Grayscale Research expects that CEX will continue to dominate the trading of large market cap assets like Bitcoin, but DEX will become the preferred choice for trading long-tail assets.

Written by: Michael Zhao & Zach Pandl, Grayscale

Translation: Golden Finance xiaozou

- Just like in traditional finance, exchanges are the core infrastructure of the digital asset industry. Although decentralized exchanges (DEX) currently focus mainly on trading crypto assets, the trading volume of stablecoins and tokenized assets is expected to continue to grow over time.

- Currently, cryptocurrency trading is still dominated by centralized exchanges (CEX), which adopt traditional corporate structures. However, the industry is increasingly "eating its own tail": more and more trading volume is shifting to decentralized exchanges (DEX), as evidenced by the explosive growth of the decentralized futures exchange Hyperliquid this year.

- Decentralized exchanges (DEX) settle trades on-chain without the need for centralized operators—these take the form of smart contract applications deployed on blockchains like Ethereum or Solana, or trading logic directly embedded in Layer 1 protocols (such as Hyperliquid). In the first five months of 2025, DEX accounted for 7.6% of the total cryptocurrency trading volume.

- While cryptocurrency exchanges can benefit from increased trading volume, they also face competitive pressure regarding trading fees. Grayscale Research predicts that CEX will continue to dominate the trading of large market cap assets like Bitcoin, but DEX will become the preferred choice for trading long-tail assets, as well as for users who value the transparency and accessibility of permissionless global platforms.

Public blockchains provide digital business solutions without centralized intermediaries. However, to attract users, decentralized technologies must offer features that are at least as attractive as centralized solutions. If decentralized applications lag behind centralized solutions in terms of speed, cost, and historical data, blockchain activity is likely to remain a small part of the online business landscape.

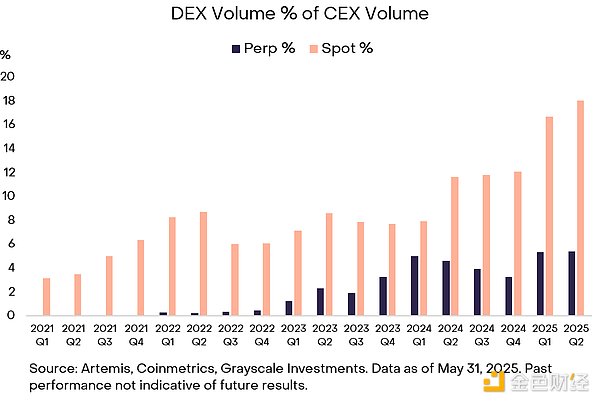

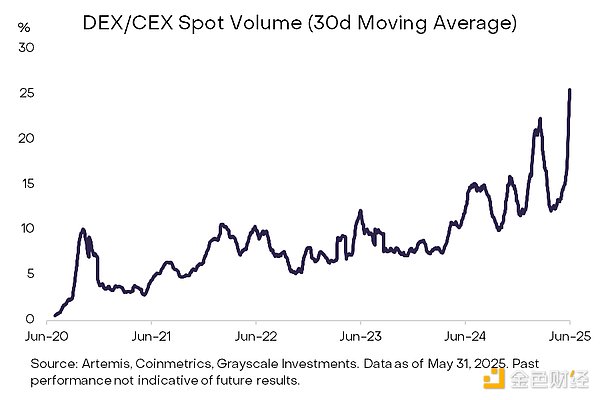

Fortunately, after years of exploration, we have witnessed decentralized applications competing directly with traditional institutions in the core area of cryptocurrency—token trading. Grayscale Research estimates that DEX currently accounts for 7.6% of the total global cryptocurrency trading volume (up from just 3% in 2023), and its trading volume relative to CEX has significantly increased (Figure 1). Today, DEX is on par with CEX in terms of pricing, often offers greater transparency, and frequently serves as the primary trading venue for newly issued on-chain assets.

