Compiled by: Jerry, ChainCatcher

Performance of Crypto Spot ETFs Last Week

US Bitcoin Spot ETF Net Inflow of $2.214 Billion

Last week, the US Bitcoin spot ETF saw a net inflow for five consecutive days, totaling $2.214 billion, with a total net asset value of $133.17 billion.

Three ETFs experienced net inflows last week, primarily from IBIT, FBTC, and ARKB, which saw inflows of $1.31 billion, $504 million, and $268 million, respectively.

Data Source: Farside Investors

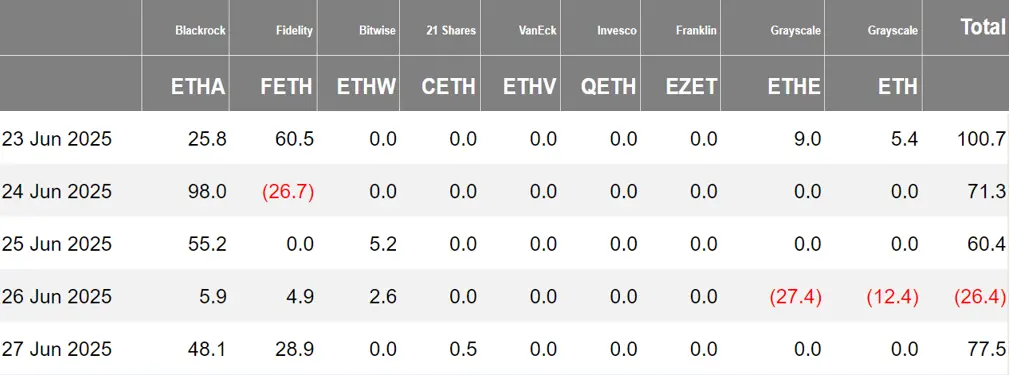

US Ethereum Spot ETF Net Inflow of $283 Million

Last week, the US Ethereum spot ETF had a net inflow over four days, totaling $283 million, with a total net asset value of $9.88 billion.

The inflow last week mainly came from BlackRock's ETHA, with a net inflow of $233 million. A total of three Ethereum spot ETFs had no fund movement.

Data Source: Farside Investors

Hong Kong Bitcoin Spot ETF Net Outflow of 0.001 Bitcoin

Last week, the Hong Kong Bitcoin spot ETF experienced a net outflow of 0.001 Bitcoin, with a net asset value of $447 million. The holdings of the issuer, Harvest Bitcoin, decreased to 301.44 Bitcoin, while Huaxia maintained 2,230 Bitcoin.

The Hong Kong Ethereum spot ETF had no fund inflow, with a net asset value of $53.29 million.

Data Source: SoSoValue

Performance of Crypto Spot ETF Options

As of June 27, the nominal total trading volume of US Bitcoin spot ETF options was $1.04 billion, with a nominal total long-short ratio of 4.21.

As of June 26, the nominal total open interest of US Bitcoin spot ETF options reached $16.36 billion, with a nominal total long-short ratio of 2.07.

The market's short-term trading activity for Bitcoin spot ETF options has increased, with overall sentiment leaning bullish.

Additionally, the implied volatility was 42.74%.

Data Source: SoSoValue

Overview of Crypto ETF Developments Last Week

Asset Management Company KraneShares Applies to US SEC to Launch Coinbase 50 Index ETF

According to The Block, ETF-focused asset management company KraneShares announced on Friday that it has submitted an application to the US Securities and Exchange Commission (SEC) to launch a "Coinbase 50 Index ETF" that tracks the top 50 digital assets by market capitalization. This index product is set to be launched by Coinbase, the largest cryptocurrency exchange in the US, by the end of 2024, with quarterly adjustments to the component weights. Currently, its top three holdings are Bitcoin (50%), Ethereum (approximately 21%), and XRP (9%).

KraneShares was founded by Jonathan Krane in 2023 and is an investment company based in New York, primarily focusing on China, climate, and alternative investments. The company is controlled by China’s well-known financial services institution, China International Capital Corporation (CICC).

