Author: arndxt

Translation: Yuliya, PANews

In the context of the current market sentiment being generally low and directionless, the author of this article makes a bold and critical assertion about the altcoin market: "We may be in the last calm period before the next round of 'altcoin season' erupts." Unlike a broad market rally, the future market will be driven by core narratives such as ETFs, real yields, and institutional adoption. Below is the original text of the article, translated by PANews.

We may be at a critical turning point—the most grueling period in the market cycle. During this phase, 99% of market participants choose to wait on the sidelines due to exhaustion or indecision, while only that 1% quietly completes trades that can impact their lives.

Signals of Altcoin Season Are Emerging

Just last week, Bitcoin reached its highest monthly closing price in history, but its market dominance began to decline. At the same time, whales quietly accumulated over 1 million ETH in a single day, amounting to about $3 billion, while Bitcoin's balance on exchanges has dropped to a multi-year low.

Retail investors remain on the sidelines, still skeptical. Sentiment indicators are at low levels—this is precisely the ideal market state for early entrants.

Everything is beginning to brew at this moment.

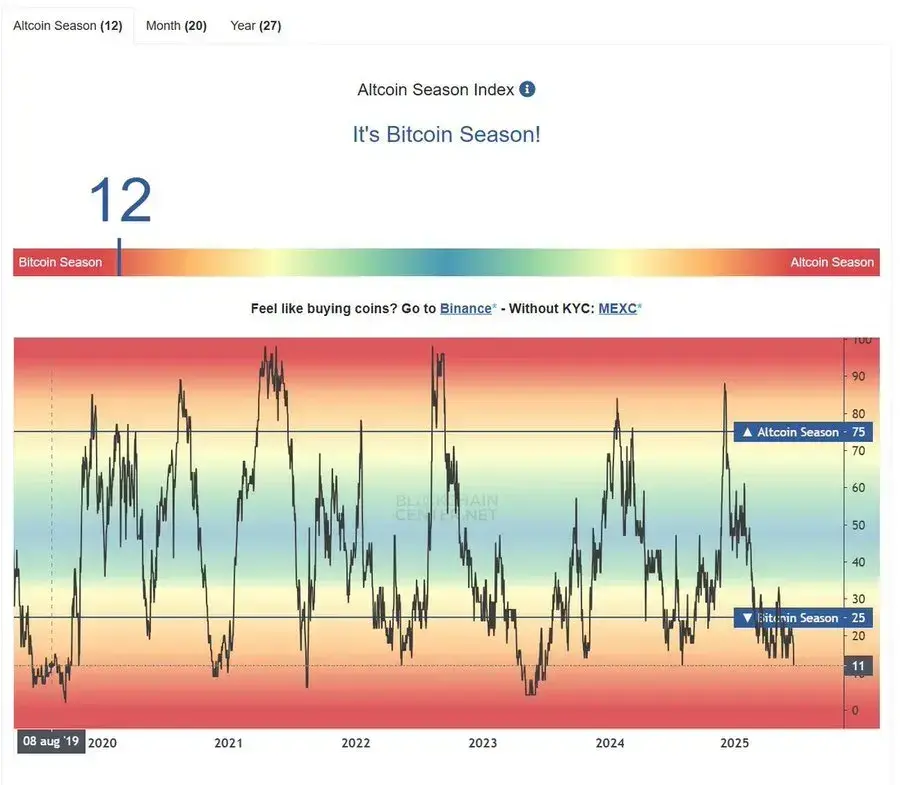

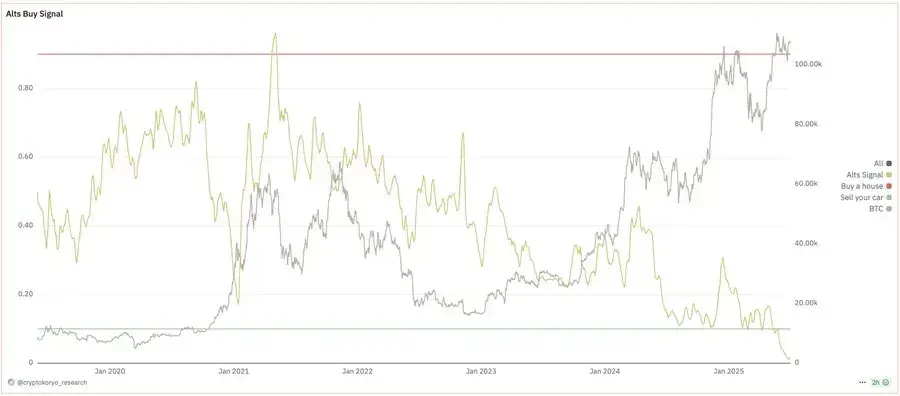

The current altcoin speculation index is still below 20%, and the ETH/BTC pair has finally recorded its first weekly green candle in several weeks. The approval of the Solana ETF is a done deal. The rotation of on-chain capital has quietly begun, with funds subtly flowing into areas aligned with market narratives such as DeFi, real-world assets (RWA), and restaking.

But this is not 2021; the kind of "everyone taking off" market will not reappear.

The upcoming market will be more selective and deeply narrative-driven. Capital is flowing towards real yields, cross-chain abstract infrastructure, and ETF structured assets with staking yield mechanisms.

If you have been quietly accumulating, this is your signal.

Profound Changes in the DeFi Sector

We are witnessing DeFi moving towards a phase of "more institutionalized and more invisible." On one hand, financial primitives designed specifically for institutions, such as restaked bonds, fixed-rate auto-renewing credit, and stablecoin circular vaults, are thriving. On the other hand, composable layers like Enso and Dynamic are simplifying operational complexity for ordinary users.

Ultimately, only those protocols that transcend "points games" and integrate real economic value or use cases will continue to attract capital inflows. Behind this, the real winners will be those protocols that can perfectly combine seamless cross-chain user experience (UX), secure infrastructure, and predictable, real-world-like investment returns.

Here are six major trends occurring in the DeFi sector:

1. Stablecoin Yield Optimization and Fixed Income DeFi

