With the official implementation of the U.S. stablecoin bill (GENIUS), the global stablecoin market has entered a new stage of development. This not only marks the deep integration of traditional finance and blockchain technology but also signals an intense competition for the dominance of the digital dollar—the "stablecoin war" has begun.

The AiCoin Research Institute conducts an in-depth analysis of the six major forces, competitive landscape, and future trends in the current stablecoin market based on candlestick analysis, AI algorithm insights, and market hot news, providing comprehensive industry insights for investors and practitioners. — In-depth Analysis by AiCoin Research Institute

1. Analysis of the Six Major Types of Stablecoins in the Market

Currently, the global stablecoin market has formed six major forces, each relying on different resource endowments and strategic layouts to compete for market dominance. Below is a detailed analysis of each force:

- Tether Camp: The Absolute Dominator of Offshore Stablecoins

Core Players: Tether (USDT issuer), Bitfinex, Cantor Fitzgerald (former CEO was U.S. Secretary of Commerce Wilbur Ross), CEP (son of the Secretary of Commerce + SoftBank investment), Bit Deer (Tether holds 25.5%).

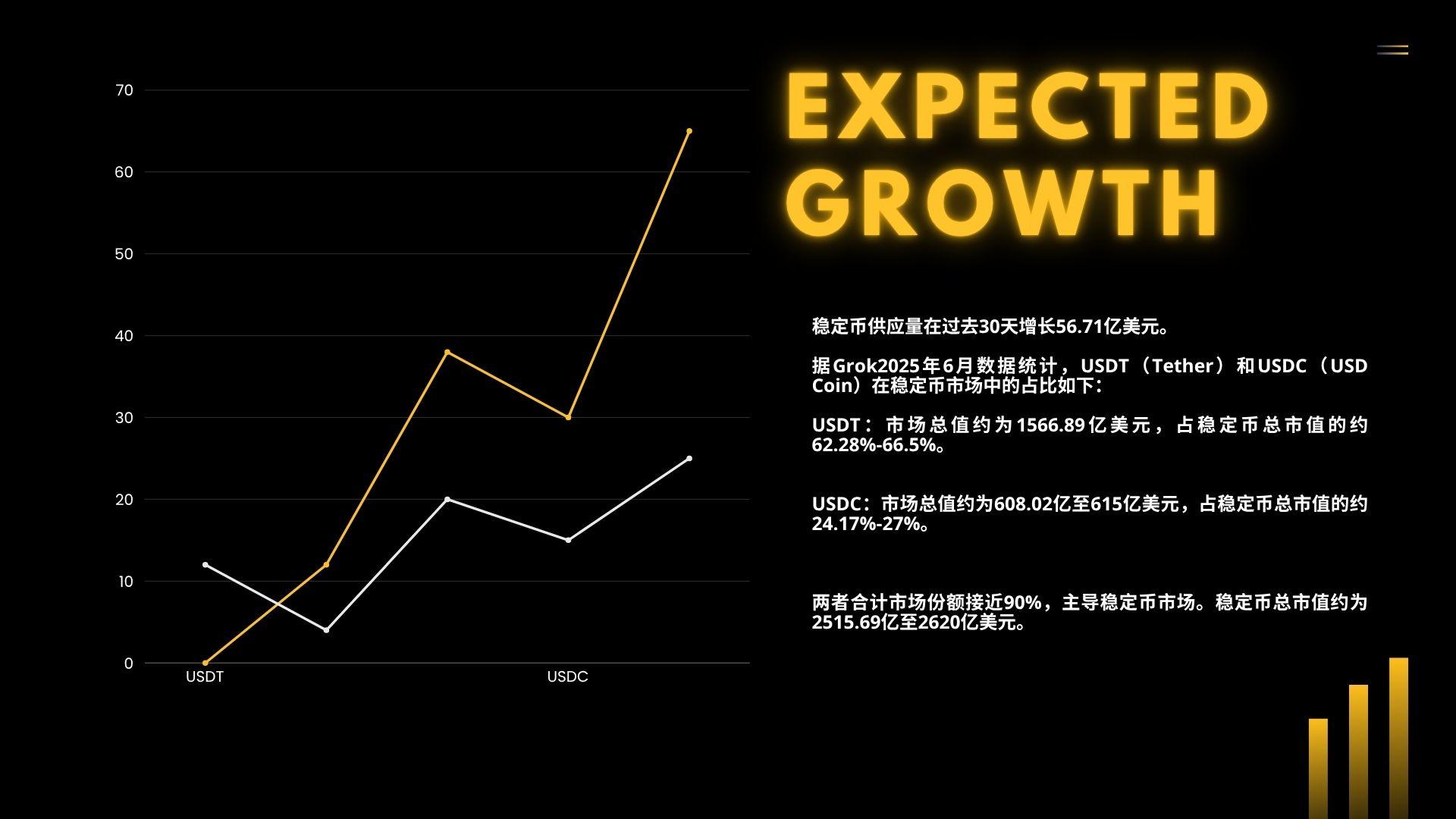

Market Position: USDT occupies 66.5% of the global stablecoin market with a market capitalization of $150 billion, making it the undisputed leader.

Advantages:

- First-mover advantage: As one of the earliest stablecoins, USDT is widely used in crypto trading, cross-border payments, and gray market scenarios, creating a strong network effect.

- Political resource backing: Tether has gained significant political endorsement by aligning with U.S. Secretary of Commerce Wilbur Ross. The addition of Cantor Fitzgerald and CEP further strengthens its position at the intersection of traditional finance and blockchain.

- Accelerated compliance: In the past, the compliance of USDT's reserves was heavily criticized, with only 50% being compliant assets; now, over 85% of reserves are compliant and continue to be optimized, enhancing market trust.

- Challenges:

- Despite the accelerated compliance process, USDT's offshore nature still subjects it to regulatory pressure, especially in the context of tightening global regulations, which may compress its market share.

- Its high reliance on gray market scenarios still exists, and long-term development requires deeper exploration of compliant application paths.

