On June 23rd, the Bitcoin market witnessed another showdown between whales, with a short position worth over $100 million quietly established. The volatility triggered by high-leverage operations quickly became the market's focus. Meanwhile, another whale managed to turn the tables through prudent asset management, reversing losses into profits, creating a stark contrast.

Whales Establish Short Positions, Market Game Intensifies

On-chain tracking shows that well-known trader AguilaTrades established a short contract position of up to 1000.82 BTC at 01:50 on June 23rd, using 20x leverage, corresponding to a nominal value of nearly $100 million, with an opening price of approximately $99,616. Although this position had an unrealized profit of about $112,000 within 20 minutes of establishment, it quickly turned into an unrealized loss, with current losses exceeding $1.34 million and a liquidation price of $104,730.

In contrast, another whale trader nicknamed "Insider Brother" by the market successfully took profits and exited by flexibly adjusting strategies, turning a profit of over $2 million after recovering initial losses. The two trading styles are distinctly different, highlighting the importance of trading rhythm in a highly volatile market.

These massive position-building actions not only brought short-term price disturbances but also left clear technical traces on the charts.

Trend Momentum Weakens, Rebound Still a Repair

I would like to analyze the key characteristics of current price behavior from three dimensions: the daily, 4-hour, and 1-hour charts of BTC/USDT.

Daily Observation:

- The current price has rebounded to around $101,200, slightly closing with a bullish candle;

- The previous decline started from the June 21 high of about $106,500, dropping to a low of $98,200;

- Trading volume has not effectively increased, and the price remains below the major moving averages and previous highs;

- The chart shows a weak repair structure after a decline, and a trend reversal has not yet formed.

4-Hour Observation:

- After a strong short-term drop, the price began to consolidate and slowly rebound;

- The Bollinger Bands are gradually narrowing, and the price is attempting to stay above the middle band but has not effectively broken through;

- Overall, it remains in a "decline → consolidation" structure and has not yet formed a reliable bottom.

1-Hour Observation:

- The rebound that started from the June 23 low of $98,200 has currently pushed up to over $101,200;

- The MACD has shown a golden cross, with the histogram continuously turning positive and expanding;

- However, as the price approaches the previous rebound high, there are signs of weakening momentum;

- If the MACD histogram begins to converge, and the fast and slow lines come closer together while the price fails to break through $102,000, caution is needed for a short-term pullback.

The current market is still in an adjustment phase. Although there are signs of a short-term rebound, the momentum is insufficient, and its sustainability is questionable. We need to be wary of the risks of a second bottom test or false breakouts. The 1-hour chart, as a rhythm indicator, should pay special attention to the synchronization of momentum and price to determine whether the rebound has a basis for continuation.

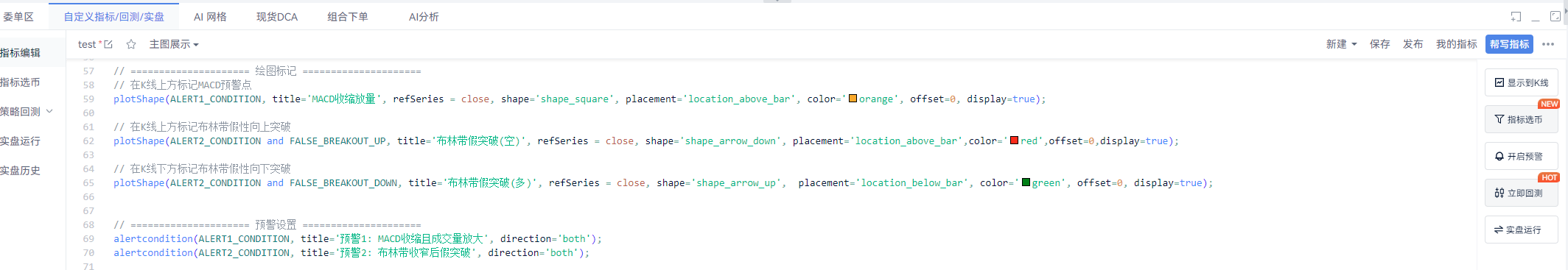

Indicator Warning System: Building a Risk Perception Framework

To systematically capture structural turning points and market risks, I attempted to use AiCoin's custom indicator feature to build a technical warning module, hoping to help everyone establish a "forward-looking judgment mechanism" for better subsequent decision-making!

Module One: MACD Momentum Convergence Warning

Logic Trigger Conditions: MACD histogram continuously contracts ≥ 3 bars; the distance between the fast and slow lines narrows, showing signs of a death cross or golden cross; simultaneously, trading volume shows a significant increase.

This warning can serve as an early alert for trend weakening or reversal, suitable for adjusting position rhythm or setting reduction reminders.

Module Two: Bollinger Band False Breakout Identification

Logic Trigger Conditions: Bollinger Band width significantly narrows; K-line breaks above/below the band and quickly retracts; RSI indicator does not make a new high or low.

The Bollinger Band warning can be used to identify false breakouts, preventing blind chasing of prices in the absence of confirmation signals, suitable for identifying reversal strategies.

Conclusion

The current market structure is still in a weak rebound phase after a decline and has not formed a trend reversal. For traders, judging the market's rhythm and risk signals is far more important than guessing price levels.

By building an indicator warning system, we can capture changes in structure and momentum before price fluctuations occur, allowing for more foresight and confidence in strategy execution.

"Not all volatility is worth chasing, but every change in momentum is worth observing."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。