Trump Vs Powell: The Growing Rift Over Fed Rate Policy

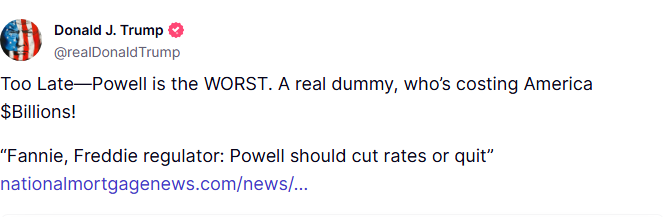

Donald Trump has once again criticised the Federal Reserve Chairman, stating it’s too late to act and accusing him of costing the US” hundreds of billions of dollars” by delaying interest rate cuts. This continues Trump’s long-standing critique of Powell’s resistance to political pressure on monetary policy.

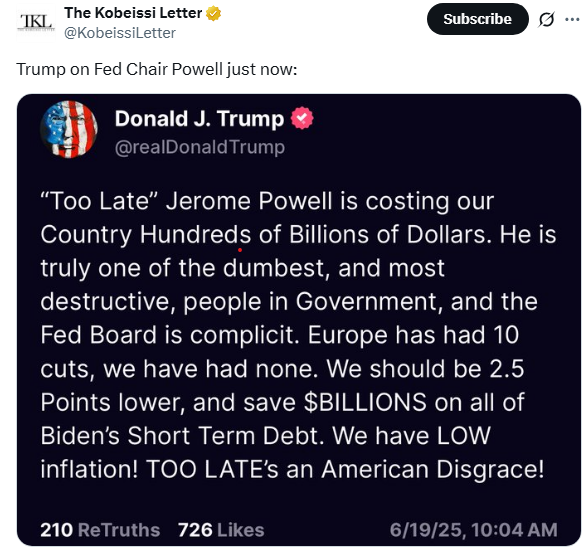

He claims that the US is now 2.5 percentage points lower in interest rates, which, according to him, results in saving billions of dollars on the short-term debt accumulated under President Biden.

In a late-night post on Truth Social, President Trump lashed out at Jerome Powell, calling “a real dummy” in his latest wave of criticism.

Source: Truth Social Post

Powell Under Fire: Trump's Renewed Critique of Fed Policy

The criticism came shortly after the Federal Reserve announced that it would maintain its benchmark interest rate in the range of 4.25% to 4.50% . While the central bank emphasised a cautious approach due to inflation uncertainties and global tensions, Trump didn’t hold back, labelling he's “deeply damaging” and even suggesting he’s among the most harmful figures in government decision-making.

Trump accused Powell of being “too slow to act”, further calling him “ a real dummy”

Source: X

Trump vs Powell: Interest Rates at the Centre of Politics Heat

Despite growing political heat, Federal Chair has remained composed, standing by his cautious and data-driven approach.

Speaking at a post-meeting press conference. Powell reaffirmed that the Fed's Decisions are guided secretly by economic data and not with political pressure. “For the time being, we are well-positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policies.”

Despite growing political pressure, Powell has stayed steady in his approach. During a post-meeting press briefing, he emphasised that the policy decision remains grounded in economic data, not external influence. “We’re closely tracking the numbers,” Powell Stated,” and any rate cuts will happen only when the conditions are right.”

Why "Too Late"? Trump's Rationale for Rate Cuts

President Trump argues that the US economy is fundamentally strong and could benefit greatly from a lower interest rate. In this view, cutting rates would act as ‘rocket fuel’ to accelerate growth and investments. He also points to recent rate cuts by central banks in Europe , suggesting that the Federal Reserve is falling behind global trends. According to Trump, tariffs - many of which were introduced during his administration - should not factor heavily into decision-making on interest rates.

Powell’s Defence:- On the other hand, the Fed primarily maintains that its decisions are driven by economic data, not political influence. The Fed Chair and other officials had continuously emphasized their dual mandate for the promotion to maximum employment and maintaining the stability of the prices.

