撰文:CryptoLeo,Odaily 星球日报

「价值投资一场空,梭哈『大饼』住皇宫」,这句话的含金量还在不断提升。

前有萨尔瓦多不顾与 IMF 间的贷款协议条款阻拦持续囤积比特币,后有比特币「死忠粉」 Saylor 旗下企业 Strategy 每周发布比特币 Tracker 持续增持 BTC。近 1 年,陆续还有很多非加密企业宣布其 BTC 储备计划并陆续公开比特币持仓,比如日本上市公司 Metaplanet——从「业绩不佳」的酒店企业转型实施比特币战略,市值上涨超 50 倍达到 50 亿美元。再比如传统游戏和娱乐软件零售业巨头 GameStop,也在宣布比特币储备战略后迎来股价大幅上涨。

Odaily 星球日报盘点了近期转型实施比特币储备的七个传统企业。

1、域塔物流科技集团

公司简介:域塔物流科技集团(Nasdaq: RITR)是一家总部位于香港的纳斯达克上市企业,其采用物流科技赋能房地产开发的「房地产 + 物流科技」(PLT)模式,域塔为物流房地产投资者提供资产管理服务,包括基金、家族办公室、物业拥有者、高净值人群等;同时亦为物流营运商及终端用户提供专业的物流科技解决方案。域塔物流科技集团于 2015 年启动房地产投资和资产管理计划,于 2024 年 8 月在纳斯达克上市 (Nasdaq: RITR)。

其业务包括:资产管理(投资公寓及办公建筑)、建筑及建造、工程开发、设计与装修、专业顾问、物流科技、智慧仓储即服务 (iWaaS)。

比特币储备:此前于 6 月 6 日,域塔物流科技集团宣布已与一个 BTC 投资方签订比特币收购协议。根据协议,域塔可向 BTC 投资方购买最多 15, 000 枚比特币,交易总金额最高可达 15 亿美元。其官方界面显示,域塔物流科技集团计划发行一种数字代币——「RBTC」,公司预计该代币将得到 100% 比特币储备的全面支持, 1: 1 锚定比特币。客户可以使用港元或美元兑换「RBTC」,并可以在域塔物流科技集团旗下的所有智能仓库中以折扣价支付存储租金、增值服务费、仓储即服务(WaaS)和相关服务费,进一步推动仓储支付流程的数字化、智能化和透明化,促进智能物流的升级。

随着香港通过《稳定币条例草案》,域塔物流科技集团正研究相关监管细节,并计划在法规生效(8 月 1 日)后申请香港稳定币发行许可证,推出稳定币「RHKD」。RHKD 将主要用于跨境电子商务、物流和供应链的支付和结算。

囤币宣言:域塔物流科技控股主席兼行政总裁陈建中表示:「以比特币作为公司财务策略支柱,有助于我们在 PLT 生态系统的长远发展上奠定坚实基础,并引领物流数字化进程,抓住亚洲数万亿美元供应链现代化浪潮中的巨大机遇」。