Figure 1: DEX trading volume has more than doubled relative to CEX since 2021

This year is likely to be a turning point for the industry, as technological advancements and regulatory clarity will drive user adoption of DEX and other decentralized finance (DeFi) applications. This article will provide a comprehensive overview of the DEX industry, including its structure, competitive landscape, and development prospects. Grayscale Research believes that market leadership will ultimately concentrate in a few top platforms—each segment (CEX vs. DEX, spot vs. perpetual contracts) may only have one or two exchanges remaining—combining deep liquidity, capital-efficient infrastructure, and attractive token or equity economic models.

1. How to Trade Tokens

In traditional finance (TradFi), trades are executed through exchanges or over-the-counter (OTC) markets after both parties reach a price consensus. These trades are matched through a central limit order book (CLOB) or broker networks. After trade execution, clearinghouses like the Depository Trust Company (DTC) confirm trade details, net participant risk exposures, and complete settlement the next day (electronic records of fund and security ownership transfer). Stock securities will transition from T+2 to T+1 settlement in May 2024.

Cryptocurrency trading adopts a completely different market structure, which can be divided into three main categories: trading venues, exchange architecture, and trading products.

Cryptocurrency trading venues are primarily divided into two categories:

- Centralized Exchanges (CEX): Traditional business entities that use off-chain custody and trade matching, providing an almost instantaneous settlement experience through internal ledgers. However, users still experience settlement delays when transferring assets to traditional bank accounts.

- Decentralized Exchanges (DEX): Smart contract applications directly deployed on blockchains (like Ethereum) that allow users to trade directly from self-custodied wallets. When trading on DEX, execution and settlement are completed within a single block confirmation cycle, usually taking only a few seconds.

DEX primarily adopts two trading architectures:

- Automated Market Makers (AMM): Provide quotes passively through liquidity pools, based on preset mathematical curves (like the constant product formula x*y=k) or the concentrated liquidity model of Uniswap v3. AMMs are particularly adept at efficiently handling long-tail asset exchanges and stablecoin trading, performing well on blockchains with limited throughput.

- Central Limit Order Book (CLOB): Highly replicates the traditional exchange model, matching trades through limit orders dynamically managed by liquidity providers. This method typically achieves narrower spreads and higher capital efficiency, especially suitable for high-volume assets and perpetual contracts. However, maintaining this efficiency requires frequent order updates and relies on complex infrastructures like specialized blockchain application chains or Roll-ups.

Both CEX and DEX support two types of product trading:

- Spot Trading: The underlying token is delivered immediately at the agreed price—no leverage, only involving on-chain transfers (or internal ledger updates within CEX).

- Perpetual Contracts (Perps): Derivative contracts with no expiration date that track the price of the underlying asset, settled through margin adjustments and funding rate payments, supporting leveraged trading.

2. Business Models of Exchanges

Exchanges profit by charging trading fees. In the crypto space, CEX directly charges fees, while DEX typically allocates fees to liquidity providers, token holders, and/or protocol treasuries through smart contract mechanisms or governance decisions.

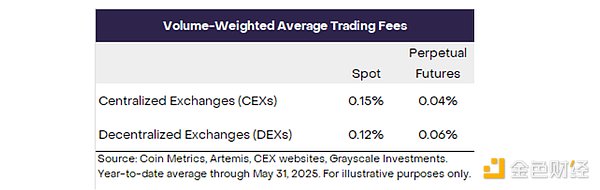

Currently, DEX has fully achieved price competitiveness against CEX. According to data from the first five months of 2025, Grayscale Research estimates that the average trading fee for CEX spot trading is about 15 bps, while for DEX it is 12 bps; the average fee for CEX perpetual contracts is 4 bps, while for DEX it is 6 bps (Figure 2). Although these figures do not reflect the rate differences among various platforms and tokens, they indicate that the average fees of the two types of platforms have become comparable.

