Author: Catalaize, substack

Translation: Felix, PANews

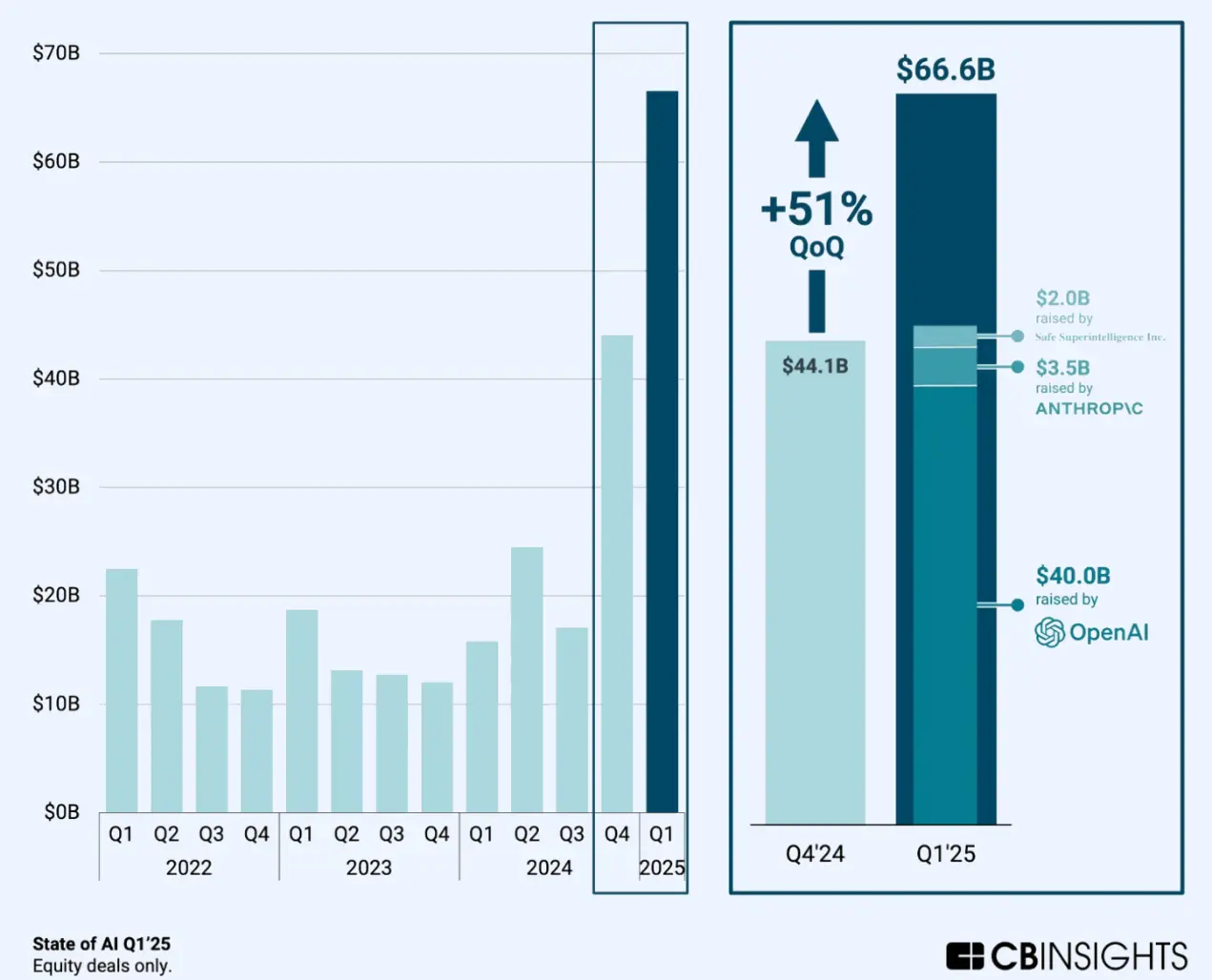

From January to June 2025, global investment in AI startups far exceeded that of the first half of 2024. In just the first quarter of 2025, approximately $60 billion to $73 billion was attracted, surpassing half of the total amount for all of 2024, with a year-on-year growth of over 100%. In the first quarter, venture capital for AI companies accounted for about 58% of the total, compared to about 28% a year earlier. This clearly indicates investors' "AI FOMO" mentality.