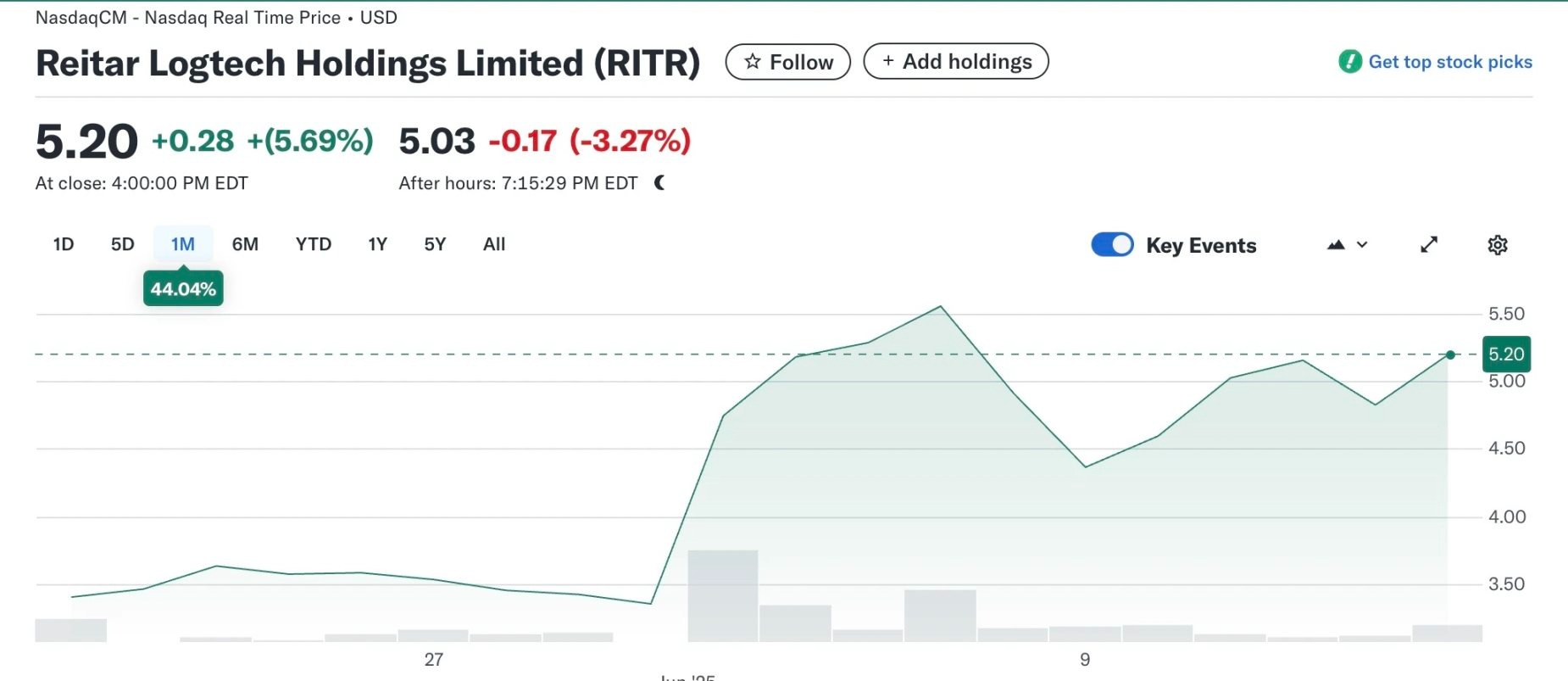

股价涨幅:截至发文,该公司股价暂报 5.2 美元,月内上涨 44.04% ,距其宣布 15 亿美元比特币储备计划至今股价并无太大波动。但结合近期加密美股涨势,或许可以关注其价格涨幅。

2、汽车金融服务公司 cango 灿谷

公司简介:灿谷(NYSE:CANG)起初是一家中国汽车金融服务公司,成立于 2010 年,总部位于上海,业务覆盖全国。以汽车贷款促成为切入点,灿谷搭建起深植低线城市及县域市场的广阔渠道网络,并将业务延伸至汽车产业链服务,包括交易和售后市场领域,建立起覆盖汽车流通全价值链的服务平台,其业务发展顺利,曾获得华平投资、春华资本、腾讯集团、泰康人寿、滴滴出行等投资。

比特币储备:但在 2024 年底,灿谷预转型为比特币挖矿公司,作为转型的一部分:

-

灿谷宣布以 3.52 亿美元的价格将其国内汽车金融业务出售给与比特大陆附属公司 Antalpha 有关联的 Ursalpha Digital Limited;

-

灿谷发布公告宣布其将购买加密矿机,灿谷斥资 2.56 亿美元从比特大陆购买算力达 32 EH/s 的比特币矿机。此外,灿谷已同意通过发行价值 1.44 亿美元普通股,从 Golden TechGen(比特大陆前首席财务官 Max Hua 旗下公司)和其他实体收购额外的机架式比特币矿机,算力总计 18 EH/s。