They warned against the premature rate cuts, specifically with the extension remaining high. The Fed Chair has warned that tariffs would not push up the high consumer prices, and the Fed is opting to wait for clear signs that inflation is moving sustainably towards its 2% target before making any major policy shifts.

Wall Street Treads Carefully Amid Fed Tensions

Following the decision to hold the interest rate steady, financial markets showed a muted response. Wall Street experienced slight fluctuations, while bond yields dipped modestly- reflecting investor uncertainty about when, or if, rate cuts will come. Experts remain split: all others call for quicker action, while others warn that pressuring the Fed could risk its credibility and long-term stability.

Politics and Policy on a Collision Course

With the 2026 expiration of Powell’s term in sight and political tensions running high, Trump’s criticism may signal deeper changes ahead. The president has already suggested they would appoint a more aggressive, pro-growth. Fed Chair, if given the opportunity,- potentially shifting the central bank’s approach dramatically.

Powell Stays the Course- For New

Despite the growing politics; noise, Jerome Powell continues to focus on the Fed’s data-first mandate. A change in leadership could mark a significant shift in how the Fed approaches monetary policy.

Whether this strategy proves wise – or if Trump’s warnings of missed opportunities hold merit- will become clearer in the months ahead, as economic conditions evolve and the political spotlight sharpens.

Speculation Grows: Who Could be the Next Fed Chair ?

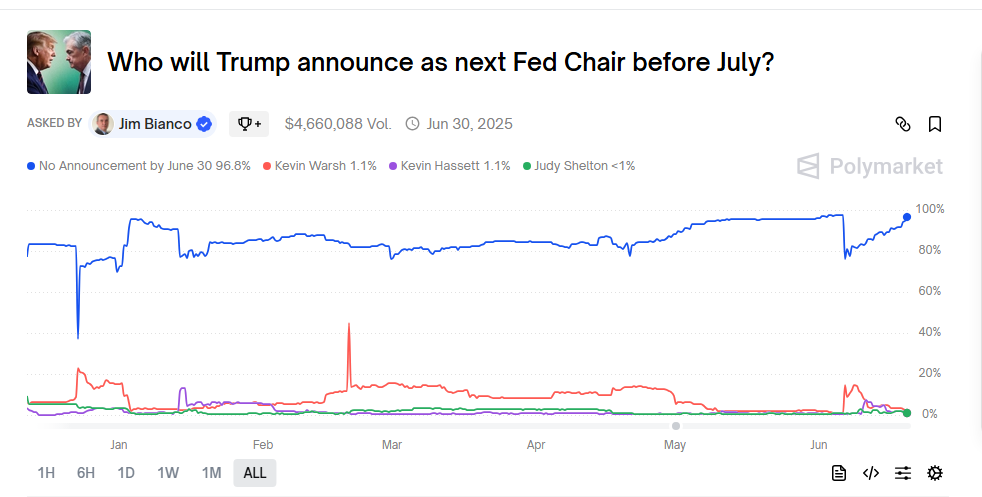

As the debate over the Federal Reserve’s direction intensifies, a new question is gaining traction: Who might succeed Jerome ? According to prediction data from PolymarketCap , several potential candidates are being discussed. Topping the list is former Fed Governor Kevin Warsh, currently with 1.1% support.

Trailing behind are economist Judy Shelton with 1% and tax policy advocate Arthur Laffer at 0.5%. Names like Kevin Hassett are also in the race to be elected as the Chair with equal percentage votes of 1.1% and Larry Kudlow have also surfaced, though with limited backing for now.

Source: PolyMarket

Looking Ahead: The Impact of Trump's Remarks on Future Fed Decisions

The tension between Trump and Powell goes beyond personal criticism- it’s a reflection of two very different views on economic leadership. Trump sees faster rate cuts as a way to boost growth and ease debt pressures, while Powell is committed to a slower, data-driven strategy aimed at long-term stability.

With the economic uncertainty still in the air, this debate is likely to grow louder. Whether Powell's steady approach proves effective or Trump’s urgency gains validation, one thing is clear: the decision made now will have lasting consequences for the US economy- and for the credibility of its central bank.

Also read: Semler Scientific Aims to Own 105,000 Bitcoins by 2027免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。