DeFi is increasingly mimicking traditional finance by converting stablecoins into high-yield, quasi-fixed income assets to attract funds. In the context of heightened volatility in the spot market, various protocols are shifting their focus towards capital efficiency and fixed-rate structures to meet the dual demands of institutions and retail investors.

- Euler Finance: This super lending application deployed on Arbitrum provides lending markets for blue-chip assets like ARB, WETH, USDC, and WBTC, attracting liquidity through the rEUL reward mechanism.

- Yield Nest: Centered around stablecoins, it launched a new asset $ynUSDx, maximizing stablecoin yields through the Superform platform and strategies based on SuperUSDC.

- Size Credit: Innovatively allows users to recycle fixed income principal tokens in exchange for lower-cost USDC, attempting to generate double-digit annualized returns from idle capital.

- Renzo Protocol: Meanwhile, in the realm of restaking, Renzo has introduced fixed-term "zero-interest restaking bonds," providing predictable cash flow for Active Validation Services (AVS) while offering liquidity providers bond-like fixed income exposure. This structure could become a cornerstone of fixed income in the EigenLayer security market.

However, it is important to note that the high yields (15%+) advertised often require leverage, restaking lock-ups, or recycling strategies. After deducting fees, slippage, and risk drag, the real net return may be closer to 6-9%. Additionally, while the composability supporting these recycling structures offers convenience, it also increases systemic risks of chain liquidations and stablecoin de-pegging.

2. Integration of Cross-Chain Liquidity and User Experience

The way users interact with multi-chain liquidity is undergoing a fundamental transformation. Cross-chain user experience is evolving from cumbersome bridging processes to seamless, intent-based deposit systems, effectively abstracting the boundaries between chains.

- GHO: Its deployment on Avalanche (the first outside of Ethereum) showcases the development trend of native cross-chain stablecoin utility.

- Enso: The launch of an embeddable cross-chain DeFi deposit component represents a generational leap in user experience. This component is built on LayerZero and Stargate, allowing users to bridge, swap, and deploy strategies with a single click. Projects like Pume Network and Yield have integrated this component to drive capital into their vaults.

- T1 Protocol's Proof of Read system is also promoting real-time cross-chain verification mechanisms, relying on TEE (Trusted Execution Environment) infrastructure to provide high-speed cross-chain verification between Arbitrum and Base without multi-signature, effectively enhancing bridging efficiency and trust assumptions.

- The new collaboration between Wormhole and Ripple enables cross-chain information transfer on the XRP Ledger, further indicating that the war between chains will not disappear, but user experience is gradually integrating.

The trend is clear: value capture is gradually shifting from L1 public chains themselves to those composable infrastructures and messaging layers.

