Singapore, this "wealth haven," is becoming a "hunting ground" in the eyes of scammers.

With the surge in family offices and the influx of high-net-worth individuals, various sophisticated scams have quietly emerged in Singapore: from infiltrating the core of family wealth disguised as investment advisors to manipulating virtual assets and impersonating bank employees to carry out transnational fraud.

Criminals are targeting institutional loopholes and trust blind spots, setting traps that have ensnared some wealthy individuals, leading to significant losses. On the surface, Singapore appears to have a robust legal system and mature institutions, but it is facing a dual challenge regarding wealth security and regulatory upgrades.

"6 out of 10 people have encountered scams"

By the end of 2024, Lee, who works in sales, suddenly received a message on WhatsApp from a foreign number claiming to offer her an online part-time job. Lee, who always thought her job was quite ordinary, gladly agreed.

Soon after, she received another message from a man who claimed to be a Malaysian living in Singapore, married with a child. Although she suspected it was a scam, she decided to participate, saying, "I just wanted to scare those scammers. I thought I could outsmart them."

For months, the man sent her encouraging and cheerful messages every day. Gradually, Lee began to see him as a real friend, "He would ask every day, 'Sister, how are you? Want to try this online job? Over time, I thought it was just a part-time job to earn some extra cash."

This job allegedly required her to deposit cryptocurrency and complete surveys related to about 30 brands, after which she could withdraw her deposit along with commissions. Initially, the funds Lee deposited quickly yielded returns far exceeding her principal, prompting her to invest more. It wasn't until she deposited over $11,000 that the cryptocurrency platform suspended transfers and warned her via email that she might have been scammed.

But Lee still trusted the man until the platform asked her to invest $120,000, which she did not have. At that point, she realized something was wrong. By then, she had already transferred $78,000 but was told she could not withdraw the money until the work was completed.

Lee was very upset and pleaded for the return of her hard-earned money, but her requests were denied, and she was advised to borrow money from a bank or licensed lender.

Lee is not alone; several individuals have lost $167,000 simply by clicking on fraudulent ads from Facebook or Instagram.

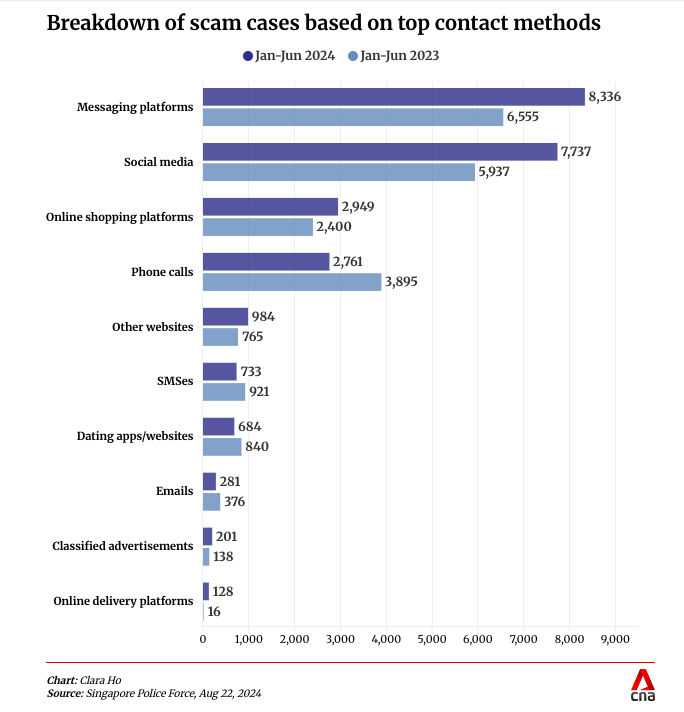

According to data, in Singapore, 6 out of 10 people have encountered scams. The government states that nearly half of the scam cases originate from Meta's platforms—Facebook, WhatsApp, and Instagram.

