Solana ETF Filed by Invesco Aims for Listing on Cboe BZX Exchange

The crypto ETF race is heating up once more, with Solana this time around. Invesco Capital Management and Galaxy Digital have now filed for a Solana ETF with the U.S. Securities and Exchange Commission (SEC) officially. The fund, called the Invesco Galaxy Solana Exchange Traded Fund, hopes to list under the ticker QSOL on the Cboe BZX Exchange once approved.

If approved, the ETF would be one of the first to follow Solana's spot price, in accordance with Lukka Prime Solana Reference Rate. Invesco will be the sponsor, Galaxy Digital will be responsible for acquiring SOL tokens. Coinbase Custody will be in charge of token storage. Bank of New York Mellon, on the other hand, will serve as fund manager.

Why Does This ETF Filing Matters?

This development reflects increasing institutional faith in this altcoin, a blockchain network for quick transactions and minimal fees. So far, the vast majority of ETF filings have centered on Bitcoin or Ethereum. This currency having its own Exchange Traded Fund indicates that it's being seriously considered by large players in digital finance.

But this is not a fait accompli yet. The SEC has to approve the application , and that's where it may get complicated. The regulator has been cautious of crypto ETFs, particularly for assets that could be considered securities. The position of SOL remains in a grey area, and that might impact the result.

Solana Price Responds to ETF Hype

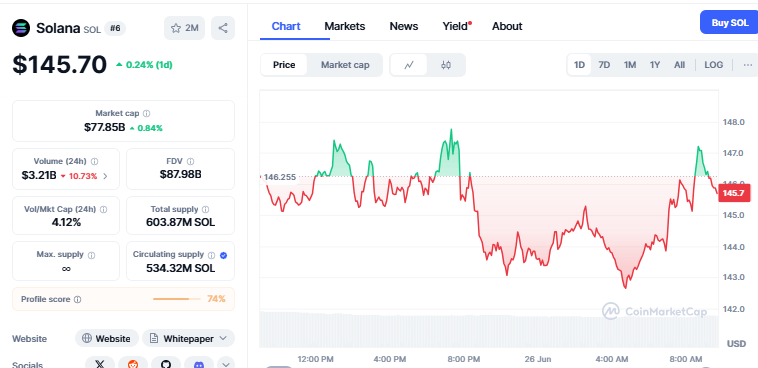

As predicted, the news on the ETF created a lot of hype. However, the market did not just spike, SOL actually fell to about $147.50, as traders took profits and prepared for possible sell-offs. Analysts now consider $140 to be critical support and $200 psychological resistance. Sitting at $145.70 with an increase of 0.24% within a day.

Source: CoinMarketCap

Technical indicators such as MACD and RSI are indicating neutral to bearish signals, which means there is caution from the traders. Funding rates are zero, indicating there is no strong bullish or bearish sentiment currently. In short, the market is waiting to see.

What Are the Odds of QSOL Approval?

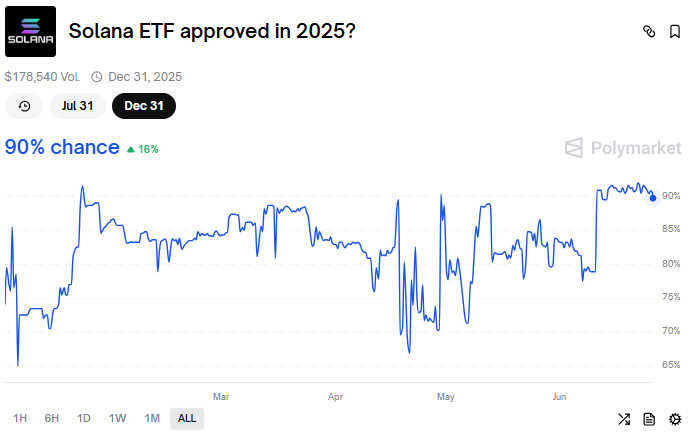

Twitter is abuzz with enthusiasm regarding QSOL. It is widely thought that this cyrpto product will stand a good chance of being approved in 2025, particularly with recent SEC hints at being more positive toward crypto ETFs. A huge transaction, 3 million SOL for more than $430 million, was just transferred between unidentified wallets, which some interpret as whale accumulation in preparation for a probable ETF launch. The polymarket prediction suggests 90% chances of approval by this year.

Source: Polymarket

Earlier Filing For SOl ETFs

Most recently, VanEck's proposed Solana ETF, trading under VSOL , has appeared on the Depository Trust & Clearing Corporation (DTCC) website. This is significant news in the battle among these and could be an indicator that regulatory approval is on its way.

The filing is a sequel to VanEck's earlier filing of an S-1 with the SEC on June 13, and together with other major promoters like 21Shares, Franklin Templeton, Grayscale, Fidelity, Bitwise, and Canary Capital . A notable feature in all the filings is the inclusion of staking language that would allow the crypto products to earn yield from enabling securing the Solana network, according to analyst James Seyffart. This adds a new level of usefulness and value for traditional investors targeting this altcoin exposure.

A Step Towards Wider Crypto Adoption

Whether QSOL gets accepted or not, the fact that they in fact submitted it is a massive success on behalf of Solana and the crypto market, as a whole. It shows that the community is ready to support more than Bitcoin to large financial institutions. It is likely that once approved, this financial crypto products will attract other investors, greater liquidity, and further cement SOL into mainstream markets.

At this point, everyone is waiting to see what the SEC proceeds with. With the approval of the agency, this altcoin might eventually receive its institutional recognition.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。