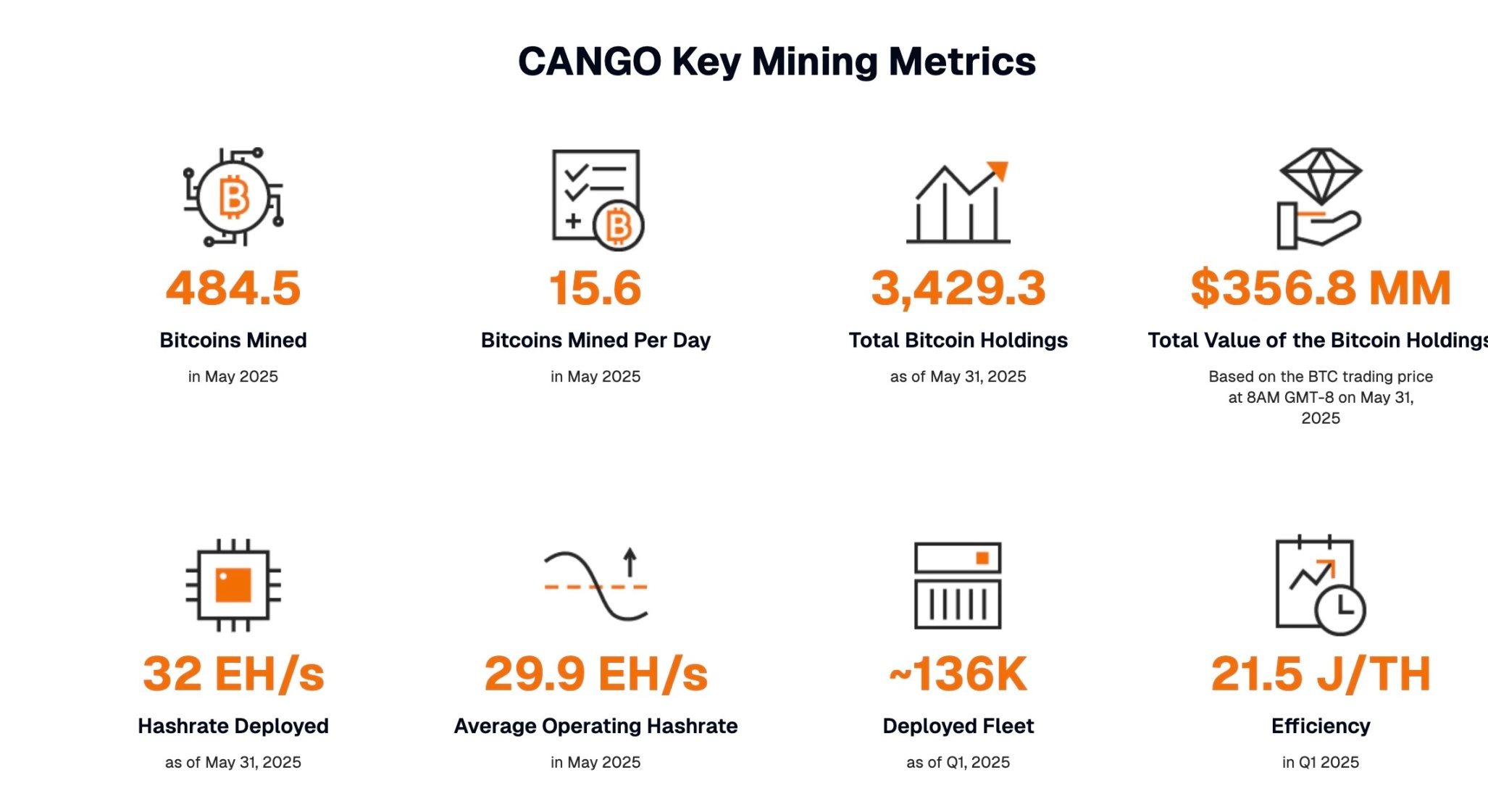

官网数据显示,截止发文,灿谷 5 月份挖到 484.5 枚比特币,平均每日挖 15.6 枚比特币,其比特币总持仓增至 3429.3 枚。

囤币宣言:灿谷高级通讯总监 Juliet Ye 表示:「我想这对于(比特币挖矿)行业的人们来说是令人惊讶的,因为之前没有人听说过 Cango,但 Cango 的历史就是一部适应的历史。自 2010 年公司成立以来,我们至少已经进军不同领域两到三次。」