US Asset Management Company Calamos to Launch Three Bitcoin Principal-Protected ETFs on July 8

US asset management company Calamos Investments plans to launch three Bitcoin ETFs with downside protection on July 8 (local time), which are:

- 100% Principal Protection (CBOY): Initial return cap of 9%-11%

- 90% Principal Protection (CBXY): Initial return cap of 24%-28%

- 80% Principal Protection (CBTY): Initial return cap of 43%-48%

This series of ETFs aims to provide exposure to Bitcoin while adjusting the return caps based on the level of protection, with an investment period of one year.

Caitong Securities Subsidiary Caitong Hong Kong Approved for Virtual Asset ETF Client Trading

According to Jin10 data, Caitong Securities stated on its interactive platform that its wholly-owned subsidiary Caitong Hong Kong has been approved to conduct virtual asset ETF client trading.

Korean Democratic Party lawmaker Min Byung-deok today initiated an amendment to the "Capital Markets and Financial Investment Business Act," aiming to include digital assets (virtual assets) within the scope of underlying assets and trust property for financial investment products.

This amendment would allow digital assets like Bitcoin to serve as underlying assets for financial products such as exchange-traded funds (ETFs), while also providing legal grounds for trust companies to custody and manage digital assets. This move is one of South Korean President Lee Jae-myung's core campaign promises.

If the bill passes, South Korean investors will be able to indirectly invest in digital assets through institutional financial products, which will help enhance investor protection and market transparency.

Bitwise Submits Revised S-1 Form for Spot DOGE and Aptos ETFs to US SEC

Bloomberg analyst Eric Balchunas posted on X platform that Bitwise has submitted a revised S-1 form for its spot DOGE and Aptos ETFs to the US SEC.

NYSE Submits Application to US SEC for Truth Social Bitcoin and Ethereum ETF

According to Decrypt, the New York Stock Exchange (NYSE) has submitted a rule change application to the US SEC to allow the listing of Truth Social Bitcoin and Ethereum ETFs from Trump Media & Technology Group.

This application was submitted eight days after Trump Media filed a prospectus for the Truth Social Bitcoin and Ethereum ETFs in partnership with Yorkville America, which will have a holding ratio of 75% Bitcoin and 25% Ethereum. Crypto.com will act as the custodian, executing agent, and liquidity provider. This so-called 19b-4 rule change is an important step in the regulatory process for considering ETFs, but it does not compel the SEC to approve the product.

Grayscale Spot Solana ETF Management Fee Expected to be 2.5%

According to a revised S-1 registration statement submitted by Grayscale on June 14, the management fee for this trust product is set at 2.5%.

REX Shares: Solana Staking ETF Coming Soon

REX Shares announced on the X platform that the Solana staking ETF "REX-Osprey SOL+Staking ETF" is coming soon, reportedly designed to track the performance of Solana while generating returns through on-chain staking. It is claimed to be the first staking cryptocurrency ETF in the US.

Additionally, Bloomberg senior ETF analyst Eric Balchunas disclosed on the X platform that the US SEC has indicated no further comments, suggesting they are ready to proceed.

Invesco Galaxy Submits Solana Spot ETF S-1 Filing to US SEC

Cboe Submits 19b-4 Application to US SEC for Canary PENGU ETF

US SEC Delays Review of 21Shares Spot Polkadot ETF

Views and Analysis on Crypto ETFs

ETF Expert: Ripple vs. SEC Lawsuit Conclusion Clears Path for XRP Spot ETF and BlackRock's Entry

Nate Geraci, CEO of ETF Store, a US ETF expert, stated on social media that an XRP spot ETF is imminent.

He emphasized, "With Ripple withdrawing its lawsuit against the US SEC, the path for the XRP spot ETF has been cleared… and it has also paved the way for BlackRock's entry."

US SEC Commissioner Hester Peirce: Physical Redemptions for Crypto ETFs May Soon Be Realized

Hester Peirce, a commissioner of the US Securities and Exchange Commission (SEC), stated that physical redemptions for cryptocurrency exchange-traded funds (ETFs) may soon be realized.

Peirce was asked during a panel discussion at the Bitcoin Policy Institute whether the SEC would approve physical creation and redemption, and if this was "imminent." She responded, "These (applications) are going through the process… so I think it is definitely 'imminent' at some point. I can't predict, but we have heard a lot of interest."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。