The Genius Act or changes to stablecoin regulations may impact blockchain choices and market liquidity.

Written by: Alex Carchidi

Translated by: Baihua Blockchain

On June 17, the U.S. Senate passed the "Guidance and Establishment of a National Stablecoin Innovation Act" (Genius Act), marking the first comprehensive federal regulatory framework for stablecoins, overcoming the largest hurdle.

The bill has now been submitted to the House of Representatives, where the House Financial Services Committee is preparing its own text for a negotiation meeting, with a possible vote later this summer. If all goes well, the bill could be signed into law before autumn, significantly reshaping the landscape of the cryptocurrency industry.

The bill's strict reserve requirements and national licensing system will determine which blockchains are favored, which projects become significant, and which tokens are used, thereby influencing the direction of the next wave of liquidity. Let’s delve into the three major impacts the bill could have on the industry if it becomes law.

1. Payment-type alternative tokens may disappear overnight

The Senate bill will create a new "licensed payment stablecoin issuer" license and require each token to be backed 1:1 by cash, U.S. Treasury securities, or overnight repurchase agreements (repos)—with issuers having a circulation of over $50 billion subject to annual audits. This stands in stark contrast to the current "Wild West" system, which has virtually no substantive guarantees or reserve requirements.

This explicit regulation comes at a time when stablecoins are becoming the primary medium of exchange on blockchains. In 2024, stablecoins are expected to account for about 60% of the value of cryptocurrency transfers, processing 1.5 million transactions daily, with most transaction amounts below $10,000.

For everyday payments, a stablecoin token that consistently maintains a value of $1 is clearly more practical than most traditional payment-type alternative tokens, which may fluctuate by 5% before lunch.

Once U.S. licensed stablecoins can legally circulate across state lines, merchants that still accept volatile tokens will find it difficult to justify the additional risks. In the coming years, the practicality and investment value of these alternative tokens may significantly decline unless they can successfully transform.

Even if the Senate bill does not pass in its current form, the trend is evident. Long-term incentives will clearly favor dollar-pegged payment channels over payment-type alternative tokens.

2. New compliance rules may effectively determine new winners

The new regulations will not only provide legitimacy to stablecoins; if the bill becomes law, it will ultimately guide these stablecoins toward blockchains that can meet auditing and risk management requirements.

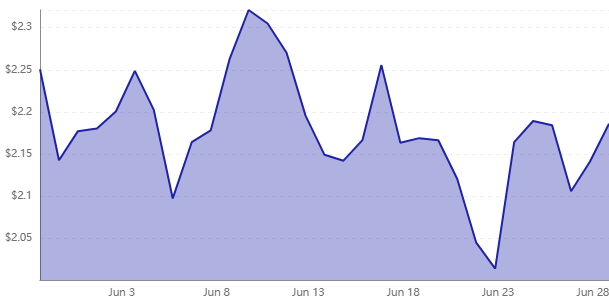

Ethereum (ETH 1.15%) currently hosts about $130.3 billion in stablecoins, far exceeding any competitors. Its mature decentralized finance (DeFi) ecosystem means issuers can easily access lending pools, collateral lockers, and analytical tools. Additionally, they can stitch together a set of regulatory compliance modules and best practices to attempt to meet regulatory requirements.

In contrast, the XRP Ledger (XRPL) is positioning itself as a compliance-first tokenized currency platform, including stablecoins.

In the past month, fully supported stablecoin tokens have been launched on the XRP Ledger, each with built-in account freezing, blacklisting, and identity screening tools. These features align closely with the Senate bill's requirements that issuers maintain robust redemption and anti-money laundering controls.

Ethereum's compliance framework may lead issuers to violate these requirements, but it is currently difficult to determine how strict regulators will be in this regard.

Nevertheless, if the bill becomes law in its current form, large issuers will need real-time verification and plug-and-play "know your customer" (KYC) mechanisms to remain broadly compliant. Ethereum offers flexibility, but its technical implementation is complex, while XRP provides a streamlined platform and top-down control.

Currently, both blockchains seem to have an advantage over chains that focus on privacy or speed, which may require costly overhauls to meet the same requirements.

3. Reserve rules may bring a flood of institutional funds to blockchains

As each dollar of stablecoin must be backed by an equivalent amount of cash-like assets, the bill quietly ties cryptocurrency liquidity to U.S. short-term debt.

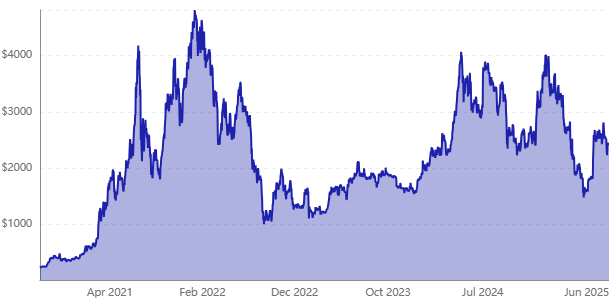

The stablecoin market has surpassed $251 billion. If institutions continue to develop along the current path, it could reach $500 billion by 2026. At this scale, stablecoin issuers will become one of the largest buyers of U.S. short-term Treasury securities, using the proceeds to support redemptions or customer rewards.

This connection has two implications for blockchains. First, the demand for more reserves means that more corporate balance sheets will hold Treasury securities while also holding native tokens to pay network fees, thereby driving organic demand for tokens like Ethereum and XRP.

Second, the interest income from stablecoins could fund aggressive user incentives. If issuers return a portion of Treasury yields to holders, using stablecoins instead of credit cards may become a rational choice for some investors, thereby accelerating on-chain payment volumes and fee throughput.

Assuming the House retains the reserve provisions, investors should also expect increased currency sensitivity. If regulators adjust collateral eligibility or the Federal Reserve changes the supply of Treasury securities, the growth of stablecoins and cryptocurrency liquidity will fluctuate in sync.

This is a notable risk, but it also indicates that digital assets are gradually integrating into mainstream capital markets rather than existing independently from them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。