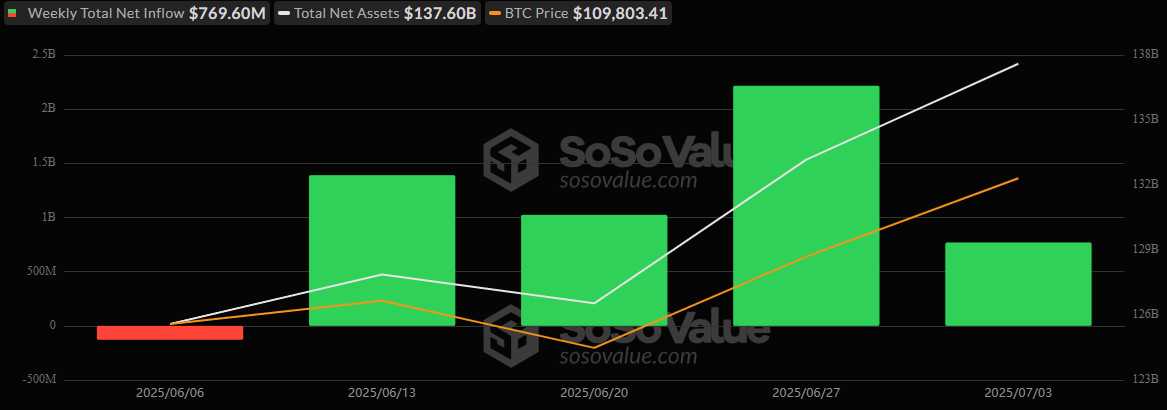

Bitcoin ETFs Log $769 Million Weekly Inflow as Institutional Momentum Rolls Into July

Wall Street’s appetite for digital assets shows no signs of slowing as both bitcoin and ether ETFs posted another impressive week of inflows to close out the first few days of July. With just 4 trading sessions due to the U.S. Independence Day holiday, the numbers were nothing short of robust.

Bitcoin ETFs saw $769.60 million in net inflows, stretching their weekly green streak to 4 weeks. Thursday, July 3, led the charge with a staggering $601.94 million, powered by inflows into the largest funds.

Blackrock’s IBIT continued to dominate with $336.85 million, while Fidelity’s FBTC followed closely at $248.36 million. Other strong performers included Ark 21Shares’ ARKB ($160.04 million), Bitwise’s BITB ($57.49 million), Grayscale’s Bitcoin Mini Trust ($22.36 million), and Vaneck’s HODL ($10.08 million).

Source: Sosovalue

Smaller contributions came from Invesco’s BTCO and Franklin’s EZBC, with $9.85 million and $9.51 million, respectively. Only Grayscale’s GBTC stood in the red, logging a $84.95 million outflow.

Meanwhile, ether ETFs clocked in $219.19 million in net inflows, their 8th straight week of positive flows. Blackrock’s ETHA led the pack with $99.40 million, followed by Fidelity’s FETH at $92.03 million. Grayscale’s two ether products added a combined $16.60 million, while Bitwise’s ETHW and Vaneck’s ETHV contributed $8.33 million and $2.84 million, respectively.

Trading volumes remained high throughout the week, reinforcing strong institutional conviction in crypto’s long-term viability. With flows surging and investor sentiment firm, all eyes are on how ETFs will perform in the weeks ahead.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。