Will JPMD Spark a Tokenization Boom on Base?

Launching a Groundbreaking Deposit Token on Base Network, JPMorgan asserts its superiority over stablecoins.

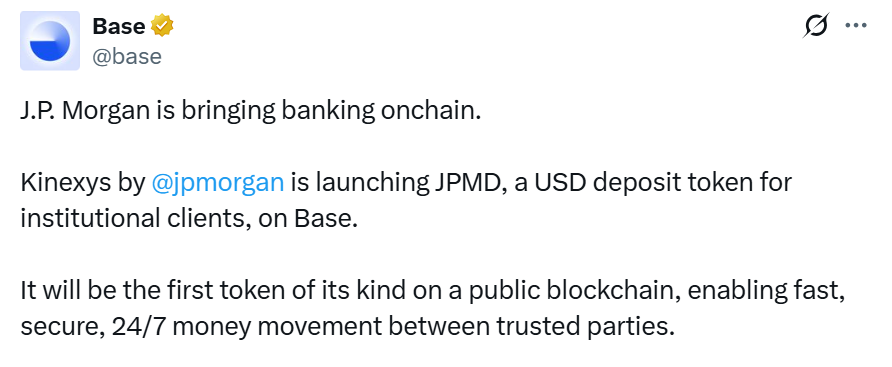

J.P. Morgan is launching JPMD, a USD deposit token for institutional clients on Base, marking the first of its kind on a public blockchain for secure, 24/7 money movement. This isn't about adopting cryptocurrency. Banks are rebuilding settlement rails in public. JPMorgan Chase filed a trademark application on June 15th, which has already given hints to investors for the stablecoin project. JPMD's entry into the stablecoin space challenges existing players like Tether (USDT) and Circle (USDC), which currently dominate the market.

This is massive for crypto as JPMorgan's entry into the deposit token market with JPMD, particularly on platforms like Base, signifies a significant endorsement from traditional finance for digital assets. This move enhances credit and liquidity channels, potentially transforming cash management and settlements. Additionally, JPMD can provide a foundation for cross-bank collaboration and stablecoin competition, offering regulated alternatives.

Source X

Is Base Network Ready for JPMorgan’s Big Move?

The introduction of a deposit token by JPMorgan to Base gives TradFi access to go on-chain, which might open up new credit and liquidity channels for financial companies. It is an Ethereum Layer 2 platform, gaining popularity due to its scalability and institutional-grade infrastructure. Its partnership with Coinbase, which supports the deposit token, increases the platform's profile for enterprise use cases beyond retail DeFi or memecoins. This partnership brings trust, liquidity, and volumes to the platform, potentially increasing TVL and developer interest in real-world asset tokenization projects. Additionally, Coinbase's integration reduces barriers to entry for institutions, making its security, speed, and custodial offerings an attractive entry point.

JP Morgan is shifting funds onchain for this reason:

In contrast to stablecoins, the JPMD token offers prospective benefits like interest and deposit insurance by directly representing claims on commercial bank accounts.

-

Reduced fees due to cheaper blockspace.

-

Real-time auditability for regulators and risk teams.

-

Programmable flows for split, stream, or self-refund.

-

Allows idle cash to earn or collateralize upon wallet hit.

-

Tradfi seeks the same advantages as crypto.

-

Instant market reach with a browser and internet link.

-

24/7 money movement, reducing settlement times.

Will JPMD drive massive institutional flows onto Base

This indicates a number of significant changes in institutional finance as well as the larger ecosystem of digital assets. The collaboration will legitimize real-world asset tokenization on public blockchains, increasing transparency and enabling programmable finance. It also drives regulatory clarity, normalizing tokenized settlement, and attracting mainstream attention, driving fintechs, banks, and DeFi projects to collaborate on compliance, user experience, and global accessibility. JPMorgan's move to integrate digital assets into banking could enhance crypto integration, making it safer for larger institutions. This could also improve credit and liquidity channels by using JPMD as collateral, potentially alongside assets like spot Bitcoin ETFs. Additionally, JPMorgan's deposit tokens could challenge crypto-native stablecoins by offering regulated, institutionally-backed alternatives, potentially transforming cash management, collateral transfers, and intra-bank settlements.

The financial sector is undergoing a change as a result of this move. Due to worries about the security and use of public blockchains, banks have historically mostly refrained from introducing products on them. However, under President Donald Trump's second term, there has been a regulatory thaw towards cryptocurrency startups in the US.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。