- Coinbase and Circle Consortium: Leaders in Compliant Stablecoins

Core Players: Coinbase, Circle (USDC issuer).

Market Position: USDC occupies 28.3% of the market share with a market capitalization of $61 billion, making it the leader in compliant stablecoins.

Advantages:

- Compliance advantage: USDC strictly adheres to U.S. regulatory requirements, with high transparency of reserves, gaining widespread recognition from traditional financial institutions.

- Potential for scenario expansion: Circle is actively collaborating with internet giants, such as negotiating with Meta to pilot small tipping scenarios on Instagram. This indicates that USDC is expected to quickly penetrate consumer scenarios through the vast user base of internet platforms.

- Technical and ecological support: Leveraging Coinbase's exchange ecosystem, USDC has strong liquidity in the crypto trading market.

- Challenges:

- Lack of strong political resources may put it at a disadvantage in policy negotiations.

- USDB is still in the early stages of market recognition and liquidity, requiring time to accumulate.

- Trump Family and USD1: Political Resources and Risks Coexist

Core Players: Trump Family (USD1 issuer), Abu Dhabi Royal Family MGX Sovereign Fund, Binance.

Market Position: USD1 quickly entered the market through its launch on Ethereum's Uniswap and BNB Chain's Pancake, but specific market capitalization data has not been fully disclosed.

Advantages:

- Top political resources: The Trump family's background provides strong political endorsement for USD1, while the MGX Sovereign Fund's $2 billion investment (entirely paid in USD1) further enhances its financial strength.

- Binance ecosystem support: As the world's largest crypto exchange, Binance provides strong circulation channels for USD1.

- Challenges:

- High political risk: The strong political attributes of USD1 make it highly dependent on the policy environment, and any change in political winds could significantly impact it.

- Market acceptance yet to be verified: The brand effect and actual application scenarios of USD1 have not fully unfolded, leading to uncertainty in market performance.

- Stripe and USDB: A Potential Player in Payment Scenarios

Core Players: Stripe (issuing USDB through the acquisition of Bridge).

Market Position: USDB, as an emerging stablecoin, has quickly emerged relying on Stripe's payment ecosystem.

