Source: The GENIUS Stablecoin Play

Compiled by: Lenaxin, ChainCatcher

On August 15, 1971, President Nixon announced a series of economic policies: the end of the dollar's convertibility to gold, a freeze on wages and prices, and a 10% import tariff. "I have instructed the Secretary of the Treasury to take necessary measures to protect the dollar from speculators." This declaration, which changed the global monetary system, was later referred to as the "Nixon Shock," and at the time, it was more criticized than praised.

This week, the U.S. Senate passed the GENIUS Stablecoin Act with an overwhelming vote of 68 to 30, marking a key step towards the first comprehensive regulatory framework for a digital dollar in the United States. Unlike Nixon's hasty abandonment of the gold standard, this legislation builds a prudent and thorough monetary infrastructure for the digital age. According to Citigroup's predictions, the current $250 billion stablecoin market could soar to $3.7 trillion by 2030 in a bull market scenario.

The bill is pending a vote in the House of Representatives and the President's signature. This in-depth report will analyze:

- How will this bill reshape the financial system?

- Why is Tether facing an existential crisis?

- Is the U.S. truly at a watershed moment for its monetary system?

Blueprint for a Digital Dollar

The GENIUS Act delineates clear boundaries in the digital currency space. Unlike the past fragmented cryptocurrency regulations, this bill establishes explicit standards:

Its core requirement is straightforward: Stablecoin issuers must maintain a 1:1 reserve of dollars, short-term government bonds maturing within 93 days, or equivalent liquid assets, and must undergo mandatory public audits every month. Interest-bearing stablecoins are explicitly prohibited.

Only three types of entities can issue payment stablecoins: subsidiaries of insured banks, federally qualified non-bank issuers approved by the Office of the Comptroller of the Currency, or state-qualified issuers that meet federal standards. Foreign issuers are granted only a three-year transition period, after which non-compliant entities will be completely excluded from the U.S. market.

By classifying stablecoins as "digital currency" rather than special crypto assets, the bill transforms them from chaotic experiments into legitimate financial infrastructure through monthly reserve disclosures, criminal accountability for false statements, and compliance with the Bank Secrecy Act. This move not only establishes the legal status of the digital dollar but also systematically eliminates non-compliant participants.

Increased Competition

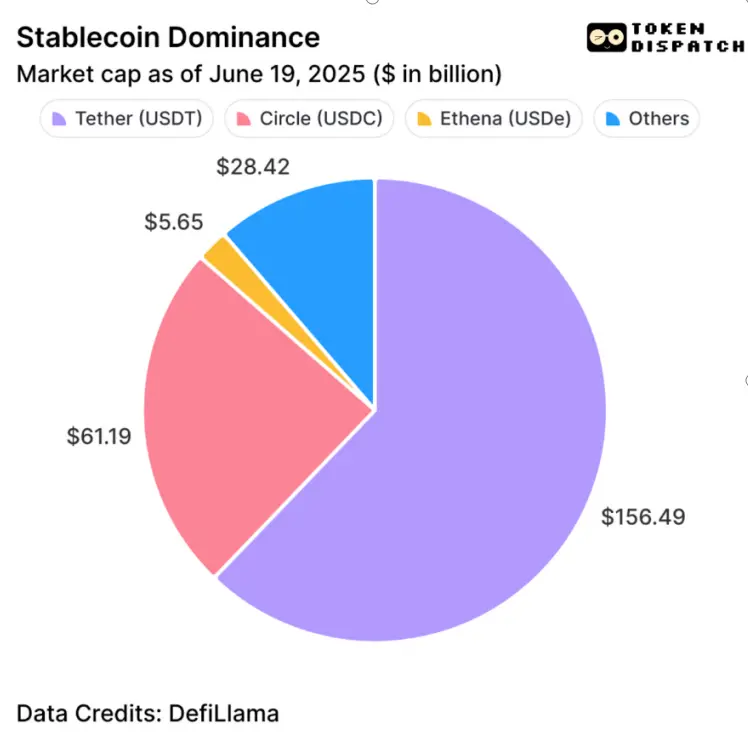

For Tether, the world's largest stablecoin issuer, the GENIUS Act serves as a precisely worded three-year countdown ultimatum. The issuer of USDT, which currently holds a 62% share of the stablecoin market, may face the most severe impact—confirming the market law that "the bigger the tree, the more wind it catches."

Tether's existing reserve structure does not meet the bill's requirements; its website shows that only 81.5% of USDT is backed by cash and short-term deposits, failing to reach the 1:1 high liquidity asset standard. Its Italian auditing firm BDO also does not meet U.S. PCAOB qualification requirements and needs to rebuild its auditing system.

Although its CEO has promised to launch compliant products, Tether's business model, which relies on high-yield investments, directly conflicts with the bill's prohibitions. During the three-year transition period, USDT will lose institutional support from banks, payment processors, and corporate finance, leading to a continuous reduction in application scenarios.

As the issuer of USDC, Circle's stock surged 35% after the bill's passage, reaching five times its issuance price. Its domestic advantages, compliant reserves, and banking partnership network capitalize on regulatory benefits, and the recent integration of USDC payments by Shopify further highlights its expansion momentum.

