Today, the most scarce thing for countless young people is not education, not capital, but a sense of direction.

Written by: Daii

Two events prompted me to discuss this topic today. Like a fishbone stuck in my throat, I need to get it out.

One is a Chinese PhD delivering takeout;

The other is that young people in South Korea are flocking to cryptocurrency exchanges out of despair.

These two scenarios seem unrelated, yet they reflect the same group—young people—caught in a dilemma torn between two extremes.

Let’s first talk about the young delivery workers in China.

Delivering takeout is not shameful, but when someone with a high degree like a PhD has to rely on being a rider to make a living, it becomes an irony of the times. Ding Yuanzhao, widely reported by the media, is a microcosm of this group. He is a PhD, well-educated, yet due to real-life difficulties, he ultimately chose to don the rider's vest and join the "highly educated delivery army" hustling through the city.

He is not an isolated case.

China now has over 7.45 million Meituan riders, among which hundreds of thousands hold a college degree or higher, and tens of thousands are master's degree holders. Meituan officially disclosed in 2022 that 29% of its riders have a college degree or above, and the company recruits over 5,000 fresh graduates each year to fill rider positions (source: Caixin Global).

Now, let’s understand the young people in South Korea who are keen on trading cryptocurrencies.

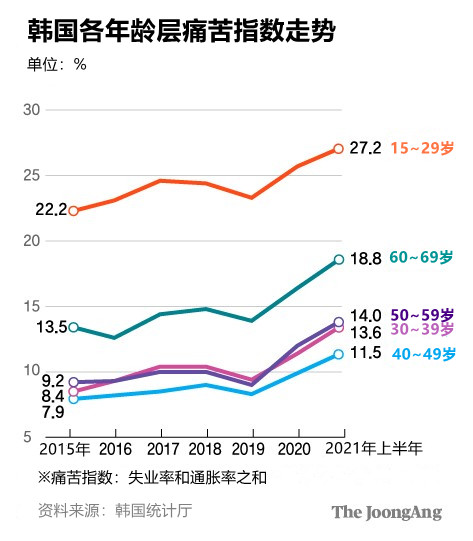

In South Korea, the number of real-name registered cryptocurrency trading accounts exceeds 16 million, accounting for one-third of the national population. In the first half of 2023, the price of Bitcoin in South Korea was once 12% higher than the global average, creating the well-known "Kimchi Premium."

According to Cointelegraph, the emergence of this premium is not a market coincidence but a typical product of a large influx of retail investors trying to "get rich overnight." The "enthusiasm" of the new generation of users for cryptocurrencies in South Korea is actually more like a sense of despair:

With traditional channels yielding lower returns, young people are increasingly inclined to choose high-risk, high-volatility assets as a breakthrough.

The young people in these two countries seem to be on different paths—one is delivering takeout, and the other is trading cryptocurrencies—but in essence, they are trapped by the same problem:

Imbalanced resource allocation, narrowing upward mobility, and increasing real-life pressures.

Let’s take a closer look at the roots of this dilemma.

1. Real-life Dilemma

On a macro level, the dilemma faced by contemporary young people often does not stem from personal laziness or lack of ability, but from being swept up in the economic structural changes of the entire era. They grew up in a period of rapid development but hit a growth ceiling when they truly entered society, facing not "how to climb faster," but "how not to be left behind."

The root of all this can be traced back to the slowdown in economic growth.

1.1 Economic Growth Shift and Stalling

South Korea's per capita GDP reached a historical peak in 2021 and then entered a plateau. According to World Bank data, the growth rates for 2022 and 2023 have been consistently below the global average. Meanwhile, the youth unemployment rate (ages 15–29) in South Korea has long remained around 6.6%, double the national average, indicating the structural difficulties faced by the youth group.

China's situation is even more severe. Data from the National Bureau of Statistics shows that in 2023, the unemployment rate for non-student youth aged 16–24 soared to 21.3%. In 2024, this data was temporarily "suspended from publication," drawing significant public attention. By May 2025, the unemployment rate still stood at a high of 14.9% (source: Reuters).

Unemployment itself is not the most terrifying part—what is truly despairing is the prolonged inability to find a job that matches one's educational background and skills. When there is a huge gap between "available jobs" and "the prospects promised by education," young people can easily fall into a sense of "stagnation": having a degree but no way out; putting in effort but receiving no return.

1.2 Severe Housing Price Squeeze

Housing, once the starting point of life, has now become the ceiling crushing young people.

