Original Author: BitMEX

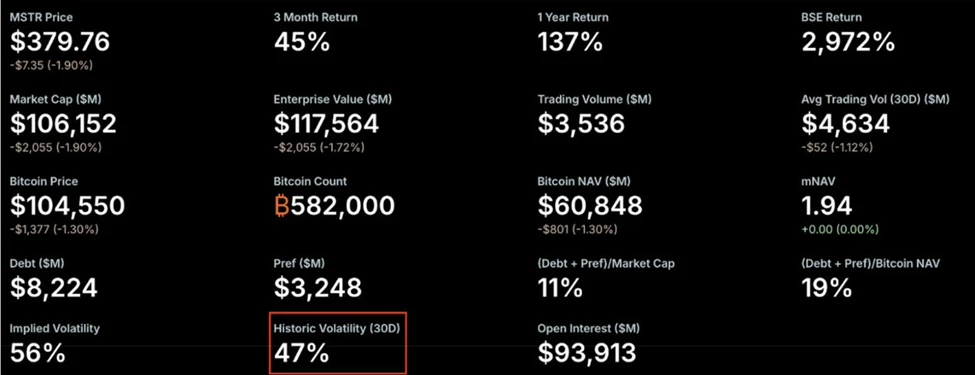

As Bitcoin once again becomes the focus of global investors, publicly listed companies holding Bitcoin—commonly referred to as "Bitcoin treasury stocks"—are also experiencing a surge in valuation. Japan's Metaplanet (stock code MTPLF) is currently trading at a premium of about 7 times mNAV (market capitalization / net asset value), far exceeding the approximately 1.8 times of the established American "Bitcoin treasury" MicroStrategy (MSTR). What does this figure really mean? Does Metaplanet truly possess stronger asset management and financing capabilities, or is it merely a product of investor sentiment? This article will analyze the logic behind Metaplanet's valuation from three aspects: financing structure, Bitcoin accumulation efficiency, and risk.

1. Floating Strike Price Warrants: A New Bottle for Old Wine, or a Systemic Breakthrough?

Traditional publicly listed companies often use a combination of "convertible bonds + stock issuance" to quickly raise funds for purchasing Bitcoin. However, once convertible bonds trigger conversion, they often lead to significant dilution for existing shareholders, putting pressure on the stock price. Metaplanet has innovatively introduced "floating strike price warrants" in Japan.

The core innovation of Metaplanet's floating strike price warrants is that the exercise price is not locked in at one time, but is dynamically adjusted based on stock price performance and preset indicators. The company set the initial exercise price at 1,388 yen, which is 1.83% higher than the previous trading day's closing price. This premium design reflects the management's strong confidence in the company's intrinsic value. More importantly, in the highly volatile environment of cryptocurrency-related stocks, this dynamic adjustment mechanism can effectively weaken the vicious cycle of "sell-off—dilution—re-sell."

Metaplanet demonstrates extreme focus and strategic clarity in its use of funds. The company allocates 96% of the raised funds directly to Bitcoin purchases, with the remaining small amount used for bond redemption and yield generation strategies (such as selling put options). This highly concentrated allocation strategy reflects the management's firm belief in Bitcoin as a strategic asset to hedge against Japan's long-term negative interest rate environment and the weakness of the yen.

In terms of risk control, the company has set multiple safety thresholds:

Minimum exercise price protection: A minimum exercise price of 777 yen is set to build a final defense line for shareholders in extreme market conditions, avoiding unlimited dilution risk.

Execution rhythm control: The Tokyo Stock Exchange rules limit the number of exercises per month to no more than 10% of the circulating share capital, and the right to suspend exercises is reserved to avoid sudden market shocks.

Institutional endorsement: Shares will be sold to EVO FUND, a Cayman Islands fund that has previously supported multiple rounds of financing for Metaplanet.