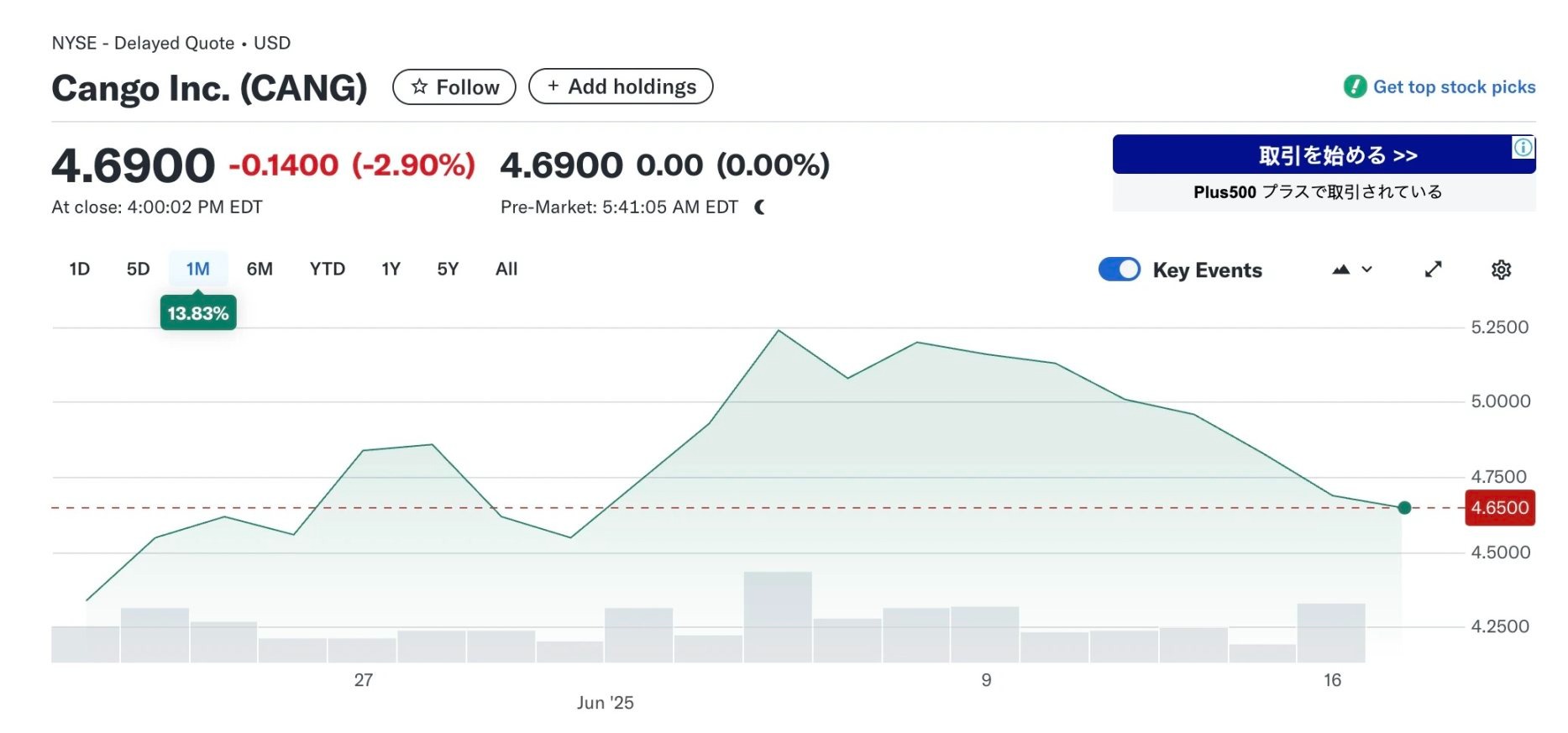

股价涨幅:CANG 现报 4.69 美元,在其宣布转型之前 CANG 的股价并未有很大波动,随着灿谷宣布部分剥离中国业务并转型为比特币挖矿公司后,其股价迎来一波上涨。

3、烈酒厂商 Heritage Distilling

公司简介:Heritage Distilling (Nasdaq: CASK)是美国比较有名的独立精酿酒厂之一,于 2011 年创立,提供各种威士忌、伏特加、金酒、朗姆酒和即饮罐装鸡尾酒。Heritage 连续十年被美国酿酒研究所评为北美获奖最多的手工酿酒厂。此外,Heritage 还在国家和国际烈酒比赛中获得诸多奖项。(官网可通过 Visa 等方式支付,目前还未推出加密货币支付渠道)

Heritage Distilling Co. 于 2024 年 11 月 22 日宣布在纳斯达克上市,公开发行 1, 687, 500 股普通股,发行价格为每股 4.00 美元,扣除承销折扣和发行费用前,总募资金额约为 675 万美元。

比特币储备:Heritage 比特币储备计划时间较久,时间线如下

-

2025 年 1 月 7 日成立加密货币委员会;

-

2025 年 1 月 10 日,宣布将推出加密货币储备政策;

-

2025 年 5 月 15 日,宣布采用公司加密货币储备政策;

-

2025 年 6 月 3 日,公司宣布预发布新的比特币波旁(Bitcoin Bourbon)威士忌。

具体为, 2025 年 5 月 15 日,Heritage Distilling 宣布其董事会已批准其加密货币储备政策的最终版本,公司能够在其直接面向消费者的电子商务平台上接受 BTC 和 DOGE 作为其产品和服务的支付形式,并允许公司获取和持有加密货币作为战略资产。该倡议由董事会技术和加密货币委员会领导,该委员会由 Matt Swann(前亚马逊副总裁兼支付业务经理)担任主席。由 Swann 领导的 Heritage 加密委员会,未来也将推出:链上忠诚度计划、产品绑定的 NFT、代币化供应链、去中心化的消费者参与工具。

Heritage 首席执行官 Justin Stiefel 表示,公司正在积极评估与其加密货币储备政策相关的融资机会。

囤币宣言:Matt Swann 表示:「一个全新的商业时代正在崛起,加密货币正引领着减少商品和服务买卖双方间摩擦的道路。在近二十年的时间里,我们一直致力于技术和货币的融合,看到 Heritage 公司勇敢地抓住机遇,将消费者和加密货币的力量结合起来,这令人倍感振奋。」

Heritage 首席执行官 Justin Stiefel 评论:「Heritage 始终走在创新的前沿,我们准备接受 BTC 和 DOGE 作为在线电子商务销售的支付方式,并收购和持有这些加密货币作为资产。正如我过去所指出的,与那些用现金购买加密货币并立即面临潜在价格波动的传统投资者不同,作为一家生产商品以供销售的公司,我们产品的零售价与生产成本之间的可接受利润率,预计将抵消我们持有加密货币价值的潜在波动,这为我们提供了相当大的财务灵活性。」

股价涨幅:Heritage 股票 CASK 距其发行价已下跌 87% ,现报 0.52 美元,在其宣布将实施比特币储备策略后也并未有很大波动,其目前流动性资产总额为 3, 249, 767 美元,并无太大的购买力。不过 Heritage 像是在走 Metaplanet 的老路,股价低迷,转而寻求融资购买比特币,鉴于其目前还在筹备中,可以对 CASK 股票价值保留期待。