Advantages:

- Payment scenario advantage: Stripe is the world's largest traditional payment solution provider, covering multiple fields such as e-commerce and SaaS, allowing USDB to seamlessly integrate into its payment network.

- Technical and user base: Stripe's global merchant network provides natural application scenarios for stablecoins.

- Challenges:

- As a new player, USDB's market recognition and liquidity still need time to accumulate.

- Needs to balance the integration costs of traditional payments and blockchain technology.

- PayPal and PYUSD: Strong User Base but Insufficient Promotion

Core Players: PayPal (PYUSD issuer).

Market Position: PYUSD has a market capitalization of about $900 million, with a small market share.

Advantages:

- Large user base: PayPal has hundreds of millions of active users, theoretically providing a broad potential user base for PYUSD.

- Early innovative attempts: PYUSD previously attracted users on the Solana chain with high dividends of 15%-20%, showing some market vitality.

- Challenges:

- Insufficient promotion: PYUSD has been relatively conservative in market promotion and has not effectively converted PayPal's large user base into stablecoin users.

- Competitive pressure: Under the squeeze from USDT and USDC, PYUSD's growth potential is limited.

- U.S. Bank Alliance: Reputation is Key, Coordination is Difficult

Core Players: A bank alliance composed of JPMorgan Chase, Citigroup, Wells Fargo, Zelle, etc.

Market Position: The alliance plans to issue a unified stablecoin, but specific progress has not been clarified.

Advantages:

- Top-notch reputation: Backed by top U.S. banks, the trust in the stablecoin is extremely high, suitable for institutional-level applications.

- Integration with the financial system: Can be deeply integrated with existing bank clearing and settlement systems, reducing transaction costs.

- Challenges:

- Coordination difficulties: The interests of multiple banks may lead to slow project advancement.

- Lack of innovation: Traditional banks are relatively conservative in applying blockchain technology, potentially missing early market opportunities.

2. Stablecoin Market Structure: A Dual Track of Offshore and Compliant

The competitive landscape of the stablecoin market shares many similarities with the crypto exchange market and can be divided into two major camps: offshore stablecoins and compliant stablecoins.

- Offshore stablecoins: Represented by USDT, they occupy a dominant market position due to their first-mover advantage and flexibility. USDT is widely used in gray market and cross-border trade scenarios, and despite facing regulatory pressure, its offshore leading position is unlikely to be shaken in the short term.

- Compliant stablecoins: Represented by USDC, they are favored by traditional financial institutions and internet giants due to transparent reserve management and regulatory compliance. The potential for scenario expansion makes USDC a leader in the compliant field.

However, the market is not just a "duel between two heroes." In different countries and business scenarios, regional and niche market "local stablecoins" are rising. For example:

- Hong Kong's Hong Kong dollar stablecoin: Serves local financial needs and may play an important role in the Guangdong-Hong Kong-Macao Greater Bay Area.

- Stablecoins in the e-commerce sector: Such as Stripe's USDB or potential stablecoins from JD.com, which can optimize supply chain finance and payment efficiency.

- Bank alliance stablecoins: Focused on real-time interbank settlement, reducing clearing costs.

These "local stablecoins" act like tentacles, extending the liquidity of the digital dollar to various niche scenarios and local markets… forming a diversified pattern of the "hundred coin battle."

As the stablecoin landscape gradually becomes clearer, the competition between offshore and compliant is attracting more participants to the battlefield, with new scenarios and roles continuously emerging.

3. The Deep Logic of the Stablecoin War: A New Version of the "Dollar Export War"

The competition for stablecoins is essentially a "power game" centered around the dominance of the digital dollar. Here are several key observations:

- Extension of Dollar Hegemony: Stablecoins are anchored to the dollar, and their proliferation is essentially the global export of the dollar in the digital economy. Whether through the offshore expansion of USDT or the compliant penetration of USDC, both are reinforcing the global financial influence of the dollar.

- Compliance is the Trend: The U.S. stablecoin bill (GENIUS) clearly requires issuers to hold compliant financial licenses, which will further raise market entry barriers. Internet giants like Meta are more inclined to collaborate with compliant stablecoins like USDC rather than building their own financial entities, highlighting the importance of compliance.

