JPMD is not just a technological upgrade; it introduces a new class of digital assets in the form of tokenized bank deposits.

Author: Zhou Hao, Sun Yingchao

(Zhou Hao is the Chief Economist at Guotai Junan International and a member of the China Chief Economists Forum)

JPMorgan Chase recently quietly submitted a trademark application for "JPMD," sparking interest in the financial and crypto industries. Unlike speculative token launches or experimental pilots, this move reflects that the world's largest bank is rapidly entering the digital finance space. However, JPMD is not a stablecoin.

Investors tend to view this as a carefully considered bet on blockchain infrastructure. JPMD is supported by regulated deposits and piloted on a public blockchain, serving as a blueprint for how traditional institutions can embrace decentralized pathways without sacrificing compliance, stability, or control.

JPMD is a form of customer deposit based on blockchain technology, seamlessly operating within existing banking infrastructure. Essentially, the issuance of JPMD tokens is intended to represent the U.S. dollar deposits held by institutional clients at JPMorgan Chase. These tokens can be transferred, traded, or used for payments across supported blockchain networks.

JPMorgan chose to pilot on Base, involving the transfer of a fixed number of JPMD to Coinbase to test institutional transfers. Upon successful completion, selected institutional clients will gain access to real-time trading. Industry insiders believe that JPMorgan's move signifies a strategic shift from permissioned chains to public chains, suggesting that permissioned blockchains and permissioned distributed ledger technologies (DLTs) may have reached a dead end in certain areas of innovation and product development.

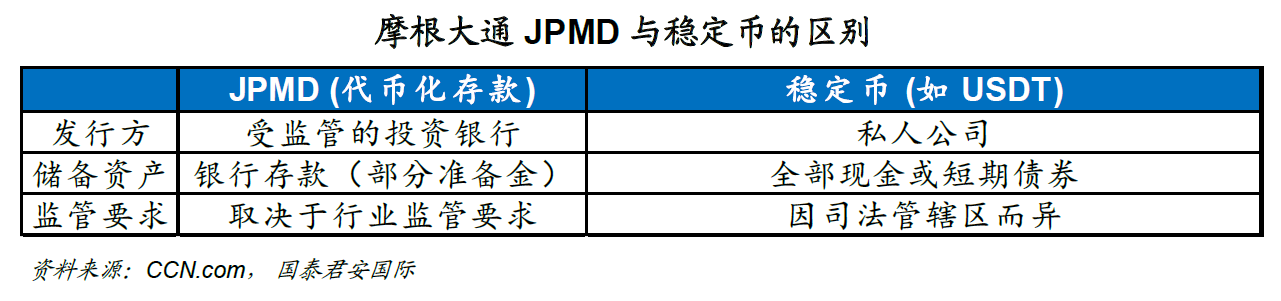

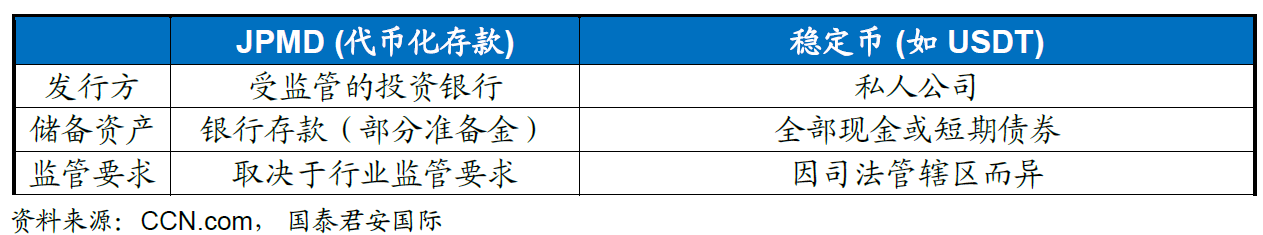

Understanding the distinction between deposit tokens and stablecoins is crucial. Stablecoins like USDT are typically backed 1:1 by cash or cash equivalents and issued by private companies. They are designed to maintain stable value and are widely used in crypto trading and DeFi. Deposit tokens are directly issued by regulated banks, supported by fractional reserves, and are intended to integrate with the banking system. Institutional experts believe that regulatory advantages are key. A potential advantage of JPMD over Circle is that it is a bank, and a large one at that, with decades of operational and regulatory experience in managing foundational banking services like balance management. Therefore, from a technical perspective, the truly interesting aspect of JPMD is the innovations in risk management, operations, and products that the world's largest bank will bring to this field.

From a trend development perspective, JPMD is not just a technological upgrade; it introduces a new class of digital assets in the form of tokenized bank deposits. It is positioned as a trusted and compliant entry point into blockchain-based finance, providing institutions with a way to engage in digital assets while maintaining regulatory standards. Ultimately, it could become a template for how traditional finance can embrace blockchain innovation without compromising security or oversight. If JPMorgan successfully expands JPMD beyond the pilot phase, it could lead a transformation, indicating that banks, payments, and capital markets are beginning to exist safely and legally on-chain.