4、巴黎圣日耳曼足球俱乐部

公司简介:法国巴黎圣日耳曼足球俱乐部(PSG)大家应该都很熟悉,法甲联赛的顶级强队,今年 5 月 31 日晚举行的欧冠联赛决赛中夺得冠军。而就在其夺冠的前一天(5 月 30 日),PSG 宣布已将比特币纳入其财务储备。

但 PSG 严格上不算是「加密无关」组织,我们熟知的有粉丝代币 PSG,有 CHZ,其曾经发行过 NFT、与 Crypto.com 达成过合作,但比特币储备确实是首次公开,也是今年该俱乐部顺应 BTC 储备大势之时所做出的改变。

囤币宣言:巴黎圣日耳曼负责人 Pär Helgosson 表示:「我们去年就开始通过法币储备收购比特币,俱乐部在全球 5.5 亿球迷中约有 80% 年龄在 34 岁以下。我们关注未来,关注比特币。我们正在加速比特币创业者和比特币企业的发展,利用遍布全球超过 5 亿的粉丝,帮助比特币扩展全球市场」。

5、人工智能教育集团 Genius Group

公司简介:Genius Group (NYSE:GNS)是一家总部位于新加坡的教育科技公司,专注于提供个性化、创新性的 AI 教育解决方案。该公司由 Roger Hamilton 创立,旨在通过利用数字技术和全球化的资源,为学龄儿童、大学生、成人和创业者等群体提供从基础教育到高等教育的全方位学习体验。目前在 100 多个国家 / 地区拥有超过 570 万名学生。

比特币储备:Genius Group 于 2024 年 11 月宣布拟采用比特币优先的储备战略,计划将 90% 以上的储备分配给比特币,推出 Web3 教育系列并在 Edtech 平台上实现比特币支付。

Genius Group 的比特币储备较为坎坷,其于 2 月份宣布增持 200 万美元比特币,储备增至总计 440 枚,但因美国法院禁令(禁止使用投资者资金购买比特币,禁令于 2 月 14 日至 5 月 6 日生效)暂停比特币购买,而在此期间 Genius Group 被迫出售了大量比特币储备。此后该公司宣布在美国上诉法院解除比特币禁令,重组其业务并重建其比特币储备库,目前已将其比特币储备增加了 52% ,达到 100 枚比特币,购买金额 1006 万美元,比特币均为 100, 600 美元。

此外,Genius Group 还推出了比特币学院(THE BITCOIN ACADEMY),主打 Learn to Earn,通过学习课程获得 GEM,以兑换奖励。

囤币宣言:转为比特币储备后,Genius Group 首席执行官 Roger Hamilton 表示:「Genius Group 是目前唯一一家在美国主要证券交易所上市的亚洲比特币储备公司。我们发现,国际投资者对比特币的国际敞口、零资本利得税以及美国金融市场的流动性越来越感兴趣。随着我们比特币学院的启动,我们正在向企业、高管和投资者提供关于机构采用比特币的好处方面的教育,我们很高兴能够赞助并参加香港的数字资产机构峰会和纽约的比特币投资者周,作为我们推广活动的一部分。」