This design allows Metaplanet to "finance at a high premium" when stock prices soar and "accumulate Bitcoin at a low price" when Bitcoin adjusts, achieving "maneuver warfare" returns through time differences. When stock prices perform strongly, the exercise price of the floating strike price warrants will adjust accordingly, allowing the company to issue new shares at a higher price; when Bitcoin prices pull back, the company can use previously raised funds to increase its Bitcoin holdings at a lower price.

The effectiveness of this strategy has been validated by the market. Metaplanet's stock price has risen over 275% this year, while its Bitcoin investment portfolio value has exceeded $1 billion, achieving a 225.4% return this year. This dual leverage effect—stock price increases leading to better financing conditions and Bitcoin appreciation enhancing investment returns—has created significant value growth for shareholders.

From the perspective of institutional innovation, Metaplanet's floating strike price warrants are not simply "new wine in old bottles," but a significant breakthrough based on traditional warrants, providing a new financing tool paradigm for companies in the high-volatility asset allocation field.

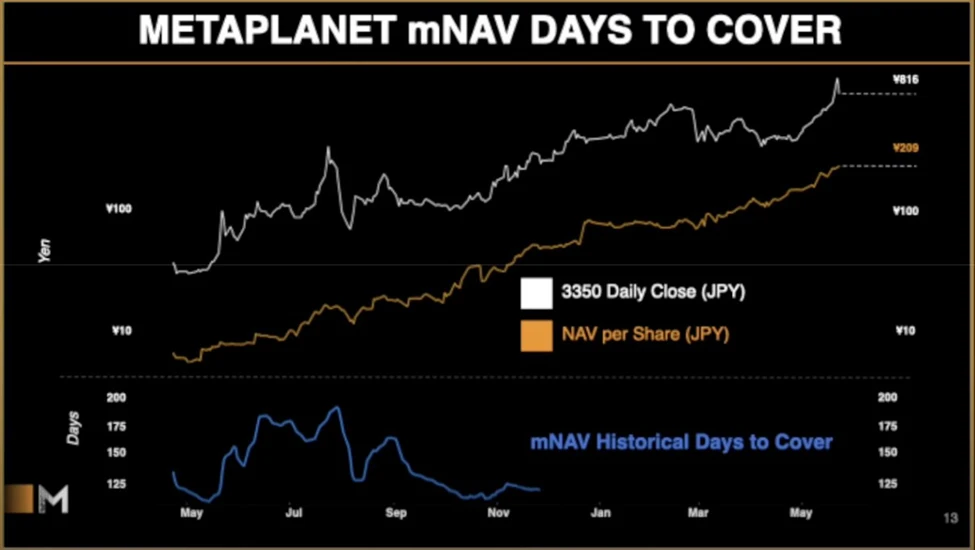

2. Metaplanet's Bitcoin Accumulation Efficiency: Premium Recovery Days Only Need 120 Days

The key to measuring whether the premium of treasury stocks can "materialize" is the speed at which the company converts the premium into physical Bitcoin. The commonly used metric Days-to-Cover is calculated as follows:

Days-to-Cover = Current Premium ÷ Daily Bitcoin Accumulation Yield

Metaplanet: Daily Bitcoin accumulation yield is approximately 1.4%-1.5%, with Days-to-Cover of about 120 days.

MicroStrategy: Daily Bitcoin accumulation yield is only about 0.12%, with Days-to-Cover lasting 626 days.

In other words, barring external variables, Metaplanet theoretically only needs four months to "fill" the market capitalization premium with newly acquired Bitcoin, while MSTR would need nearly two years. The efficient accumulation rhythm is the core reason the market is willing to assign a higher mNAV.

3. Metaplanet Uses Volatility to "Extract" Bitcoin—You Can Run Fast on This Train, But Please Buckle Up

Capital formation and premium creation are the two key elements for rapidly accumulating Bitcoin. Metaplanet clearly utilizes its extreme stock price volatility, which is 2-3 times that of Bitcoin, to issue new shares at high prices during rapid market surges and exercise warrants at favorable times, thereby maximizing financing efficiency.

