains.

Focus on Technological Evolution: Ethereum's Cancun upgrade and Layer 2 progress may catalyze the next round of explosions, and the ecological expansion of high-performance chains like Solana is also worth tracking.

Beware of Regulatory Variables: The U.S. SEC's regulatory stance on altcoins remains uncertain, and one should guard against "black swan" events like XRP facing lawsuits. Prioritize projects with clear compliance progress.

Avoid High-Leverage Operations: Analyst 2Lambroz warns that the current market "lacks a strong narrative belief." With accelerated capital rotation, high leverage is prone to liquidation.

The market is undergoing a silent transformation. As Bitcoin breaks through $120,000 to set a new historical high, capital has begun to quietly shift.

Institutional investors are continuously injecting liquidity through ETF channels, while retail funds are flowing along the path of ETH → major altcoins → innovative projects. This rotation differs from the frenzy of 2021 and resembles a value rediscovery based on fundamentals.

The crypto market is always evolving in cycles. As Bitcoin establishes its status as digital gold, Ethereum is quietly building its own digital economic kingdom. This alternating rise is a necessary path for the maturation of cryptocurrencies.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。