This means: Capital is concentrating in the AI field on an unprecedented scale, with major institutions doubling down on those companies believed to excel in AI, which may reshape the funding allocation landscape for the second half of the year.

Massive Financing Dominated by a Few Giants

During this period, the ultra-large late-stage financing rounds led by leading companies were particularly prominent. In March, OpenAI raised $40 billion (the largest private financing round in history), reaching a valuation of $300 billion, while Anthropic's $3.5 billion Series E financing brought its valuation to $61.5 billion. Other transactions, such as Safe Superintelligence's $2 billion financing and Neuralink's $650 million Series E financing, further inflated the total.

This means: A "winner-takes-all" situation is concentrating most of the funds into a very small number of companies, thereby crowding out funds that could have flowed to early-stage or smaller companies.

Transaction Scale Under the Barbell Effect

In addition to the highly publicized massive financings, there was a surge in medium-sized transactions, while seed round financing activities remained selective. The median seed round financing in the AI field reached about $15 million (with an average of about $41 million), and the median Series A financing was about $75 million to $80 million, both significantly higher than historical averages (the global median for Series A financing across all industries in 2022 was about $10 million). The median growth stage financing for Series C and D concentrated between $250 million and $300 million, while the average was inflated by extreme cases like OpenAI.

This means: The expansion of transaction scale reflects fierce competition for industry-leading companies. Investors unable to write nine-figure checks may turn to niche areas or earlier-stage investments, while any startup claiming to have an AI narrative can secure larger-scale financing and higher valuations.

Industry and Regional Concentration

Participants in generative AI and core model/infrastructure fields attracted over $45 billion in funding in the first half of the year, accounting for more than 95% of disclosed funding totals. Application-oriented AI verticals, on the other hand, were relatively underfunded (approximately $700 million in healthcare/biotech; about $2 to $3 billion in fintech/enterprise). Regionally, the U.S. (especially Silicon Valley) dominated: over 99% of global AI funding in the first half of the year flowed to companies headquartered in the U.S. Asia and Europe lagged behind, with China's largest deal (Zhizhu AI) raising $247 million; Europe saw only a few medium-sized financing rounds (e.g., the UK's Latent Labs raised $50 million).

This means: This boom is centered in the U.S., led by a few large companies; it is expected that governments and investors outside the U.S. will respond in the second half of the year by establishing national AI funds, providing incentives, or engaging in cross-border investments to avoid falling behind.

Outlook for the Second Half: Enthusiasm High but Caution Remains

Despite record capital inflows, investor caution is returning. Many financing rounds in the first half of the year focused on strategic or corporate investors (cloud service providers, chip manufacturers, defense companies), indicating that investors prefer projects with practical application scenarios and strategic synergies. As we enter the second half, investors will closely monitor the performance of startups that secured massive funding in terms of product delivery, revenue, and regulatory compliance, especially in an increasingly competitive environment.

This means: In the second half, capital may favor companies that demonstrate efficiency and genuine market appeal—especially "tools and shovels" suppliers (tools, chips, enterprise software), which will raise the entry barrier for newcomers, solidify the advantages of existing companies, and pose challenges for new entrants.

Importance

The first half of 2025 is a critical moment for AI investment. The substantial influx of capital into the AI field (and its tilt towards a few participants and regions) will shape the innovation landscape and competitive dynamics for the coming years. For investors, understanding the flow of funds and the reasons behind it is crucial for navigating the second half of 2025. Will the winners prove their valuations are justified, or will there be a correction and refocusing? The data from the first half provides early clues for portfolio strategies, policy considerations (such as antitrust and national security issues), and the fundraising prospects for founders in the coming half-year.