This "harvesting volatility" strategy allows Metaplanet to:

Finance at high valuations during the strongest momentum phase, locking in premiums;

Buy Bitcoin at low prices when prices retreat or fluctuate.

In essence, it captures market imbalances and emotional cycles, setting in motion a self-reinforcing flywheel of "higher volatility → higher premium → more volatility." The higher the volatility, the more favorable it is for such stocks—because the price difference between high premium financing and low-cost Bitcoin accumulation is larger, and the speed of Bitcoin accumulation is faster. The only prerequisite is that investors must be willing to pay a very high premium during the frenzy, and this sentiment may not persist throughout every complete market cycle.

To understand why "higher volatility is actually more favorable for Metaplanet," one must first grasp how the company converts the dramatic ups and downs of its stock price into real assets. Metaplanet's financing tool is the floating strike price warrant, which allows the company to sell new shares or exercise rights at levels above market price during brief windows of high stock prices. Because the issuance price is raised higher, the company needs to dilute fewer shares to raise the same amount of funds; the loss of rights for existing shareholders is significantly compressed, while the company has more cash on hand.

Next, Metaplanet will immediately convert about 96% of the new funds into Bitcoin. If Bitcoin subsequently experiences a pullback, the company effectively uses the premium obtained from "selling stocks at high prices" to "buy coins at low prices," locking in a price difference. When this operation occurs repeatedly, the more volatile the stock price, the larger the price difference, allowing the company to quickly solidify stock market bubbles into visible Bitcoin assets on its balance sheet, thus accelerating the increase in net asset value (NAV).

On a data level, the high volatility of stock prices also shortens the "Days-to-Cover" metric. Days-to-Cover measures how long the company needs to use newly acquired Bitcoin to digest the existing market capitalization premium. High volatility means the company can raise and convert larger amounts into Bitcoin daily, thus reducing the required days. For investors, this represents faster premium realization and quicker asset backing of the bubble.

Of course, the core assumption of this logic is that market sentiment remains willing to pay high premiums to take up newly issued shares during periods of high stock prices; once sentiment cools or regulations tighten, the financing window will close, the flywheel will stop, and high stock price volatility may backfire on the company. Therefore, Metaplanet's model resembles an engine fueled by sentiment: volatility provides fuel, high premiums accelerate the engine, and asset conversion turns momentum into physical Bitcoin; once sentiment is exhausted, the engine will stall.

In short, Metaplanet treats extreme volatility as a two-tier leverage for financing and Bitcoin accumulation: the more sharply the stock price rises, the higher the financing price; the faster Bitcoin falls, the lower the cost of buying coins. As long as the emotional cycle can be sustained, it can wield the double-edged sword of "high volatility" as favorably as possible.

4. Conclusion: Coexistence of Value and Bubble, the Key Lies in the Company's "Execution Power"

Metaplanet's 7 times mNAV is not just theoretical:

It is supported by institutional innovation (floating strike price) and a high-frequency financing + Bitcoin accumulation closed loop;

It is also extremely sensitive to market volatility and execution efficiency.

For investors looking to capture the opportunity of a "second MSTR," Metaplanet indeed offers higher leverage and faster realization capabilities—but with greater uncertainty. Simply put, if you believe that Bitcoin will remain highly volatile and trend upward in the long term, and that Metaplanet can continue to execute its "financing—Bitcoin accumulation—premium release" flywheel, the company's high premium has a certain rationality; conversely, one should cautiously assess the potential risks of sudden stops in the midst of volatility and regulatory constraints.

The core of investing has never been about betting on rises with high leverage, but about identifying and managing the costs behind the "benefits." Metaplanet uses volatility as fuel to rapidly expand its Bitcoin accumulation; you must also employ equally robust risk governance to navigate this high-leverage game successfully.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。