Peter Schiff Says Silver Has More Upside Than Bitcoin or Gold

Gold enthusiast and economist Peter Schiff is again loudly advocating for silver, this time emphasizing its value as a superior investment opportunity than both gold and virtual currency such as Bitcoin. Silver now offers a rare combination of low downside risk and high upside potential, particularly for anyone desiring to diversify away from gold, says Schiff. Peter Schiff believes that it does not make a lot of sense to invest in Bitcoin when the conventional asset provides what he considers a more realistic and stable opportunity.

Source: Peter Schiff X Handle

The Inflation Hedge Debate: Silver vs Crypto

The argument by Peter Schiff is based on the practical use of silver. It is an industrial metal that is utilized in electronics, energy, and manufacturing, among other uses. It has real value which is not speculative. He feels this makes this physical asset a more solid investment than digital currencies. Though gold is still a primary inflation and market uncertainty hedge, Peter Schiff feels that this traditional asset has more potential for growth in current times since it has more uses industrially and is less expensive per ounce.

Silver: Bound for New ATH?

Currently BTC is up by 50% from previous Ath and gold is up by 65% from Ath, and silver is currently down 28% from Ath. If it follows BTC and Gold it can be up by 70 to 80% from current levels. On the 6 month chart rounding pattern it seems, if the rally continues it will hit ATH and sustain above can hit new all time high as BTC and gold.

Source: Trading View

Peter Criticizes Bitcoin Again

As much as digital currencies' popularity increases, Peter Schiff is still skeptical of their long-term worth . He has wondered why people are still rushing into a highly volatile virtual asset with no practical use scenario, more so when the likes of the second best traditional asset can be used as an alternative. In his opinion, digital currencies are being purchased based on hype rather than fundamentals and will be a greater risk in a bear market.

Counterpoint: What Crypto Advocates Say in Response?

Many in the crypto community strongly disagree with the outlook of Peter Schiff. They argue that his comparison between these two assets is outdated. While silver prices have remained flat for over a decade, Bitcoin has seen exponential growth and broader adoption. Critics point out that digital assets are now part of a growing financial system, accepted by governments, major companies, and institutional investors adopting Bitcoin as a key reserve asset .

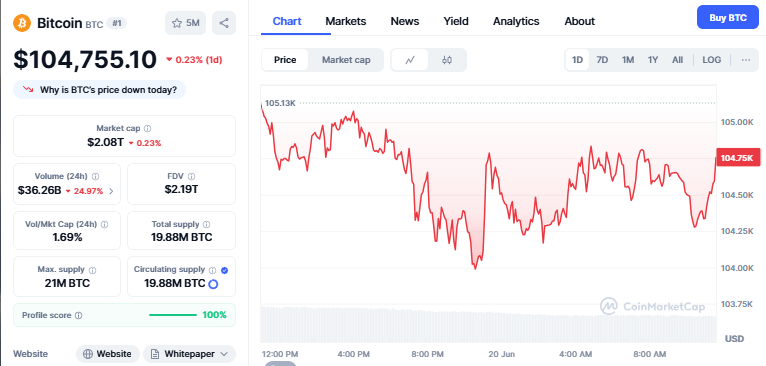

The currency is currently trading at 104755.10 with a decrease of 0.22% in the last 24 hours. The decline in price is due to the geopolitical uncertainty due to the Iran-Israel war , profit taking, no change in fed interest rates.

Source: CoinMarketCap

These advocates consider Bitcoin not only as a store of value, but as a monetary system innovation, programmable, global, and independent of central banks.

Traditional Assets vs. Digital Currency

The crux of the argument is the characteristics of each asset. Silver is a commodity mined, with value allocated to supply, demand, and industrial trends. Its supply is continued, and its price is susceptible to changes in global production and policy. Bitcoin, on the other hand, is a decentralized digital network with a maximum supply of 21 million coins. Believers think this finite supply causes digital scarcity and makes Bitcoin a better long-term store of value, especially in an era of escalating inflation and monetary uncertainty.

Two Alternatives, One Question

Both these assets present different approaches for investors. XAGUSD could still remain as a conventional hedge with tangible demand. But for those wagering on the future of finance, Bitcoin is becoming a digital alternative to conventional systems.

Peter Schiff is firm in his conviction that silver is the superior option, but in an ever-evolving financial landscape, others are turning to technology-based assets that move ahead of conventional models.

Also read: Is Visa Fueling Global Stablecoin Domination in 2025?免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。