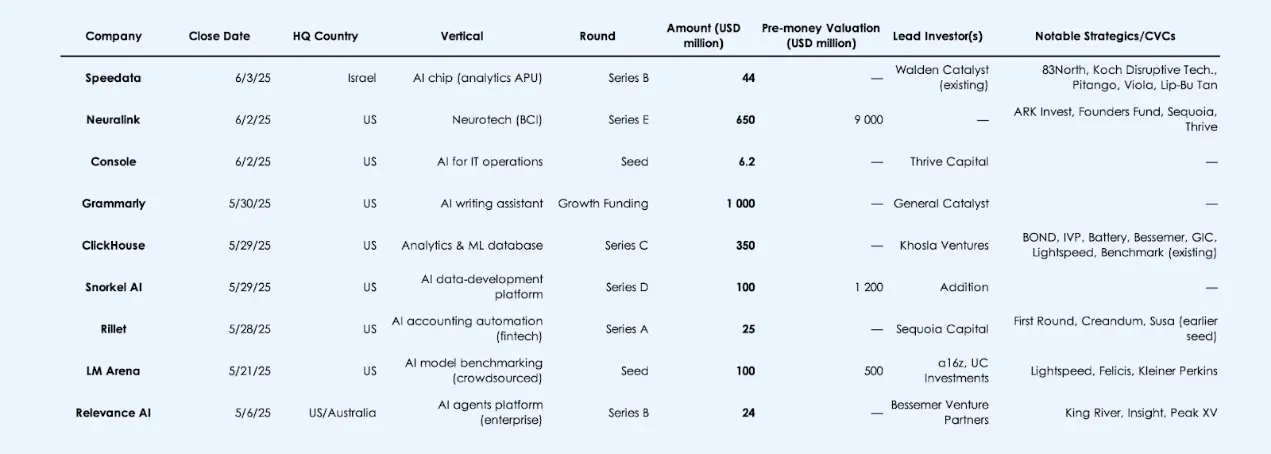

The most noteworthy financings in the AI field over the past month

Macro and Trend Analysis

1. Financing Momentum: Unprecedented Year-on-Year Surge

In the first half of 2025, venture capital for AI startups far exceeded the levels of the same period in 2024. Reliable data shows that approximately $70 billion flowed into AI companies in just the first quarter, surpassing half of the total financing amount for the entire AI field in 2024. This means that the financing amount in the first half of 2025 is more than double that of the first half of 2024 (in dollar terms).

In the first quarter of 2025, AI's share of global venture capital surged to about 53% to 58%, compared to about 25% to 30% a year earlier. This means that currently, over half of global venture capital is directed towards the AI field.

Driving factors: A few massive financings; without these, global venture capital funding would be roughly flat year-on-year.

Impact on the second half of 2025: Overall venture capital metrics may depend on transaction flow in the AI field; any cooling of enthusiasm in the AI sector could lower overall financing levels.

2. Financing Stages: Significant Growth in Late-Stage Financing, Mixed Early-Stage Financing

Data shows that the transaction scale in the AI field exhibits a barbell distribution.

Late-stage (C+ rounds) dominate: In the first quarter of 2025, the total amount of late-stage financing across all industries reached $81 billion, a year-on-year increase of about 147%, with AI being a major driving force.

- The average size of Series D and E financing is about $300 million to $950 million (with a median of about $250 million to $450 million).

Early-stage: The number of transactions has decreased (with a year-on-year decline of about 19% in global early-stage transactions), but the scale of financing has significantly increased.

- The median seed round financing for AI startups in the first half of 2025 was about $15 million; Lila's $200 million seed financing is an outlier.

- The median Series A financing was about $75 million to $80 million.

Key point: Investors are putting funds into fewer, higher-stakes projects—confident in specific AI themes while being cautious in other areas. This polarization is expected to continue into the second half.

3. Industry Allocation: Core Models and Infrastructure Development

Over 95% of AI funding is chasing generative AI model developers and their infrastructure (cloud computing, chips, development platforms). Just OpenAI and Anthropic attracted about 60% of AI funding in the first half of the year.

In contrast, vertical application fields are almost negligible:

- Healthcare/Biotech AI: About $700 million (e.g., Hippocratic AI raised $141 million, Insilico raised $110 million).

- Financial services and enterprise productivity: Only a few billion dollars in total.

- Robotics/Defense AI: A niche but noteworthy area (e.g., Shield AI raised $240 million).

Investor logic: Control the "AI stack"; vertical applications may commoditize (note: the unique value of brands and other attributes may disappear due to sufficient market competition) or face longer GTM cycles.

4. Regional Distribution: Concentration in the U.S., Bay Area Accounts for Half of Financing Amount

In the first quarter, 71% to 73% of global venture capital flowed to North America; in terms of value, about 99% of AI funding is concentrated in the U.S. The San Francisco Bay Area (including OpenAI) alone accounted for nearly half of global venture capital.

Europe, the Middle East, and Africa: Only a few medium-sized AI transactions (Latent Labs raised $50 million, Speedata raised $44 million).

