Original | Odaily Planet Daily (@OdailyChina)

Author | Ethan (@ethanzhangweb3)_

RWA Market Performance

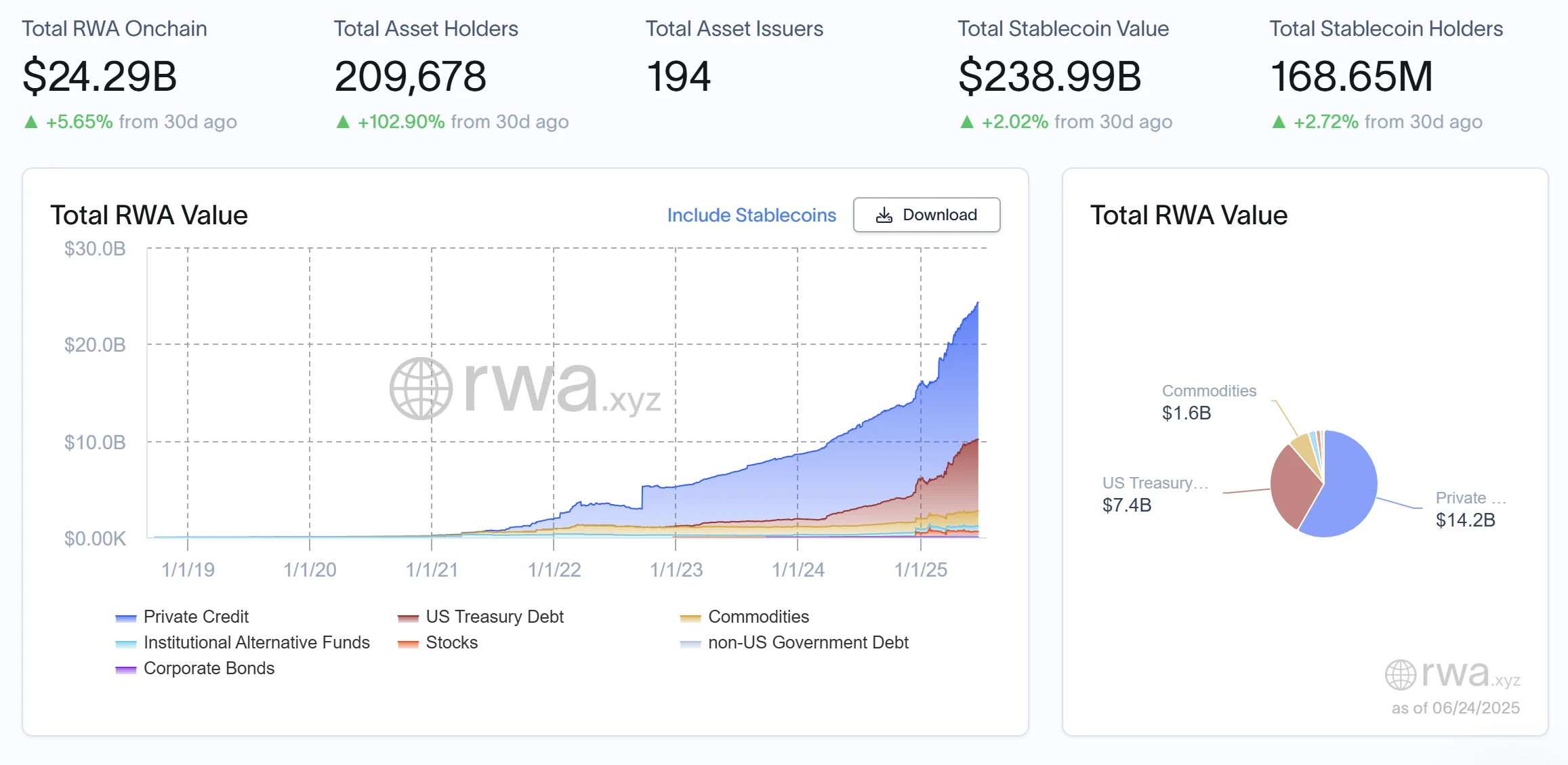

According to the latest data from RWA.xyz, as of June 24, 2025, the total on-chain value of RWA reached $24.29 billion, an increase of 1.67% from $23.91 billion on June 17, maintaining a stable upward trend. The number of on-chain asset holders rose to 209,678, up 13.16% from last week's 185,289, showing rapid expansion for two consecutive weeks and a continuously growing user base. The number of asset issuances remained unchanged at 194. The total value of stablecoins increased from $238.03 billion to $238.99 billion, a rise of 0.4%; the number of stablecoin holders increased from 167.45 million to 168.65 million, a growth of 0.71%.