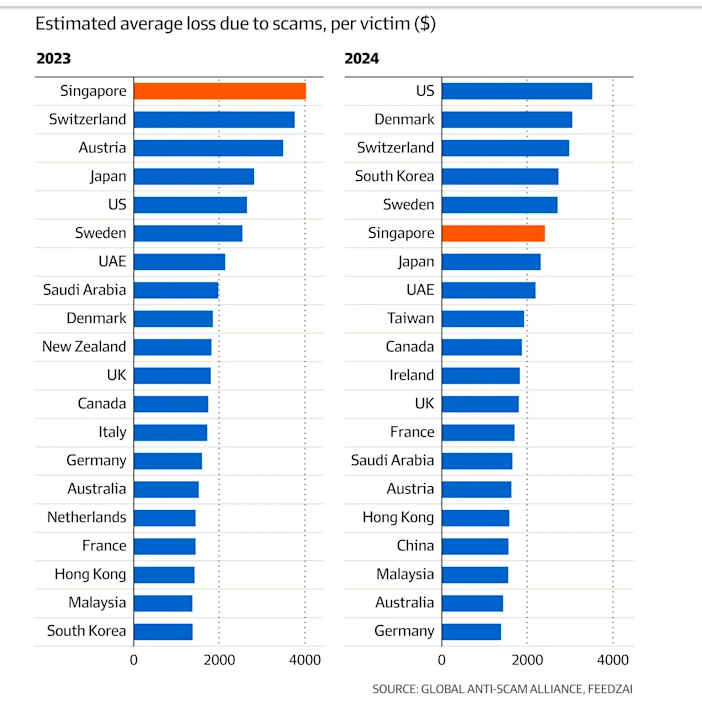

Historically, Singaporeans have been among the largest victims of scams globally. In 2023, the average loss per person in Singapore was $4,031, the highest among all countries.

Since 2019, the number of scam cases and the amount of losses in Singapore have reached new highs every year. In 2024, a total of 51,501 scam cases were reported, involving over $1.1 billion, marking the first time annual scam losses exceeded $1 billion. Of this, the police only recovered about $182 million. More than two-thirds of Singaporean victims did not report the cases.

In 2025, from January to April alone, Singapore reported over 13,000 scam cases, with victims losing more than $313.7 million.

"They are 'wealthy and naive'"

Even the "wealthy" are not immune to being "scammed."

A Singaporean actor, Mike (pseudonym), always reminded himself to be cautious of scams, especially online scams. However, when he met a young Filipino woman named Debra on a dating site, he couldn't resist talking to her.

Over a few months, Debra convinced Mike to invest nearly 40,000 Singapore dollars (30,000 USD) in cryptocurrency for an e-commerce business. When he discovered that the money he invested yielded nothing, Mike requested a face-to-face video call with Debra, only to find that the person in the video bore little resemblance to the photos on her profile.

Mike is not the only "wealthy" high-net-worth individual who has been "scammed."

A gang has been inviting Chinese business owners to Singapore since 2017 to sign contracts, charging "management fees" or "administrative fees." They rented office spaces in places like Marina Bay Financial Centre to create a legitimate office environment, supplemented by fake contracts, mimicking a high-end business atmosphere. At least 10 business owners were scammed, with a total amount exceeding 2.5 million Singapore dollars.

In March 2025, during a transnational operation, a financial director in Singapore was tricked by scammers using Deepfake technology to impersonate the CEO of his multinational company in a video and phone call, leading him to transfer about 499,000 Singapore dollars. Fortunately, through cross-border cooperation, the police successfully recovered the funds.

In early 2025, a financial advisor in Singapore was scammed out of 1.2 million Singapore dollars by impersonators from the "Anti-Scam Centre," who falsely claimed he was involved in money laundering and needed to cooperate with an investigation.