From a longer-term perspective, the integration of institutional finance and decentralized infrastructure is already underway. As more digital financial tools combine with digital technologies, such as more tokenized assets built on the Solana ecosystem, staking services like Marinade will become part of the TradFi validation and infrastructure layer. This also means that future on-chain financial transactions will be richer and more derivative, while compliance will help deepen the integration with traditional finance.

JPMorgan Chase recently quietly submitted a trademark application for "JPMD," sparking interest in the financial and crypto industries. Unlike speculative token launches or experimental pilots, this move reflects that the world's largest bank is rapidly entering the digital finance space. However, JPMD is not a stablecoin.

Investors tend to view this as a carefully considered bet on blockchain infrastructure. JPMD is supported by regulated deposits and piloted on a public blockchain, serving as a blueprint for how traditional institutions can embrace decentralized pathways without sacrificing compliance, stability, or control.

JPMD is a form of customer deposit based on blockchain technology, seamlessly operating within existing banking infrastructure. Essentially, the issuance of JPMD tokens is intended to represent the U.S. dollar deposits held by institutional clients at JPMorgan Chase. These tokens can be transferred, traded, or used for payments across supported blockchain networks.

Unlike stablecoins such as USDC or USDT, JPMD is:

- Fully integrated into the traditional banking system

- Backed by real bank deposits held under regulatory supervision

- Designed for institutional use

Currently, JPMD is only available for institutional use. However, if the pilot proves successful and regulations evolve to accommodate broader adoption, future iterations could support: cross-border commercial payments, fund management solutions, and programmatic settlement of corporate finances. Given current banking regulations, it is unlikely that JPMD will be used by retail customers in the short term.

JPMorgan's trademark application outlines a broad range of services for JPMD. These include:

- Digital asset trading

- Facilitation of cryptocurrency exchanges

- On-chain transfers and settlements

- Payment processing

While not a stablecoin, JPMD encompasses many features associated with digital tokens tied to fiat currencies. This suggests that JPMorgan may position JPMD as more than just a payment tool; it could evolve into a foundational tool for tokenized finance.

From JPM Coin to JPMD

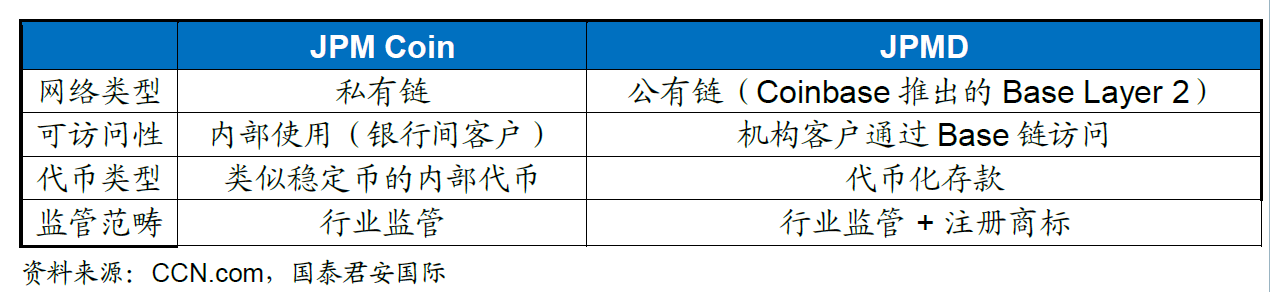

JPMorgan is no stranger to digital tokens. Its JPM Coin, launched in 2019, has processed over $1.5 trillion in institutional payments on a private blockchain. The difference with JPMD is that it utilizes a public chain, bringing broader interoperability.

JPMD expands on the concept of JPM Coin, allowing for on-chain transfers that interact with a broader blockchain ecosystem, including Ethereum-based applications and institutions operating on Base.

Launching on Base: Why Choose Layer-2

JPMorgan's choice of Base (a Layer-2 blockchain developed by Coinbase) indicates its openness in overall strategic considerations. In other words, while JPMD is currently limited to use within the JPMorgan ecosystem, its issuance on Coinbase's Base network suggests that the bank intends to expand into broader consumer and commercial payment scenarios in the future. Base is known for the following features:

- High throughput and low transaction fees

- Compatibility with Ethereum-based infrastructure

- Increasing adoption of institutional DeFi projects

By choosing Base, JPMorgan will:

- Leverage a scalable and secure public blockchain

- Benefit from Coinbase's regulatory reputation and user base

- Explore practical applications of blockchain beyond the proof-of-concept stage

The pilot involves transferring a fixed number of JPMD to Coinbase to test institutional transfers. Upon successful completion, selected institutional clients will gain access to real-time trading. Industry insiders believe that JPMorgan's move signifies a strategic shift from permissioned chains to public chains, suggesting that permissioned blockchains and permissioned distributed ledger technologies (DLTs) may have reached a dead end in certain areas of innovation and product development.