Asia-Pacific: In the first quarter of 2025, only $1.8 billion was raised for AI (a year-on-year decline of 50%); China's largest round of financing was Zhizhu AI's $247 million.

In summary: The U.S. holds an advantage in funding in this "AI arms race."

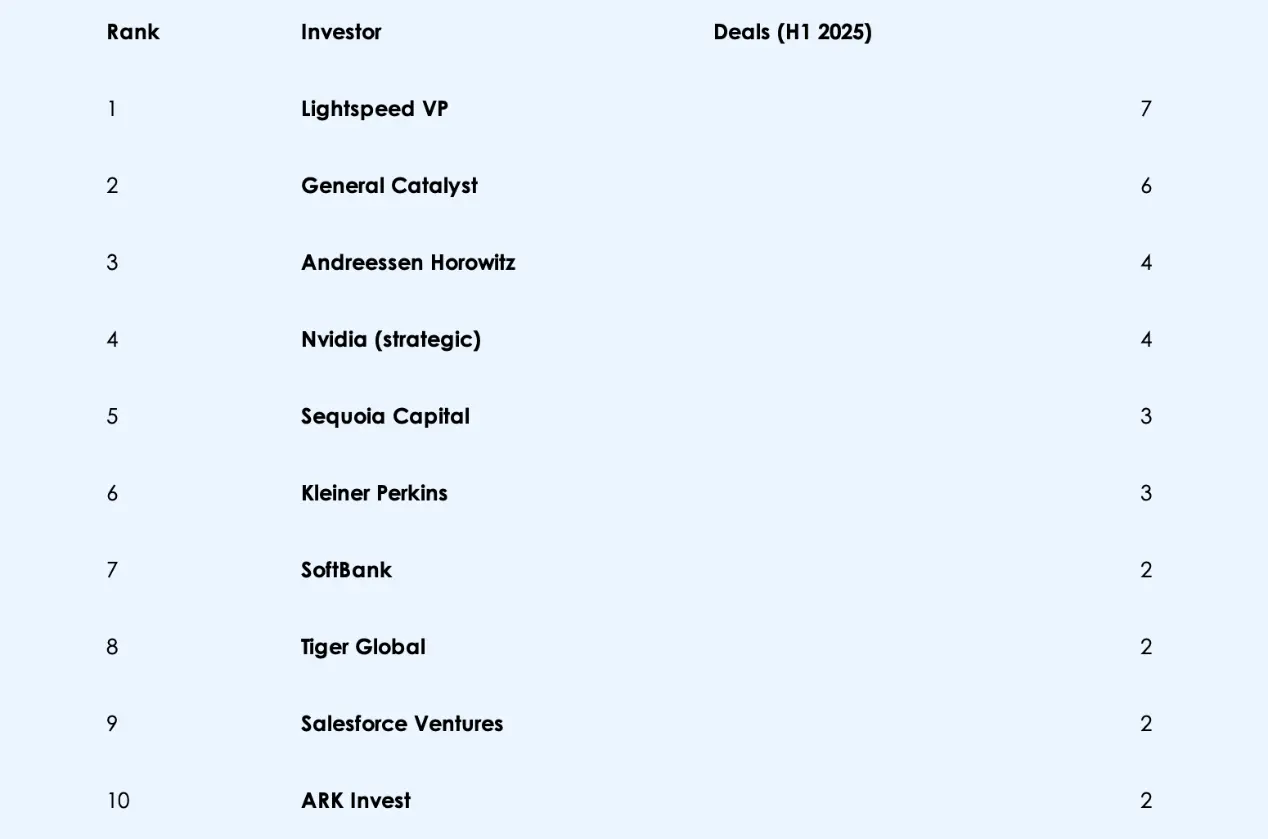

5. Investor Landscape:

Sovereign wealth funds and cross-border funds (Saudi Arabia's Prosperity7, Malaysia's Khazanah, Thrive Capital) led multiple financing rounds.

Corporate venture capital departments of large tech companies (Microsoft, Salesforce, Google) were very active.

Net effect: Capital is flooding in from all sides.

Forward-Looking Outlook for the Second Half:

Regulatory Milestones

Governments around the world are still exploring how to respond to AI. In the EU, the "AI Act" is expected to be finalized by the end of 2025. In the second half, startups are likely to engage in lobbying battles, and early compliance signals may emerge. In the U.S., any movements regarding AI from executive orders and Congress—hearings, proposed legislation—will be crucial. New regulations surrounding data usage, model transparency, or chip export controls could reshape the economic landscape for startups and investor confidence.