In March 2025, the Singapore High Court ordered a private trustee handling the bankruptcy assets of the alleged scammer Ng Yu Zhi to accept a claim of $12 million from creditors, which had previously been denied. Ng had created fake nickel metal trading projects through his Envy series of companies, attracting about 1.5 billion Singapore dollars in funds since 2017.

The project promised a 15% quarterly return, using forged trading contracts and historical records. Some early investors received returns, luring more people to join. This case involves nearly 300 (high-net-worth) victims, with a total amount of 1.5 billion Singapore dollars, and is still under trial, making it the "largest metal scam case in Singapore's history."

In March 2025, a Chinese billionaire sued four former employees, accusing them of fraudulently stealing funds from his family office, Panda Enterprise, and Li & Fung International (LFI) in Singapore over the years through fraudulent transactions and false claims. This incident highlights the vulnerabilities in certain family office structures.

The billionaire, who controls the family office Panda Enterprise and LFI, Zhong Renhai, alleged that the four former employees abused his trust and confidence, transferring 74 million Singapore dollars (approximately 400 million RMB) into their own accounts or misappropriating funds belonging to him without authorization.

It seems that these "wealthy individuals" are often more susceptible to scams. As someone involved in asset recovery said, "They are wealthy and naive."

Even Temasek was scammed

In 2025, Singapore's Senior Minister of State, Janil Puthucheary, and Singapore's sovereign wealth fund Temasek issued a public warning about an investment scam related to a doctored photo of Janil Puthucheary, a fake application, and a WeChat group, which allegedly promoted Chinese financial products.

In the altered photo, Janil Puthucheary was shown attending a signing ceremony for a memorandum of understanding (MOU) with two fictitious organizations—a Chinese Chamber of Commerce and an asset management company named Taibai.

Temasek clarified on May 12 that Taibai Investment is one of its wholly-owned subsidiaries but denied any association with the Taibai application or WeChat chat group. Janil Puthucheary stated in a Facebook post on May 12 that his original photo was taken at the Singapore-China Economic Partnership Meeting on February 1, 2024, and attached both the real and fake photos.

Temasek and Taibai Investment stated that they do not sell or market investment products in China and have not authorized any third party to do so. Reports indicate that several individuals have lost significant amounts of money through the Taibai financial application.

Additionally, Temasek previously decided to reduce its investments in early-stage companies by 88% over three years due to losses from investments in two fraudulent companies—FTX and eFishery.

As one of the largest investors in FTX, Temasek, along with SoftBank, BlackRock, and others, became a victim of the largest scam in cryptocurrency history. The company also has institutional investors like Sequoia Capital.

This investment accounted for about 0.1% of Temasek's investment portfolio for the fiscal year 2023, resulting in a loss of millions, which is "embarrassing."

As of the financial report for March 31, 2023, Temasek reported a net loss of $7.3 billion for the fiscal year 2023. After Temasek wrote off this investment, some Singaporean lawmakers questioned the organization's due diligence.

Although Temasek stated that it conducted "extensive due diligence on FTX, taking about eight months from February to October 2021," Temasek remarked regarding FTX's founder, "This investment clearly reflects our trust in Sam Bankman-Fried's behavior, judgment, and leadership, a trust that stemmed from our interactions with him and the views expressed in discussions with others, but it now seems to have been misplaced."

The impact of this investment failure extends beyond financial loss. The then Singapore Finance Minister, Lawrence Wong (now Prime Minister), publicly stated that this investment damaged Temasek's reputation. Subsequently, Temasek implemented salary cuts for its investment team and senior management.

Even more shocking is Temasek's failed investment in Indonesian agritech company eFishery. This startup, which developed an automated feeding system for fish and shrimp farming, was reported to have fabricated sales and profit data. According to media reports in April, one of eFishery's founders admitted to falsifying data in the company's financial reports.

"The profile of the 'hunters'"

In Singapore, the types of scams are diverse and complex, including phishing, investment scams, impersonation scams, e-commerce scams, job scams, romance scams, application fraud, credit card fraud, email scams, online dating, identity theft, malware, money laundering, sexual extortion scams, loan scams, and more.

