Grayscale ETF Approval Marks Milestone in Crypto Fund Expansion

In a major move for the crypto industry, the U.S. SEC has approved a key rule change. Enabling Digital Large Cap Fund of Grayscale to trade as an ETF. The Exchange Traded Fund includes top crypto assets like Bitcoin, Ethereum, XRP, and Cardano. This Grayscale ETF will be listed on New York Stock Exchange Arca, opening the door for more conventional traders to access several digital currencies in one regulated product.

This approval was granted under Section 19(b)(2) of the Exchange Act. It is giving the green signal to a proposal first submitted by NYSE Arca. The Grayscale ETF became one of the first times a multi-asset crypto fund has been allowed to trade like a stock in the United States market.

What This Means for the Market?

This SEC approval gives the digital assets space a much-needed boost. Unlike single-asset funds, the Grayscale ETF covers a basket of the largest digital coins, offering broader exposure in one place. For everyday investors, this makes it easier to buy into digital currency without needing to manage wallets or trade on unfamiliar platforms.

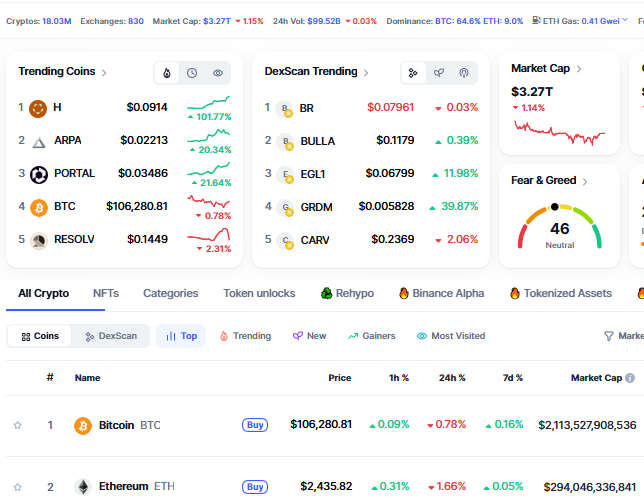

With rising interest from both retail and institutional investors, the new fund could help bring more capital into digital assets, while giving investors a way to spread risk across multiple assets. The cryptocurrencies are now trading at Bitcoin $106,280, 0.74% decrease, Ethereum $2435, 1.66% decrease, XRP $2.18, 1.92% decrease, and Cardano $0.5509, 2.60% decrease.

Even after this positive announcement about the Grayscale ETF approval, the cryptocurrency market is down. The major catalyst of the downward market momentum is the fear among the traders before the 9th July update about the tariffs . As President Trump has already said, tariffs are not going to be postponed, which might accelerate trade war tensions again. What president Trump is going to announce will impact the crypto market in the upcoming days.

Source: CoinMarketCap

Bitwise Still Waiting for Approval

After this approval has achieved this milestone, another major crypto organisation Bitwise is still waiting on a decision for its own Bitwise 10 Crypto Index Fund . Bitwise hopes to offer investors exposure to a wider range of cryptocurrencies in one product. The SEC has not given a timeline for the decision, but interest in diversified ETFs is clearly growing.

Background: SEC Slowly Opening to Crypto Funds

This approval came after the months of back-and-forth between cryptocurrency organisations and United States regulators. In 2024, the commission approved many spot Bitcoin Exchange Traded Fund and Ethereum ETF. It was a huge milestone that triggered billions of dollars in inflows. In the months that followed, firms like Grayscale also filed for other ETFs, which includes Ethereum staking options .

Single-asset funds for Solana and Litecoin were also applied. Some of these are still under the process of review.

Even without the feature of staking, Ethereum ETFs have already pulled in over $2.28 billion for investment , proving strong demand. Grayscale’s Ethereum staking plan is still awaiting a decision, expected later in 2025.

Why This Approval Matters?

The SEC approval of Grayscale ETF is not just any other listing. It indicates that regulators are increasingly becoming comfortable with crypto, particularly when provided in a controlled and regulated manner. Although the road is slow and the legalization is still to get a force, every approval helps others to go ahead.

Final Thoughts

There is a growing list of ETF applications and increasing interest by investors, so this ruling about Grayscale ETF approval could be used to propel further multi-asset cryptocurrency ETFs. Until the time, this is taking place as a good sign in the market- and even closer to being mainstream.

Also read: Big Beautiful Bill Passed—Will House Let America Fall Apart?免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。