The Collapse of Stablecoins and Traditional Payment Models

Written by: Rob Hadick, Partner at Dragonfly

Translated by: AididiaoJP, Foresight News

Stablecoins are not meant to improve the existing payment networks; rather, they aim to completely disrupt traditional payment networks. Stablecoins allow businesses to bypass traditional payment channels entirely, meaning that these traditional payment channels are likely to be completely replaced one day in the future.

When payment networks are based on stablecoins, all transactions are merely changes in ledger numbers. Many emerging companies are already beginning to drive the reconstruction of capital flow methods.

Recently, there has been much discussion about how stablecoins can become a Banking as a Service (BaaS) network platform, connecting existing payment channels from issuing banks to merchant acceptance, and everything in between. While I agree with these views, when I think about how businesses and protocols will create and accumulate value in the future under this new paradigm, viewing stablecoins merely as a platform connecting existing payment channels actually underestimates their true potential. Stablecoin payments represent a gradual improvement, indicating the possibility of reimagining payment channels from the ground up.

To understand the future direction, we need to look back at history, as history reveals the obvious evolutionary path.

The Evolution of Modern Payment Channels

The origins of modern payment systems can be traced back to the early 1950s. Diners Club, founded by Frank McNamara, launched the first multi-purpose charge card. This charge card introduced a closed-loop credit model, with Diners Club acting as an intermediary between merchants and cardholders. Before Diners Club, almost all payments were made directly between merchants and customers through cash or proprietary bilateral credit agreements.

After the success of Diners Club, Bank of America (BofA) saw a huge opportunity to expand its credit business and reach a broader customer base, launching the first consumer credit card aimed at the mass market. BofA mailed over 2 million unsolicited, pre-approved credit cards to middle-class consumers, which could be used at more than 20,000 merchants in California. Due to regulatory constraints at the time, BofA began licensing its technology to other banks in the U.S. and even expanded to international markets, leading to the creation of the first credit card payment network. However, this was accompanied by significant operational challenges and serious credit risks, with delinquency rates soaring above 20%. Coupled with rampant fraud, the entire project was on the verge of collapse.

People began to realize that the challenges and chaos within the banking network could only be resolved by establishing a true cooperative organization that would set the rules for managing the system and provide infrastructure. Members of the organization could compete on product pricing but needed to adhere to unified standards. This organization later became known as Visa. Another organization founded by California banks, which competed with Bank of America, later became Mastercard. This marked the birth of our modern global payment model, which has become the dominant structure in the global payment industry.

From the 1960s to the early 21st century, almost all innovations in the payment field revolved around enhancing, complementing, and digitizing the current global payment model. After the internet boomed in the 1990s, many innovations shifted to software development.

E-commerce emerged in the early 1990s, with the purchase of Sting's CD on NetMarket being the first online payment. Subsequently, PizzaNet became the first national retailer to accept online payments. Well-known e-commerce companies such as Amazon, eBay, Rakuten, and Alibaba were established in the following years. The prosperity of e-commerce companies led to the emergence of many early independent payment gateway and processor companies. The most notable were Confinity and X.com, founded in late 1998 and early 1999, respectively, which merged to become today's PayPal.

Digital payments gave rise to numerous household names with market capitalizations in the hundreds of billions of dollars. These companies connected offline merchants and online retail, including payment service providers (PSPs) and payment facilitators (PayFacs) such as Stripe, Adyen, Checkout.com, and Square. They addressed merchant-side issues by bundling gateways, processing, reconciliation, fraud compliance tools, merchant accounts, and other value-added software and services. However, it is clear that they did not bring about a disruptive transformation of traditional financial payment networks.

While some startups focused on disrupting traditional banking payment networks and issuing infrastructure, well-known companies like Marqeta, Galileo, Lithic, and Synapse primarily aimed to bring new companies into the existing banking networks and infrastructure, rather than disrupting the existing payment networks. Many companies found that simply adding a software layer on top of existing infrastructure did not lead to true exponential growth.