The number of scam cases is "as numerous as the stars," with scam information and cases published almost daily on the Singapore Police Force's official announcements (SPF).

For example, according to a message released by SPF on June 11, 2025, SPF received multiple reports from victims of government official impersonation scams (GOIS), claiming they were deceived by scammers impersonating staff from the Monetary Authority of Singapore (MAS). Victims' funds were transferred to credit cards and then used for unauthorized transactions. It is reported that the scam amount exceeded $262,000.

In summary, the methods of these scammers in Singapore are constantly evolving, from traditional telecom fraud to "high-end customized" financial fraud, from impersonating bank personnel to disguising themselves as senior fund managers or even government officials. They are increasingly adept at leveraging Singapore's own "advantages" as props for their deceptive narratives.

First, impersonating professional consultants. Scammers often pose as representatives from law firms, family office advisors, audit experts, or even fake Monetary Authority of Singapore (MAS) staff. They forge documents and email domains, using meticulously designed logos and scripts to make it seem like they are communicating with genuine professional institutions.

Second, packaging "compliance identities." Fraud rings often exploit Singapore's international trust image, forging local company registration information, showcasing bank cooperation certificates, and even renting office addresses in Marina Bay Financial Centre to enhance the "authenticity" of their scams.

Third, establishing a trust loop. These scammers are not in a hurry to "strike," but instead engage with their targets over the long term, gradually building what appears to be a solid trust chain. By participating in the same social circles, charity events, or business forums, they create an "insider" image, drawing closer relationships to prepare for the next step of "harvesting."

Fourth, utilizing new technological tools. AI-generated videos, voice impersonation, and ChatGPT-generated investment reports have become their "precision strike" weapons, making it difficult even for seasoned investors to see through the deception at a glance.

Moreover, some financial companies have inadvertently become "enablers." In 2020, a trust company in Singapore was fined $793,000 (1.1 million SGD) for serious violations of MAS's anti-money laundering/combating the financing of terrorism regulations across multiple different accounts. The MAS announced that the violations occurred over a period of more than a decade from 2007 to 2018.

Additionally, the International Consortium of Investigative Journalists (ICIJ) revealed that the trust company was soliciting clients in the U.S. for Cook Islands trusts (a type of secure asset used for wealth and asset management that is difficult to penetrate).

The Underlying Currents Behind Family Office Prosperity

Singapore, a globally renowned wealth management center, attracts a large amount of international capital due to its strict rule of law, low tax environment, highly transparent financial system, and immigration policies friendly to high-net-worth individuals. In recent years, an increasing number of family offices have been established in Singapore, managing private wealth from around the world.

According to relevant data, by the end of 2024, there were over 2,000 family offices based in Singapore.

However, just like moths to a flame, "where there is wealth, there is risk." Behind this facade of safety and prosperity, a silent hunting operation is unfolding, with scammers targeting family offices and high-net-worth individual investors, meticulously designing scams, excelling in disguise, and quietly infiltrating to extract huge illegal profits from this glittering land.

While high-net-worth individuals enjoy the fruits of their wealth, they are increasingly becoming the carefully "hunted" targets of scammers. So why do these individuals, who intuitively should possess strong risk awareness and investment judgment, frequently fall victim? Behind this often lie psychological and structural vulnerabilities unique to the wealthy class.

First, information closed loops and relationship orientation. Many family offices operate based on networks of relationships, with recommendations often coming from "familiar circles," where risk assessments are frequently replaced by trust instead of professional due diligence. Scammers precisely target this point, using "internal recommendations" to break through defenses.

Second, excessive trust in the "Singapore label." "This is a Singapore-registered company," "This is a MAS-approved project" often become passes for exemption from scrutiny. High-net-worth individuals have great trust in local regulation but overlook whether the companies are genuinely operational behind the scenes.