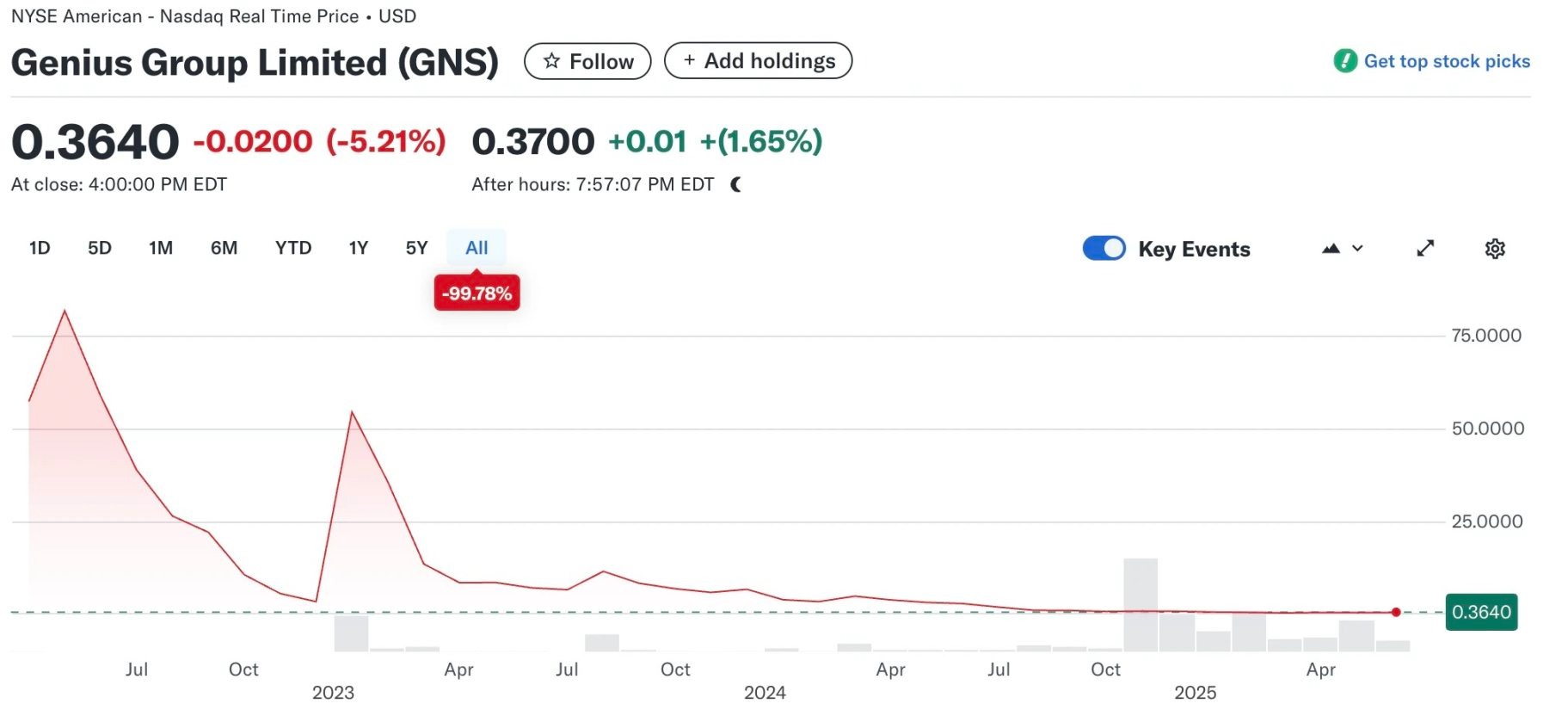

股价涨幅:Genius Group 股票 GNS 现报 0.364 美元,其效仿 Strategy 建立比特币储备或也是挽回其市值和股票下跌的手段之一。

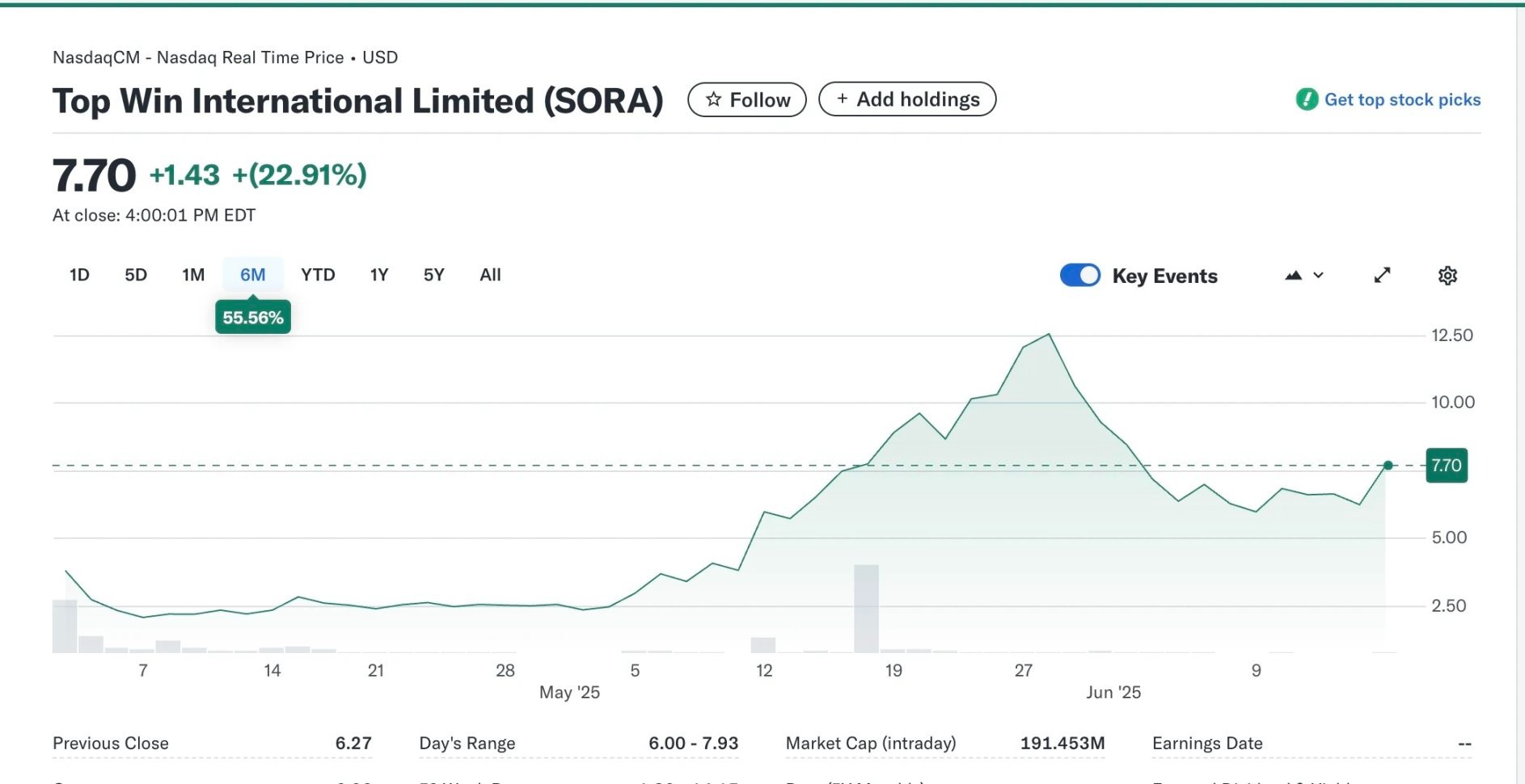

6、奢侈手表商 Top Win

公司简介:Top Win(Nasdaq:TOPW,后更名为 SORA)是一家总部位于香港的奢侈腕表公司,专注于国际知名品牌奢侈腕表的贸易、分销和零售,成立于 2001 年。此前于 2025 年 4 月 2 日成功在纳斯达克上市,

比特币储备:Top Win 于 2025 年 5 月 19 日宣布正式迈入加密领域,并与知名 Web3 基金 Sora Ventures 合作,推动以比特币为核心的资产储备策略。

而 Sora Ventures 也是一家比较著名的投资基金,此前专注于 DeFi、BTC、NFT 等领域,也投资过 Pendle、Tap Protocol 和 Xverse 等项目,而在其转位比特币储备后,其主要业务转向 BTC 储备,在亚洲范围内拓展 Strategy 比特币储备模式,此前 Sora Ventures 推出 1.5 亿美元基金,拟推动亚洲上市公司采用比特币储备策略。后又与 Metaplanet 达成合作,创建首个「亚洲版微策略」。

而近期就是与 Top Win 合并,并将其企业品牌重塑为「AsiaStrategy」在纳斯达克上市,经典的借壳上市。

囤币宣言:Sora Ventures 创始人 Jason Fang(AsiaStrategy 联席 CEO)表示:「SORA 这样的比特币资管公司将在推动比特币价格创下新高方面发挥主导作用。」