3. Restaking and On-Chain Security Market

Restaking is continuing to evolve into an independent on-chain security market, essentially injecting restaked ETH into structured products to create yield mechanisms similar to corporate bonds or government bonds.

- Renzo Protocol's new Flow vault and restaking bonds empower AVS (Active Validation Services) to budget based on known yields while allowing liquidity providers to lock ETH into fixed income-style products.

- Succinct has now entered the 2.5 phase testnet, adding decentralized validation layers, competitive validation auctions, staking mechanisms, and hardware optimization features, laying the groundwork for a high-performance restaking ecosystem.

- In the Solana ecosystem, jito is also providing restaking support for rollups through the Magicnet project, promoting the expansion of the Solana on-chain security layer.

As capital gradually flows towards EigenLayer's primitives, we are seeing the emergence of a new form of "restaking yield curve": the prices of short-term and long-term bonds will be priced differently based on risk perception, exit liquidity, and slash risk, leading to discounts or premiums.

However, composability also brings vulnerabilities. For example, zero-interest bond structures mean that principal must be locked until maturity, and any forfeiture event or validator downtime could severely damage the principal—even without smart contract vulnerabilities.

4. Monetization and Programmability of Data Infrastructure

Block space is no longer the bottleneck; data latency and composability are. Projects like Shelby and Dynamic aim to provide monetizable real-time read/write infrastructure for Web3 developers.

- Shelby: Developed by Aptos and Jump, it can achieve sub-second reads, dynamic content, and monetizable data access, aiming to replace static cold storage with real-time streaming computation.

- ZKsync's Airbender module can generate zkVM proofs in 35 seconds at a cost of only $0.0001, with speed and cost improvements six times that of previous solutions.

- Dynamic addresses friction in wallet switching and user onboarding from the wallet interaction layer. Its infrastructure supports over 20 million users and 500+ wallets, achieving payment composability in multiple application scenarios.

This trend is giving rise to a new middleware business model: providing developers with low-latency, chain-agnostic data access services and charging on demand, potentially introducing an AWS-style pricing model and a developer tier system based on latency.

5. Institutional Credit Infrastructure and RWA Integration

On-chain lending is moving towards institutionalization, with automatic renewal credit lines, backup floating rates, and leveraged RWA strategies becoming the focus.

- The integration of Tenor Finance and Morpho V2 showcases the maturity of on-chain credit. Their new fixed-rate loan products come with automatic renewal and backup logic, providing institutional users with tools commonly used in TradFi.

- Morpho has also previewed a leveraged RWA strategy based on Apollo Global's ACRED fund, indicating that the future trend is to build high-yield, compliant, and institutionally liquid on-chain vaults.

- Euler Prime is driving stablecoin liquidity enhancement through targeted incentives, optimizing yield efficiency for market makers and vault managers seeking predictable returns.

We are gradually approaching on-chain wholesale brokerage, with compliant, structured fixed income products leading a new wave of growth. However, RWA strategies require high-fidelity oracles and robust redemption logic. Any off-chain mismatches could trigger large-scale de-pegging or margin call risks.

6. Airdrop Economy and Incentive Mining

Airdrops remain a primary user acquisition strategy, although user retention data continues to decline.

The SNAPS event by Spark, Aethir's Cloud Drop 2.0, and KiiChain's ORO testnet activity continue the familiar formula: points, task systems, and gamified interactions to attract attention.

However, data shows that two weeks after an airdrop, only about 15% of the total value remains. As a result, project teams are forced to offer higher point multipliers (such as LPs up to 30x) or bind additional benefits (governance rights, enhanced yields) to attract users.

Platforms like Cookie.fun are attempting to reduce Sybil attacks through social or behavioral verification, but mining whales still evade restrictions through methods like splitting wallets and multi-signature structures.

Projects seeking long-term liquidity must shift towards retention-oriented incentive mechanisms, such as veNFT locking, time-weighted reward mechanisms, or restaking access, rather than relying solely on speculative points to attract new users.

Macro Narratives and Investment Framework

Although geopolitical turmoil may still hit the market hard, structural buyers are continuously absorbing every dip. Altcoins will not experience a "broad rally" like in 2021; instead, narratives with tangible catalysts (such as ETFs, real income, and exchange distribution channels) will draw attention away from pure meme speculation.

