When a person dies, their assets may also be lost; this is not just a joke. Without proper planning, personal assets may face the risk of complete disappearance.

Written by: 1912212.eth, Foresight News

In Zhao Benshan's skit "Not Short of Money," Xiao Shenyang said, "The most painful thing in life is when a person dies, and the money hasn't been spent." In the world of blockchain, perhaps the most painful thing is when a person dies, not only leaving money unspent but also having the hard-earned fortune permanently "forgotten" on exchanges or on-chain.

Recently, Binance launched the "Emergency Contact and Heir" feature in its app update, sparking heated discussions in the market. Specifically, users can add an emergency contact in the "Account Security" settings of the Binance app, with the path being: Home - Personal Information - Account Security - Emergency Contact. When an account remains inactive for a long time, Binance will automatically notify the emergency contact, who has the right to apply for inheritance.

After this feature was widely disseminated, some users quickly set up their emergency contacts.

The Billion-Dollar Dilemma of Crypto Asset Inheritance

The decentralized nature of cryptocurrencies gives users complete control over their assets but also brings a tricky problem: when a user unexpectedly passes away or loses access to their account, their digital assets are often permanently locked on the blockchain due to lost private keys or lack of knowledge. It is estimated that the loss of crypto assets due to accidental deaths exceeds $1 billion each year, with a significant amount of assets stranded in centralized exchanges.

In April 2018, XRP early investor Matthew Mellon, a scion of American banking, made substantial early investments in XRP and reaped huge returns. After his unexpected death, many funds could not be taken over by his family or lawyers because the assets were stored in multiple opaque cold wallets and were not properly backed up. At the end of 2018, QuadrigaCX's founder and CEO Gerald Cotten suddenly died in India, claiming to be the only person who held the private keys to the cold wallets. Since no one could access these wallets, a large amount of user funds remains unrecoverable to this day. The exchange went bankrupt, leading to significant user losses, becoming one of the most famous "locked assets due to death" cases in crypto history. In June 2021, early Bitcoin evangelist Mircea Popescu drowned in Costa Rica. Rumors suggested he held tens of thousands of BTC, but he left no clear asset access authorization or inheritance plan, which could lead to the permanent loss of his Bitcoin holdings.

One user stated, "If a low-profile crypto investor suddenly faces an accident, and their relatives and friends have never understood the user's trading history, with parents not even knowing what Binance is, this passively stored fund will likely remain unknown forever."

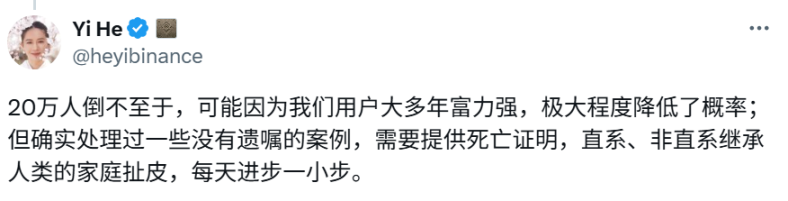

Binance co-founder He Yi publicly responded in the Twitter comments, stating that Binance users are generally young and strong, significantly reducing the probability of accidental death, but they have indeed dealt with some cases without wills, requiring death certificates and handling disputes over direct and non-direct inheritance.

In the past, the crypto industry had very limited solutions to this problem. The traditional financial system relies on wills, lawyers, and courts to handle estate distribution, which is a costly and lengthy process. In the crypto world, the anonymity and irreversibility of private keys make this process exceptionally complex.

Zhao Changpeng also tweeted, "This is a topic people are reluctant to mention, but humanity has not achieved immortality. Every platform should have a 'will function' to ensure that when users are no longer around, their assets can be distributed to designated accounts in specified proportions." Legal regulations should also allow minors to have accounts (trading may not be allowed, but receiving funds should be).

The Will Function is Not a New Concept

Long before, entrepreneurs in the crypto field had considered the issues of asset inheritance and wills, pushing for wallet functionality upgrades.

In 2021, the decentralized incapacitation switch application Sarcophagus included a will function. Built on Ethereum and Arweave, users can upload files in Sarcophagus and designate private key recipients. If the user fails to perform an action or the set time expires, the recipient will receive the private key to access the files stored in Arweave. Use cases include wills and trusts, password recovery, and certificate storage.

In 2022, Israeli blockchain technology developer Kirobo launched a crypto asset inheritance feature on its Liquid Vault wallet, allowing users to designate crypto wallets for inheritance. This feature supports the generation and execution of automated wills without the need for lawyers, government agencies, or any other centralized entities; users simply select up to 8 beneficiaries and choose a date for asset distribution to designated wallets. Subsequent wallets, including Webacy, have also introduced will-related features.

On the exchange side, Gate launched the "Backup Contact (Account Heir)" feature five years ago. With Binance adding emergency contacts, it may attract more exchanges and on-chain wallets to follow suit with similar feature upgrades.

The Next Stop for Digital Inheritance

Binance's emergency contact and heir feature is a significant breakthrough in the field of digital asset management, but it is not the end. With the rapid development of the crypto industry, the concept of digital inheritance will become more complex. For example, future solutions may need to encompass non-fungible tokens (NFTs), decentralized identities (DIDs), and on-chain social relationships as non-financial assets. Additionally, the combination of smart contracts and multi-signature wallets may further enable automated and trustless asset inheritance.

For users, Binance's feature reminds us that managing crypto assets is not only a technical issue but also a part of life planning, reminding us that while enjoying the freedom of cryptocurrencies, users must also prepare for an unpredictable future.

The launch of Binance's emergency contact and heir feature is not only a precise insight into user needs but also a measure to consolidate its leadership position in the global crypto market. In the future, as technology and regulations continue to improve, the inheritance of digital assets will become more seamless, making the crypto world more humane and sustainable.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。