Bitcoin Gains Ground in US Housing Finance Framework

Quantum leap for Digital Currency adoption, Bitcoin (BTC) has been formally recognized as a reserve asset within the US Housing Finance System- a move that could reshape how digital currencies are viewed in mainstream finance.

Chairman of MicroStrategy Micheal Saylor , a long time Bitcoin advocate, hailed the development as a “decisive moment” for institutional adoption.

Source: X

Saying “it is recognized as a reserve asset by the US housing system- a defining moment for institutional BTC adoption and collateral recognition.”

A New Era For Housing Finance: FHFA Directive Leads the Charge

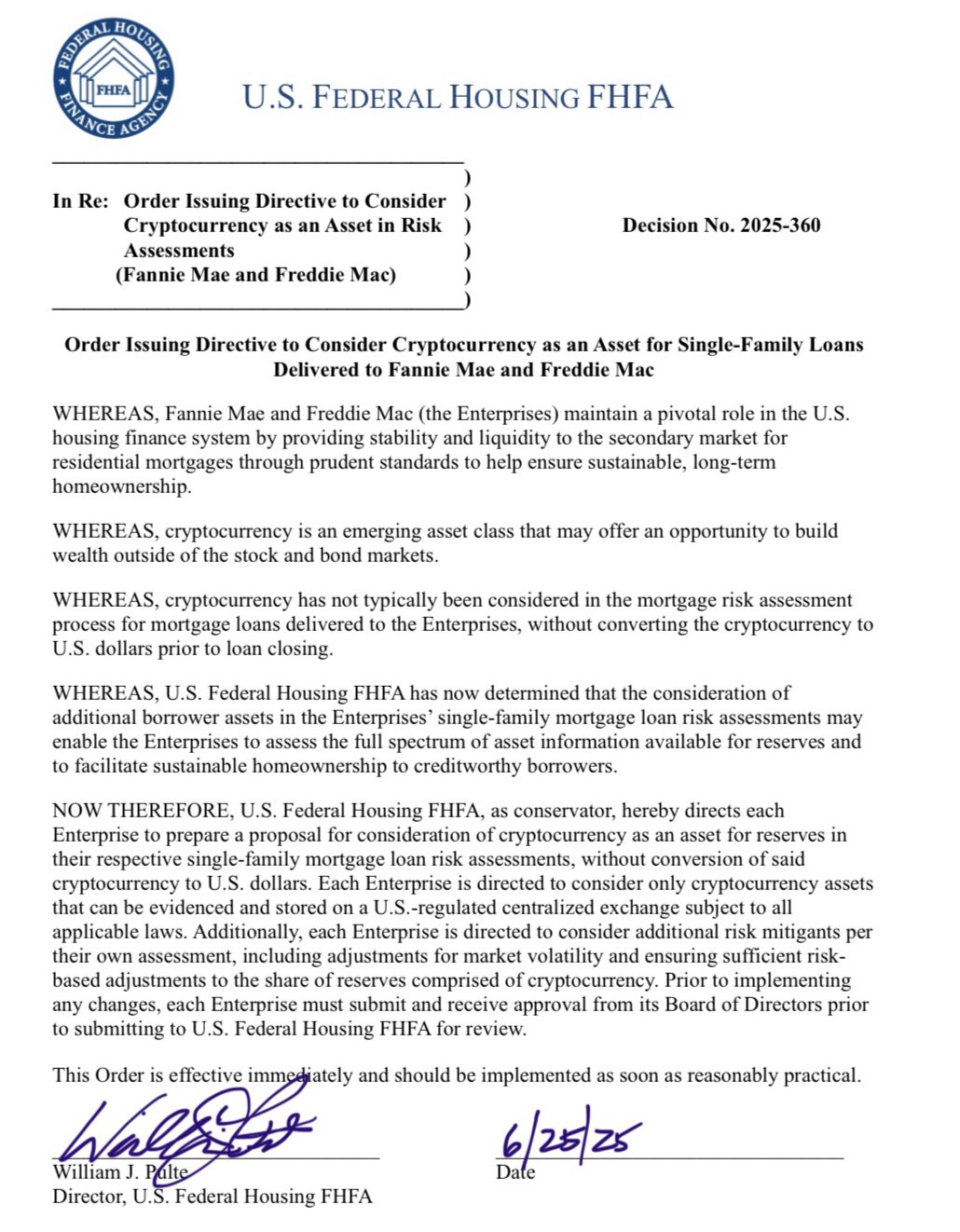

This milestone comes on the heels of a directive issued by the Federal Housing Finance Agency - the regulatory body overseeing key mortgage entities like Fannie Mae and Freddie Mac.

The FHFA has instructed three agencies to begin evaluating how digital currencies like Bitcoin can be considered as part of applicants' asset portfolios during mortgage processing.

This means borrowers could potentially list their digital currency holdings as financial assets - without needing to sell them for cash first.

Not Just Any Bitcoin: Rules Around Custody And Regulation

While this is a promising shift, the FHFA has set clear boundaries to ensure compliance and security.

-

Only Crypto held in regulated US - base exchanges such as Coinbase or Kraken will qualify.

-

Applicants must provide proof of ownership and custody.

-

All assets must comply with existing AMI, (Anti-Money Laundering) and KYC (Know Your Customer) standards.

This ensures that only verifiable, securely held, and lawfully obtained crypto can be considered in the lending process.

Industry Reactions: Praise and Optimism

The move has stirred excitement in the crypto world. Hunter Horsley, CEO of Bitwise Asset Management, called a “fully collateralized asset”, emphasizing its growing legitimacy in traditional finance.

Even FHFA Director, Bill Pulte weighed in, noting this initiative as a part of a larger effort to cement America’s status as a global leader in crypto innovation.

Source: Twitter

Tracking Volatility: Managing Crypto’s Wild Swings

Despite the optimism. The FHFA is also taking a cautious approach. It has directed Fannnie Mae and Freddie Mac to draft risk management strategies, particularly focused on price volatility.

These strategies must meet FHFA’s standards before greenlit for implementations.

What this means for Bitcoin and the Future of Crypto?

This recognition of Bitcoin as a reserve asset market is a watershed moment. Not only does it validate BTC’s role as a serious financial tool, but it also signals a broader shift towards institutional acceptance of digital currencies.

As Fannie Mae and Freddie Mac begin to chart this new territory, the world will be watching- and the US housing finance systems may never look the same again .

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。