Original|Odaily Planet Daily (@OdailyChina_)

_

Author|CryptoLeo (@LeoAndCrypto)

"Value investing is a waste, going all-in on 'big pie' to live in the palace," this saying's value is continuously increasing.

Previously, El Salvador continued to accumulate Bitcoin despite the loan agreement terms with the IMF, and then Bitcoin "die-hard fan" Saylor's company Strategy releases Bitcoin Tracker weekly, continuously increasing its BTC holdings. In the past year, many non-crypto companies have announced their BTC reserve plans and publicly disclosed their Bitcoin holdings, such as the Japanese listed company Metaplanet—transforming from a "poor-performing" hotel business to implement a Bitcoin strategy, with a market value increasing over 50 times to reach $5 billion. Another example is the traditional gaming and entertainment software retail giant GameStop, which saw a significant rise in stock price after announcing its Bitcoin reserve strategy. Related reading: "The meme stock GameStop joins the BTC reserve camp, is a strategy coming to the gaming field?"

Odaily Planet Daily has compiled six traditional companies that have recently transformed to implement Bitcoin reserves.

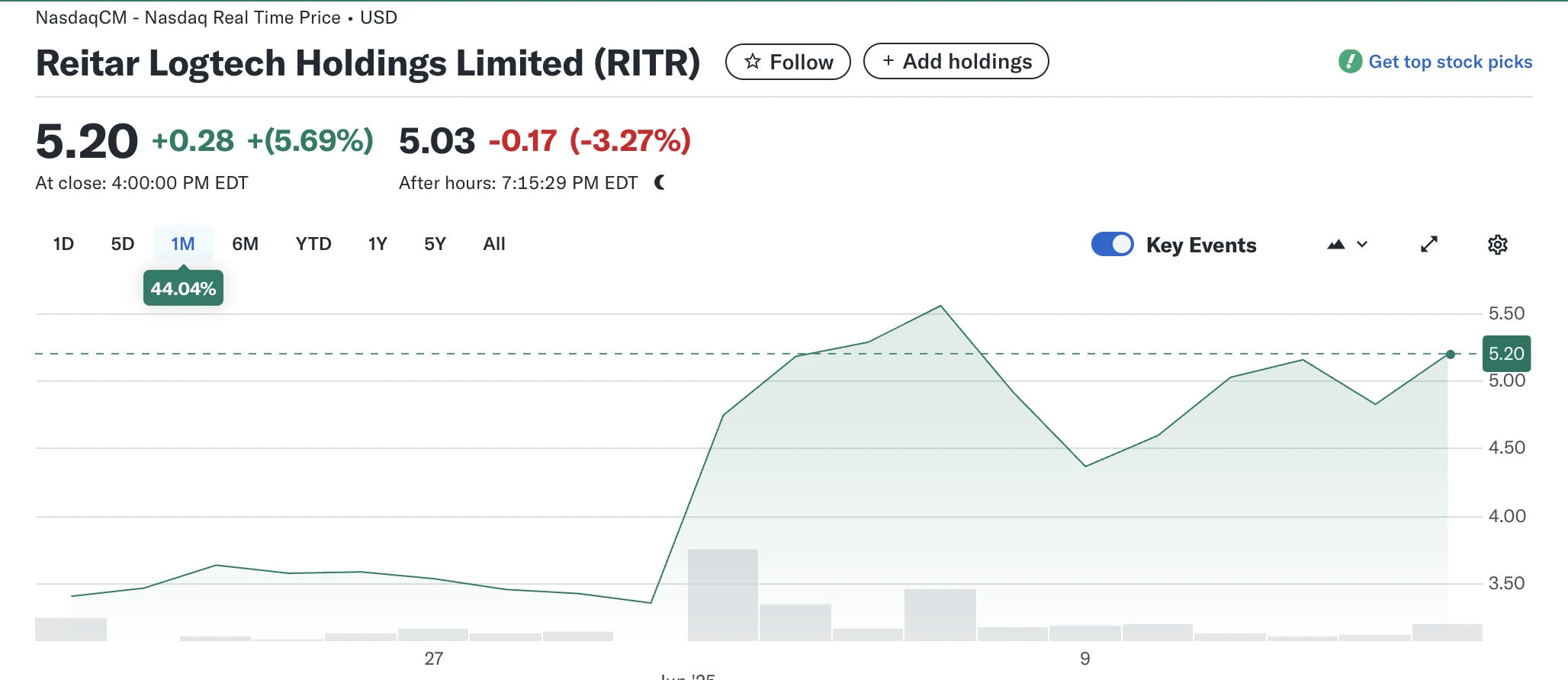

1. Yuta Logistics Technology Group

Company Overview: Yuta Logistics Technology Group (Nasdaq: RITR) is a Nasdaq-listed company headquartered in Hong Kong, adopting a "Real Estate + Logistics Technology" (PLT) model to empower real estate development. Yuta provides asset management services for logistics real estate investors, including funds, family offices, property owners, and high-net-worth individuals; it also offers professional logistics technology solutions for logistics operators and end-users. Yuta Logistics Technology Group launched its real estate investment and asset management plan in 2015 and went public on Nasdaq in August 2024 (Nasdaq: RITR).

Its business includes: asset management (investing in apartments and office buildings), construction and building, engineering development, design and decoration, professional consulting, logistics technology, and intelligent warehousing as a service (iWaaS).