1. Macro Background: Volatility Linked to Headlines

During the conflict between Iran and Israel, Bitcoin's price fell from $105,000 to just below $99,000, further proving that the 2025 market is driven by headlines. Within 36 hours, the U.S. confirmed strikes on Iranian nuclear facilities, the Iranian parliament threatened to block the Strait of Hormuz, and Tehran symbolically launched missiles at U.S. military bases, while Trump quickly mediated a ceasefire. The entire process was compressed into a weekend, with BTC's price rapidly dropping and then fully recovering.

Market interpretation: After three months of sideways trading, the short leverage buildup has led to geopolitical panic merely triggering liquidity grabs, pushing chips from uncertain holders to long-term accounts. ETFs continue to absorb circulating chips, and every macro disturbance accelerates this transfer. BTC is currently fluctuating around $107,000, about 25% lower than this round's peak, but still above the "buy" range in the rainbow valuation model (i.e., below $94,000).

2. A Summer of Silence or a Build-Up Before the Leap?

While seasonal statistics suggest that the Q3 market may be relatively flat, two structural forces are breaking this trend:

- Stable buying from ETFs: Experience in 2024 indicates that stable ETF inflows create a structural bottom. Once miner selling pressure further weakens and chips continue to flow into corporate treasuries, BTC could quickly surge to $130,000 once volume increases.

- Leadership from the U.S. stock market: The S&P 500 index reached a new high on June 27, while Bitcoin lagged. Historically, this gap is often closed by BTC within 4 to 8 weeks. If overall risk appetite remains optimistic, the crypto market may simply be "lagging" rather than "failing."

3. The Only Altcoin Narrative Worth Watching: Solana ETF

In a market severely lacking a "next big event" narrative, the Solana spot ETF has become the only topic with institutional weight. The SEC's review window for four ETF applications (VanEck, 21Shares, Canary, Bitwise) officially opened this January, with a final ruling expected by September at the latest.

If the future Solana ETF structure includes staking rewards, its role will shift from "high Beta L1 trading target" to "quasi-income digital equity." This will prompt staking-related targets (like JTO, MNDE) to also be included in the ETF narrative. The current SOL price below $150 is no longer pure speculation but an early layout for "ETF-wrapped trading."

4. Fundamental Support for DeFi

Although meme coins and rotation narratives dominate the topic heat on platform X, truly cash-flowing on-chain protocols are quietly strengthening.

5. Meme Coins

Recently launched perpetual contracts on Binance, such as $BANANAS31, $TUT, and $SIREN, exhibit a "pump and dump" trading model: these low-liquidity assets are pumped through perpetual contracts, with funding rates quickly turning negative, while marketers package them as "sector rotation." In essence, most of these trades are extractive—non-value-creating. It is advised to either accept them as a "Ponzi game" and set clear stop-loss and take-profit points or to completely ignore them.

The same warning applies to meme coins on the Base chain (like $USELESS, $AURA), which can surge 10 times in a day or plummet 70%.

6. New Issuance Projects and Structural Benefits

- Robinhood's Move to L2: Robinhood has chosen Arbitrum Orbit as its L2 solution and is promoting the development of tokenized stocks. This strengthens the "exchange chain" theory pioneered by Coinbase's Base. Robinhood may leverage its millions of users to boost user activity on Ethereum L2, potentially sparking a wave during the usual summer trading lull.

- Recent token prices for $H (Humanity Protocol) and $SAHARA (Sahara AI) indicate that even with significant initial sell-offs, as long as the team has credible planning and a verifiable roadmap, their tokens can still attract positive market buying in secondary trading.

7. Q3 2025 Investment Framework

- Core Position: Continue to allocate heavily to BTC until ETF outflows significantly exceed inflows (no such signs have appeared yet).

- Rotational Beta: Continue to build positions in SOL below $160, using it as an alternative to ETFs, and pair it with $JTO and $MNDE for enhanced yield potential.

- Fundamental DeFi Portfolio: Equal-weight allocation to $SYRUP, $LQTY, $EUL, $FLUID; when one of these projects performs outstandingly, rotate profits into underperforming projects.

- Speculative Position: Limit the risk exposure of meme coins to within 5% of total net asset value; treat each meme coin on Binance perpetual contracts as weekly options trading—using small costs to seek high returns and setting strict stop-losses.

- Event-Driven: Track milestone events for Robinhood L2; in the Arbitrum ecosystem tokens, pre-position catalysts related to user growth.

Recommended Reading:

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。