股价涨幅:SORA 现报 7.7 美元,自上市后上涨 55.56% ,在宣布 BTC 战略后的几天迎来上涨,也是近期几个转向囤币企业中为数不多实现上涨的股票。

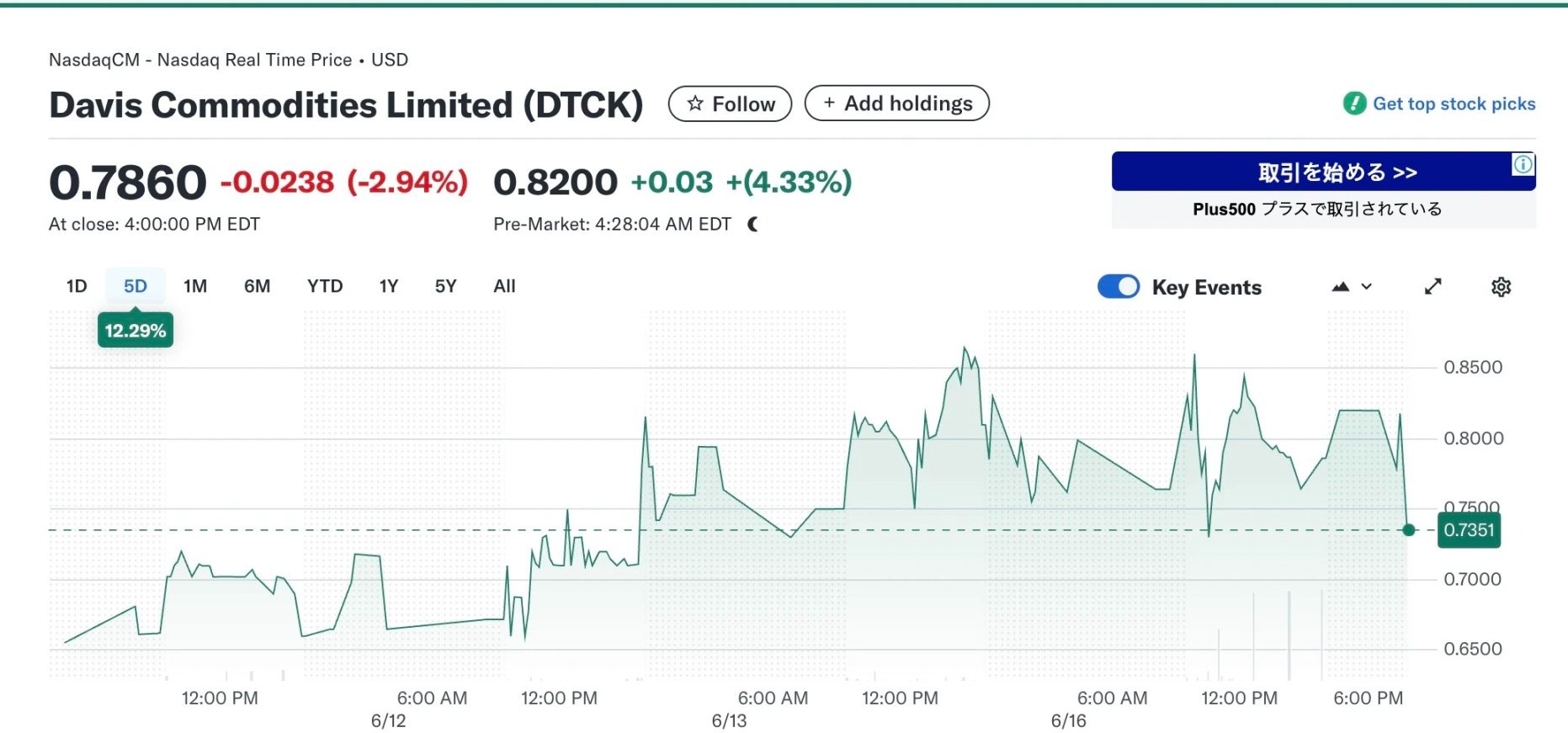

7、新加坡农产品贸易公司 Davis Commodities

公司简介:Davis Commodities(Nasdaq:DTCK)是一家总部位于新加坡的农产品贸易公司,主要从事糖、大米和油等农产品的贸易,并向包括亚洲、非洲和中东在内的多个市场分销这些产品。该公司官网显示,截至 2024 年 12 月 31 日止年度,Davis Commodities 总收入为 1.324 亿美元,较 2023 年的 1.907 亿美元下降 30.6% 。下降主要归因于主要市场(尤其是东南亚和非洲)糖和大米产品销售放缓。

比特币储备:或因收入同比降低,Davis Commodities 转向比特币储备和 RWA。

其于 6 月 16 日宣布推出 3000 万美元战略增长计划,计划将 40% (1200 万美元)分阶段配置为比特币储备,第一阶段将约 15% 的资金(450 万美元)投入比特币储备。Davis Commodities 预计其比特币储备在未来 36 个月内将带来可衡量的回报,具体取决于市场条件和全球采用趋势的持续增长。此项资金分配预计将增强公司的财务韧性,多元化资产管理框架,并强化公司的长期增长潜力;

此外, 50% 的资金(1500 万美元)投入到领先的 RWA 代币化项目,重点聚焦农业大宗商品领域,通过将糖、大米和油等实物资产代币化,释放新的流动性渠道、简化交易流程并提升农业贸易效率;

剩余 10% 的资金(300 万美元)将用于建设先进的技术基础设施、实施强大的安全措施以及建立战略合作伙伴关系。

囤币宣言:Davis Commodities 首席执行官表示:「 3000 万美元募资计划是 Davis Commodities 在重新定义全球大宗商品交易格局中迈出的关键一步,通过整合比特币储备和 RWA 代币化,我们不仅巩固了作为领先农业贸易商的地位,还抓住了传统大宗商品与数字资产交汇处的广阔机遇。这一战略旨在推动可持续增长、提升投资者回报,并确保我们始终处于全球贸易创新的前沿。」

股价涨幅:DTCK 现报 0.786 美元,近 5 天涨幅 12.29% ,但距其上市价格下跌严重。

结语

正如彭博首席财经作家 Matt Levine 在《美股上市公司疯狂买入加密货币的底层逻辑》文中所述,以上美股上市公司(除足球俱乐部外)几乎都具备一个共同特点,最初这些公司只是勉强挂牌在市,上市后股价下跌严重;但它有一个美国上市公司的壳,而且基本上没怎么用这个壳干什么事。

「这让它成为理想的『转型做加密金库』的标的公司。就像我以前常说的,美国的股市愿意为 1 美元的加密资产支付 2 美元以上的价格。这个现象,加密圈的创业者早就发现了。如果你手上有一大笔 BTC、ETH、Solana、狗狗币(Dogecoin),甚至是 TRUMP,最好的办法就是把它们装进一家美国上市公司里,然后以更高的价格卖给二级市场的投资者。现在的情况就像是加密圈在不停地耍美股市场,而美股市场一次次地上当。」

特别是近期,随着 USDC 稳定币发行商 Circle 上市,其股价从 31 美元暴涨到 151 美元,再次验证了区块链概念股的市场潜力。以上几家企业,也绝不会是最后一批采用比特币储备的公司,未来我们会看到越来越多的传统企业搭乘加密的快车实现战略转型。

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。