Permissioned blockchains require nodes to participate in the network through identity verification (such as consortium chains or private chains), primarily serving enterprise-level scenarios (like supply chain finance). Permissioned DLT emphasizes "permission control," contrasting with the "decentralized and permissionless" nature of public chains (like Bitcoin and Ethereum). Fundamentally, the original intention of blockchain is to solve trust issues through decentralization, while permissioned chains essentially retain "centralized verification" (such as administrator privileges), compromising data transparency and censorship resistance, which may hinder the emergence of disruptive innovations (like Web3 and metaverse applications that rely on public chains).

Of course, some industry insiders believe that permissioned chains are not "completely at a dead end." For instance, in specific scenarios, permissioned chains still have their practicality, such as in areas where compliance and efficiency need to be balanced (like government affairs and large enterprise supply chains), where the controllability of permissioned chains remains an advantage. Their innovation direction is shifting towards "efficiency optimization" (like increasing TPS throughput) rather than "decentralized disruption." Meanwhile, there is also a trend of integration between permissioned chains and public chains, with some projects attempting to combine the advantages of both (such as "permissioned + public chain" hybrid architecture), processing private data through permissioned chains while achieving ecosystem interconnectivity through public chains, which may open new paths for product development.

JPMD and Stablecoins

Understanding the distinction between deposit tokens and stablecoins is crucial. Stablecoins like USDT are typically backed 1:1 by cash or cash equivalents and issued by private companies. They are designed to maintain stable value and are widely used in crypto trading and DeFi. While USDT still dominates in terms of market capitalization and usage, Circle's IPO in June 2025 marks its transition from a privately held company to a publicly traded one, giving USDC regulatory and transparency advantages, especially in the institutional market.

On the other hand, deposit tokens are directly issued by regulated banks, supported by fractional reserves (like traditional bank deposits), and are intended to integrate with the banking system. Institutional experts believe that this regulatory advantage is key. A potential advantage of JPMD over Circle is that it is a bank, and a large one at that, with decades of operational and regulatory experience in managing foundational banking services like balance management. Therefore, from a technical perspective, the truly interesting aspect of JPMD is the innovations in risk management, operations, and products that the world's largest bank will bring to this field.

Naveen Mallela, head of JPMorgan's blockchain division Kinexys, described deposit tokens as "an excellent alternative to stablecoins from an institutional perspective." This is because they offer compliance, scalability, and the potential for interest payments—features that most stablecoins do not provide today.

The launch of JPMD closely follows the U.S. Senate's approval of the GENIUS Act, marking an important step toward stablecoin regulation in the U.S. If passed, the bill would introduce clearer rules for digital dollar tokens, including reserve backing and audit standards.

The Future of JPMD and Digital Finance

The emergence of JPMD is part of a broader trend:

The momentum for the development of tokenized assets is strong: real-world assets (RWA) such as U.S. Treasury bonds and other securities are increasingly being tokenized, with companies like BlackRock and Franklin Templeton exploring blockchain for issuance and settlement.

Banks are moving away from the trend of being marginalized: JPMorgan, Citigroup, and others are actively testing digital versions of their services, from tokenized deposits to programmable payments.

Compliance is a competitive advantage: unlike early crypto projects, institutions are now seeking regulatory certainty. JPMD sits at the intersection of innovation and regulation.

From these perspectives, JPMD is not just a technological upgrade; it introduces a new class of digital assets in the form of tokenized bank deposits. It is positioned as a trusted and compliant entry point into blockchain-based finance, providing institutions with a way to engage in digital assets while maintaining regulatory standards. Ultimately, it could become a template for how traditional finance can embrace blockchain innovation without compromising security or oversight. If JPMorgan successfully expands JPMD beyond the pilot phase, it could lead a transformation, indicating that banks, payments, and capital markets are beginning to exist safely and legally on-chain.

From a longer-term perspective, the integration of institutional finance and decentralized infrastructure is already underway. As more digital financial tools combine with digital technologies, such as more tokenized assets built on the Solana ecosystem, staking services like Marinade will become part of the TradFi validation and infrastructure layer. Marinade Finance (Marinade) is a leading liquid staking protocol on Solana. Users can stake SOL (the essential native token of the Solana blockchain) to receive mSOL. mSOL represents the staked SOL and accumulated rewards, which can be freely used in DeFi to earn additional yields. It automatically distributes SOL to numerous validator nodes, making operations convenient and yielding substantial returns (base staking rewards + DeFi yield opportunities), while supporting network decentralization. This also means that future on-chain financial transactions will be richer and more derivative, while compliance will help deepen the integration with traditional finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。