Figure 2: DEX now possesses comparable price competitiveness to CEX

As the cryptocurrency industry develops, all exchanges may benefit from increased trading volume, but they will also face pressure from fee compression. Although the fees of CEX and DEX have become closer, cryptocurrency trading fees are still relatively high compared to the most efficient markets in traditional finance. For example, academic research has found that the average trading fee on U.S. stock exchanges is only 0.0001% (i.e., one basis point). It will take time for cryptocurrency trading to reach such low levels, but the intense competition among traditional exchanges indeed suggests that as market competition intensifies, cryptocurrency trading fees will inevitably decline.

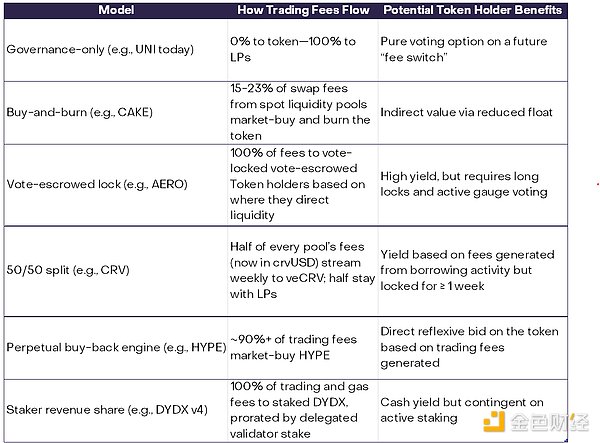

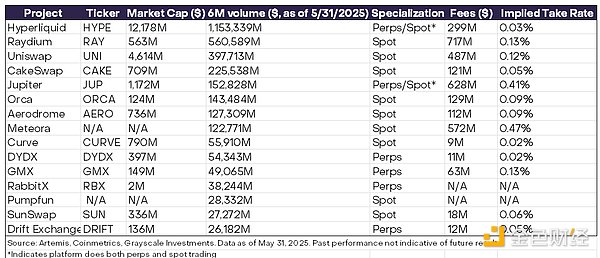

In the long run, we expect the capital structures of cryptocurrency exchanges to also converge. As traditional enterprises, CEX typically raise funds through equity financing (like Coinbase), but may also issue associated tokens (like BNB). DEX, on the other hand, are based on open-source software smart contracts and operate without reliance on any controlling party. However, the development teams behind them may obtain funding support through equity, tokens, or a combination of both. Tokens may provide various rights to holders, but there is no unified model across different projects: DEX tokens may capture cash flow, provide governance rights, or only possess marketing and brand value (Figure 3). It is particularly important to note that token models may indeed change through governance; for instance, Uniswap's UNI token has explored proposals such as enabling fee switches for stakers (a governance-controlled fee distribution switch), which could reshape the token's value proposition overnight. Therefore, investing in DEX tokens requires a deep understanding of the project's economic model, governance proposals, and token supply and value accumulation mechanisms.

Figure 3: Significant differences in the economic models of DEX tokens

3. The Evolution of DEX

The development of decentralized exchanges shows clear stage breakthroughs, with each generation overcoming the limitations of the previous one. Early attempts (2017-2018)—such as EtherDelta's order book model, 0x protocol's off-chain relay solution, and Bancor's pioneering AMM liquidity pools—validated the feasibility of decentralized trading but faced serious user experience and liquidity challenges. The launch of Uniswap in 2018 marked a turning point, as its simplified AMM model and intuitive interface significantly enhanced accessibility, paving the way for explosive growth in trading volume and total locked value during the "DeFi Summer" of 2020.

Further optimizations from 2021 to 2023—especially the concentrated liquidity design of Uniswap v3, along with innovations in perpetual contracts from Perpetual Protocol and GMX—significantly improved capital efficiency and enabled more refined on-chain derivative trading. The most recent phase (2023-2025) has seen the emergence of on-chain CLOBs like dYdX Layer1 and Hyperliquid's ultra-fast custom blockchain, combining the speed and precision of centralized exchanges with the transparent decentralized characteristics of DeFi.