- Positive expectations: Clearer, business-friendly guidelines will legitimize the application of AI across various industries.

- Negative expectations: Strict regulations (e.g., liability for AI errors) may deter startups and investors.

Additionally, attention should be paid to the U.S. government's AI procurement situation—rumors about a multi-billion dollar program could provide significant demand signals for enterprise-focused AI companies.

IPO Channels and Exit Routes

Despite a surge in private financing in 2025, there have yet to be any groundbreaking AI IPOs. This situation may change in the second half of the year. Companies like Databricks, Stripe (AI-related), and even OpenAI could be potential IPO candidates.

- A successful IPO could reprice the market, release liquidity in late-stage funding, and provide comparable data.

- Ongoing IPO stagnation may shake investor confidence in the exit timelines for AI startups.

Meanwhile, M&A activity may escalate. Large tech companies may take action: Google, Microsoft, or Nvidia could acquire smaller AI teams or core infrastructure providers. A significant AI acquisition could reshape the competitive landscape and yield returns for venture capital firms.

Technological Breakthroughs and Product Releases

Major announcements are anticipated: possibly OpenAI's next-generation model or hardware launched in collaboration between Sam Altman and Jony Ive.

Any significant capability breakthroughs (e.g., models capable of reasoning or models that reduce costs by tenfold) could validate high valuations and trigger a new wave of capital.

Attention should also be paid to enterprise-level appeal—API sales, SaaS adoption, and revenue performance. However, risks exist; any security incidents or public misuse could provoke strong regulatory backlash, dampening market sentiment.

In summary, the technological and business execution in the second half will determine whether the optimism of the first half can be sustained.

Regulatory and Ethical Resistance

If governments or the public feel that AI has gone out of control, swift intervention measures are expected: such as implementing licensing systems, imposing fines under the General Data Protection Regulation (GDPR), or imposing strict restrictions on certain models.

Ethical resistance: Scandals, mass layoffs due to automation, or AI-generated misinformation could quickly change market sentiment, making it harder to secure funding.

Computational and Talent Constraints

The lifeblood of AI—graphics processing units (GPUs) and elite engineers—remains scarce.

GPU bottlenecks may force underfunded teams to exit, while well-funded companies hoard computational resources.

The talent war is intensifying, with OpenAI and Google competing for top talent.

Burn rates are skyrocketing: some startups are spending over $100 million annually on cloud services without quickly launching products. If the gap between costs and products continues to widen, financing discounts and a brutal market reset are expected.

Model Commoditization

Ironically, the large language model (LLM) race is driving rapid commoditization. Open-source releases (Meta's LLaMA, Mistral, etc.) blur the lines of differentiation.

Moats are shifting towards data quality, distribution channels, or vertical integration.

If OpenAI starts to lose ground to streamlined open-source participants or models developed in-house by enterprises, venture capitalists may reassess the true meaning of "defensibility."

The second half may sound the alarm: not every well-tuned wrapper deserves a billion-dollar valuation.

Predictions for the Second Half of 2025

Financing Scale Slows, but Remains High

After the excitement of the first half, the pace of transactions will slow. It is expected that there will not be another $40 billion financing round, but quarterly AI financing amounts will still be double that of 2024 levels. The boom continues, but it is more robust.

Major Liquidity Events on the Horizon

At least one exit of over $10 billion is expected: an IPO (e.g., Databricks) or acquisition by a traditional company trying to maintain influence.

This will affect investor sentiment and reset pricing expectations.

The clear stratification of the startup ecosystem will become evident by the fourth quarter:

The top 5-10 AI companies (with strong funding and growth momentum) will gradually exit and may attract talent through acquisitions.

Those in the mid-tier or overhyped but yet to achieve product-market fit? Many will pivot, experience valuation downgrades, or gradually disappear.

Investors will reward execution that can generate revenue, not just research proposals or GPU investments.

Final Conclusion

The next six months will stress-test the AI narrative. Will 2025 mark the beginning of sustained transformation, or will it reveal a bubble that needs correction?

Some bubbles will burst, but the core argument remains valid. AI continues to be the most attractive frontier in the venture capital space, though the flow of funds will be more cautious.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。