Bitcoin Reserve: On June 6, Yuta Logistics Technology Group announced it had signed a Bitcoin acquisition agreement with a BTC investor. According to the agreement, Yuta can purchase up to 15,000 Bitcoins from the BTC investor, with a total transaction amount of up to $1.5 billion. Its official interface shows that Yuta Logistics Technology Group plans to issue a digital token—"RBTC," which the company expects will be fully backed by 100% Bitcoin reserves, pegged 1:1 to Bitcoin. Customers can exchange "RBTC" for Hong Kong dollars or US dollars and can pay for storage rent, value-added service fees, warehousing as a service (WaaS), and related service fees at discounted rates in all intelligent warehouses under Yuta Logistics Technology Group, further promoting the digitization, intelligence, and transparency of the warehousing payment process, and facilitating the upgrade of intelligent logistics.

With Hong Kong passing the "Stablecoin Regulation Draft," Yuta Logistics Technology Group is studying the relevant regulatory details and plans to apply for a Hong Kong stablecoin issuance license after the regulations take effect (August 1), launching the stablecoin "RHKD." RHKD will primarily be used for payments and settlements in cross-border e-commerce, logistics, and supply chains.

Coin Hoarding Declaration: Yuta Logistics Technology Holdings Chairman and CEO Chen Jianzhong stated: "Using Bitcoin as a pillar of the company's financial strategy helps us lay a solid foundation for the long-term development of the PLT ecosystem and leads the digitalization process in logistics, seizing the tremendous opportunities in the modernization wave of Asia's trillions of dollars supply chain."

Stock Price Increase: As of the publication date, the company's stock price is reported at $5.2, up 44.04% for the month, with little fluctuation in stock price since its announcement of the $1.5 billion Bitcoin reserve plan. However, considering the recent rise in crypto stocks, it may be worth paying attention to its price increase.