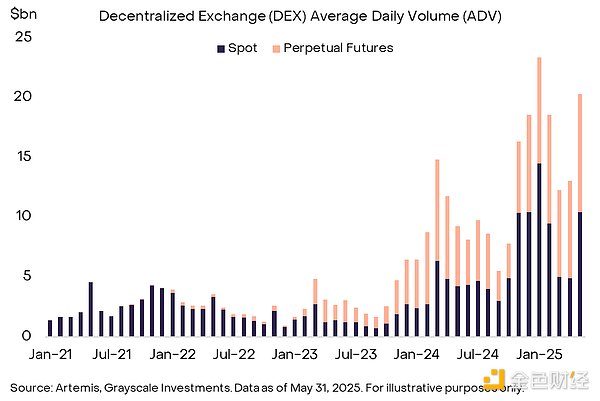

Currently, the average daily trading volume (ADV) of spot and perpetual contracts on cryptocurrency DEX has approached $10 billion (Figure 4), while the average daily trading volume of platforms under the New York Stock Exchange Group is about $150 billion. The growth in DEX perpetual contract trading volume is primarily driven by Hyperliquid, which accounts for about 80% of the total average daily trading volume of perpetual contracts.

Figure 4: DEX spot and perpetual contract average daily trading volume has surpassed $10 billion

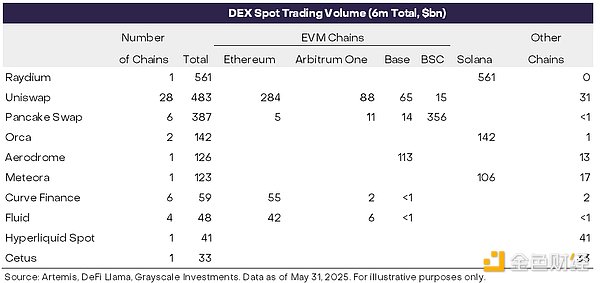

A unique feature of cryptocurrency trading is that some spot DEXs are deeply integrated with specific blockchain ecosystems like Ethereum or Solana. For example, Figure 5 shows the distribution of DEX spot trading volume across various blockchains over the past six months—industry leader Raydium is deployed solely on the Solana chain, while Uniswap's AMM model has expanded to 28 different chains. Therefore, for crypto spot DEXs, changes in trading volume are often closely related to fluctuations in economic activity within their respective blockchain ecosystems.

Figure 5: Spot DEXs can achieve multi-protocol deployment

4. Expansion of DEX Market Share

Currently, DEXs account for about 25% of the trading volume in the cryptocurrency spot market. The ability of decentralized exchanges to continuously capture market share is mainly due to rapid innovation on the product supply side. DEXs often launch new tokens first, attracting early liquidity and speculative trading volume. For example, during the on-chain ecosystem explosion at the end of 2024, many popular crypto narratives—such as AI-themed tokens on Solana and Base chains, as well as viral tokens like the TRUMP meme coin on Meteora—initially emerged only from decentralized liquidity pools on chains like Solana and Base. These new tokens did not initially land on centralized exchanges, prompting traders to interact directly with decentralized platforms.

Figure 6: The ratio of DEX to CEX spot trading volume continues to rise

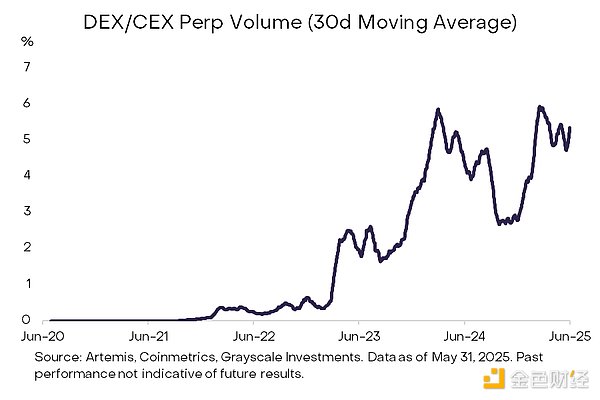

Decentralized exchanges have also made significant progress in the perpetual contract trading space—primarily due to the explosive success of the decentralized perpetual contract exchange Hyperliquid. Grayscale Research estimates that in the 30 days ending May 31, 2025, DEX perpetual contract trading volume accounted for about 5.4% of CEX perpetual contract trading volume (Figure 7). Nevertheless, centralized perpetual contract exchanges still possess several advantages, including deep liquidity and network effects, high-speed execution capabilities, and an integrated user experience.