Some businesses are acutely aware of the limitations of traditional payment methods and foresee that a payment solution can be built entirely independent of traditional banking infrastructure based on internet-native currencies, with PayPal being the most famous example. In the early 21st century, many startups focused on developing digital wallets, peer-to-peer transactions, and alternative payment networks. By completely bypassing banks and issuing alliances, these companies provided end customers with a degree of monetary autonomy, including PayPal, Alipay, M-Pesa, Venmo, Wise, Airwallex, Affirm, and Klarna.

Initially, they focused on providing a better user experience, product offerings, and cheaper transactions for groups overlooked by traditional finance, but gradually began to capture an increasing market share. Traditional financial payment companies felt the threat from these alternative payment methods (APMs), leading Visa and Mastercard to launch Visa Direct and Mastercard Send, respectively, also focusing on providing real-time payment services for peer-to-peer transactions. Although these models have seen significant improvements, they are still plagued by the limitations of existing infrastructure. These companies still need to pre-fund or bear foreign exchange/credit risks while needing to hedge their own capital pools, making instant transparent settlement impossible.

Essentially, the evolutionary path of modern payments is: closed-loop + trusted intermediary → open-loop + trusted intermediary → open-loop + partial individual autonomy. However, opacity and complexity still dominate, resulting in a poorer user experience and rent extraction at various stages throughout the network.

The Evolution of Merchant Payments

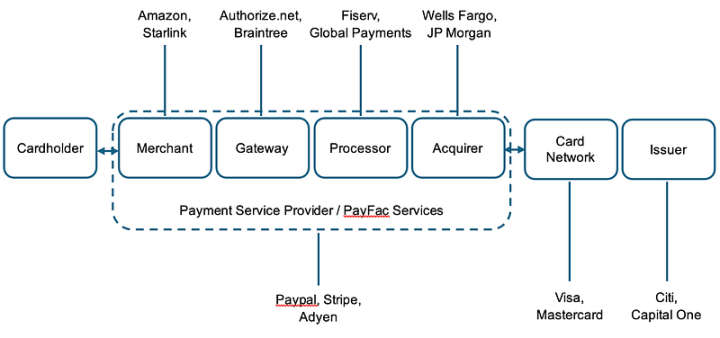

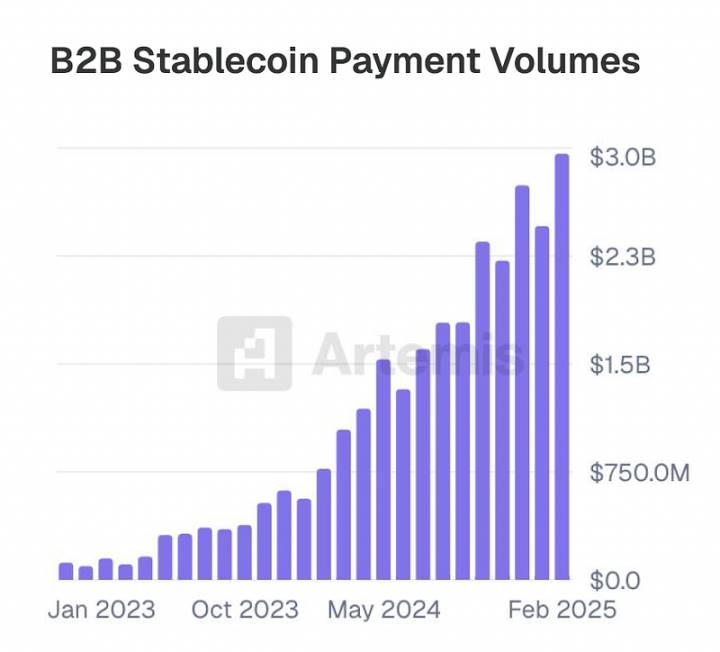

Businesses can bypass part or all of the traditional payment network's technical infrastructure through stablecoins. The following is a simplified diagram of merchant payments:

And the responsibilities of each part in the stablecoin payment network:

Currently, Stripe is already handling a significant portion of the work on the merchant side of payments, including providing merchant accounts and various software for operating businesses and accepting payments. However, they have not formed their own issuing organization or issued payment cards.

