This article will analyze the impact of major wars and conflicts over the past five years on Bitcoin price trends, as well as the recovery trajectory of the crypto market after past wars.

Written by: bitsCrunch

From Ukraine to Iran, the investment logic and role of Bitcoin under geopolitical conditions have evolved.

In the early hours of June 13, 2025, Israel launched "Operation Lion's Rise," attacking multiple cities, military bases, and nuclear facilities in Iran. Recently, Iran's largest crypto exchange, Nobitex, suffered a cyberattack from Israeli hackers, resulting in losses of tens of millions of dollars in stablecoins. Bitcoin fluctuated quietly amidst the smoke of war, rising close to $110,000 before falling again. From 2020 to 2025, we can observe Bitcoin's sensitive response to geopolitical events through several major wars and conflicts. This article will delve into the impact of major wars and conflicts over the past five years on Bitcoin price trends, as well as the recovery trajectory of the crypto market after past wars.

The Turning Point of the Russia-Ukraine Conflict

Market Turbulence in the Early Stages of War

The Russia-Ukraine conflict fully erupted on February 24, 2022, with speculation that Russian funds would flow into cryptocurrencies like Bitcoin, causing Bitcoin's price to soar by 20%, briefly surpassing $45,000. At the same time, Russian oligarchs attempted to transfer frozen assets through Bitcoin, seemingly confirming the "crisis value" of cryptocurrencies.

However, in the long run, as the war drove European natural gas prices to historical peaks and the Federal Reserve was forced to initiate the most aggressive interest rate hikes in forty years, Bitcoin experienced a 65% crash in 2022. While this decline cannot be entirely attributed to the war, the geopolitical uncertainty undoubtedly exacerbated market pessimism.

Data source: bitscrunch.com

Interestingly, the persistence of the war provided new narrative support for Bitcoin. The Ukrainian government raised millions of dollars in donations through cryptocurrencies, highlighting the unique value of digital currencies in the context of restrictions in the traditional financial system. At the same time, facing Western sanctions, Russia also turned to cryptocurrencies to some extent as a tool to evade sanctions, further reinforcing Bitcoin's status as an alternative financial instrument.

It is worth noting that in 2014, Bitcoin fell into a prolonged bear market after Russia invaded Ukraine. However, by 2022, Bitcoin had developed into a larger, stronger asset class that was more accepted by institutional investors.

Market Tests of the Israeli War

Short-term Impact and Rapid Recovery

On October 7, 2023, the Israel-Gaza conflict erupted. On October 11, according to bitsCrunch data, Bitcoin fell below $27,000, hitting a new low since September, with traders generally attributing this to the negative impact of the Middle East conflict on investor sentiment. During the Gaza conflict in 2023, the weekly transfer volume of USDT surged by 440%, with stablecoins becoming the new infrastructure.

Since the start of the Israel-Hamas conflict, there has been no significant volatility in digital asset prices. This relative stability reflects a reduced sensitivity of the cryptocurrency market to geopolitical events.

The Iran-Israel Conflict

In April 2024, during the Iran-Israel conflict, on the day of missile strikes, Bitcoin's volatility was only ±3%, less than one-third of the volatility during the outbreak of the Russia-Ukraine war in 2022. BlackRock's ETF saw a net inflow of $420 million in a single day, forming a buffer against volatility. The average daily trading volume of spot ETFs accounted for 55%, diluting the war sentiment with institutional order flow.

Data from bitsCrunch shows that even during significant geopolitical events such as Israel's airstrikes on Iran, the Bitcoin market did not enter a panic mode. Although Bitcoin fell by 4.5% to $104,343 within 24 hours of the war's onset in June 2025, and Ethereum dropped by 8.2% to $2,552, this decline was still manageable relative to the severity of the event, demonstrating strong resilience.

However, according to the Geopolitical Risk (GPR) index, we find that the index is currently on an upward trend, around 158. The last time it exceeded 150 was in early 2024. This index was constructed by Dario Caldara and Matteo Iacoviello. The Geopolitical Risk (GPR) index peaked before and after the two World Wars, during the early stages of the Korean War, during the Cuban Missile Crisis, and after the "9/11" events. The higher the geopolitical risk, the lower the investment, stock prices, and employment rates. The higher the geopolitical risk, the greater the probability of economic disaster, and the greater the downside risk to the global economy.