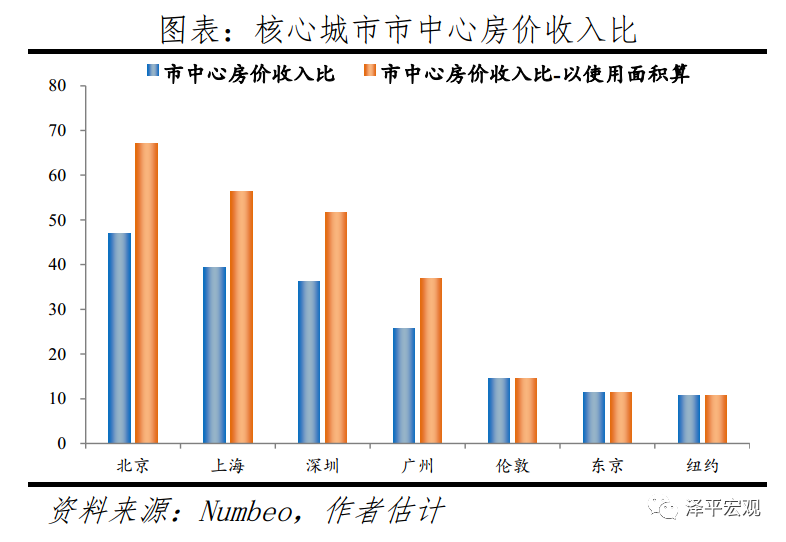

In South Korea, the price-to-income ratio (PIR) for housing in Seoul is about 15, meaning a young person would have to work for 15 years without eating or drinking to afford their own home (data source: Numbeo). In China, this ratio is far higher—cities like Beijing and Shanghai have a PIR exceeding 34, placing them at extreme levels among major global economies.

The OECD (Organization for Economic Cooperation and Development) currently has 38 member countries, covering the most developed and representative market economies in the world. Under its statistical criteria, the average PIR for member countries generally falls between 7 and 10. However, the level exceeding 30 in China's first-tier cities has long deviated from the internationally acceptable range, indicating that the threshold for young people to purchase homes has become extremely abnormal.

The reality is harsh: amidst the urban buildings, young people increasingly resemble "external residents" without ownership. They cannot afford to buy, nor dare to rent long-term; they do not belong and cannot escape.

1.3 Rapid Decline in Educational Returns

The belief that "knowledge changes destiny" is being repeatedly challenged by reality.

In the past two decades, the expansion of higher education in China has pushed it towards universal access. In 2000, the national enrollment in higher education was only 2.2 million, but by 2025, this number is expected to exceed 10.5 million, nearly a fivefold increase. However, the explosive growth in educational scale has not brought about a corresponding increase in returns.

According to data released by the Ministry of Education, the median annual salary for undergraduate graduates has remained between 60,000 and 80,000 yuan for several years. In first-tier cities, this is even insufficient to cover basic rent and living expenses. The income levels of many professions are severely imbalanced with the opportunity costs incurred during education.

More critically, there is a "decline in the marginal value of degrees." Research by Stanford University education economist Hanushek shows that the income premium associated with a bachelor's degree compared to a high school diploma has dropped from 15% at the end of the last century to 8–10% today. This means that the "social passport" effect of a degree is rapidly depreciating. When "degrees" are no longer scarce, they lose their function of screening and empowering, becoming just an ordinary label.

In summary: for many young people, education is no longer a handrail to climb the ladder of fate but has become the default entry ticket for job hunting. Having it does not guarantee a change in life; not having it means you can't even get in the door.

2. Choices They Have to Make

Young people are not unmotivated, nor do they refuse to be grounded. They are simply trapped in a cruel paradox of reality:

The harder they work, the more likely they are to fall into low-value repetitive labor; the more they persist, the harder it is to break through the boundaries set by the system.

2.1 The End of "6 Yuan per Order" is an Invisible Future

On the streets of China, riders have become the most basic "muscle organization" of the platform economy. They weave through the gaps in the city, measuring every 3-kilometer distance with their feet, exchanging time for a reward of 6 yuan per order. Their work is precisely sliced by algorithms into metrics like "delivered within 20 minutes," "customer satisfaction," and "completion rate," with all actions quantified, scored, and ranked.

They rely on completing orders, increasing order volume, and boosting performance, yet struggle to accumulate any social capital, transferable skills, or career advancement pathways—no matter how fast they deliver, they cannot transition to the platform's operations or algorithm departments.

Their "efforts" reset every day, never turning into "compound interest."

2.2 "High Leverage" Bets on Fate, Not Market Trends

In South Korea, young people embrace cryptocurrencies not out of a belief in technology, but from a deep sense of economic despair. They clearly understand that saving for a down payment from their salary is a fantasy, starting a business requires barriers, and failing exams means they cannot reach the top; thus, the only remaining option is to place a bet.

The high-leverage products offered by cryptocurrency exchanges can turn a $1,000 position into $10,000 in a day or into nothing at all. Screenshots of "+$5,000 credited" and "50% surge today" flood social media in Korean cryptocurrency communities and Telegram groups, sticking to the screens of every disheartened young person like visual toxins.

They do not truly believe in blockchain; they simply cannot see a path to "get on board" through conventional means. So they gamble their fate on a high-volatility asset, willing to try even if the probability of success is only one in a thousand.

This is not speculation; it is a desperate belief.

They use their capital, emotions, and trust to fill a structural void of upward mobility.