Now imagine a world where Stripe becomes a central bank, issuing its own stablecoin backed by collateral approved by the GENIUS Act. Stablecoins can achieve atomic settlement between consumer and merchant accounts through a transparent open-source ledger (blockchain). You no longer need payment card banks and acquiring banks; Stripe (or any other issuer) only needs one (or a few) banks to hold the collateral for its issued stablecoins. They transact directly on the blockchain through wallets or by initiating minting/redeeming requests to Stripe (the issuer/central bank), followed by settlement on the blockchain. The clearing and settlement of funds are completed through a series of smart contracts that can handle refunds and disputes (see Circle's refund agreement). Similarly, payment routing and even conversions to other currencies/products can be programmed. With stablecoins and blockchain technology, the data transmission standards from banks to gateways, processors, and networks become easier. The transparency of data and the reduction of stakeholders simplify fees and accounting.

In such a world, Stripe seems to have almost completely replaced the current payment model—possessing complete infrastructure, providing accounts, issuing, credit, payment services, and networks, all built on better technology, thereby reducing intermediaries and allowing wallet holders almost complete control over the flow of funds.

Simon Taylor: "If everything is based on stablecoins, all transactions are merely changes in ledger numbers. Merchants, gateways, PSPs, and banks previously needed to reconcile different ledger entries. With stablecoins, anyone operating with stablecoins is simultaneously a gateway, PSP, and acquiring bank; all transactions are just changes in ledger numbers."

This sounds like science fiction. Are there many real-world issues related to fraud, compliance, the availability of stablecoins, liquidity/costs, etc.? Will there be incremental steps from today to this potential future? Technologies like real-time payments (RTPs) also have flaws, and the programmability and interoperability of cross-border remittances are issues that RTP cannot solve.

Regardless, the future is gradually arriving, and some companies are preparing for it. Top issuers like Circle, Paxos, and withausd are expanding their products, while payment-focused blockchains like Codex, Sphere, and PlasmaFDN are also moving closer to end consumers and businesses. Future payment networks will significantly reduce intermediaries, increase autonomy, enhance transparency, improve interoperability, and bring more value to customers.

Cross-Border Payments

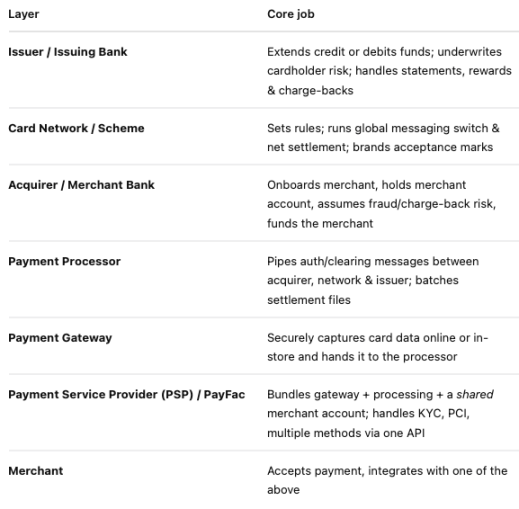

B2B cross-border payments are currently one of the areas where stablecoin applications are growing significantly.