The Game of Safety and Innovation

The most controversial provision of the GENIUS Act is the comprehensive ban on interest-bearing stablecoins, reflecting Congress's deep lessons learned from the collapse of cryptocurrency leverage. The core idea is that payment tools should not have investment attributes. When stablecoins generate returns, their nature approaches that of bank deposits or securities, and the traditional banking system manages such systemic risks through mechanisms like deposit insurance and capital adequacy ratios.

This will directly impact decentralized finance (DeFi) protocols that rely on interest-bearing stablecoins. The bill explicitly excludes "securities issued by investment companies" and "deposits" from regulatory oversight, meaning that users seeking returns can only turn to tokenized bank deposits or regulated investment products.

However, controversy follows. While users bear the opportunity cost of holding non-interest-bearing assets, stablecoin issuers can still earn returns through investments in interest-bearing instruments. This trade-off brings institutional confidence that far exceeds the value lost from DeFi yields: monthly reserve transparency, mandatory anti-money laundering compliance, and transaction monitoring requirements are transforming stablecoins from fringe experiments in the crypto space into formal financial infrastructure.

Now, large banks can view compliant stablecoins as true cash equivalents, corporate finance departments can hold them with confidence, and payment service providers can integrate them based on their bank-standard characteristics. This institutional recognition may reshape the entire financial ecosystem.

Infrastructure for Scalable Applications

The GENIUS Act builds a regulatory foundation for stablecoins to integrate into mainstream finance through custodial protection and compliance clarity as its two pillars.

The custodial framework requires qualified custodians to isolate client assets, prohibit the mixing of funds, and ensure priority in bankruptcy settlements, extending traditional financial protections to the digital asset space.

- For retail users, the bill preserves the right to self-custody while requiring service providers to meet bank-level standards, allowing regulated stablecoin wallets to enjoy the same protections as bank accounts.

- For corporate applications, cross-border settlements can be shortened to minutes, supply chain payments can achieve programmable circulation, and fund management can break through holiday restrictions. Individual users can also enjoy fast cross-border transfers without high fees.

The bill also mandates the assessment of interoperability standards to ensure stablecoins can circulate across platforms, avoiding regulatory fragmentation that hinders innovation.

Challenges to Implementation

Although the GENIUS Act has bipartisan support, its implementation still faces multiple challenges:

Compliance costs will reshape the market landscape. The monthly audits, complex reserve management, and ongoing regulatory reporting required by the bill effectively create a high compliance barrier. Large issuers can easily cope with this due to their scale, while small and medium-sized stablecoin companies may be forced out of the market due to soaring operational costs.

Cross-border friction hinders global applications. European companies using dollar-pegged stablecoins may face "currency conversion" and "foreign exchange risk" issues. Heiko Nix, head of global cash management and payments at German industrial giant Siemens, revealed to Bloomberg that this is precisely why the company chose tokenized bank deposits.

The ban on yields may force innovation to flow elsewhere. If other jurisdictions allow interest-bearing stablecoins, the U.S. may maintain financial stability but could lose technological leadership. DeFi protocols that rely on interest-bearing stablecoins will face cliff-like impacts if they cannot find compliant alternatives.

Coordination between state and federal regulation adds new variables. The bill allows issuers with a market cap below $10 billion to choose state regulatory systems, but they must prove that their standards are "substantially similar" to federal requirements. State regulators must proactively submit compliance proof, and the Secretary of the Treasury has the authority to veto certifications, forcing reluctant issuers into the federal regulatory framework.

Token Dispatch Observations

With the Republican Party controlling the House of Representatives with a 220-212 seat majority, the bill's passage was virtually assured, but its execution will test the U.S.'s ability to balance innovation and regulation. This legislation may reshape the monetary sovereignty landscape in the digital age, just as the "Nixon Shock" ended the gold standard amid controversy in 1971; today, the GENIUS Act may usher in a new era for the digital dollar. Its core mechanism is: forcing all compliant stablecoins to use dollars/U.S. Treasuries as reserves, directly converting global stablecoin demand into reliance on the dollar system.

The bill introduces a unique "substantially similar" reciprocity clause: compliant entities are allowed to enter the U.S. market, while non-compliant ones face market isolation. Ironically, this technology, originally created to evade centralized regulation, has become a tool to reinforce dollar hegemony. Crypto fundamentalists will have to confront this institutional irony.

Traditional financial institutions view it as a turning point for digital assets to integrate into mainstream finance, while Circle's 35% stock surge confirms capital's choice: a clear regulatory framework is far more attractive than a wild-growing market. When technological idealism meets real-world regulation, the market has cast its vote of trust with real money.

Disclaimer

The content of this article does not represent the views of ChainCatcher. The opinions, data, and conclusions in the text reflect the personal positions of the original author or interviewees. The compiler maintains a neutral stance and does not endorse their accuracy. This does not constitute any professional advice or guidance; readers should exercise caution based on independent judgment. This compilation is for knowledge-sharing purposes only; readers should strictly adhere to the laws and regulations of their respective regions and refrain from participating in any illegal financial activities.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。