Data source: bitscrunch.com

The Best Window to Observe Capital Logic

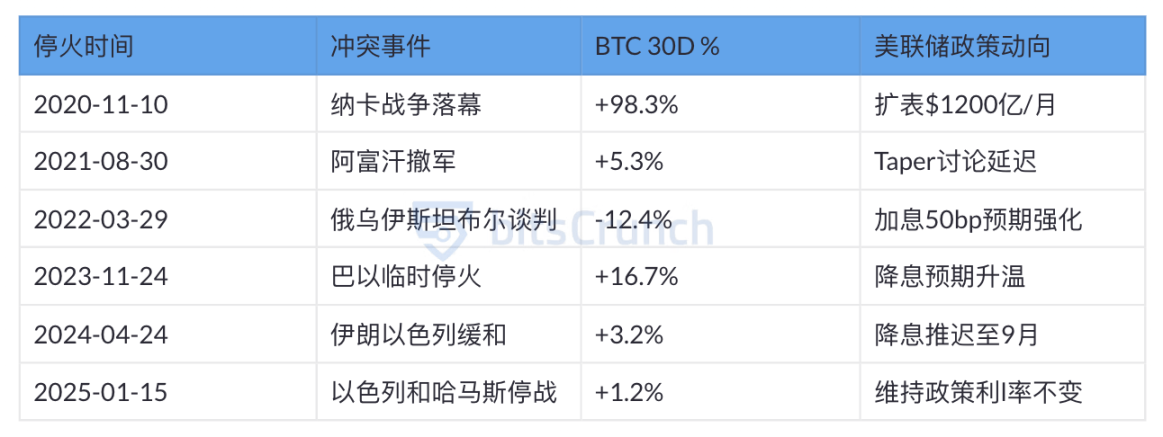

The moment a ceasefire agreement is signed often serves as the best window to observe capital logic. After the Nagorno-Karabakh war ended in November 2020, Bitcoin nearly doubled in the following 30 days. The territorial dispute of this small Caucasian country ignited the crypto market primarily because the war did not change the global easing tone, with the Federal Reserve's monthly $120 billion bond-buying program continuing to nourish risk assets. In contrast, during the Russia-Ukraine negotiations in March 2022, the brief hope for a ceasefire was shattered by the Federal Reserve's announcement of a 50 basis point rate hike, causing Bitcoin to drop by 12%.

Data source: bitscrunch.com

On the day of the temporary ceasefire between Israel and Hamas in November 2023, the crypto derivatives market saw liquidations of $210 million. The BTC to Egyptian pound exchange rate premium in the Egyptian over-the-counter market dropped from 8.2% to 2.1%, indicating a gradual retreat of demand in war-torn areas. The narrative of war was quickly overshadowed by native narratives such as ETF approvals and halving cycles. On January 15, 2025, Israel and Hamas agreed to a proposal for a ceasefire and prisoner exchange. Subsequently, Bitcoin surged again, breaking through $100,000 before falling. The market performance during the Middle East conflict prompted a reevaluation of Bitcoin's safe-haven asset attributes—Bitcoin and Ethereum can no longer be viewed as safe-haven assets in the gold market.

Entering the Institutional Era

The war value of digital assets has not disappeared but has been reconstructed in a contextual manner. The Ukrainian government received $127 million in crypto donations, accounting for 6.5% of its early international aid; the underground network in Gaza maintained communication networks through Bitcoin mining machines; Iranian oil merchants used mixers to break sanctions… These real applications in marginal areas are forming a parallel dark-line ecology with Wall Street. While the mainstream market focuses on ETF fund flows, the demand for cryptocurrencies in war-torn areas has become a new indicator for observing digital assets.

The current crypto market has formed a clear war response mechanism: crude oil prices trigger inflation alarms, the VIX panic index, and open interest on Deribit, among others. Data from bitsCrunch shows that less than 5% of the safe-haven funds released by geopolitical conflicts ultimately flow into the crypto space, a number that may further shrink in the ETF era.

The real turning point lies in monetary policy. When the Federal Reserve opens the interest rate cut channel, the signing of ceasefire agreements will become an accelerator for capital inflows. On June 18, 2025, U.S. interest rate futures prices reflected a 71% probability of a Federal Reserve rate cut in September, up from 60% before the announcement, with a slight increase in the probability of a September rate cut. However, if the war causes disruptions in the energy supply chain, even if the fighting subsides, the shadow of stagflation will still suppress the crypto market. Monitoring the Federal Reserve's interest rates remains a top priority.

Post-War Recovery Patterns in the Crypto Market

From past conflicts, the end of wars typically brings a gradual recovery of market confidence. For the Bitcoin market, the advancement of peace processes usually reduces the geopolitical risk premium, making investors more willing to take on risks. This rebound in risk appetite often benefits the price performance of risk assets like Bitcoin.

If Bitcoin demonstrates good risk resilience during wartime, institutional investors may increase its weight in their portfolios. Conversely, if it performs poorly, it may face pressure from capital outflows. From recent performance, Bitcoin's relative stability during geopolitical crises may enhance its standing in the eyes of institutional investors.

Conclusion

Looking ahead, with continuous technological advancements and the gradual improvement of regulatory frameworks, cryptocurrencies like Bitcoin are expected to play a more important role in the global financial system. Although various challenges and fluctuations may still be faced in the short term, its status as an important financial tool in the digital age has already been preliminarily established.

In this era of uncertainty, digital assets like Bitcoin are redefining our understanding of currency, value storage, and financial systems. While the road may be fraught with challenges, the historical significance and potential value of this transformation cannot be overlooked.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。