Figure 7: DEX perpetual contract trading volume, though small, continues to grow

Given that CEXs have these advantages, why has Hyperliquid been able to capture such a large trading volume? We believe that the reasons traders are increasingly leaning towards decentralized perpetual contracts include:

Self-custody and auditability: Funds deposited are always under user control, and every operation from trading to settlement is transparently recorded on-chain, reducing counterparty risk as demonstrated by events like the FTX collapse and recent hacks of centralized exchanges.

Global accessibility: Decentralized platforms enable global participation without barriers.

Composability and seamless integration: Complex financial products such as third-party bots, trading vaults, analytics dashboards, and fully on-chain delta-neutral strategies can be integrated directly, bypassing regulatory friction.

Faster launches: Community-driven governance models allow decentralized platforms to quickly launch perpetual contracts for emerging tokens, far outpacing centralized counterparts.

Rapid advancements and increasingly mature technological architectures suggest that the competitive landscape may undergo significant changes in the coming years.

5. The DEX Battle

The top ten DEXs by cryptocurrency market capitalization account for 6.7% of total trading volume, with a total market cap of $22 billion, and the top five platforms hold about 80% of the trading share (Figure 8). These platforms may benefit from strong network effects: on the spot trading side, concentrated liquidity AMMs minimize slippage; in the perpetual contract space, highly competitive fee tiers attract high-frequency traders. In both scenarios, deeper liquidity pools attract more order flow—traders naturally tend to choose exchanges with narrower spreads, lower execution risks, and large active communities.

Figure 8: Despite the numerous DEXs, only a few have dominant trading volume advantages

We believe that no single exchange can monopolize every corner of the cryptocurrency market. Instead, each type of exchange (CEX vs. DEX) and product type (spot vs. perpetual contracts) may see one or two dominant platforms emerge.

In the spot product space, trading of large-cap assets (such as Bitcoin, Ethereum, and major stablecoins) still tends to favor CEXs. With fiat on-ramp channels, deep inventories from market makers, and VIP trading fees below 10 basis points, CEXs typically allow users to trade mainstream tokens at lower costs than the most efficient AMM liquidity pools. However, for small-cap and newly issued tokens, early trading activity remains concentrated on DEXs. Since DEXs support permissionless token listings, when market narratives focus on a newly created niche token, traders seeking first-day exposure often follow the platform where liquidity first appears.

A similar pattern is observed in the perpetual contract space. CEXs account for over 90% of the notional value of Bitcoin and Ethereum perpetual contracts, as they offer millisecond latency, market-making rebates, and mature clearing engines. However, when looking at contracts ranked beyond the top ten, market share begins to reverse: for several mid-cap trading pairs, Hyperliquid contributes a significant portion of global trading volume and open interest. For traders chasing new assets, advantages such as self-custody, borderless access, and governance-driven contract creation may outweigh the convenience of centralized exchanges.

6. Conclusion

DEXs have evolved from experimental concepts to core infrastructure for on-chain asset expansion. As the scale of stablecoins grows, real-world assets accelerate their migration to public chains, and blockchain space costs decrease, the share of DEXs in everyday trading will continue to expand—especially for new tokens or niche markets that have never touched centralized order books. CEXs will still maintain an advantage in high notional value, low-latency sensitive trading flows. However, the long-term competitive landscape is more grand: cryptocurrency exchanges as a whole are poised to challenge traditional exchanges, launching assaults on asset custody, liquidity provision, and price discovery mechanisms in areas like tokenized stocks and bonds. In short, the question is no longer "Are DEXs important?" but rather how fast their transparent and programmable infrastructure will redefine "exchanges" over the next decade.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。