- Scenario-Driven Growth: The application scenarios for stablecoins are expanding from gray market and cross-border trade to broader compliant fields. For example:

- E-commerce scenarios: E-commerce platforms like JD.com can optimize supply chain finance and reduce transaction costs through stablecoins.

- Bank clearing and settlement: Bank alliance stablecoins can achieve real-time settlement, reducing friction costs in the traditional financial system.

- Social media: The collaboration between Meta and Circle explores new scenarios such as small tipping.

- Liquidity Dividend: The diversification of stablecoins will bring more liquidity to the crypto market, benefiting the entire industry. Whether offshore or compliant stablecoins, their growth will drive the prosperity of the blockchain ecosystem.

4. Future Trends and Investment Opportunities

- The dual oligopoly pattern of USDT and USDC is unlikely to change in the short term.

- With a 66.5% market share and strong political resources, USDT will remain the leader of offshore stablecoins; USDC, with a 28.3% market share and compliance advantages, will firmly hold the top position among compliant stablecoins. Both will continue to dominate the market in the short term.

- Breakthroughs in emerging stablecoin scenarios.

- Stripe's USDB and PayPal's PYUSD, leveraging their advantages in payment scenarios, are expected to achieve breakthroughs in niche areas such as e-commerce and social media. In particular, Stripe's global merchant network may make it a "local player" in e-commerce stablecoins.

- The game of politics and regulation.

- Although USD1 has strong political resources, its market performance is highly dependent on the policy environment, and investors should be wary of potential political risks. In contrast, the bank alliance's stablecoin has greater long-term potential due to its high credibility, but it needs to overcome coordination challenges.

- The rise of regional stablecoins.

- With the improvement of the global regulatory framework, regional stablecoins (such as the Hong Kong dollar stablecoin) will occupy a place in localized scenarios, providing investors with diversified allocation opportunities.

- Deep integration of technology and scenarios.

- The future competition of stablecoins will not only be limited to the strength of issuers but will also depend on the ability to integrate technology (such as the choice of blockchain networks) and the speed of scenario implementation. High-performance public chains like Solana and BNB Chain may become popular platforms for stablecoin innovation.

The AiCoin Research Institute believes that the "hundred coin battle" in the stablecoin market is both a challenge and an opportunity.

Analyzing opportunities from a new perspective may start from the following dimensions:

1. Mint (Issuer):

This has basically been monopolized, and the participation threshold is high. However, USD1, as an asset tool of the Trump camp, may still gain special market windows.

2. Channel/Scenario Partners:

Companies with backgrounds in payment channels, e-commerce, or social platforms can participate in profit distribution by integrating mainstream stablecoins (such as USDC). For example, Meta + USDC, JD.com + Hong Kong dollar stablecoin for e-commerce supply chain integration.

3. Niche Scenario Service Providers (most worth paying attention to):

Similar to Square's role, they can streamline payment logic in specific industries or pain point scenarios.

Small cross-border remittance scenarios are a definitive killer application for stablecoins.

For example:

- SWIFT: $10-30 fee, arrival in 1-3 business days.

- Stablecoin transfers: Almost $0 fees, seconds to arrive.

- User experience improvement of more than 10 times.

If such "underlying foundational scenarios" can be streamlined, it is entirely possible to replicate a "stablecoin version of PayPal."

4. Technical Services/Compliance Custodians:

Such as Ceffu, Coinbase Custody, although the threshold is high and profit margins are low, they offer stable cash flow and counter-cyclical benefits, making them suitable tracks for large companies to incubate or for mid-to-late stage startups.

Regulatory observers: Closely monitor the implementation details of the U.S. stablecoin bill and regulatory trends in other regions globally, as these will directly impact the market landscape.

The stablecoin war is not only an important turning point in the blockchain world but also a true reflection of the trend of integration between the digital economy and traditional finance. From Tether's offshore dominance to USDC's compliance leadership, and the scenario breakthroughs of emerging players, the stablecoin market is reshaping the global financial landscape.

We welcome you to continue following the AiCoin Research Institute, as we will keep tracking the progress of stablecoin policies, primary market dynamics, and on-chain data trends to provide you with the most valuable investment research references.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。