2.3 Young People Without Compound Interest

More dangerous than unemployment is the loss of the ability to accumulate. Both physical labor and high-risk gambling lack a foundation for "accumulation"; they do not provide positive feedback or long-term curves.

Delivery relies on physical strength, trading relies on emotions, returns rely on luck, but the risks are borne solely by the individual. Platforms and exchanges appear neutral on the surface, but in reality, they use algorithms and rules as control tools, turning every participant into "fuel for algorithm operation"—extracted, utilized, yet without the right to share in the value.

Delivery is exploited liquidity; trading is ignited liquidity.

Though these two paths seem to diverge, they are mirrors of the same mechanism:

Both contribute traffic and volatility at the system's edge but have never owned the right to share in the system's profits.

It is not that they are not good enough; rather, systemic structures obstruct their paths to advancement.

So, do young people really have no way out? Of course not. The way out lies not between these two "pseudo-options," but in breaking free from the entire misleading structure and seeking a true path of accumulation that belongs to them.

3. Breaking the Deadlock Begins with Upgrading Cognition

Breaking the deadlock is not impossible; it requires a profound reconstruction of cognition.

In this algorithm-driven, structurally solidified era, if you want to escape the dilemma, you cannot continue to spin in place along the paths designed for you by the system.

3.1 Understand: A Degree is Not a Sunk Cost, but a Basic Asset with "Attached Options"

It may no longer be scarce, nor directly translate into value, but it remains the minimum threshold for you to enter new platforms, new industries, and new markets. What truly determines the value of this degree is not its inherent prestige, but whether you are willing to actively exercise that "option for re-learning."

The return on educational investment has shifted from "one-time realization" to "continuous transformation"—only by constantly reshaping your knowledge structure and stepping out of familiar zones can a degree avoid becoming a mere line on your resume and instead truly translate into opportunities.

3.2 Bet on "Compoundable × Transferable" Skill Paths

Do not expect that one exam, one hiring, or one offer will determine your lifelong career. This is a path to illusion. The new reality demands that you iterate yourself every six months.

Applications of AI tools, data analysis, Web3 security, cross-border remote collaboration skills, video expression abilities… these fields share three common characteristics:

Short learning curve (can be initially mastered in 3–6 months)

Transferable skills (applicable across multiple platforms and industries)

Significant market premium (sought after by scarce positions)

In today's world, where the "degree premium" has collapsed, the compounding of skill combinations is the new social passport.

3.3 Start Building Cross-Cycle Asset Allocation Skills

You do not need to become an investment expert, but you must have basic means to withstand cycles. After reserving living expenses, choose assets with long-term scarcity for low-frequency investments—such as Bitcoin.

This serves as an anchor against inflation and is the starting point for breaking free from "living solely on salary." It is not gambling, but a defensive action to establish asset independence across local economic cycles.

I have previously detailed more strategies in "Bitcoin: The Ultimate Hedge for Long-Termists." It is a personal financial structure that is independent of platforms and decoupled from market trends, providing a "backup plan" for the future.

3.4 Most Crucially—Stop Entrusting Your Life to Any Platform UI

Do not let pop-ups like "Complete 30 orders to earn 150 yuan" control your time, nor let market notifications like "BTC breaks 110,000" manipulate your emotions. Those UIs and notifications are not merely informing you; they are training you.

True freedom is the ability to operate and judge independently even during the 48 hours when platforms crash or markets halt.

Life is not a racing game based on order completion or price speculation; it is a self-designed, long-term accumulation of a compounding curve. The starting point of this curve begins with cognitive awakening.

Conclusion: Not Being Defined, But Defining

Chinese actor Wang Baoqiang rose from the countryside to the spotlight, from a supporting role to a director. He has never relied on being "chosen," but rather on consistently investing time in worthwhile endeavors. He has no shortcuts, only choices—he does not chase popular paths but continues to do those seemingly insignificant things that can yield compounding returns. He did not have a fate of overnight fame, but he carved out a reusable trajectory.

This is precisely what countless young people lack today:

Not education, not capital, but a sense of direction.

What is worth doing day after day? What skills can transcend cycles and quietly accumulate your chips?

Choices determine whether you will be consumed by the system;

Persistence determines whether you can ultimately break free from the system.

American writer Vivian Greene once said:

Life isn’t about waiting for the storm to pass; it’s about learning to dance in the rain.

This statement, though concise, strikes a chord. It does not speak of idealism, nor does it comfort you with the notion that the storm will eventually pass. It simply reminds you:

The world may not get better, but you can become stronger.

Do not wait for the "platform system" to design your fate, nor place your hopes on a single market surge or opportunity explosion. True power comes from your willingness to build something of your own amidst the most chaotic winds and the grayest days.

Start today, with one proactive choice. Even if it’s just reading one more page, learning one more skill, or recording one more observation.

What you create, no matter how small, is your outstretched hand reaching for fate.

The storm will come again; even if the eaves leak and the ground is muddy, you must build your own stage—

And then dance in the rain.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。