In terms of asset structure, private credit continued to grow this week to $14.2 billion, an increase of $400 million from last week, maintaining its position as the most supported asset type in the current RWA ecosystem. The value of U.S. Treasury bonds slightly increased to $7.4 billion, indicating ongoing demand for stable assets.

Commodity assets rose to $1.6 billion this week, marking the third consecutive week of increase, possibly related to fluctuations in the global commodity market; the total value of institutional alternative funds also continued to grow, from $543.1 million to approximately $543 million, showing small but stable growth; data on equity assets was not disclosed separately.

Trends (Compared to Last Week)

The total on-chain market value continues to break through, with significant user growth: after breaking through $23 billion for two consecutive weeks, this week the total market value of RWA approached $25 billion, and the number of holders increased by over 24,000 people weekly, indicating that the influx of users has not slowed down, and the RWA ecosystem is attracting more institutional and retail investors; strong growth in private credit, with a significant weekly increase: this week saw an increase of nearly $400 million, showing that the market still maintains confidence in high-yield asset allocation, which is the core driving force behind the current structural growth of RWA; stable allocation of defensive assets like U.S. Treasuries: U.S. Treasury bonds rose to $7.4 billion, continuing to play a stabilizing role, still favored by investors amid fluctuating global interest rate expectations; commodity assets continue to rise, possibly driven by macro factors: the commodity market may be influenced by inflation, geopolitical factors, etc., showing corresponding allocation tendencies on-chain; alternative funds maintain moderate growth, with stable structural supplementary roles: performing steadily, continuing to support diversified asset portfolios.

As of June 24, the overall RWA on-chain asset market maintains a “steady rise + user expansion + structural optimization” operational trend. High-yield and low-volatility assets achieve synergistic growth, further expanding the market participation base, and the activity level of the ecosystem continues to rise. It is recommended that investors continue to adhere to the “risk diversification + active rotation” strategy framework at this stage: on one hand, capture growth opportunities in core assets like private credit, and on the other hand, increase the allocation ratio of stable assets such as U.S. Treasuries, commodities, and alternative funds to balance portfolio risks. At the same time, pay attention to the platform's dynamic disclosures and structural expansions in emerging sectors like equity assets, and prepare for medium- to long-term layouts.

Key Events Review

Senator Hagerty Claims Trump Ready to Sign the GENIUS Act

U.S. Senator Hagerty stated in an interview with crypto KOL Scott Melker that President Trump is ready to sign the GENIUS Act, and that the bill "may soon be delivered to his desk." This act is seen as an important milestone in stablecoin regulatory legislation and may have a profound impact on the industry.

Coinbase Seeks SEC Approval to Launch "Tokenized Stocks"

Coinbase is seeking approval from the U.S. Securities and Exchange Commission (SEC) to launch a "tokenized stock" trading service. The company's Chief Legal Officer Paul Grewal stated that this plan is a "major priority" for Coinbase, and if approved, it would allow the platform to compete directly with traditional brokers like Robinhood.

Since the Trump administration, the U.S. crypto regulatory environment has significantly improved. The SEC withdrew its enforcement action against Coinbase in February 2023. Analysts point out that if the plan is approved, the SEC may allow it through a "no-action letter." Currently, exchanges like Kraken have already provided similar services for overseas users.

Deutsche Bank, Memento Blockchain, and Axelar Network developer Interop Labs jointly released the DAMA 2 project white paper, proposing a next-generation asset tokenization platform solution for institutions. This platform is built on Ethereum Layer 2, emphasizing compliance and privacy protection, utilizing zkSync ZK Chain technology and enabling multi-chain asset issuance through Axelar, aiming to serve the creation and custody of stablecoins, funds, and RWA assets. DAMA 2 adopts a "blockchain as a service" model, lowering the entry threshold for institutions, with the mainnet expected to launch in the second half of 2025.