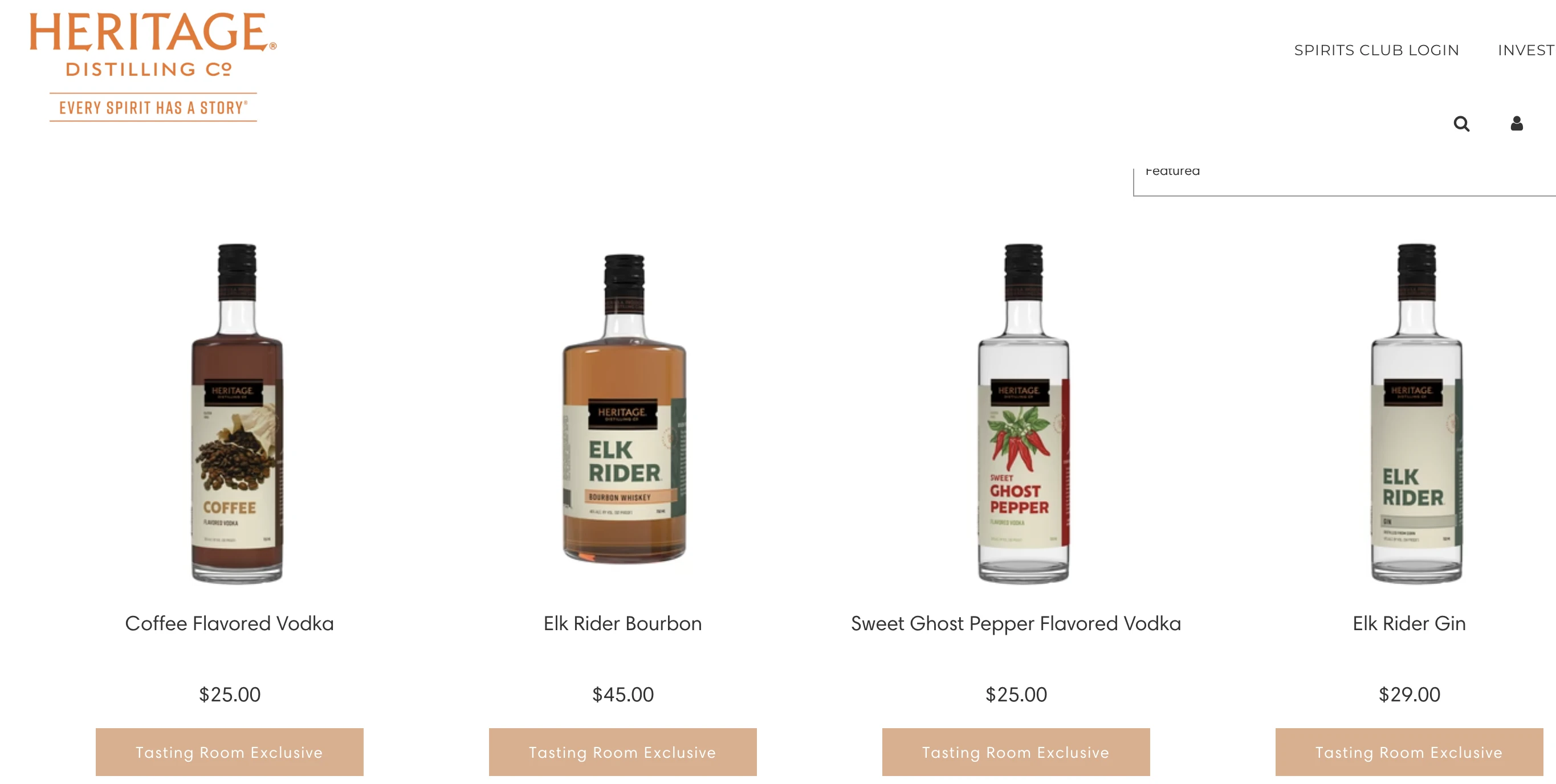

2. Distillery Heritage Distilling

Company Overview: Heritage Distilling (Nasdaq: CASK) is one of the more well-known independent craft distilleries in the United States, founded in 2011, offering a variety of whiskey, vodka, gin, rum, and ready-to-drink canned cocktails. Heritage has been recognized as North America's most awarded craft distillery by the American Distilling Institute for ten consecutive years. Additionally, Heritage has won numerous awards in national and international spirits competitions. (The official website accepts payments via Visa and other methods, but has not yet launched cryptocurrency payment channels.)

Heritage Distilling Co. announced its Nasdaq listing on November 22, 2024, publicly offering 1,687,500 shares of common stock at a price of $4.00 per share, raising approximately $6.75 million before underwriting discounts and issuance costs.

Bitcoin Reserve: Heritage's Bitcoin reserve plan has been in the works for some time, with the timeline as follows:

January 7, 2025: Establishment of the cryptocurrency committee;

January 10, 2025: Announcement of the launch of the cryptocurrency reserve policy;

May 15, 2025: Announcement of the adoption of the company's cryptocurrency reserve policy;

June 3, 2025: Company announces the pre-release of new Bitcoin Bourbon whiskey.

Specifically, on May 15, 2025, Heritage Distilling announced that its board of directors had approved the final version of its cryptocurrency reserve policy, allowing the company to accept BTC and DOGE as payment for its products and services on its direct-to-consumer e-commerce platform, and permitting the company to acquire and hold cryptocurrencies as strategic assets. This initiative is led by the board's technology and cryptocurrency committee, chaired by Matt Swann (former Amazon Vice President and Payments Business Manager). The Heritage cryptocurrency committee, led by Swann, will also launch: on-chain loyalty programs, product-bundled NFTs, tokenized supply chains, and decentralized consumer engagement tools.