Third, the pursuit of "high confidentiality + high returns." Some individuals desire discreet asset allocation, high returns, and avoidance of overseas regulation. Such demands are precisely the "target phrases" that scammers love to exploit.

Fourth, the "children's management" misconception. Many high-net-worth individuals delegate financial matters to the younger generation or assistants, lacking direct involvement, which relaxes their vigilance and gives scammers an opportunity.

Why Do Scammers "Favor" Singapore?

The reasons scammers are attracted to Singapore are not coincidental but closely related to its unique economic structure, social trust environment, and global reputation.

First, a financial center with convenient capital flow. Singapore is one of the world's most important financial centers, with highly free capital movement, an open foreign exchange policy, and a banking system that facilitates fund transfers and cross-border financial operations. This creates an ideal environment for scammers to "launder money."

Second, a lenient tax system with strong privacy protection. Singapore has low tax rates and strong financial privacy protections (especially with a mature trust and family office system), making it easy for some wealthy individuals and "sources of unclear funds" to establish shell companies or family offices with a "legal facade" for asset allocation and fund transfers.

Third, obtaining "legal identities" is not difficult. Singapore's investment immigration system was once relatively lenient, allowing scammers or money launderers to obtain long-term residency or even citizenship through investment, legitimizing their presence. This makes some criminals willing to use Singapore as a "springboard" or "safe house."

Fourth, social stability and a trusted law enforcement system. Compared to traditional tax havens like Caribbean island nations, Singapore has a higher rule of law and financial reputation, making it easier for scammers to "hide" here and maintain a long-term appearance of being "high-net-worth individuals."

Fifth, a large influx of international funds creates significant scrutiny pressure. As a global asset allocation hub, Singapore attracts a massive amount of international capital, and financial institutions face considerable anti-money laundering compliance pressure due to such vast capital flows, sometimes making it difficult to scrutinize every transaction, leading to vulnerabilities.

Sixth, Singapore has a high acceptance of "superficial compliance." Some banks, trusts, and family office service providers often do not delve into substantive issues as long as clients meet formal compliance (such as providing identity and income source explanations). This allows some "pseudo high-net-worth" or "fake family offices" to blend in.

Additionally, cross-border law enforcement collaboration is challenging. Many scammers do not carry out fraudulent activities in Singapore but transfer "dirty money" into Singapore. Since the location of the fraudulent activity is separate from where the funds are held, Singapore's law enforcement agencies often require cooperation from other countries, with varying efficiency, allowing some scammers to "escape justice."

As Singapore embraces digital transactions and cashless payments, scammers are adjusting their strategies, targeting digital wallets and online platforms, leading to an increase in phishing and malware scams.

A "Safe Haven" and a "Battlefield"

Over the past fifty years, Singapore has thrived on its global and regional hub strategy. However, as Southeast Asia faces increasingly severe transnational crime issues, the challenges posed by illicit capital flows are also becoming more pronounced.

Scammers flock to Singapore not because it "tolerates" them, but because its highly developed, free, and mature financial system itself provides opportunities for "malicious actors" to exploit loopholes. The policies under strict scrutiny include family office programs and a little-known loophole that can facilitate criminal activities.

For many criminals and corrupt individuals in the region, Singapore is the perfect "refuge": a major financial center through which wrongdoers can enter the global financial system, transferring dirty money worldwide—or hiding it under the noses of Singaporean authorities through suspicious real estate transactions.

Setting aside reputation, Singapore's thriving banking sector not only promotes employment, local economic growth, and increases in real estate values but also presents a compliance headache.

Following significant money laundering cases in 2022-2023, Singapore has strengthened its anti-money laundering regulations. However, a balance must be struck between regulation and the operational freedom of financial companies—this is a challenging balance for a trade city with global and regional influence.

(The "Family Office New Insights" reminds: The content and views are for reference only and do not constitute any investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。