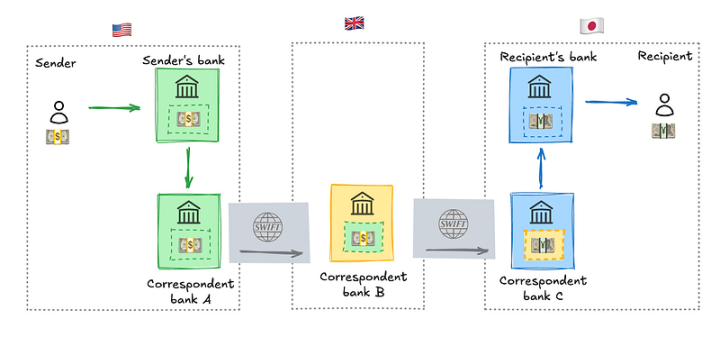

Matt Brown wrote an article about cross-border payments last year, from which we can see:

In many cases, there are multiple banks involved in cross-border transactions, all using SWIFT to transmit information. SWIFT itself is not the problem, but the back-and-forth communication between banks incurs additional time costs, often involving other clearing counterparties. In fact, the clearing process typically takes 7-14 days to complete, undoubtedly bringing significant risks and costs, and the process is extremely opaque. For example, it is not uncommon for JPMorgan to "lose" millions of dollars for extended periods when transferring funds from its U.S. parent company to foreign subsidiaries. Additionally, there are foreign exchange risks among multiple counterparties, leading to an average increase in transaction costs of 6.6%. Furthermore, when a company's funds flow across borders, they are almost unable to earn interest.

Therefore, it is not surprising that Stripe recently announced the launch of a stablecoin-based financial account. This allows businesses to access dollar financial accounts supported by stablecoins, directly mint/redeem stablecoins through Bridge, and transfer funds to other wallet addresses via the Stripe dashboard. Using the Bridge API for fiat deposits and withdrawals, issuing payment cards backed by stablecoin balances (depending on the region, currently using Lead Bank), exchanging for other currencies, and ultimately directly converting to interest-bearing products for fund management. Although many features still rely on traditional systems as temporary solutions, the sending, receiving, issuing, and exchanging of stablecoins and tokenized assets do not depend on traditional systems. The fiat deposit and withdrawal solutions are similar to the current state of alternative payment methods (APMs), where companies like Wise and Airwallex essentially create their own banking networks to hold funds in different countries and settle net amounts at the end of the day. Airwallex's co-founder Jack Zhang correctly pointed this out last week, but he did not consider how the world would change if fiat deposits and withdrawals were no longer needed.

If you are simply purchasing tokenized assets through stablecoins without needing to convert to fiat, you essentially bypass the traditional agency model entirely. This would significantly reduce users' reliance on third parties that actually hold and send assets, allowing customers to capture more value and lower payment costs for everyone. Startups like Squads protocol, Rain cards, and Stablesea are all working towards the possibility of directly buying and selling tokenized assets through stablecoins, and all companies operating in this space will eventually expand across the entire network.

However, if you want to convert stablecoins to fiat for use, Conduit Pay can work directly with the largest local forex banks to enable seamless, low-cost, and almost instant on-chain cross-border transactions. Wallets become accounts, tokenized assets become products, and blockchains become networks, significantly improving the user experience, with potentially lower costs if fiat deposits and withdrawals are not required. All of this can be achieved through better technology, providing simpler reconciliation, more autonomy, higher transparency, faster speeds, stronger interoperability, and even lower costs.

So what does all this mean?

It means that a payment-native world exists on-chain, based on stablecoins (changes in ledger numbers), is coming. It will not only connect current payment models but will gradually replace them. This is why we will see the first trillion-dollar stablecoin-based fintech company emerging soon.

I know this article will provoke many reasonable criticisms, such as my failure to consider certain issues. But please understand that I and many entrepreneurs in this field are already aware of these issues and are working hard to address them. Innovation is like this; incremental building on old systems will never truly bring about a brand new system because vested interests will always obstruct such occurrences.

Closed-loop + trusted intermediary → open-loop + trusted intermediary → open-loop + partial individual autonomy → truly open digital-native systems, where everyone can compete across the entire payment network, and customers exercise autonomy through open networks.

This article represents the author's subjective views and does not necessarily reflect the views of Dragonfly or its affiliates. Dragonfly may have invested in some of the protocols or cryptocurrencies mentioned in this article.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。