Heritage CEO Justin Stiefel stated that the company is actively evaluating financing opportunities related to its cryptocurrency reserve policy.

Coin Hoarding Declaration: Matt Swann stated: "A new era of business is rising, and cryptocurrency is leading the way to reduce friction between buyers and sellers of goods and services. For nearly two decades, we have been committed to the integration of technology and currency, and it is exciting to see Heritage bravely seize the opportunity to combine the power of consumers and cryptocurrency."

Heritage CEO Justin Stiefel commented: "Heritage has always been at the forefront of innovation, and we are ready to accept BTC and DOGE as payment methods for online e-commerce sales and to acquire and hold these cryptocurrencies as assets. As I have pointed out in the past, unlike traditional investors who buy cryptocurrencies with cash and immediately face potential price fluctuations, as a company producing goods for sale, the acceptable profit margin between our product's retail price and production cost is expected to offset the potential volatility of the value of our held cryptocurrencies, providing us with considerable financial flexibility."

Stock Price Increase: Heritage stock CASK has fallen 87% from its issue price, currently reported at $0.52, and has not seen much fluctuation after announcing its Bitcoin reserve strategy. Its current total liquid assets amount to $3,249,767, showing limited purchasing power. However, Heritage seems to be following the old path of Metaplanet, with a sluggish stock price, turning to seek financing to purchase Bitcoin. Given that it is still in preparation, there may be expectations for the value of CASK stock.

3. Paris Saint-Germain Football Club

Company Overview: The French Paris Saint-Germain Football Club (PSG) is well-known, being a top team in Ligue 1, and won the championship in the UEFA Champions League final held on the evening of May 31 this year. Just a day before their victory (May 30), PSG announced that it had included Bitcoin in its financial reserves.

However, PSG is not strictly a "crypto-unrelated" organization; it has well-known fan tokens PSG and CHZ, has previously issued NFTs, and collaborated with Crypto.com, but the Bitcoin reserve is indeed its first public announcement, and it is a change made by the club in response to the trend of BTC reserves this year.

Coin Hoarding Declaration: PSG official Pär Helgosson stated: "We started acquiring Bitcoin through fiat currency reserves last year, and about 80% of the club's 550 million fans are under 34 years old. We are focused on the future and Bitcoin. We are accelerating the development of Bitcoin entrepreneurs and Bitcoin businesses, leveraging our over 500 million fans worldwide to help Bitcoin expand its global market."

