Original | Odaily Planet Daily (@OdailyChina)

On July 1, FTX creditor representative Sunil updated the status of the claims compensation:

On February 18, 2025, users with claims under $50,000 will receive 120% compensation;

On May 30, 2025, users with claims over $50,000 will receive 72.5% compensation, while those under $50,000 will still receive 120%;

Future expected compensation distribution dates are: October and December 2026, and in 2027;

Users with claims over $50,000 who have already received 72.5% compensation will subsequently receive 27.5% of the face value, achieving 100% compensation. (Note: Based on the compensation situation, the interest rate for FTX creditors after applying for compensation is approximately 40-80%.)

Just as creditors were planning to wait patiently for their compensation, FTX's claims process hit another snag.

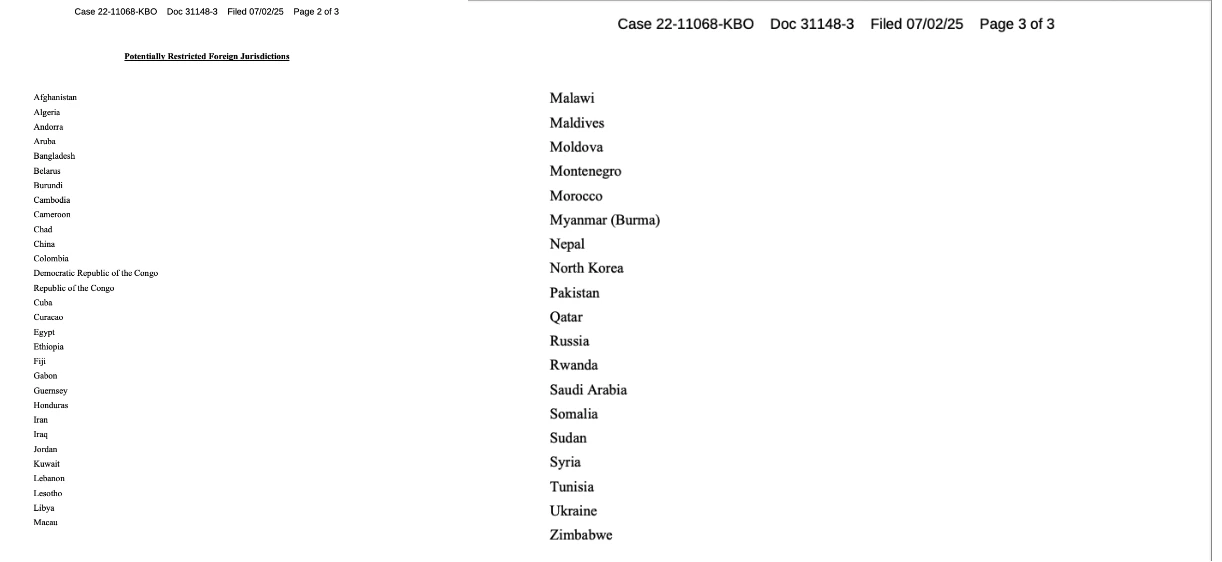

On July 4, FTX creditor representative Sunil posted on X platform stating that creditors from 49 jurisdictions, including China, may lose their right to claim, with these regions accounting for 5% of the total claims funds, approximately valued at $825 million (calculated based on $16.5 billion total compensation assets), of which 82% belongs to Chinese creditors, with claim assets valued at approximately $676.5 million.

List of jurisdictions that may not be able to claim

At the same time, Sunil stated that FTX will seek legal advice to allocate to restricted foreign jurisdictions. However, if it is determined that users belong to restricted foreign jurisdictions, the claims will be disputed, users have 45 days to raise objections, but if the issue is not resolved, users will completely lose their allocation rights, and their share of compensation will be confiscated and returned to the FTX liquidation trust for distribution to other legitimate creditors in different countries and regions.

In fact, when FTX officially began compensating users with claims under $50,000 on February 18, it indicated that users from five regions, including China, Russia, Egypt, Nigeria, and Ukraine, would temporarily be unable to participate in the claims distribution, with Chinese users being the largest group, accounting for 8% of FTX's total user base.

At that time, affected users might have thought that the restriction on claims due to jurisdiction was only temporary, and that FTX would propose a solution in the future. However, the news released today has expanded the regions with restricted claims, and the rhetoric almost sentenced the claim rights of creditors in restricted areas to death.

Regarding FTX's actions, the anger of affected users can no longer be suppressed. User @zhetengji stated that they have contacted a lawyer in New York and called for more people to take action:

I will definitely take action and raise objections at every stage. I also hope more people can stand up. We cannot just wait — this is absolutely unreasonable. Although mainland China does not support cryptocurrency trading, residents are allowed to hold cryptocurrencies. The law recognizes the commodity nature of virtual currencies. The claims process is settled in USD. Although foreign exchange controls limit the amount of USD that mainland Chinese residents can receive each year, they are allowed to hold USD abroad.

How should Chinese creditors collect their debts?

Using legal means also requires consideration of costs and benefits. For large creditors suffering losses of tens to hundreds of millions of dollars at FTX, the cost and benefit of legal action may be equivalent; but for users with claims under $50,000, the compensation amount seems insignificant compared to the funds, time, and effort spent on legal avenues.

So should they just watch their money flow into someone else's pocket? Of course not. In fact, there are already many third-party platforms providing debt sale services for FTX creditors, such as RootData, claims market, ftxcreditor, and Xclaim. To better understand how Chinese creditors of FTX can "collect debts," Odaily consulted with RootData's FTX creditor solutions head Loners Liu:

RootData's main business is as a financing information platform, and it also provides debt sale services for Chinese users of FTX. It has successfully handled over 1,000 cases, assisting in processing claims exceeding $300 million. Loners Liu stated, "You can think of us as a real estate agency; we help Chinese creditors sell their claims at a discount, or we can help them hold their claims."

RootData currently charges a service fee of 1-2% for this service, and the main solutions it offers to Chinese users for handling FTX claims include:

Selling claims;

Transferring claims to entities owned outside of China;

Transferring claims in the name of trustees, banks, or other entities outside of China;

Changing residency;

If selling claims, users first need to log in to claims.ftx.com to confirm KYC approval, then both parties need to schedule a video meeting, log in to verify and sign the contract, and finally complete the transfer.

"Previously, some people were hesitant about whether to actively handle their claims, but after the news of the restrictions on Chinese users' FTX claims came out in recent days, many have come to consult," Loners Liu answered my questions while responding to inquiries from creditors.

"However, according to our estimates, among Chinese creditors, there may only be a little over 1,000 users with claims exceeding $50,000," Loners Liu stated that in reality, many large clients have already processed their claims through various channels.

From the perspective of affected users, waiting for years without receiving money is akin to a bolt from the blue. The 45-day appeal period given by the creditor representative, combined with the cross-border claims rights and their frustrating efficiency, delivers a heavy blow. At this moment, being able to recover a certain amount (debt transfer rate + a small service fee) is considered a good solution in a desperate situation.

If one were to stubbornly cling to legal principles and strictly defend their rights, facing bankruptcy lawyers who charge exorbitant fees and hold the power of legal discourse, Chinese creditors would indeed find themselves without leverage. In the rapidly changing and tumultuous world of cryptocurrency, the FTX collapse seems distant, but the scars left on all parties involved have yet to heal. The most unbearable scene is when the cryptocurrency that once carried dreams of wealth ultimately turns into dollars filling the pockets of legal teams.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。