Is a Bitcoin Dip Coming? Robert Kiyosaki Urges ‘Buy the Fear’ Strategy

Robert Kiyosaki has predicted a likely short term drop in Bitcoin and in the prices of gold, which points to the growing national debt as a big concern.

Despite this warning, he motivated investors to see any market decline as an opportunity, advising the users to buy during the dips rather than to panic in the situation.

What happened?

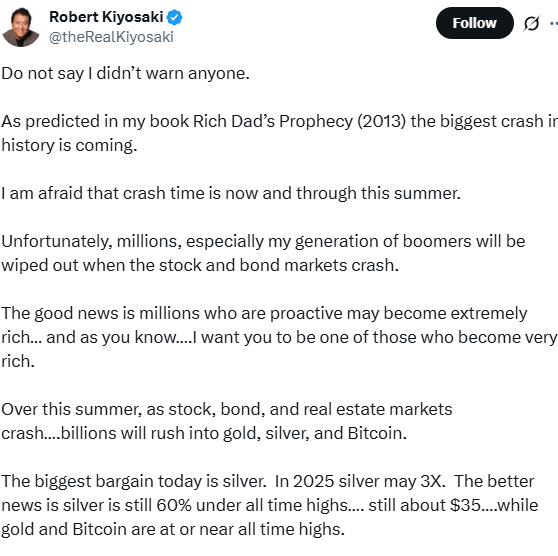

Robert Kiyosaki who is a businessman and famous author recently shared a tweet on his X handle saying “Silver is the best investment today”.

.

Source: X

Through this he sees silver as the most promising investment in the current situation, especially as global uncertainty fuels a shift toward safer assets.

With the geopolitical tensions on rise, investors are moving into a risk-off mindset. He highlighted the financial risks tied to the scenario, requesting users to prepare for increased market volatility.

Why does Robert Kiyosaki Predict a Bitcoin Crash

With US national debt taking flight to $37 trillion, Kiyosaki predicted a fresh warning of an forthcoming global financial collapse. He is witnessing Bitcoin, gold and silver as the top assets for protection of wealth while dismissing fiat currency as junk.

He recently restated his daring prediction of Bitcoin reaching $1million by 2030, urging users to accumulate while prices are still low.

Source: X.

Amid growing geopolitical tensions between the Iran-Israel conflict, he expects a short-term dip in the value of Bitcoins, but sees it as a buying opportunity.

Although, for now he is favouring silver , forecasting it could triple to over $100 per ounce by 2025 .

Source: x

Kiyosaki warns of imminent global economic collapse

Robert Kiyosaki has warned of an emerging global monetary collapse, citing what he calls “the largest debt bubble in history”.

He said that those who are holding cash and bond assets will be the biggest losers in the scenario and would suffer the most.

He advised investors to rethink fiat beliefs and seek for assets that build real wealth.

Crypto markets react to Growing Iran-Israel Conflict

Rising Iran-Israel tensions over the weekend sparked selling in the world of crypto. It is leading towards $458 million erasure. Bitcoin briefly dropped below $100k before rebounding above $101k. As investors shifted to a risk-off stance amid growing geopolitical uncertainty.

Conclusion

Robert Kiyosaki continues to sound the alarm on rising debt and global instability, making investors understand to move away from fiat assets and focus on Bitcoin, gold and especially silver.

With the geopolitical tensions soaring and market volatility rising, his message is clear i.e to prepare wisely, buy the dips, and prioritize real assets that can weather financial turbulence.

Also read: Surge in Crypto Scams: Hackers Now Targeting Leading Info Platforms 免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。