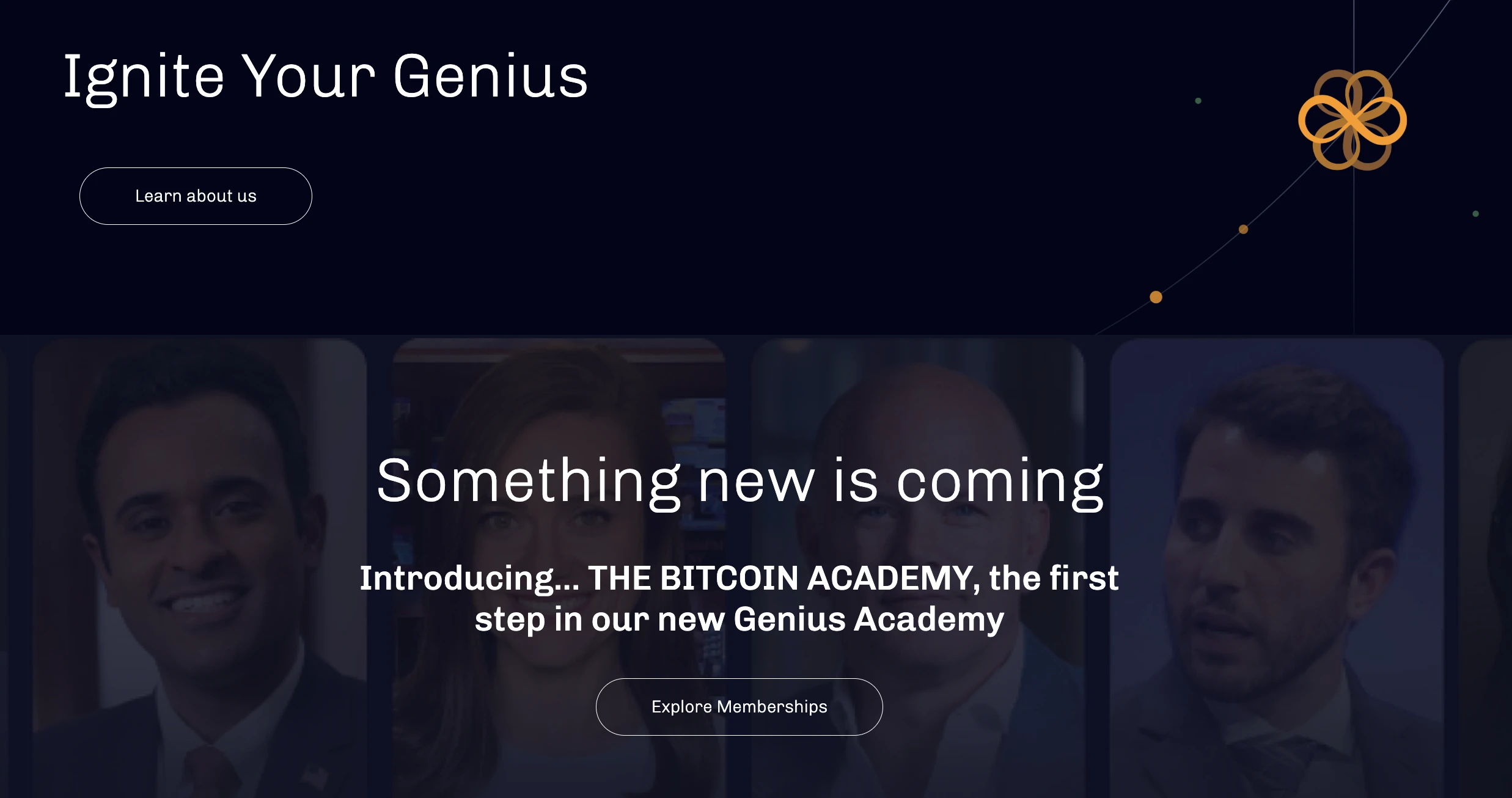

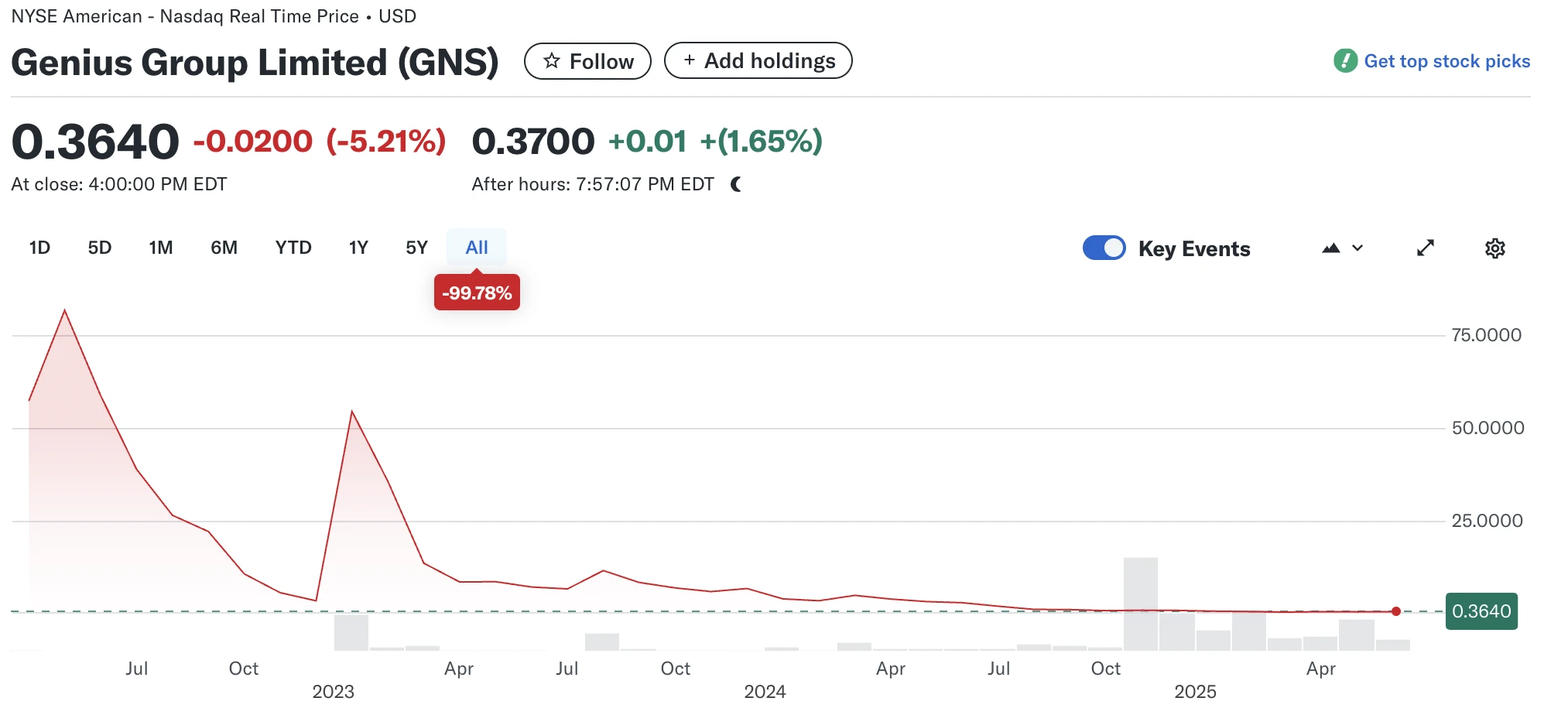

4. Genius Group, an Artificial Intelligence Education Group

Company Overview: Genius Group (NYSE: GNS) is an education technology company headquartered in Singapore, focusing on providing personalized and innovative AI education solutions. Founded by Roger Hamilton, the company aims to offer a comprehensive learning experience from basic education to higher education for school-age children, university students, adults, and entrepreneurs by leveraging digital technology and global resources. Currently, it has over 5.7 million students in more than 100 countries/regions.

Bitcoin Reserve: Genius Group announced in November 2024 its intention to adopt a Bitcoin-prioritized reserve strategy, planning to allocate over 90% of its reserves to Bitcoin, launch a Web3 education series, and implement Bitcoin payments on its Edtech platform.

Genius Group's Bitcoin reserve journey has been tumultuous; in February, it announced an increase of $2 million in Bitcoin, raising its total reserves to 440 coins. However, due to a U.S. court injunction (prohibiting the use of investor funds to purchase Bitcoin, effective from February 14 to May 6), it paused Bitcoin purchases and was forced to sell a significant portion of its Bitcoin reserves during this period. Subsequently, the company announced that the U.S. appellate court lifted the Bitcoin injunction, allowing it to restructure its business and rebuild its Bitcoin reserves, which have now increased by 52% to 100 Bitcoins, with a purchase amount of $10.06 million, at an average price of $100,600 per Bitcoin.

Additionally, Genius Group launched the Bitcoin Academy, focusing on Learn to Earn, where participants can earn GEM by completing courses to redeem rewards.

Coin Hoarding Declaration: After transitioning to a Bitcoin reserve, Genius Group CEO Roger Hamilton stated: "Genius Group is currently the only Asian Bitcoin reserve company listed on a major U.S. stock exchange. We have found that international investors are increasingly interested in Bitcoin's international exposure, zero capital gains tax, and the liquidity of the U.S. financial markets. With the launch of our Bitcoin Academy, we are educating businesses, executives, and investors about the benefits of institutional adoption of Bitcoin, and we are excited to sponsor and participate in the Digital Asset Institutional Summit in Hong Kong and Bitcoin Investor Week in New York as part of our promotional activities."

Stock Price Increase: Genius Group's stock GNS is currently priced at $0.364, and its establishment of a Bitcoin reserve may also be one of the means to recover its market value and stock decline.

5. Luxury Watch Retailer Top Win

Company Overview: Top Win (Nasdaq: TOPW, later renamed SORA) is a luxury watch company headquartered in Hong Kong, specializing in the trade, distribution, and retail of internationally renowned luxury watch brands, established in 2001. It successfully went public on Nasdaq on April 2, 2025.