JPMorgan Trials JPMD Deposit Token on Base Chain, First Commercial Deposit on Chain

JPMorgan announced it will pilot the issuance of JPMD tokens on Coinbase's public chain Base, representing U.S. dollar deposits. The first transfer will be completed in a few days and is only open to institutional clients. JPMD is scalable and may support interest and deposit insurance in the future, seen as a compliant alternative to stablecoins.

Ondo Finance Launches Global Markets Alliance

Ondo Finance announced the launch of the Global Markets Alliance, aimed at coordinating industry standards and promoting the interoperability of tokenized securities, shaping the practices and standards of tokenized securities around interoperability, investor protection, liquidity, and composability. Participating institutions include the Solana Foundation, Bitget Wallet, Jupiter, Trust Wallet, Rainbow Wallet, BitGo, Fireblocks, 1inch, and Alpaca.

Mainstream Crypto Platforms to Accept BlackRock's Money Market Fund BUIDL as Collateral

BlackRock's first money market fund issued on a public blockchain, BUIDL (launched in collaboration with tokenization firm Securitize), is set to become an accepted collateral asset on trading platforms Crypto.com and Deribit. This means that institutions and professional traders can now use interest-bearing, blockchain-native U.S. Treasury token as trading margin. Since BUIDL combines low volatility (current annualized yield of about 4.5%) with yield attributes, exchanges can lower minimum collateral requirements, freeing up more funds for other investments.

Hot Project Updates

Ondo Finance (ONDO)

One-Sentence Introduction:

Ondo Finance is a decentralized finance protocol focused on structured financial products and the tokenization of real-world assets. Its goal is to provide users with fixed-income products, such as tokenized U.S. Treasuries or other financial instruments, through blockchain technology. Ondo Finance allows users to invest in low-risk, high-liquidity assets while maintaining decentralized transparency and security. Its token ONDO is used for protocol governance and incentive mechanisms, and the platform also supports cross-chain operations to expand its application scope in the DeFi ecosystem.

Latest Updates:

On June 17, Ondo Finance announced the establishment of the Global Markets Alliance in collaboration with the Solana Foundation, Bitget Wallet, Trust Wallet, Jupiter, Fireblocks, and BitGo, aimed at promoting the on-chain capital market and establishing interoperability standards for on-chain stocks.

Plume Network

One-Sentence Introduction:

Plume Network is a modular Layer 1 blockchain platform focused on the tokenization of real-world assets (RWA). It aims to transform traditional assets (such as real estate, art, equity, etc.) into digital assets through blockchain technology, lowering investment barriers and increasing asset liquidity. Plume provides a customizable framework that supports developers in building decentralized applications (dApps) related to RWA, integrating DeFi and traditional finance through its ecosystem. Plume Network emphasizes compliance and security, dedicated to providing solutions that bridge traditional finance and the crypto economy for both institutional and retail investors.

Recent Updates:

On June 17, Plume announced that Chainlink CCIP (Cross-Chain Interoperability Protocol) has been launched on its mainnet, supporting secure cross-chain messaging and native token transfers, connecting over 46 networks. The next day, Plume announced that the M0 (@m0) Universal Stablecoin platform has been natively deployed on the Plume mainnet, unlocking the programmable layer of stablecoins within the RWAfi economy.

On June 18, Plume announced the establishment of its headquarters in the Empire State Building in New York, stating that New York is the "global financial center." Plume will promote the compliant development of RWAfi in the U.S. through multiple rounds of communication with policymakers, including the U.S. Secretary of the Treasury and the Vice President.

Recommended Related Articles

Summarizing the latest insights and market data in the RWA sector.

《Comprehensive Interpretation of RWA Ecosystem Projects》

A comprehensive report written by DePINOne Labs, detailing the main categories and representative projects of the RWA ecosystem in 2025.

《BlackRock and JPMorgan Compete for Layout, 2025 RWA Full Track Guide》

This article will analyze the currently most promising RWA sub-sectors and list the most representative leading projects in each field.

Written by a Web3Caff researcher, this report contains over 25,000 words, providing a comprehensive in-depth analysis in conjunction with the most cutting-edge regulatory frameworks, while also focusing on the progress of infrastructure service providers in future key areas such as standardized assets, physical asset RWA, and the synergy of technology regulation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。