Bitcoin Reserve: On May 19, 2025, Top Win announced its official entry into the crypto space and partnered with the well-known Web3 fund Sora Ventures to promote a Bitcoin-centric asset reserve strategy.

Sora Ventures is also a well-known investment fund, previously focused on DeFi, BTC, NFTs, and has invested in projects like Pendle, Tap Protocol, and Xverse. After transitioning to a Bitcoin reserve, its main business shifted towards BTC reserves, expanding the Strategy Bitcoin reserve model across Asia. Previously, Sora Ventures launched a $150 million fund aimed at promoting the adoption of Bitcoin reserve strategies among Asian listed companies. It later partnered with Metaplanet to create the first "Asian version of MicroStrategy."

Recently, it merged with Top Win and rebranded its corporate identity as "AsiaStrategy" for its Nasdaq listing, a classic reverse merger.

Coin Hoarding Declaration: Jason Fang, founder of Sora Ventures (Co-CEO of AsiaStrategy), stated: "Bitcoin asset management companies like SORA will play a leading role in driving Bitcoin prices to new highs."

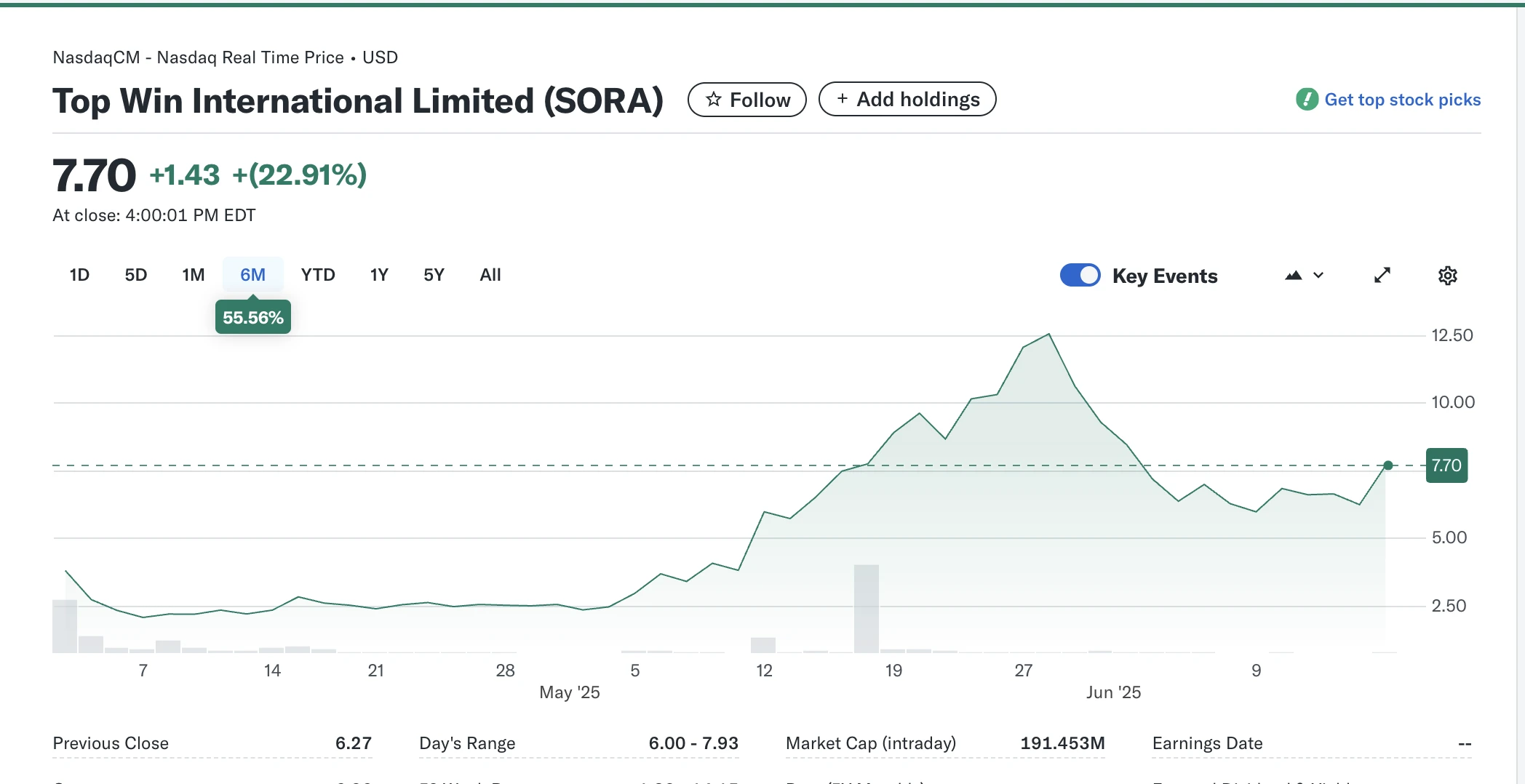

Stock Price Increase: SORA is currently priced at $7.7, having risen 55.56% since its listing, experiencing an increase a few days after announcing its BTC strategy, making it one of the few stocks among recent companies transitioning to hoarding Bitcoin that has seen an increase.

6. Singapore Agricultural Trading Company Davis Commodities

Company Overview: Davis Commodities (Nasdaq: DTCK) is an agricultural trading company headquartered in Singapore, primarily engaged in the trade of agricultural products such as sugar, rice, and oil, distributing these products to various markets, including Asia, Africa, and the Middle East. According to the company's website, as of the fiscal year ending December 31, 2024, Davis Commodities reported total revenue of $132.4 million, a 30.6% decrease from $190.7 million in 2023. The decline is mainly attributed to a slowdown in sales of sugar and rice products in key markets, particularly Southeast Asia and Africa.

Bitcoin Reserve: Due to the year-on-year decrease in revenue, Davis Commodities has turned to Bitcoin reserves and RWA.

On June 16, it announced a $30 million strategic growth plan, intending to allocate 40% ($12 million) in phases to Bitcoin reserves, with the first phase investing approximately 15% ($4.5 million) into Bitcoin reserves. Davis Commodities expects its Bitcoin reserves to yield measurable returns over the next 36 months, depending on market conditions and the continued growth of global adoption trends. This allocation of funds is expected to enhance the company's financial resilience, diversify its asset management framework, and strengthen its long-term growth potential.

Additionally, 50% of the funds ($15 million) will be invested in leading RWA tokenization projects, focusing on agricultural commodities, by tokenizing physical assets such as sugar, rice, and oil to unlock new liquidity channels, streamline trading processes, and improve agricultural trade efficiency.

The remaining 10% of the funds ($3 million) will be used to build advanced technological infrastructure, implement robust security measures, and establish strategic partnerships.

Coin Hoarding Declaration: The CEO of Davis Commodities stated: "The $30 million fundraising plan is a key step for Davis Commodities in redefining the global commodity trading landscape. By integrating Bitcoin reserves and RWA tokenization, we not only solidify our position as a leading agricultural trader but also seize the vast opportunities at the intersection of traditional commodities and digital assets. This strategy aims to drive sustainable growth, enhance investor returns, and ensure we remain at the forefront of global trade innovation."

Stock Price Increase: DTCK is currently priced at $0.786, with a 12.29% increase over the past five days, but it has significantly declined from its listing price.

Conclusion

As noted by Bloomberg's chief financial writer Matt Levine in "The Underlying Logic of U.S. Public Companies Going Crazy Buying Cryptocurrency," the above U.S. listed companies (excluding the football club) share a common characteristic: initially, these companies barely made it to the market, and their stock prices fell significantly after listing; however, they have the shell of a U.S. listed company, and essentially have not utilized this shell for much.

"This makes it an ideal target company for 'transforming into a crypto vault.' As I have often said, the U.S. stock market is willing to pay more than $2 for a $1 crypto asset. This phenomenon has long been recognized by entrepreneurs in the crypto space. If you have a large amount of BTC, ETH, Solana, Dogecoin, or even TRUMP, the best way is to put them into a U.S. listed company and then sell them to secondary market investors at a higher price. The current situation is like the crypto circle continuously playing the U.S. stock market, and the U.S. stock market keeps falling for it."

Especially recently, with the listing of USDC stablecoin issuer Circle, its stock price skyrocketed from $31 to $151, further validating the market potential of blockchain concept stocks. The companies mentioned above will certainly not be the last batch to adopt Bitcoin reserves; in the future, we will see more traditional enterprises riding the crypto wave to achieve strategic transformation.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。